Anndy Lian's Blog, page 96

October 29, 2022

Dogecoin Price Doubles In A Week, Analyst Say DOGE Can Hit 50 Cents By End Of 2022

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Dogecoin Price Doubles In A Week, Analyst Say DOGE Can Hit 50 Cents By End Of 2022

ZINGER KEY POINTSDogecoin’s price more than doubles in a week.Analysts predict huge upswing from current levels.

ZINGER KEY POINTSDogecoin’s price more than doubles in a week.Analysts predict huge upswing from current levels.Popular memecoin Dogecoin has rallied by a staggering 56% over the past 24 hours and has more than doubled its price in the last week, amid Tesla chief Elon Musk’s acquisition of social networking giant Twitter.

Interestingly, Musk is widely touted to be the “Dogefather” — as he frequently mentions the cryptocurrency and engages with its community of users.

Musk has had a blow-hot blow-cold relationship with DOGE and has previously shared numerous DOGE-related memes and promoted it in tweets.

Musk’s’ The Boring Company, SpaceX, and Tesla all accept Dogecoin as payment for merchandise.He even named SpaceX’s 2022 moon mission DOGE-1.

Dogecoin has witnessed wild swings in the past over Musk’s tweets and announcements.

The billionaire has flirted with the idea of using Dogecoin as a payment option for a membership or paid version of Twitter.His rants, however, have also gotten him in trouble.

A number of Dogecoin investors had sued Musk and his firms for $258 billion for racketeering this summer, alleging that they purposefully inflated the price of Dogecoin before allowing it to plummet.

In response, Musk stated in June that while he himself supports cryptocurrency, he never advised anyone to invest in the space.

Dogecoin is the ‘best crypto’ in the long termAnndy Lian, book Author of “NFT: From Zero to Hero” tells Benzinga that Dogecoin’s price action has a history and is closely linked to Musk.

“Also, Dogecoin has strong community support. Dogecoin sub-Reddit has more than 2.2 million subscribers. Moreover, I think Dogecoin’s inflationary is an advantage. There are several reasons why deflationary currencies like Bitcoin might never be used as money. But Dogecoin’s tendency toward inflation ranks it among the best cryptocurrencies over the long term,” Lian says.

In the shorter term as long as Elon is still the Dogecoin, we will still see more rallies before the year ends as he lays out plans for Twitter, Lian adds.

Dogecoin at 50 cents before the new yearAliasgar Merchant, lead developer of relations at Akash Network, a decentralized cloud platform, said the current trend reversal for Dogecoin seems sustainable, and the memecoin can easily hit the 50-cent mark before the end of the year.

“Since last August, Dogecoin has not broken the 30 U.S. cents mark, however, with the memecoin’s use cases skyrocketing with Musk’s takeover of Twitter, there is no reason it cannot reach the 50 cents mark before the new year,” he said.

He added that Dogecoin would see strong support between 0.0772 and 0.0792 levels, as data from IntoTheBlock suggests that approximately 27,000 addresses scooped up 5.89 billion DOGE tokens at these levels.

Whales lapping up DogecoinMeanwhile, Dogecoin Whale Alert, a Twitter account that tracks the movement of DOGE whales tweeted that 286,953,266 DOGE, worth $22,140,740 was transferred from a “Top 20 wallet” to a Binance wallet.

Dogecoin’s ascent to prominence as the tenth-largest cryptocurrency by market capitalization was fueled by Dogechain, a layer-2 scaling solution for Dogecoin, which recently unveiled its future roadmap.

Dogechain beginning the voting process for its coin burn fueled a bullish sentiment among DOGE holders.

The post Dogecoin Price Doubles In A Week, Analyst Say DOGE Can Hit 50 Cents By End Of 2022 appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Anndy Lian Talks about “Trends Shaping the Future of NFT” at Busan Blockchain Week

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Anndy Lian Talks about “Trends Shaping the Future of NFT” at Busan Blockchain Week

Busan Blockchain Week (BWB) 2022, hosted by Busan Metropolitan City held at BEXCO for 3 days from Oct. 27th (Thu.) to the 29th (Sat).

With the theme of “Blockchain, City and Life”, as an extension of last year’s NFT Busan 2021, BWB 2022 will feature conferences for the advancement of the blockchain industry and provide a space to obtain insight as well as to share information.

Anndy Lian’s speech is on “Trends Shaping the Future of NFT”.

Anndy Lian is an all-rounded business strategist in Asia. He has provided advisory across a variety of industries for local, international, public listed companies and governments. He is an early blockchain adopter and experienced serial entrepreneur, book author, investor, board member and keynote speaker.

NFT: From Zero to Hero is his latest book. Zero to Hero is a call to anyone and everyone excited about the prospect of the world of NFT. Bound by imagination only, the NFT space is still in its early days and early adopters can be a “hero” in their search for new possibilities. The book is available on Amazon and Bybit. More than 8,000 copies were sold.

NFTs took 2021 by storm. With billions traded over NFTs and a strong community behind the technology, we’re seeing NFTs being adopted by industries as diverse as gaming, finance, art, and medicine.

NFT Gaming and GameFi: This trend is obvious. At present, many successful game manufacturers in the traditional game industry want to get involved in NFTs.

NFT Ticketing: NFT ticketing goes beyond this. The future of NFTs in ticketing offers opportunities for lifetime value, exclusive access, and extra incentives for buyers.

NFT Fragments: Fractionalization essentially breaks up an NFT into smaller pieces, so people can purchase small parts of an expensive NFT.

Digital Twin NFTs: Imagine this same type of record existing for physical items. It would completely change resale markets.

AI NFTs: Alongside blockchain, artificial intelligence (AI) is the next major disruptor in tech. So it should be no surprise the two are being combined.

NFTs and Health: With issues surrounding counterfeit vaccination passports and concerns about the vulnerabilities of centralized data storage of sensitive medical information, NFTs and the blockchain may well be integrated more and more into medicine and health in the years to come.

Growth Amidst Doubt

Although the popularity of NFTs is indeed declining, all walks of life are still accelerating their integration with NFTs.

Starting in the second half of 2021, many well-known brands have also begun to try NFTs, matching them with real objects and even designing their own metaverse. Obviously, the utility has become the first test for big brands in the metaverse field through NFTs.

NFT essentially provides brands with a new way to launch limited-edition products, and the resulting community and word-of-mouth communication will raise their share of voice compared to rival brands.

The Future of NFTs

A number of countries are now actively working on regulatory frameworks for NFT assets, strengthening anti-fraud and anti-manipulation audits of projects, determining the business core of each platform, and solving financial security issues such as illegal fundraising and false fraud.

At the same time, major public chains are actively upgrading, expanding, and building their own ecological frameworks to provide underlying support for the production, confirmation, pricing, circulation, and traceability of NFT assets. Nowadays, NFT financial tools are becoming more and more abundant, and the scale of financial derivatives is steadily increasing. The NFT industry is gradually exploring a development path suitable for blockchain assets.

“The future these NFT trends depict is an interesting one. While many people are concerned about the implications of the metaverse and the rise of AI, it’s a future full of possibilities. We are still early. Let’s build the ecosystem together.” Anndy Lian added.

The post Anndy Lian Talks about “Trends Shaping the Future of NFT” at Busan Blockchain Week appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 28, 2022

Anndy Lian’s Keynote Speech at GNSEC 2022: Future of NFTS, Regulations & Bear Market Benefits

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Anndy Lian’s Keynote Speech at GNSEC 2022: Future of NFTS, Regulations & Bear Market Benefits

In the digital transformation trend, the transformation of software engineering technology plays an important role and leads the development pattern of the digital technology industry.

GNSEC 2022 Global Next Generation Software Engineering Online Summit focuses on the full spectrum of software engineering and technology to define a new generation of software engineering. It aims to gather experts, scholars and practitioners in the software engineering industry to tell important latest research results, share the most cutting-edge technical practice experience, and promote mutual exchange and cooperation between experts in production, learning and research.

The event brought more than 1,000 registered delegates and will provide an on-site virtual experience that allows attendees to interact, learn and grow together. The online summit will focus on DevOps, Cloud Native and Open Source, AI, Testing and Quality, R&D performance and O&M-related issues, while focusing on software engineering best practices in finance, communications, the internet and many other industries. Thus, breaking down industry barriers and making technology drive performance.

His topic on NFT is timely for the industry as there are more people who are into NFT and would like to find out more.

Anndy Lian is one of the speakers at the event. He is an early blockchain adopter and an intergovernmental expert on crypto matters. His recent book “NFT: From Zero to Hero” has sold more than 8,000 copies on Bybit NFT Marketplace and now selling on Amazon and Google books.

Around 105 nations have legalised NFTs expressly or as part of a larger recognition of cryptocurrencies and virtual currencies. However, as the aforementioned list illustrates, legislation regarding NFTs is frequently general and not designed mainly for NFTs.

The U.S., Canada, Australia, and most of the European Union are notable examples of integrated and moderately regulated markets. In each of these jurisdictions, the predominant legal strategy is to view NFTs as either a type of capital gains taxable asset or a component of an individual’s income tax portfolio.

Anndy mentioned in his speech that creators must look at regulations before starting their businesses. there are still a lot of nations where NFTs and cryptocurrencies are either implicitly or expressly banned. This is because those governments view NFTs and other digital assets as threats to the current financial system and sources of illicit and/or terrorist financing. China, Vietnam, Algeria, Egypt, Qatar and Nepal are notable instances.

GNSEC is Co-Organized by DAOPS FOUNDATION and Escom Event, and supported by HKPC and Greatops. This is GNSEC’s second online event in Southeast Asia.

The post Anndy Lian’s Keynote Speech at GNSEC 2022: Future of NFTS, Regulations & Bear Market Benefits appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 24, 2022

Metaverse Cops: INTERPOL Launch Online Virtual Global Police Force

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Metaverse Cops: INTERPOL Launch Online Virtual Global Police Force

INTERPOL’s metaverse is designed for law enforcement around the worldINTERPOL warns of rising crime in the metaverseWill INTERPOL become the new sheriff of the metaverse?

INTERPOL’s metaverse is designed for law enforcement around the worldINTERPOL warns of rising crime in the metaverseWill INTERPOL become the new sheriff of the metaverse?

Metaverse cops: INTERPOL, the global police organization, have unveiled the first metaverse designed specifically for law enforcement around the world.

INTERPOL announced that the fully operational metaverse allows registered users to tour a virtual office at INTERPOL’s General Secretariat headquarters in Lyon, France. This is without geographical or physical boundaries. Users can interact with other officials through their avatars. Users can even conduct immersive training courses on forensic investigation and other policing capabilities.

According to INTERPOL, its metaverse is “designed for law enforcement around the world.” They say it will help global forces “interact with other officers through their avatars.”

It seems that INTERPOL wants to prepare for the possible future expansion of the metaverse. Madan Oberoi is the Executive Director of Technology and Innovation at Interpol. “The metaverse has the potential to transform every aspect of our daily lives, with huge implications for law enforcement.”

Oberoi says there is only one way for the police to understand the functioning of bad actors in this new virtual environment. “For the police to understand the metaverse, we have to experience it.”

INTERPOL warns of rising crime in virtual worldsAccording to INTERPOL’s latest Global Crime Trends report, crime has increasingly moved to the internet as the pace of digitization increases.

“As the number of users of the metaverse grows and the technology continues to develop, the list of potential crimes will only expand to potentially include crimes against children, data theft, money laundering, financial fraud, counterfeiting, ransomware, phishing, and sexual assault and harassment.”

The creation of the metaverse for global policing began when the international body’s roundtable asked a question. “How can law enforcement continue to protect communities and ensure the rule of law?” Humans are interacting in new ways. So, the “limits of the physical world will increasingly shift towards a digital realm, seemingly without borders.” Therefore policing must be prepared for this new digital environment.

Will INTERPOL become the new sheriff of the metaverse? At least it seems that they don’t want to be left behind.

Source: INTERPOL (Lyon headquarters)The new trend among police agencies?

Source: INTERPOL (Lyon headquarters)The new trend among police agencies?INTERPOL is not the first police division to launch a metaverse. Recently a division of the Dubai police launched its own metaverse police.

So the question remains. If a crime happens in the metaverse, is it really even a crime? Do we need a police force in the metaverse? And the most important question of all: Can metaverse cops catch Do Kwon?

Source: https://beincrypto.com/metaverse-cops-interpol-launch-online-global-police/

The post Metaverse Cops: INTERPOL Launch Online Virtual Global Police Force appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Are NFT Regulated? What Are The Concerns?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Are NFT Regulated? What Are The Concerns?

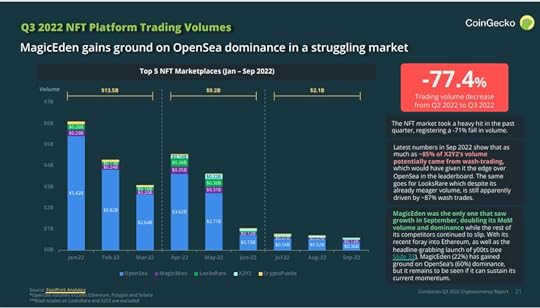

The hype around NFT has slowed down. It seemed like NFT was slated for explosive growth in 2022, being named “word of the year” and coming off a record-high volume in January this year. But as it turns out, that was the peak. Looking at Q3 2022 NFT trading volume around the top 8 chains. There is a 76.4% trading volume decrease from Q2 2022 to Q3 2022.

Since then, the trading volume has tumbled 83% from the start of the year, according to Footprint Analytics’s data on CoinGeco. Recent months have logged numbers lower than July 2021, right before NFT summer. Most notably, Ronin and Avalanche have fallen out of the Top 8, replaced by ImmutableX and Panini. Recent sports mania has spilt over to the NFT space, propelling Flow into the Top 3. Solana’s NFT ecosystem doubled its September volume while all its competitors faltered.

During this period of time, where the market is bearish, you will see changes. For example, in Q3 Magic Eden gains grounds on OpenSea dominance. Magic Eden was the only one that saw growth in September, doublings its month-on-month volume and dominance, while the rest of its competitors continued to slip further. Magic Eden (22%) has gained ground on OpenSea’s (60%) dominance, but it remains to be seen if it can sustain its current momentum.

Another factor in sustaining the current momentum is aligning with the regulatory norms. There is still disagreement over how to handle NFTs, which makes it difficult to set clear regulatory norms. NFTs can now be seen in one of three ways: as commodities, securities, or intellectual property. Let’s explore each interpretation in more detail.

Commodities

Commodities are defined by US law as reasonably interchangeable services, goods, and rights, including money and interest rates, that are traded as commercial articles. The Commodity Futures Trading Commission (CFTC) asserts that cryptocurrencies like Bitcoin and Ethereum, as well as renewable energy credits and other intangible assets, are included in the definition of commodity.

If we take NFTs, they resemble cryptocurrencies in several ways. They may be bought and sold and are based on blockchain technology. In addition, the CFTC emphasises price manipulation and commodities exchanges more than it does on underlying assets and issuers. The Commodity Exchange Act (CEA) may be implemented if it is decided that NFTs should be classified as commodities. The CEA’s rules on manipulative trading may be applicable in this situation.

Securities

Most NFTs with a single owner and only one unique asset are unlikely to be securities. However, under certain situations, they might. If an NFT possesses security-like characteristics or otherwise satisfies the Howey test, such as when money or another kind of compensation is invested with a reasonable expectation that gains will result from others’ efforts, then the NFT may be subject to US securities legislation. A case-by-case Howey analysis is essential to ascertain if a specific NFT is a security. NFTs may, however, violate securities laws in the following situations, depending on the specifics:

NFTs are pre-sales of digital assets intended to be used on a platform that has not yet been developed, with the sale’s proceeds going toward developing the platform;Digital assets can be “pooled” or “fractionalised” (for instance, in the case of art, when creators pool resources and divide profits, or where several NFTs reflect different investors’ fractional ownership of a single asset);NFTs are a license to a digital asset (like a song) and a portion of its earnings (e.g., a percentage of sales).Intellectual Property

NFTs might be covered by intellectual property rights such as copyright, design patents, and trademark protections. As a result, buyers of NFTs should be aware of any associated intellectual property rights. In fact, the license that comes with many or even most NFTs merely allows the NFT buyer to use, copy, and display the NFT.

A clip of renowned basketball star LeBron James’ slam dunk is an excellent illustration. The video was made available as a limited-edition NBA highlight video collector. The NBA collectables are available for purchase and sale on the Top Shot NFTs market. The NBA owns the copyright, nevertheless, and the rules of its licensing agreement continue to apply to any purchased item’s replication.

However, while most NFT producers place limitations on commercial use, other authors grant NFT owners broader rights. Members of the Bored Ape Yacht Club (BAYC) have the right to use their “apes” for commercial purposes, which allows them to produce and market hats, T-shirts, mugs, and other items.

Brand owners should consider how current or upcoming design patents can protect against imitations or infringement in addition to trademark and copyright protection. Because they grant owners full ownership of an infringer’s profits rather than just the fraction related to the use of the design, design patents are important intellectual property protections compared to other IP rights.

Fraud Schemes

Despite being a relatively new idea, NFTs are already being utilised to commit numerous forms of fraud. Here, we go over some of the most prominent NFT-related fraud schemes that have occurred:

Tokenisation– The process of producing digital tokens that reflect ownership of physical assets is known as tokenisation. This happens when someone steals an artist’s creation without their consent and “mints” it to create an NFT.Wash trading– This is the practice of users manipulating transactions by trading with themselves or others to feign large demand for an NFT, manipulate its price, or enhance its visibility.Insider trading– The practice of using information that is not generally known to benefit personally from it. In recent high-profile situations, employees and executives of NFT companies and markets have engaged in behaviour that may be viewed as unfair or illegal. Various events generate negative press for these organisations. NFT insider trading regulations frequently forbid buying NFTs based on secret information. Similarly, multiple forms of trading in business NFTs that aim to inappropriately manipulate the perceived price or trading volume of such NFTs are prohibited.Anti-Money Laundering– NFTs, especially those with large value, may occasionally be utilised to aid in money laundering. A study on how the art market aids in the financing of terrorism and money laundering was released by the US Department of Treasury. The study covered a variety of topics, including the dangers of financial crimes in relation to digital art and NFTs. The study discovered that the high-value art market has several intrinsic characteristics that could make it susceptible to various financial crimes.To Conclude

As we can see, the market for NFTs is still growing, and it will take some time until an appropriate regulatory framework for NFTs is put in place. Having said that, governments all over the world have already begun the process of developing NFT norms and standards, proving that they are seriously interested in these digital assets.

Additionally, you should be aware that the phenomenal success of NFTs will undoubtedly result in fraudulent activities. For this reason, it is becoming more and more crucial to conduct your research before purchasing or investing in NFT collections or projects.

The post Are NFT Regulated? What Are The Concerns? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 23, 2022

Are Non-Fungible Tokens (NFT) Regulated? What Are The Concerns?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Are Non-Fungible Tokens (NFT) Regulated? What Are The Concerns?

The hype around NFT has slowed down. It seemed like NFT was slated for explosive growth in 2022, being named “word of the year” and coming off a record-high volume in January this year. But as it turns out, that was the peak. Looking at Q3 2022 NFT trading volume around the top 8 chains. There is a 76.4% trading volume decrease from Q2 2022 to Q3 2022.

Since then, the trading volume has tumbled 83% from the start of the year, according to Footprint Analytics’s data on CoinGeco. Recent months have logged numbers lower than July 2021, right before NFT summer. Most notably, Ronin and Avalanche have fallen out of the Top 8, replaced by ImmutableX and Panini. Recent sports mania has spilt over to the NFT space, propelling Flow into the Top 3. Solana’s NFT ecosystem doubled its September volume while all its competitors faltered.

During this period of time, where the market is bearish, you will see changes. For example, in Q3 Magic Eden gains grounds on OpenSea dominance. Magic Eden was the only one that saw growth in September, doublings its month-on-month volume and dominance, while the rest of its competitors continued to slip further. Magic Eden (22%) has gained ground on OpenSea’s (60%) dominance, but it remains to be seen if it can sustain its current momentum.

Another factor in sustaining the current momentum is aligning with the regulatory norms. There is still disagreement over how to handle NFTs, which makes it difficult to set clear regulatory norms. NFTs can now be seen in one of three ways: as commodities, securities, or intellectual property. Let’s explore each interpretation in more detail.

Commodities

Commodities are defined by US law as reasonably interchangeable services, goods, and rights, including money and interest rates, that are traded as commercial articles. The Commodity Futures Trading Commission (CFTC) asserts that cryptocurrencies like Bitcoin and Ethereum, as well as renewable energy credits and other intangible assets, are included in the definition of commodity.

If we take NFTs, they resemble cryptocurrencies in several ways. They may be bought and sold and are based on blockchain technology. In addition, the CFTC emphasises price manipulation and commodities exchanges more than it does on underlying assets and issuers. The Commodity Exchange Act (CEA) may be implemented if it is decided that NFTs should be classified as commodities. The CEA’s rules on manipulative trading may be applicable in this situation.

Securities

Most NFTs with a single owner and only one unique asset are unlikely to be securities. However, under certain situations, they might. If an NFT possesses security-like characteristics or otherwise satisfies the Howey test, such as when money or another kind of compensation is invested with a reasonable expectation that gains will result from others’ efforts, then the NFT may be subject to US securities legislation. A case-by-case Howey analysis is essential to ascertain if a specific NFT is a security. NFTs may, however, violate securities laws in the following situations, depending on the specifics:

NFTs are pre-sales of digital assets intended to be used on a platform that has not yet been developed, with the sale’s proceeds going toward developing the platform;Digital assets can be “pooled” or “fractionalised” (for instance, in the case of art, when creators pool resources and divide profits, or where several NFTs reflect different investors’ fractional ownership of a single asset);NFTs are a license to a digital asset (like a song) and a portion of its earnings (e.g., a percentage of sales).Intellectual Property

NFTs might be covered by intellectual property rights such as copyright, design patents, and trademark protections. As a result, buyers of NFTs should be aware of any associated intellectual property rights. In fact, the license that comes with many or even most NFTs merely allows the NFT buyer to use, copy, and display the NFT.

A clip of renowned basketball star LeBron James’ slam dunk is an excellent illustration. The video was made available as a limited-edition NBA highlight video collector. The NBA collectables are available for purchase and sale on the Top Shot NFTs market. The NBA owns the copyright, nevertheless, and the rules of its licensing agreement continue to apply to any purchased item’s replication.

However, while most NFT producers place limitations on commercial use, other authors grant NFT owners broader rights. Members of the Bored Ape Yacht Club (BAYC) have the right to use their “apes” for commercial purposes, which allows them to produce and market hats, T-shirts, mugs, and other items.

Brand owners should consider how current or upcoming design patents can protect against imitations or infringement in addition to trademark and copyright protection. Because they grant owners full ownership of an infringer’s profits rather than just the fraction related to the use of the design, design patents are important intellectual property protections compared to other IP rights.

Fraud Schemes

Despite being a relatively new idea, NFTs are already being utilised to commit numerous forms of fraud. Here, we go over some of the most prominent NFT-related fraud schemes that have occurred:

Tokenisation– The process of producing digital tokens that reflect ownership of physical assets is known as tokenisation. This happens when someone steals an artist’s creation without their consent and “mints” it to create an NFT.Wash trading– This is the practice of users manipulating transactions by trading with themselves or others to feign large demand for an NFT, manipulate its price, or enhance its visibility.Insider trading– The practice of using information that is not generally known to benefit personally from it. In recent high-profile situations, employees and executives of NFT companies and markets have engaged in behaviour that may be viewed as unfair or illegal. Various events generate negative press for these organisations. NFT insider trading regulations frequently forbid buying NFTs based on secret information. Similarly, multiple forms of trading in business NFTs that aim to inappropriately manipulate the perceived price or trading volume of such NFTs are prohibited.Anti-Money Laundering– NFTs, especially those with large value, may occasionally be utilised to aid in money laundering. A study on how the art market aids in the financing of terrorism and money laundering was released by the US Department of Treasury. The study covered a variety of topics, including the dangers of financial crimes in relation to digital art and NFTs. The study discovered that the high-value art market has several intrinsic characteristics that could make it susceptible to various financial crimes.To Conclude

As we can see, the market for NFTs is still growing, and it will take some time until an appropriate regulatory framework for NFTs is put in place. Having said that, governments all over the world have already begun the process of developing NFT norms and standards, proving that they are seriously interested in these digital assets.

Additionally, you should be aware that the phenomenal success of NFTs will undoubtedly result in fraudulent activities. For this reason, it is becoming more and more crucial to conduct your research before purchasing or investing in NFT collections or projects.

Source: https://www.benzinga.com/22/10/29371369/are-non-fungible-tokens-nft-regulated-what-are-the-concerns

The post Are Non-Fungible Tokens (NFT) Regulated? What Are The Concerns? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 22, 2022

Forkast Interviews Anndy Lian Book Author of “NFT: From Zero to Hero”: Was your NFT price unfairly pumped

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Forkast Interviews Anndy Lian Book Author of “NFT: From Zero to Hero”: Was your NFT price unfairly pumped

How can you spot when an NFT’s price is being artificially inflated? Anndy Lian joins us to talk more about the history of and the problems with wash trading in today’s NFT market.

Wash trading is not a new word for people in the financial world. You probably have heard from friends that cryptocurrencies are highly “washed” and round-tripping with the same buy and systematically sell price.

In a nutshell, wash trading makes it difficult for non-fungible token enthusiasts to gauge genuine market interest in NFT collections. It also inflates and skews the amount of trading in marketplaces, misleading analysts about what’s going on on trading platforms.

“Even though total volume is down by a substantial amount from January highs, the percentage of wash trading volume in the NFT market remains similar every month. This underscores how disruptive wash trading is to having accurate NFT transaction data and the importance of filtering out wash trading for any meaningful NFT data analysis. I hope to see the real sales volume for NFT. This will allow us to project and make relevant changes to grow this industry.” Anndy Lian added.

Forkast.News covers blockchain, DLT, cryptocurrency and other emerging technologies in a way that anyone can understand. From NFTs to enterprise blockchain platforms, smart contracts to altcoins, Bitcoin to DeFI and beyond; Forkast’s blend of insight, analysis & daily blockchain news keeps you on the cutting edge of the digital asset revolution and the wider digital economy it both supports and disrupts.

Anndy Lian is an all-rounded business strategist in Asia. He has provided advisory across a variety of industries for local, international, public listed companies and governments. He is an early blockchain adopter and experienced serial entrepreneur, book author, investor, board member and keynote speaker. NFT: From Zero to Hero is his latest book. Zero to Hero is a call to anyone and everyone excited about the prospect of the world of NFT. Bound by imagination only, the NFT space is still in its early days and early adopters can be a “hero” in their search for new possibilities. The book is available on Amazon and Bybit. More than 8,000 copies were sold.

The post Forkast Interviews Anndy Lian Book Author of “NFT: From Zero to Hero”: Was your NFT price unfairly pumped appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

SUSHI / BTC prediction: SushiSwap showing signs of life despite shrinking exchange market share

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

SUSHI / BTC prediction: SushiSwap showing signs of life despite shrinking exchange market share

SUSHI is well poised to see growth. These are the additional comments that I have.

Let’s track back to around two weeks ago. GoldenTree Asset Management has invested $5.3 million into SUSHI governance token. During that period of time, investors were all excited about the news. Social media mentions spiked to around 0.851%. They gained 14% in 24 hours back then.

5 days ago, we saw a plunge of around 20% when they announced their newly appointed CEO, Jared Grey. He was being accused of being involved in a couple of scam projects and once sexually assaulted a horse. The token price went down to around $1.0962 at that point. Jared has since written his statement and shared it on his personal Medium page to address all the allegations. The token has since traded higher to $1.51 this morning.

All these price movements are driven by news and this is no way sustainable. The need for SUSHI to continue to build, find new niches and new products are important for its growth. SushiSwap started with a “vampire attack” if you remember, it has drawn so much attention back then, personally I hope to see that kind of drive back to the platform.

Retail investors got to know this. In order for SUSHI to grow, SushiSwap got to continue growing in popularity. As much as I believe decentralised exchanges are the way forward, the competition is very high and it is ever changing. SUSHI or not, it all depends on how strong your team is. I look forward to their new developments.

SUSHI / BTC prediction: SushiSwap showing signs of life despite shrinking exchange market share

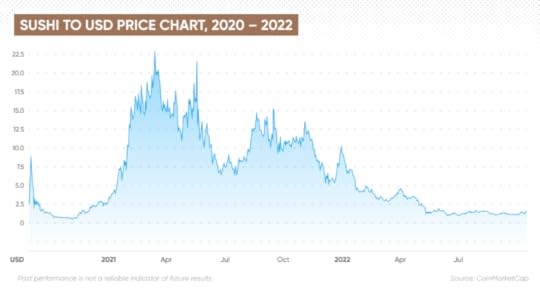

Since facing major losses in the crypto winter of 2022 cryptocurrencies have been struggling to resurface. Bitcoin (BTC) is down by 70% since its November 2021 highs while SushiSwap’s SUSHI fell by 94% since its all-time high of 14 March 2021, as of 21 October.

How do the two tokens trade against each other and what does the SUSHI to BTC forecast suggest amid the current bear market? Here we take a look at the SUSHI/BTC pair and some of the factors that may shape its exchange rate.

What is SUSHI/BTC?SUSHI/BTC is the exchange rate between SUSHI, the native cryptocurrency of the decentralised exchange (DEX) platform SushiSwap, and BTC, the native coin of the Bitcoin Network.

Joerg Hansen, Caiz Development GMbh’s CEO, told Capital.com that the SUSHI to BTC value is calculated in the same way that a fixed exchange rate is calculated and is based on the rates of up to 100 exchanges.

Bitcoin is the pioneer cryptocurrency launched in 2009 by a creator or group of creators using the anonymous nickname Satoshi Nakamoto. BTC is built, distributed, exchanged and stored on a collective network known as a blockchain, and the token is used for peer-to-peer payments.

The cryptocurrency is secured by a Proof-of-Work (PoW) consensus mechanism, which is how new bitcoins are mined. Miners gain BTC as rewards for solving mathematical equations that confirm whether a BTC transaction is legitimate.

Approximately every four years or once every 210,000 mined BTC blocks, the blockchain goes through a halving event, which is when the rewards given to miners are cut in half, decreasing the amount of bitcoins in circulation.

SushiSwap is a decentralised finance (DeFi) platform that aims to solve what it describes to be “the inability of disparate forms of liquidity to connect with markets in a decentralized way”. It creates automated liquidity pools through which anyone can swap a crypto token based on the ERC-20 Ethereum protocol for another ERC-20 token.

The platform’s Japanese food-themed ecosystem was launched in 2020 by an anonymous creator who calls themself Chef Nomi. The software is running on the Ethereum blockchain, and is often compared to other similar platforms like Uniswap (UNI) and Balancer (BAL).

SushiSwap uses a number of products to achieve full liquidity and decentralisation, and allows users to exchange, earn, lend and borrow digital assets, stack yields and leverage funds. In addition, SushiSwap has smart contract capabilities, which means it also supports the creation of non-fungible tokens (NFTs).

SUSHI coins are rewarded to users for maintaining liquidity on the platform. They can also be used for staking and governance.

SUSHI has a maximum supply of 150 million coins. Meanwhile, BTC’s maximum supply is capped at 21 million.

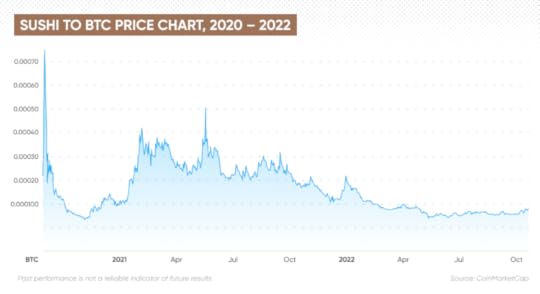

SUSHI to BTC price historyThe SUSHI to BTC exchange rate surged by more than 235% in the first four days following its launch, up from 0.0002201BTC on 19 August 2020 to 0.0007436BTC, its all-time high. The SUSHI value in USD surged by 250%.

The SUSHI/BTC price chart shows that SUSHI was quick to dip against BTC as the exchange rate’s value lost over 95% of its gains in the following months, down to 0.00003331BTC by mid-November 2020.

At the start of 2021, SUSHI/BTC jumped 317.5% from 0.0001001BTC on 8 January 2021 to 0.0004179BTC on 5 February 2021, in line with a hike in the SUSHI price in USD as the platform announced the launch of MISO, a suit of open-source smart contracts.

The bull trend in the SUSHI to BTC price chart lasted for the following five months and by 19 May 2021 the exchange rate reached 0.0005008BTC, up by 19.8% as the SUSHI ecosystem became compatible with the Polygon blockchain.

Following the positive trend, SUSHI/BTC fell by 60.2% down to 0.0001994BTC by 26 June 2021 and continued to fluctuate for the following four months seeing minor losses and gains.

By 16 September 2021, SUSHI/BTC reached 0.0003152BTC but within a month fell by 40%. Around this time, the BTC value in USD was picking up the momentum, surging by around 55% to reach its all-time high of $64,158.12 on 13 November 2021, up from $41,551.27 at the end of September 2021.

The SUSHI to BTC exchange rate continued to further decline and reached 0.0001069BTC by the beginning of December 2021. By the end of the month, the rate surged by 103% to 0.0002174BTC as the platform launched a migration to the Optics V2 bridge, but the trend was short lived.

In line with recent negative market sentiment, SUSHI/BTC has lost over 65% of its value with the pairing’s current exchange rate trading at 0.00006957BTC as of 21 October.

Caiz Deveopment’s Hansen noted that in terms of technical analysis, the SUSHI/BTC price is struggling:

“Based on technical indicators such as the Relative Strength Index (RSI) and important simple and exponential moving averages, SUSHI is currently in neutral territory and Bitcoin in a bearish one, which suggests that now is a bad time to exchange Sushi for Bitcoin.”News driving SUSHI/BTCAt the start of October, Golden Tree Asset Management announced that it will stake $5.3m into SUSHI. Anndy Lian, chief digital advisor at the Mongolian Productivity Organisation and author of NFT: From Zero to Hero, told Capital.com that the announcement sparked enthusiasm in the online SUSHI community, but the hype was short-lived. Lian explained:

“Five days ago, we saw a plunge of around 20% when [SUSHI] announced their newly appointed CEO, Jared Grey. He was being accused of being involved in a couple of scam projects and once sexually assaulting a horse. The token price went down to around $1.0962 at that point,” Lian noted.

On 11 October, a Twitter user under the handle YannickCrypto alleged in a series of tweets that Grey was involved in a series of scam projects between 2012 and 2020. The user added that they met Grey in 2019. Other users chimed in, alleging that the CEO had also engaged in bestiality with a horse.

Hey @SushiSwap how it comes you elect @JaredGrey, a scammer and con artist, as the new CEO?

Here some details about Grey:

— yannickcrypto.eth (@YannickCrypto) October 10, 2022

Grey addressed the scam allegations, saying they were “100% untrue”. But SUSHI did not resurface.

Today has been interesting. Let me be clear: the accusations towards me are 100% untrue. FYI, in 2019, my business partner stole funds from our community while I was busy raising funds to launch the Bitfineon exchange. /1

— Jared Grey (@jaredgrey) October 11, 2022

Caiz Deveopment’s Hansen told Capital.com that “sharply rising interest rates” have also been “poisonous” for the SUSHI to BTC exchange rate, as well as the declining trading volumes on cryptocurrency exchanges. He noted:

“Another important reason is the huge competition in the crypto exchanges. Since the bitcoin peak, the volume of the exchanges has fallen up to 60% this year. You can see a clear decline in crypto exchanges and coins like SUSHI because you don’t earn as much in fees at the moment.”SUSHI/BTC forecast for 2022, 2023 and beyondBased on the analysis of past performance, as of 21 October, the algorithm-based forecasting service Wallet Investor predicted that SUSHI/USD could fall to $0.0663 in 2023. The platform did not provide a price prediction for 2027.

In terms of its BTC price forecast, the site saw BTC/USD trade at $25,101.65 in 2023 and reach $46,783.81 by 2027.

While Wallet Investor did not provide a direct SUSHI to BTC forecast, data suggested that the exchange rate could be 0.0000025098BTC in 2023.

DigitalCoinPrice predicted that SHIB/USD could rise to $1.63 by the end of 2022. The site’s data, as of 21 October, showed that the coin was expected to trade at $2.18 in 2023 and $3.49 in 2025. Its long-term prediction saw the coin reaching $7.32 in 2030.

The site also gave an upbeat BTC/USD forecast, expecting the coin to grow to $24,108.19 by the end of 2022, $31,466.60 in 2023, $49,830.68 in 2025 and surpass $105,000 in 2030.

DigitalCoinPrice’s SUSHI to BTC forecast for 2022 expected the pair to reach 0.0000676119BTC and 0.0000692798BTC in 2023. The site’s SUSHI/BTC forecast for 2025 stood at 0.0000700372BTC. Its long-term SUSHI/BTC forecast for 2030 was 0.0000697143BTC.

Hansenalso gave a bullish SUSHI to BTC price outlook:

“In my opinion, the SUSHI/BTC price will climb beyond what we have seen so far, mainly because of its popularity and resilience despite it being around since the beginning stages of DeFi.”In order for SUSHI to regain past losses, the platform must continue to develop and “find new niches and new products”, Lian said. He added:

“SushiSwap started with a ‘vampire attack’ if you remember, it has drawn so much attention back then…As much as I believe decentralised exchanges are the way forward, the competition is very high and it is ever changing. SUSHI or not, it all depends on how strong your team is. ”Remember that analysts’ and algorithm-based predictions can be wrong and shouldn’t be used as a substitute for your own research.

Always conduct your own due diligence on a cryptocurrency project before trading, looking at the latest news, a wide range of analyst commentary and technical analysis. Note that past performance does not guarantee future returns. And never trade money you cannot afford to lose.

Source: https://capital.com/amp/sushi-btc-prediction-sushiswap-bitcoin-exchange-market-share

The post SUSHI / BTC prediction: SushiSwap showing signs of life despite shrinking exchange market share appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 20, 2022

S01 E44 – Episode 44: Anndy Lian, author of “NFT: From Zero to Hero”

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

S01 E44 – Episode 44: Anndy Lian, author of “NFT: From Zero to Hero”

Anndy Lian, a best selling author, joins the Podcast to discuss his newly released book called NFT: From Zero to Hero, where he aims both at the general public that wish to learn about NFT basics but also those who wish to use this technology to develop and build with it.

His book has been out for 2 months and has already sold over 9000 copies and became for the second time a bestselling author. He is also an advisor to companies and governments.

NFT stands for non-fungible token. Unlike standardized and fungible tokens that can be split almost an infinite number of times (such as Bitcoin, Ethereum, and other interchangeable tokens), NFTs are unique in nature. For example, Peter’s one BTC and Jane’s one BTC are basically the same in function, property rights, and interests. Still, an NFT can contain more unique information, including videos, pictures, and music, allowing its creator to assign more value to it.

Therefore, NFTs are ideal for recording and storing ownership of digital products, including artworks, games, and collectibles.

He talked about his way of thinking, how he works his way in the crypto industry and talked about IOTA too.

Find out more at: https://open.spotify.com/episode/4eVVP7874kvRXjtit8Atyp?si=lF28RLCLRZiWe6C45jkcPw&nd=1

The post S01 E44 – Episode 44: Anndy Lian, author of “NFT: From Zero to Hero” appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 19, 2022

如何识别 NFT「洗盘交易」?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

如何识别 NFT「洗盘交易」?

今年,一半以上的 NFT 交易量是「左手倒右手」。

原文标题:《 The scourge of NFT wash trading — and how not to get suckered in 》

撰文:ANNDY LIAN

编译:Katie 辜

对金融人士来说,「洗盘交易」(wash trading)并不是一个新词。加密货币也以相同的买入和卖出手法来回进行「洗盘」, NFT 市场亦是如此。「洗盘交易」使得 NFT 爱好者很难衡量市场对某一系列的真正兴趣,还夸大和扭曲了交易量,对交易平台的分析也造成误导。

那如何用链上数据来识别「洗盘交易」,检测可疑活动呢?

什么是「洗盘交易」?洗盘交易是一种市场操纵形式,投资者同时买卖同一种金融产品,在市场中制造误导。

在 NFT 交易中,当同一用户作为 NFT 交易的买卖双方时,就会发生「洗盘交易」。与传统证券不同,NFT 市场不受政府监管,地址背后的真实身份难判别。因此,洗盘交易在 NFT 市场非常普遍。

为什么有人洗 NFT?NFT 领域「洗盘」的背后有两个主要动机。

1)获取平台奖励

一些 NFT 市场,如 X2Y2,根据活跃用户的交易量给予他们回报(以协议代币的形式),以此来奖励他们。洗盘交易者利用这一点,通过产生大量虚假交易量来最大化他们的回报。反过来,这很容易欺骗想要根据流动性定量分析 NFT 藏品或市场的用户。

2)创造价值或流动性的假象

为了制造一种流动性的假象和特定 NFT 藏品的虚高价值,一些无良创造者转向洗盘交易来欺骗买家。当真正的买家被骗以抬高的价格从他们那里购买 NFT 时,他们就会从中获利。这种类型的洗盘交易者用新的钱包地址隐藏他们的活动,这些地址由中心化交易所钱包自筹资金。这种类型的洗盘交易产生的交易量相对较小,对市场的破坏性不如第 1 类洗盘交易。

「洗盘交易」是怎样进行的?由于第一种「洗盘交易」对 NFT 交易数据的干扰性,我们用从链上数据来识别。要理解这种类型的洗盘交易,我们必须先理解 X2Y2 和 LooksRare 的代币奖励系统。X2Y2 和 LooksRare 每天根据地址的交易量(作为市场平台每日总交易量的一部分)向卖方和买方分发代币。代币奖励每天都是固定的,所以洗盘交易者可以进行洗盘交易,并在每日分配重置时重复获得奖励代币。

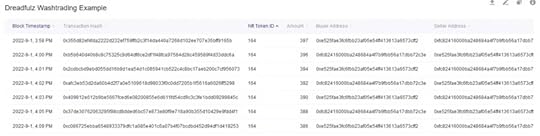

图 1 显示了 X2Y2 市场上的一个洗盘交易活动示例。

图 1——NFT 系列 Dreadfulz 的洗盘交易例子(来源: Footprint Analytics)

从上图中我们可以看到,同一个 NFT(ID 164)相同的两个钱包之间在一天内多次来回购买,每笔交易的销售价格超过 300 ETH 。2022 年 9 月 1 日,这两个地址交易了 19 次,产生了 7228 ETH 的交易量,支付了 36.14 ETH 的 X2Y2 平台费用。而 Dreadfulz 的版税费率并不是在 X2Y2 上设定的。因此,没有支付创作者费用。洗盘交易者将选择零版税费的系列,以最小化他们的交易成本。

如何识别「洗盘交易」?我研究了一些分析平台的检测方式。根据我自己的了解和分析,以下是一份可疑数据和活动的清单:

某一特定的 NFT 在同一地址每天交易超过 X 次,而其他收藏品则保持不变;同一地址正在以高频方式进行同一 NFT 交易;在没有营销或促销支持的情况下,NFT 系列以高频的方式进行自销;A 市场的平均历史交易价格是 B 市场的 X 倍;NFT 的销售价格比可供销售的最低价格 NFT 高 X 倍;同一个钱包为买卖 NFT 的所有可疑钱包提供资金;持续异常高的交易量。上述假设并不完善,我希望与研究人员合作开发一种更全面的「记分卡」,可以更有效地确定 NFT 趋势和行为。随着时间的推移,追踪多个钱包以识别不同层次的关系的能力也至关重要。

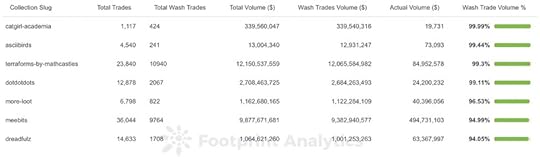

顶级 NFT 藏品是如何进行「洗盘交易」的?在图 2 中,Footprint Analytics 将他们的识别规则应用到 X2Y2 和 LooksRare 上交易量最大的 NFT 系列。

图 2——选定 NFT 系列的洗盘交易统计(来源:Footprint Analytics)

根据他们的规则,他们已经检测到这些系列的 95% 或更多的交易量是洗盘交易。洗盘交易在这些收藏品的交易量中占了极高的比例,这对收藏品的历史交易量和销售活动造成了误导。

图 3——蓝筹 NFT 系列的洗盘交易统计(来源:Footprint Analytics)

图 4——LooksRare 和 X2Y2 的洗盘交易数据(来源:Footprint Analytics)

图 5——Opensea、LooksRare 和 X2Y2 未经过滤的交易数据(来源:Footprint Analytics)

图 4 显示,LooksRare 和 X2Y2 上 94.71% 和 81.04% 的交易量是洗盘交易,这似乎与市场统计数据一致,如图 5 所示。我们可以从未经过滤的数据中看到,Looksrare 的每笔交易平均价格几乎达到 8.5 万美元,这是 OpenSea 均价的 90 倍左右,贵得离谱。

总结

图 6——OpenSea、LooksRare 和 X2Y2 的月度 NFT 销量数据(来源:Footprint Analytics)

从图 6 中可以看出,自 2022 年 1 月以来,几乎每个月 NFT 市场的月度交易统计数据的洗盘交易量占总交易量的比例都在 50% 以上。尽管总交易量较 1 月份的高点大幅下降,但 NFT 市场的洗盘交易量百分比每月保持相似。这强调了洗盘交易对准确的 NFT 交易数据的破坏性,以及「过滤」洗盘交易对的 NFT 数据分析的重要性。

Source: https://foresightnews.pro/article/detail/16762

The post 如何识别 NFT「洗盘交易」? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.