Anndy Lian's Blog, page 94

November 25, 2022

BWB2022 Day 3 First Mover Stage 앤디 리안Anndy Lian

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

BWB2022 Day 3 First Mover Stage 앤디 리안Anndy Lian

BWB 2022, hosted by Busan Metropolitan City was held at BEXCO for 3 days from Oct. 27th (Thu.) to the 29th (Sat).

With the theme of “Blockchain, City and Life”, as an extension of last year’s NFT Busan 2021, BWB 2022 featured conferences for the advancement of the blockchain industry and provide a space to obtain insight as well as to share information.

Anndy Lian, Book Author of NFT: From Zero to Hero presented his views on Trends Shaping the Future of NFT.

In his speech, he reminded all to go back to basics.

1. The 5 P’s of Marketing – Product, Price, Promotion, Place and People – are key marketing elements used to position a business strategically. Most of us, whilst still understanding what makes an NFT valuable, have forgotten that these are also the key elements for an NFT project to succeed. The industry is filled with people who are focusing on short-term hypes and price pumps. This is more obvious when the market is bullish; all kinds of projects get a price push upward no matter what you launch and draw.

He went on by saying that the regulation of NFT is a must, and we need to understand its importance.

2. As we can see, the market for NFTs is still growing, and it will take some time until an appropriate regulatory framework for NFTs is put in place. Having said that, governments worldwide have already begun developing NFT norms and standards, proving that they are seriously interested in these digital assets.

Additionally, you should be aware that the phenomenal success of NFTs will undoubtedly result in fraudulent activities. For this reason, it is becoming more and more crucial to conduct your research before purchasing or investing in NFT collections or projects.

3. Lastly, he also hoped that the general public and enthusiasts of NFT should understand what the market is like. Do not just be fooled by fake statistics. He cited NFT wash trading as an example.

Wash trading makes it difficult for non-fungible token enthusiasts to gauge genuine market interest in NFT collections. It also inflates and skews the amount of trading in marketplaces, misleading analysts about what’s going on on trading platforms.

Anndy Lian is an all-rounded business strategist in Asia. He has provided advisory across a variety of industries for local, international, public listed companies and governments. He is an early blockchain adopter and experienced serial entrepreneur, book author, investor, board member and keynote speaker.

The post BWB2022 Day 3 First Mover Stage 앤디 리안Anndy Lian appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

November 23, 2022

Roughly 48% of Ethereum NFT trades in October were fake

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Roughly 48% of Ethereum NFT trades in October were fake

Traders seeking to artificially inflate the price of collections or earn marketplace trading rewards generated $389 million in wash trades during October.

Traders seeking to artificially inflate the price of collections or earn marketplace trading rewards generated $389 million in wash trades during October.Global NFT sales in October clocked in at more than $850 million over roughly 3 million total transactions. I looked into NFT wash trades last month and that research got me to look at the numbers more closely.

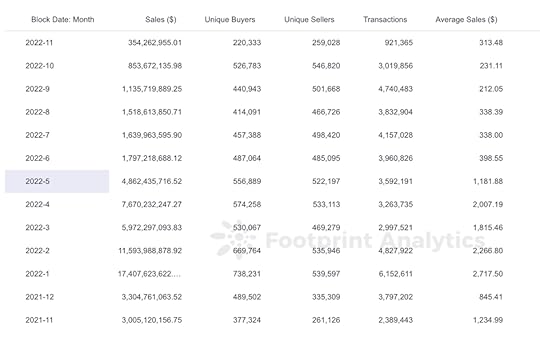

Footprint Analytics – NFT Monthly Sales

Footprint Analytics – NFT Monthly SalesThe trigger points for me to say that transactions are becoming more fake are as follows:

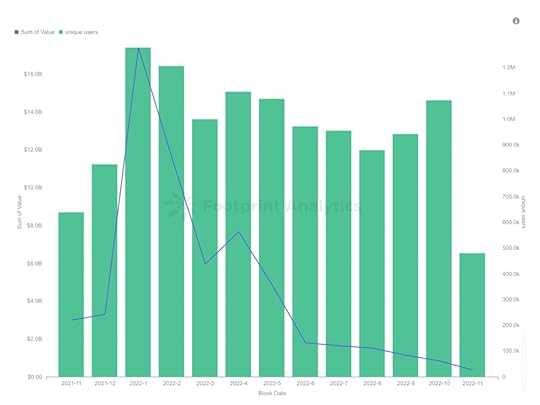

Despite bad market conditions, we continue to see a high number of unique buyers and sellers. In October, we had over 1 million unique buyers and sellers. Both buyers and sellers have increased compared to September.The number of unique buyers and sellers seems to be inconsistent with the growth of sales value and transactions. Around 1 million users contributed more than 4 million sales value in May versus less than 250,000 in October. To me, it seems unlikely to have a growing market demand with less sales value traded. Footprint Analytics – Sales value vs. Unique users

Footprint Analytics – Sales value vs. Unique usersTo look into this further, I spoke with two centralized exchanges that operate NFT marketplaces. The exchanges said that around 80% of new buyers are keeping NFTs in their wallets, rather than selling them. With the market so unfavorable, holding these assets seems to be the sensible move.

So where are all these unique buyers and sellers coming from? I had a word with Footprint Analytics and brought up my points. I realized that the statistics I am looking at are way too big. It involved multiple chains and it is hard to track everything. We agreed to work on only Ethereum-based marketplaces as an example to dive deep into since it is the most popular.

Here are the findings:

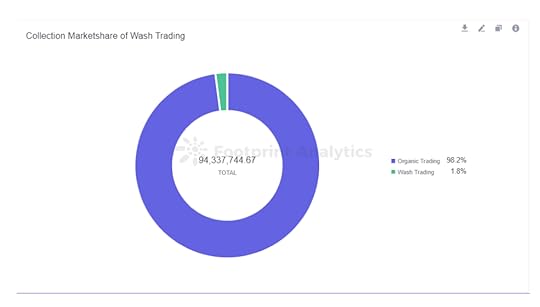

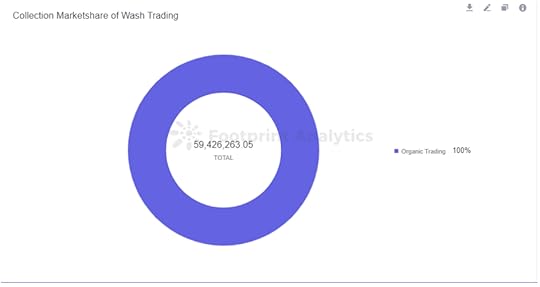

According to Footprint Analytics’ filters, wash trading makes up nearly half of all NFT trading volume.

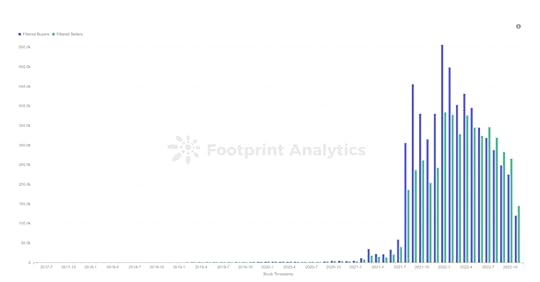

Footprint Analytics – ETH NFT Market Overview (With Wash Trading Filtered)

Traders seeking to artificially inflate the price of collections or earn marketplace trading rewards generated $389 million in wash trades out of October’s total of $758 million in NFT trading volume — bringing the amount of wash trading in the NFT market close to half that of organic trading. The number of wash trading users accounts for nearly 46% of total users.

Footprint Analytics – Marketplace Market Share Wash Trading Filtered & Without Filtered

Footprint Analytics – Marketplace Market Share Wash Trading Filtered & Without Filtered

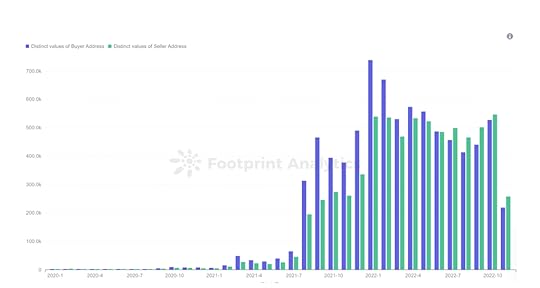

Footprint Analytics – NFT Sellers & Buyers Without Wash Trade

Footprint Analytics – NFT Sellers & Buyers Without Wash Trade

Footprint Analytics – NFT Sellers & Buyers

Footprint Analytics – NFT Sellers & BuyersWash trading is a form of market manipulation where an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace. It creates enormous dissonance in the NFT industry between what most people imagine NFT trading is i.e., someone buying an NFT for speculation, and the behavior which actually underlies the market — hundreds of insiders transferring NFTs between their own wallets.

There are several indicators to identify suspicious trading activity.

Signals and indicators include:

Overpriced NFT trades with 0% creators feesSpecific NFT IDs that are bought more than a normal amount of times in a dayNFTs bought by the same buyer address in a short period of timeThe incentives for wash trading are to earn platform rewards and to create an appearance of value or liquidity for assets. Because there is no way to prevent or discourage wash trading in the NFT market today, people have a hugely misguided picture of the amount of organic, genuine trading activity in the industry.

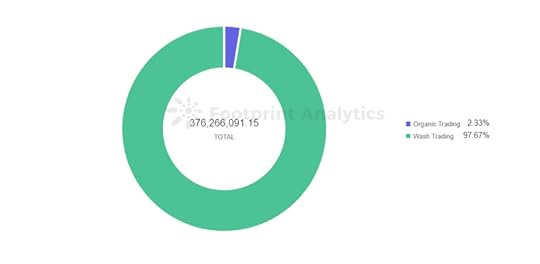

For example, 81% percent of all trades on X2Y2, one of the top 3 NFT marketplaces, were wash trades according to the filters applied. The main reason for X2Y2 wash trading is volume-based daily trading rewards. The larger the percentage of volume a user contributes to X2Y2, the larger the share of daily trading rewards the user will earn. A similar breakdown can be observed when looking at individual collections. For example, of Dreadfulz’ $1.1 billion in total volume, $1.131 billion was flagged as wash trading.

Footprint Analytics – Marketplace Wash Trading Stats

Footprint Analytics – Marketplace Wash Trading Stats

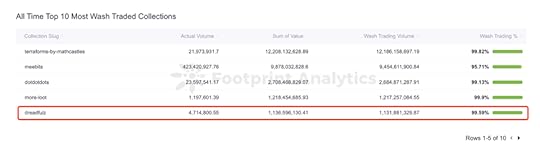

Footprint Analytics – All Time Top 10 Most Wash Traded Collections

Footprint Analytics – All Time Top 10 Most Wash Traded CollectionsAn analyst or writer who does not understand this wash trading dynamic risks grossly misunderstanding the current market. For example, here’s what Business2Community wrote on Oct. 12 about Terraforms by Mathcastles:

“Non-fungible token collections continue showing strong resilience amid the current general crypto market downturn so far this year. Here are some of the top-selling NFT collections this week: 1. Terraforms Reclaim The Top Spot. Terraforms, a non-fungible token (NFT) collection from Mathcastles, has reclaimed the top spot after flipping below our ten top-selling lists last week. Terraforms has a 24-hour sales volume of 1,814 ETH.”

The next collections the article listed were BAYC and CryptoPunks, which have nearly no wash trading. This would give a reader the impression that Terraforms more of a popular collection than those blue chip collections when in reality there were almost no organic trades.

Footprint Analytics – Bored Ape Yacht Club Trading Stats

Footprint Analytics – Bored Ape Yacht Club Trading Stats

Footprint Analytics – Cryptopunks Wash Trading Stats

Footprint Analytics – Cryptopunks Wash Trading Stats Footprint Analytics – Terraforms-by-mathcastels Wash Trading Stats

Footprint Analytics – Terraforms-by-mathcastels Wash Trading StatsBy filtering trades for wash trading, traders, analysts and investors can more accurately evaluate NFT assets and the industry. Having accurate datasets and using them are two separate things. My role here is not to whistleblow or break the NFT myths, I am here to share my knowledge and tell my side of the story to everyone.

Using this article, I would like to make a request to analyze CEX NFT marketplaces’ data. Binance or Bybit NFT Marketplace would be ideal.

Source: https://cryptoslate.com/roughly-48-of-ethereum-nft-trades-in-october-were-fake/

The post Roughly 48% of Ethereum NFT trades in October were fake appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

November 22, 2022

How many cronos tokens are there? CRO token circulation analysis

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

How many cronos tokens are there? CRO token circulation analysis

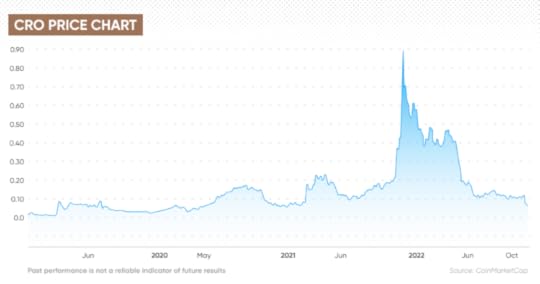

Crypto.com is one of the biggest crypto exchanges out there, however, recent negative sentiment and the collapse of the FTX crypto exchange have sent its native token, cronos (CRO), into a downwards spiral, forcing it to lose over 90% of its value from $0.8992 in November 2021 to $0.0698 a year later.

What are the latest token analytics suggesting, and how many cronos tokens are there?

What is CRO?CRO is the native cryptocurrency of the Crypto.com chain and the Cronos EVM Chain. It was formerly known as the Crypto.org Coin before being renamed to CRO.

Crypto.com is a public, open-source and permissionless blockchain that aims to help drive the mass adoption of blockchain technology through decentralised finance (DeFi), payments and non-fungible tokens (NFTs). The platform has named itself as the “next generation public blockchain”.

The platform was co-founded in 2016 by Kris Marszalek, Rafael Melo, Bobby Bao and Gary Or and is now operated as a desktop and mobile application.

The Cronos EVM Chain is the first ever Ethereum-compatible blockchain that was built on Cosmos SDK technology. It is an open source, permissionless Layer 1 chain that aims to scale the DeFi, GameFi and overall Web3 communities by letting builders instantly port apps and crypto assets from other chains while benefiting from low transaction fees, high throughput and fast finality.

The CRO token powers the ecosystem and is used for staking, which grants users a number of rewards and helps maintain the platform’s security and decentralisation. The cronos cryptocurrency is also used to settle transaction fees on the Crypto.org Chain.

Latest CRO market news2022 has not been the best year for CRO. The token has fallen by more than 87% from its all-time high of $0.8992 on 24 November 2021 to $0.1093 on 17 June 2022. The dip in the CRO price was heightened as Crypto.com announced on 1 May 2022 that it would be slashing staking rewards for all tiers of its VISA cards “to ensure long-term sustainability”, effective as of 1 June 2022.

Between mid-July 2022 and end of September 2022, Crypto.com has received a number of licence updates worldwide, including Italy, Cyprus, South Korea, Australia, Canada, the UK and France. In addition, on 12 October 2022 the firm said that Paris was established as its European Regional Headquarters and invested €150m (around $155m, as of 18 November) in France to support market operations.

Between 25 October 2022 and 28 October 2022, Crypto.com had signed three MOUs: one with the game software developing studio ACT Games; one with the city of Busan in South Korea to advance the blockchain industry; and one more with global content studio A Story to develop NFT collaborations.

However, amid all the positive news, Crypto.com has also been caught in an array of negative news. An article published on 6 October 2022 by Ad Age tech claimed that the platform had cut off deals with a number of big sports organisations, including the Los Angeles’ Angels City Football Club, the 2022 FIFA World Cup in Qatar and the online sports tournament host Twitch Rivals. The article cited unanimous former and current Crypto.com employees.

In addition, according to a series of Tweets by the article’s journalist Asa Hiken, between “June and August, 30-40% of Crypto[dot]com’s entire workforce left the company, per former and current employees. That’s 2,000+ departures — the vast majority of which were layoffs.”

The company did not address the reports.

Now, let’s take a closer look at how many cronos tokens there are now.

How many cronos tokens are there?So, let’s have a look at how many cronos tokens are available in circulation as of 18 November 2022.

According to data provided by CoinMarketCap, the maximum supply of the cronos tokens is 30.2 billion, meaning that once the total number of cronos tokens in circulation reaches that value, new tokens can no longer be mined. The current circulating supply of the CRO coin surpassed 25 billion.

However, this was not always the case for the cryptocurrency.

When the cryptocurrency was launched in 2018, its maximum supply was fixed at 100 billion coins. But, in order for the Crypto.com network to become fully decentralised at Mainnet Launch, Crypto.com decided to burn 70 billion CRO tokens in what it called “the largest token burn in history”. This was announced by the platform on 22 February 2021.

The platform released a schedule which shows that an initial batch of 59.6 billion CRO tokens was burned on 22 February 2021. Meanwhile, 10.4 billion coins were locked in a smart contract and would be burned every month as they get unlocked. This was aiming to increase the cryptocurrency circulating supply from 24% at the time to over 80%.

The remaining 5.9 billion CRO tokens were distributed in the following way:

5 billion CRO were allocated to mainnet block rewards for Chain validators and delegators0.9 billion CRO were allocated to the development of the Chain ecosystemOf that 70 billion burned:

20 billion tokens came from the platform’s capital reserve5.5 billion coins came from the platform’s community development10.4 billion tokens came from secondary distribution and launch incentives20 billion tokens came from ecosystem grants20 billion tokens came from network long-term incentivesWho are the biggest CRO token holders?Now that we have established how many cronos tokens are in circulation, let’s take a look at the biggest CRO token holders.

Data provided by etherscan.io showed that, as of 18 November, there were 281,902 CRO holders in total. The 10 biggest CRO holders collectively owned 92.54% of the total token supply in circulation, meanwhile the top 100 owned 95.93%.

The website noted that the top account holding the most CRO tokens in total was a Null Address owning over 77 billion coins, amounting to 77.89% of the total circulating supply. Crypto.com was also among the top CRO holders in the world, owning around 7 billion tokens or approximately 6.9% of the total supply.

Analyst thoughtsAnndy Lian, chief digital advisor at the Mongolian Productivity Organisation and author of ‘NFT: From Zero to Hero’ told Capital.com that while burning 70% of the then maximum CRO token supply was a good decision, doing so in 2021 was a “downside”.

“Personally, I would prefer them to burn and then buyback in stages of burning such a huge amount. The burn back then did make the market perceive that the remaining tokens have more value but that was short lived.”

Lian added that taking into consideration everything that has happened with the FTX crypto exchange in recent weeks, CRO holders are also getting anxious about the wellbeing of the Crypto.com platform, however, Crypto.com CEO Kris Marszalek’s live AMA session on YouTube on 14 November 2022 helped calm those worries down.

“Crypto.com is still facing potential bank run in my humble opinion. This to me is one of the biggest risks that CRO has a direct impact on.”The bottom line

While knowing key info about the cronos tokenomics and circulating supply is important for accessing the project’s health, it shouldn’t substitute your own research. You should always conduct your own due diligence before trading, looking at the latest news, technical and fundamental analysis, and a wide range of analysts’ opinions before making any trading decision.

Keep in mind that past performance is no guarantee of future returns. And never trade or invest money that you cannot afford to lose.

Source: https://capital.com/how-many-cro-tokens-are-there-crypto-com-circulation-analysis

The post How many cronos tokens are there? CRO token circulation analysis appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

5 Reasons Why Trustless DEX Are The Future

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

5 Reasons Why Trustless DEX Are The Future

DEXes offer strong execution guarantees and increased transparency into the underlying mechanics of trading. Trades are trackable, traceable and data is permanently on-chain. This is one of the core basics and the beauty behind the ideology of DEXes. While many have forgotten, I will remind all of you again.

Amidst talks of growing adoption and decentralization becoming the norm, the great decentralized exchange (DEX) vs centralized exchange (CEX) debate is more prominent now than ever before. This debate has many case studies for us to make reference to. The latest would be FTX. FTX owes nearly US$3.1 billion to the top 50 creditors and is estimated there to be “more than 100,000” creditors.

Let me walk you through why trustless DEX is the way forward.

1. Individual Data and Asset Control

CEX holds custody of your deposited assets and all your personal information. You have no control over how the assets and data are being used. While in a DEX environment, it is non-custodial; typically, only an individual wallet address is connected to the exchange. In other words, you have complete control over your assets.

2. Liquidity and Market Depth

Historically, CEX is known for deeper liquidity and market depth. DEXes, in general, are trying to catch up with CEX efficiency in matching and executing orders. But the top DEXes have good enough liquidity and market depth for the major coins, and in fact, DEX’s liquidity is more accurate and traceable.3. User Friendliness

CEX provides a wide range of products, including spot and fiat on-ramps, which is most familiar to traditional and crypto traders, especially beginners. DEX products may be harder to grasp with insufficient onboarding guidelines for traders. Again, this point for DEX is changing. The user interface and experience have improved so much; some of the newer DEXes look and function exactly like CEX.

4. Transaction Costs

CEX is known for high transaction or platform costs, especially when the system is hugely loaded with trades simultaneously. An increasing number of DEXes are integrating scaling solutions that will massively increase transaction workload while keeping costs low and passing the savings on to traders.

5. Community Involvement

CEXes, oftentimes one-way, non-reciprocal communication from a central operator to traders. Individual traders are seen as clients utilizing as service that the CEX provides. While DEXes focus on community-building and involvement, where traders can become stakeholders and have a say in protocol changes or share in transaction fees on the platform.

A New DEX Era

The challenge with CeFi and CEXes boils down to a lack of trust and security. This is continually reinforced time and again; this year is clearly no different, with funds, exchanges and even established projects hitting the buffers and leaving behind affected, concerned investors and traders fearing for their assets. News of increased risk with CEXes coming into the question of insolvency and possible delays in withdrawals, causing widespread panic amongst traders.

As usual, I will end with a quote. “The answer is to return to the basics of what blockchain is supposed to be. It is decentralization and transparency. DeFi is one of the solutions, and we need to work together in the future. For now, it cannot replace CeFi completely for obvious reasons, but this will not stop us from trying.” #AnndyLian

Source: https://www.benzinga.com/22/11/29809200/5-reasons-why-trustless-dex-is-the-future

The post 5 Reasons Why Trustless DEX Are The Future appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Cardano futures: ADA price pressure to persist amid FTX fallout

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Cardano futures: ADA price pressure to persist amid FTX fallout

The recent FTX crisis has caused a whirl in the crypto world with many investors pulling out their assets from the market that’s already dominated by bearish sentiment.

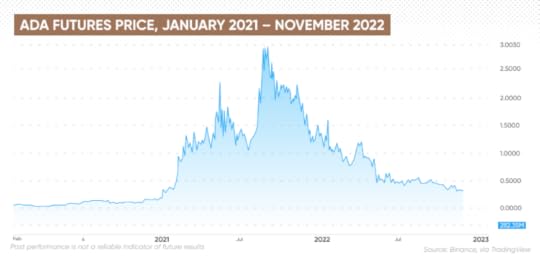

Cardano’s ADA, has been on a bear run in 2022, losing over 89.8% of its gains since the all-time high of $2.9706 on 3 September 2021 to $0.3032 on 21 November 2021.

How do Cardano futures work and where could the cardano futures price be headed? Read on…

What are cardano futures?Cryptocurrency futures are contracts between two parties that are betting on the future price of a digital asset. When traders purchase a cryptocurrency’s futures contract, they gain exposure without owning the underlying coin, agreeing to pay a certain price for the asset in future. When the futures contract expires, however, the trader has to settle it – in other words, they buy the coin.

The Cardano blockchain was launched in 2017 as a third-generation cryptocurrency platform. It has a Proof-of-Stake (PoS) consensus mechanism and was designed to be a more scalable, sustainable and interoperable version of Ethereum. For this reason, the blockchain’s supporters labelled Cardano the “Ethereum killer”.

In September 2021, Cardano gained smart contract capability, allowing for the creation of decentralised apps (dApps), non-fungible tokens (NFTs), games, new cryptocurrencies and more.

ADA is the blockchain’s native cryptocurrency named after the 19th century mathematician Ada Lovelace. The coins are used as a secure exchange of value and to pay for transaction fees

Cardano futures, therefore, are contracts between two parties that have agreed to buy and sell a specific amount of ADA at a specified price. Cardano futures are often known as Cardano perpetual futures or cardano perpetual swaps.

Traders who purchase ADA futures are betting that the price of the cryptocurrency will surge in the future. If that happens, they will profit from the price increase. If the price of Cardano falls, however, they will lose money.

Cardano futures historyCardano futures started trading on Binance at the end of January 2021. They enjoyed bullish momentum, jumping by more than 4,100% between January and May 2021. The surge came as Cardano continued development of its smart contract capabilities and launched a peer-to-peer testnet to a small group of users.

After a slight dip in July 2021, the ADA futures price climbed to the all-time high of $2.9706 on 3 September 2021. The rally came ahead of the blockchain’s Alonzo hard fork, which introduced smart contract capabilities to Cardano.

Following the bull run, the ADA futures contract dipped by more than 35% by 27 October 2021 and continued on a downward trend.

Cardano futures price fell to $0.3032 on 21 November 2022 amid negative market sentiment. The recent news on the downfall of the FTX crypto exchange and its native FTT token added to the bearish price action.

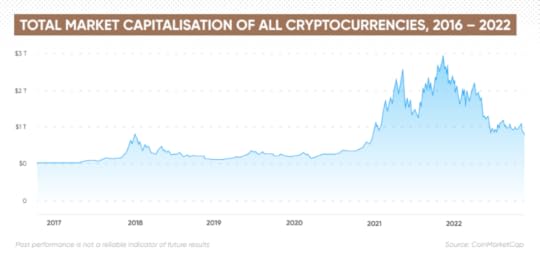

What is driving cardano futures?The collapse of the FTX crypto exchange affected many major cryptocurrencies, cooling investor sentiment. CoinMarketCap data showed that the total cryptocurrency market capitalisation fell below $800bn on 11 November, when FTX filed for Chapter 11 bankruptcy, the lowest level since early 2021.

“Although aftereffects of the FTX shock will still likely surface at some point and the industry will have to adopt more financially transparent operation and come under stricter regulatory oversight, the worst part may have passed,” Bitbank crypto market analyst Yuya Hasegawa said in his weekly view.

Meanwhile, the Cardano blockchain saw a spike in activity between 9 and 14 November as the number of new addresses on the blockchain surged from 0 to 11,240, according to data on Cardano Blockchain Insights.

The network, however, had seen a surge in the number of transactions on 8 November, which surpassed 391,000 as FTX crashed.

Cardano’s founder, Charles Hoskinson, said in a live YouTube stream on 9 November:

“I think this might be the bottom, one of the last ones to deal with. It’s going to be hard to predict how bad it will be, and it could certainly potentially be very bad. There are not many more firms that were like FTX or Alameda or like, Three Arrows Capital, and so forth. At least in this cycle, I truly do hope that this is the last cycle of this nature.”In other cardano futures news, Hoskinson told CoinDesk on 18 November that Cardano is looking to launch a new privacy blockchain and digital asset which he stated to be something “the enterprise absolutely wants”.

Cardano futures price prediction for 2023 and beyondAlgorithm-based prediction websites did not provide cardano futures forecasts, so let’s have a look at the latest ADA/USD outlook.

In line with the latest downward price action, algorithm-based forecasting service Wallet Investor gave a bearish ADA price prediction at the time of writing (21 November) noting that ADA was “a bad long-term investment”.

Based on its analysis of past price performance, Wallet Investor predicted that the token could fall to $0.01016 in 2023. The site did not provide an ADA price prediction for 2027.

DigitalCoinPrice, on the other hand, gave a bullish ADA to USD price prediction expecting the token to grow to $0.39 by the end of 2022 and reach $1.30 on average in 2025. By 2027, the site predicted that the price of ADA tokens could reach $1.59. Its long-term token forecast showed the cryptocurrency reaching $4.35 by 2030.

Meanwhile, Anndy Lian, the chief digital advisor at the Mongolian Productivity Organisation and author of ‘NFT: From Zero to Hero’, told Capital.com that mid-term technical indicators looked bearish (as of 21 November). He added:

“Sellers’ pressure increases in the cardano market. I hope the longer term potential factors like Midnight and USDA can change things for the better.”News that the group behind Cardano, Input Output Global, is planning to release a new privacy-focused blockchain could have a potential effect on ADA futures, Lian added in his cardano futures price prediction.

In addition, the launch of USDA, the first fully fiat-backed regulated stablecoin on Cardano, will start trading in early 2023, could lead to a hike in the cardano futures price.

“If executed well, I see this will help ADA decentralised finance ecosystem, thus bringing in more liquidity and support into the network,” Lian added.

Final thoughtsRemember, analysts’ and algorithm-based predictions can be wrong. If you’re considering entering the cardano futures market, we recommend you always conduct your own due diligence, looking at the latest news, a wide range of analyst commentary, technical and fundamental analysis. Note that past performance does not guarantee future returns and cryptocurrency markets remain extremely volatile. And never trade money you cannot afford to lose.

Source: https://capital.com/cardano-futures-price-prediction-ada

The post Cardano futures: ADA price pressure to persist amid FTX fallout appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

November 17, 2022

Who is Anndy Lian? How Does he Turn You Into an NFT Hero?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Who is Anndy Lian? How Does he Turn You Into an NFT Hero?

Anndy Lian is a serial entrepreneur based in Singapore. He is always trying to work hard in the crypto and blockchain industry. When I first met him, he was actively investing in Layer 1 blockchains. Then he was advising a sovereign wealth fund and was the chairperson at an Esports association. He is always busy.

His journey started in 2017 during the ICO times. He started one of the earliest supply chain blockchain companies back then and moved on to advising governments as he felt that there were too many dodgy businesses going on in the crypto scene.

He is a fund manager and partner at a local capital market services licensed firm. He is a philanthropist, giving back to society by donating and spending time serving his Singapore community. His servant leadership and attitude is well-liked by his peers.

His latest book, “NFT: From Zero to Hero”, is aligned with what he does. He likes the technology behind NFT and never likes how projects are managing NFTs as if it is like a valueless Ponzi scheme. That is also why Anndy chooses to launch the book after the hype and not during the hype. He believes that this is the right time to launch a book to tell everyone about the good and bad of NFT and how the market is changing and building stronger than ever at the same time.

During this interview, he emphasized a few points. Firstly, he wants all to know that mastering the logic behind NFT is not difficult. You need only the correct mindset and set up clear purposes when creating the NFTs. There is also a lot of information online for you to read about, and there is no reason why you cannot understand it.

Secondly, he said that there are many good tools online to help you decide what you can consider buying. He has spent time using some of the tools and listed a handful in his book that he thinks are useful. “Instead of guessing what NFT to buy, use the statistics to aid your decision,” Anndy said.

Anndy also went on to share that data could be contradicting. For example, 10,000 NFTs were sold, but when you look at the on-chain wallet addresses, only 10 of them exist. These are the small details you need to catch when making a decision.

Thirdly, he wants people who read his book and look at the trends ahead. The general public knowledge is very superficial. Many people think that NFT is a quick money scheme and we are purely selling “air”. “The fact that NFT is not just about a jpeg profile picture is not known to many. This is disturbing.”

According to Anndy, we can look at creating medical platforms using NFTs and empowering patients with the ability to control their medical records. We can look at digitizing land title deeds using NFT too. “The NFT usage scenarios are limitless.”

I also took the chance to ask Anndy what we should invest in next. He said to follow the simple rules- Consider investing in projects with good utility, strong community, and always building. “If they do not have the above, there is no need to consider who is on their cap table and how strong their team is. Assuming they have a working tech solution.”

Lian added that some people said that investing in Layer 1 blockchain is a sure win is totally wrong. He said starting layer 1 is not difficult; sustaining it with good usage is the challenging part. You need a lot more money to make it work compared to layer 2.

He said that, similarly, some people hate meme coins and said they have no value. “I don’t see eye to eye on this. The value of a meme coin is in its community and the core team. If the community is strong, anything can happen.” He added that bad management is one of the core reasons why meme coins fail. “The tell-tale signs are obvious.”

Just like the same old Anndy we see on Twitter. He ended by saying, “not financial advice”.

Anndy Lian’s new book has sold more than 8,000 copies during its launch at Bybit NFT marketplace. He has subsequently listed them on leading platforms like Amazon and Google books. At the point of this interview, he told me that he had appointed a Singapore distributor who would put his books in major bookstores in the South East Asia region.

I also read that he was awarded an Honorary Doctoral Degree by the Academic Council of Ulaanbaatar Erdem University in recognition of his contribution to the development of productivity science in Mongolia. He is also completing his PhD soon.

Congratulations Anndy.

The Future of NFTs

A number of countries are now actively working on regulatory frameworks for NFT assets, strengthening anti-fraud and anti-manipulation audits of projects, determining the business core of each platform, and solving financial security issues such as illegal fundraising and false fraud.

Nowadays, NFT financial tools are becoming more and more abundant, and the scale of financial derivatives is steadily increasing. At the same time, major public chains are actively upgrading, expanding, and building their own ecological frameworks to provide underlying support for the production, confirmation, pricing, circulation, and traceability of NFT assets. The NFT industry is gradually exploring a development path suitable for blockchain assets.

Due to the short development history of NFTs, we are still in the industry’s infancy, but we can still see its rapid development and gradual maturity. It is believed that under the transformation of the market, the improvement of supervision, and the gradual improvement of the ecosystem, the future of NFTs will never be just about hype but will become an indispensable part of future technological life.

The NFT space is fast-changing. While writing this, new NFT projects are popping up every day. From the Busan Metropolitan Government in Korea announcing an NFT conference to the International Cricket Council launching cricket NFTs to CoinRunners crowdfunding a movie by selling NFTs.

The few consistent NFT trends over the past year have been their steady growth, the rising interest in them, and their ever-expanding applications.

The future these NFT trends depict is an interesting one. While many people are concerned about the implications of the metaverse and the rise of AI, it’s a future full of possibilities.

It’s a future that bridges the gap between consumers and creators gives value and security to digital assets, and one which, for better or for worse, will shake up the world.

The future is bright, but the road is tortuous. The NFT market will eventually mature and deliver on its promise.

Your new asset is in the digital world.

Source: https://hackernoon.com/who-is-anndy-lian-how-does-he-turn-you-into-an-nft-hero?source=rss

The post Who is Anndy Lian? How Does he Turn You Into an NFT Hero? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Green and sustainable crypto – Is this the way forward?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Green and sustainable crypto – Is this the way forward?

Energy consumption has been a major source of criticism in the cryptocurrency business. Ethereum has finally deployed a huge network upgrade that dramatically transforms how the blockchain validates transactions, mints new currency, and secures its network.

This mechanism, known as proof-of-stake, has cut Ethereum energy use by more than 99 per cent. This sounds good. However, Bitcoin is unlikely to follow suit.

Is Bitcoin now green? No, but at least Bitcoin’s emissions of greenhouse gases are down than before. According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin’s greenhouse gas emissions decreased from 59 metric tons of carbon dioxide equivalent in October 2021 to 48.88 metric tons.

According to research released by Cambridge University’s Centre of Alternative Finance, Bitcoin is failing to go green, with the cryptocurrency recording only modest increases in its use of renewable energy in the year leading up to January.

Powerful computers connected to a worldwide network process Bitcoin transactions and “mine” new tokens in a competition to solve challenging mathematical puzzles. Policymakers, investors, and environmentalists concerned about the process’s impact on global warming criticise it for guzzling electricity and heavily relying on dirty fossil fuels like coal.

Green cryptocurrencies are those whose mining activities are powered by renewable energy sources.

Things are changing, and there are alternatives to make it “greener”Solar

Currently, solar is said to as “the cheapest energy source.” Solar energy, which has the greatest pace of growth among all energy sources, presently provides three per cent of the world’s electricity while emitting no noise pollution and scaling up easily. Solar energy has global potential, in contrast to comparatively rare geothermal.

According to Bloomberg, a solar power company in South Africa pays investors with cryptocurrency. Sun Exchange allows investors to spend as little as US$4 on solar cells. Although the cost is lower than what would have been charged for electricity from the grid, the customers who receive the renewable energy nevertheless pay the price for a 20-year contract.

Sun Exchange gets a portion of the revenue to pay for installation and upkeep while also turning a profit. Investors are paid the balance. They can receive South African Rands or Bitcoin, with the latter enabling simple cross-border payments to the more than 35,000 participants thus far across 180 countries.

Biomass

Five per cent of US primary consumption, 10 per cent of global energy, and 1.4 per cent of Canada’s electrical production come from biomass. Most of this energy is used for industrial heating and other activities, which have considerable environmental benefits that include enhancing hygiene by reusing waste and lowering greenhouse gas emissions.

Utilising biodegradable materials as fuel for energy production is not out of place in the race for a sustainable Bitcoin mining business. When compared to solar, it might not offer a more significant arbitrage, but buying these energy choices from a position of strength remains the ideal.

Bitcoin Magazine reported that a Dallas, Texas-based hemp processor, Generation Hemp, sees more peer-to-peer in the future for cannabis than just passing around a pre-roll. They have unveiled plans to mine for cryptocurrency using cannabis as fuel.

Hydro

Compared to other renewable energy sources, hydropower has the best energy extraction (conversion) efficiency (up to 90 per cent), is the most dependable, and has the smallest carbon footprint.

Borgo d’Anaunia is a small municipality in the Trentino-Alto Adige area of northern Italy. The 37-year-old Daniele Graziadei became Italy’s first municipality to run a crypto data centre. Another illustration of the use of hydropower is this.

The need to be more green expands to other tokens tooVeChain is working on green initiatives to increase stakeholder involvement, such as the one agreed with the government of San Marino, or to deliver the future of safe and traceable food. According to the project’s current estimating models, VeChain generates 4.58 metric tons of carbon emissions, which is equivalent to the emissions generated by mining a single BTC.

FRZ Solar System (FRZSS) was created to combat the energy issue using blockchain technologies and web innovations. Given that solar energy is limitless, renewable, endless, pollution-free, and inexpensive, the FRZSS intends to popularise solar power plants as the primary power source. The team has also been working with other companies to reduce the cost of electricity generation.

Tezos is a green energy crypto blockchain similar to Ethereum in that it supports smart contracts and can be used to mint NFTs. The low carbon footprint of Tezos means developers and users can prioritise innovation without compromising sustainability. They have increased energy efficiency per-transaction basis by at least 70 per cent.

IMPT is a blockchain-based technology that allows individuals and businesses to swiftly and safely reduce their carbon footprint. Customers can earn carbon credits while buying online. They could even buy them directly from the platform. Furthermore, IMPT should tokenise carbon credits so users can purchase them as NFTs. The NFTs are then recorded into a decentralised ledger that users view to give traceability and transparency.

Back to BitcoinThe large carbon footprint associated with Bitcoin mining appears to be at odds with any environmental objectives. The demand that limited electricity is used for the real economy and not for Bitcoin mining is justified in light of escalating energy prices and shortages.

Creating new strategies for the most efficient utilisation of resources is necessary. Bitcoin mining has the potential to hasten the global energy transition by serving as a backup energy buyer for the excess power balance.

Additionally, energy power plants constructed with the intention of mining Bitcoin can generate a higher profit than those built to sell the electricity at market rates, mainly when constructed in remote areas with easy access to renewable energy sources but no infrastructure for integrating them into the grid. Plant owners might use these revenues to fund additional clean energy initiatives that support ESG objectives and the world’s increasing demand for electricity.

But for these projects to be successful, Bitcoin generation and the associated value chains would need to be held to a very high standard of accountability and measurability.

Source: https://e27.co/green-and-sustainable-crypto-is-this-the-way-forward-20221114/

The post Green and sustainable crypto – Is this the way forward? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

November 15, 2022

Bitcoin Has Died Nearly 500 Times as Bear Market Bottom Signals End of Crypto

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Bitcoin Has Died Nearly 500 Times as Bear Market Bottom Signals End of Crypto

Bitcoin has been declared dead 465+ times from 2010Over 124 articles claimed crypto was dead in 2017.The first such claim was made in 2010 by the Underground Economist when Bitcoin was trading at $0.23.

Bitcoin has been declared dead 465+ times from 2010Over 124 articles claimed crypto was dead in 2017.The first such claim was made in 2010 by the Underground Economist when Bitcoin was trading at $0.23.

Renowned Indian Author Chetan Bhagat wrote a column declaring that crypto is dead. Is it the sign at the bottom?

The article from the well-known author Chetan Bhagat focuses on how crypto is dead due to the collapse of FTX. He expressed his strong anti-crypto opinion stating that crypto is like communism which promises decentralization but ultimately leads to power in the hands of a select few.

Bitcoin declared dead 465 times.Bitcoin has been declared dead 465+ times, according to a page in 99Bitcoins, that counts the total reported Bitcoin obituaries. The Underground Economist made the first such report with the title, “Why Bitcoin can’t be a currency,” when the price of Bitcoin was $0.23. The article is no longer live today.

Satoshi Stacker, a well-known crypto analyst, predicted that as more and more people hear about the damage caused by FTX, there will be more reporting on “Crypto is Dead.”

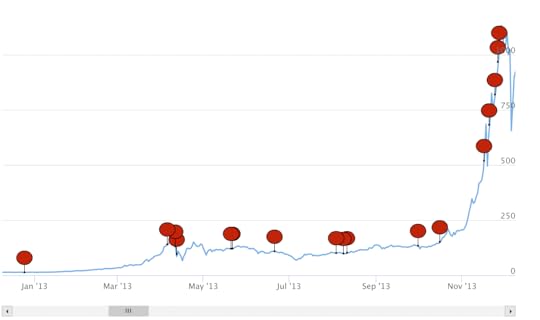

Is the bottom in?The crypto community believes that such articles are a signal for the bottom. Usually, during the market bottom, the FUD (Fear, Uncertainty, and Doubt) is at its peak. The frequency of articles claiming the death of crypto increases. The chart below shows that most articles with bearish sentiment were written when the market was preparing for a rally in Nov 2013.

Source: 99Bitcoins

Source: 99BitcoinsSimilarly, 93 obituaries were reported when the market bottomed in 2018. In 2020 various reports claimed Bitcoin was worthless, dead, and rat poison. The exception to this was in 2017 when over 124 articles were written declaring crypto dead due to multiple bans on crypto exchanges, Initial Coin Offering (ICOs) in China.

The post Bitcoin Has Died Nearly 500 Times as Bear Market Bottom Signals End of Crypto appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

November 13, 2022

Who owns the most Jasmy crypto? High concentration among top 10 holders as price of Japan’s bitcoin plumbs new depths

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Who owns the most Jasmy crypto? High concentration among top 10 holders as price of Japan’s bitcoin plumbs new depths

JasmyCoin (JASMY) has been on a bear run for over a year now, falling by more than 99% since peaking for the last time in May 2021. As of 11 November, the coin was valued at $0.0041.

Despite a downfall in JASMY price action, the token has been seeing a surge in active addresses. Let’s have a closer look at who owns the most JASMY crypto.What is JASMY?Jasmy is a Japanese internet of things (IoT) company that aims to make data sharing safer, and more decentralised and democratised. It specialises in the safe buying and selling of personal data. It was founded in April 2016 by Kunitake Ando and Kazumasa Sato, two former Sony executives, and Hiroshi Harada, a former employee at KPMG.

Harada, who serves as the platform’s CFO, told Binance in an interview in September 2022:

“Jasmy’s mission is to create a mechanism/platform which allows all users to take ownership of their own data in a secure and private manner. Instead of letting a handful of big tech corporations take control of such sensitive data, Jasmy aims to help enable a world where everyone can feel safe and secure about the use of their own data.”The platform allows users to:

Store and control their data in a safe and secure environmentSafely and securely manage and control their devicesProvide safe and secure use of their data under clear rulesJasmy’s Personal Data Locker (PDL) provides users with full ownership over their personal data while its Secure Knowledge Communicator (SKC) is responsible for the achievement of data democracy.

The platform promises to provide its customers with an IoT platform that will help them manage their IoT data securely and efficiently; IoT devices and services that will help customers with the development and maintenance of their IoT platforms and thorough data analysis which will be used for the further improvement of the platform.

Jasmy’s native token, JasmyCoin (JASMY), is used by companies that wish to purchase the users’ data stored on the platform. The token can also be used by users as investment, for governance and metaverse utility. JASMY was built on the Ethereum (ETH) ecosystem and is an ERC-20 token.

JASMY was launched at the end of October 2021 and has been dubbed as “Japan’s bitcoin”.

JASMY supply explainedAccording to data provided by CoinMarketCap, JASMY has a maximum and total supply of 50 billion coins. This makes the coin a deflationary asset, similar to bitcoin (BTC), due to the limit on how many coins can be mined.

As of 11 November 2022, the token had a circulating supply surpassing 4.7 billion and a market capitalisation of $19.4m.

JASMY was Japan’s first ever legally approved cryptocurrency as the country had imposed a strict regulation for this market. It was listed on the Japanese crypto exchange BITpoint on 27 October 2021.

The cryptocurrency was met with a lot of enthusiasm upon its launch, skyrocketing by more than 230% in four days from $1.3024 on 12 February 2021 to $4.2929 – an all-time high following its listing on the crypto exchange Gate.io.

After the fast surge, the token lost over 58% of its value falling to $1.7851 by 22 February 2021, but managed to regain 67% of its value soon after, reaching $2.9628 on 2 March 2021.

JASMY grew past the $2 barrier once again on 9 March 2021 as the platform announced it had joined GitHub, thus providing a space where its users could discuss upcoming projects, news and bugs.

JASMY to USD chart, February 2021 – November 2022

Source: CoinMarketCap

By 5 May 2021, however, the coin lost around 50% of its value, falling to $1.0965 before seeing a mini-surge on the following day and rising to $2.1586. The bullish price action did not last long. The coin entered a bear run, falling by 95% in the following weeks and reaching $0.05456 on 20 June 2021.

Since then, the coin was unable to reach previous highs, falling by an additional 92.4% to $0.004122 as of 11 November 2022.

Who owns the most JASMY crypto?In the past two months, JASMY lost over 57% of its value, falling from $0.009717 on 10 September 2022 to $0.004122 on 11 November 2022. Despite the continued bear trend, token concertation among the top 10 JASMY holders remained high.

Data published on Sanbase showed that the number of active JASMY token addresses spiked to 673 on 30 October from 224 the day before. The number of active JASMY holders spiked once again on 9 November to 719 from a low of 273 on 7 November 2022.

So, who has the most JASMY tokens? Data provided by etherscan.io showed that there are 36,169 JASMY holders in total. The 10 biggest JASMY holders, as of 11 November, collectively owned 51.33% of the total token supply in circulation, meanwhile the top 100 owned 85.44%.

The website noted that the top account holding the most JASMY tokens was the world’s biggest cryptocurrency exchange Binance (BNB). Binance owned 23.43% of the total supply, which amounted to 11.7 billion JASMY coins worth around $48,500, as of 11 November. It’s likely that the exchange is holding the tokens on behalf of its users.

The second on etherscan’s top holders of JASMY list was crypto exchange Mexc.com. It owned 5.86% of the total supply, amounting to 2.9 billion tokens. Mexc.com could own JASMY tokens on behalf of its users.

The third biggest JASMY account was Jasmy Deployer which held 4.8% of the tokens’ total supply amounting to 2.4 billion coins. The fourth and fifth biggest JASMY holders were two anonymous wallets holding 4.12% (1.34 billion coins) and 2.7% (1.29 billion coins) of the tokens’ total supply respectively.

Analyst views on Jasmy’s tokenomicsKnowing who owns the most JASMY tokens can be of use to many retail investors and traders, Anndy Lian, chief digital advisor at the Mongolian Productivity Organisation and author of ‘NFT: From Zero to Hero’, told Capital.com:

“The concentration of tokens on exchanges on leading exchanges such as Binance is a confidence booster for many retail investors.

“JASMY has gained interest from some of the biggest names in Japan’s technology industry. Pansonic and VAIO have also partnered with JASMY. During the COVID-19 pandemic, the largest call centre in Japan, Transcosmos, used JASMY to secure its data. The big names using JASMY’s technology are a really attractive selling point for retail investors.”

Lian added that for JASMY to truly grow, the firm would need to showcase its technology and focus on revenue.

“After all, they are the first legally compliant Japanese crypto coin listed on the Japanese cryptocurrency exchange. Japanese law strictly governs cryptocurrency transactions subject to Financial Services Agency inspections. Being accountable by Japanese law, they need to walk away from fluff and hype and concentrate on real business first.”Please note that analysts’ predictions and opinions can be wrong. The information about the biggest cryptocurrency whales and ownership concentration shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before trading. And never invest or trade money you cannot afford to lose.

Source: https://capital.com/jasmy-token-who-owns-most-jasmycoin-crypto

The post Who owns the most Jasmy crypto? High concentration among top 10 holders as price of Japan’s bitcoin plumbs new depths appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

November 10, 2022

The domino effects from FTX’s issue. Bitcoin, Ether in a sea of red. What next for the cryptocurrency market?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

The domino effects from FTX’s issue. Bitcoin, Ether in a sea of red. What next for the cryptocurrency market?

The FTX’s situation is not promising at the time of publishing. These are the additional comments I had.

Before the FTX incident, we analysed that there was a chance for the market to see one last pump before the end of the year.

After the incident and if there is no bailout for FTX, I would think this would be another black swan event. Based on what we see right now, there is only an $8 billion liquidity gap. Still, the numbers can go very high if you look at the ecosystem, Defi loan products and the various parties such as leading venture funds, sovereign wealth funds, and pension funds involved. The domino effects could be greater than the Terra/ UST event.

I know of a few venture capital companies who just did a restructure and are in the middle of another fundraising from the previous loss due to Terra. Now, they are being hit once again. I do not think their LPs are going to give them more money. They are gone. You will see them in the news very soon.

If you are not part of FTX ecosystem and have no exposure to them, you should continue to focus on your community, continue to build and ignore the noises. If you have exposure to FTX, my friendly advice is to protect your principal investment, exit while you can to stay afloat. The ride will be very bumpy.

Bitcoin, Ether in a sea of red. What next for the cryptocurrency market?The scrapping of the Binance-FTX deal has shaken the confidence of investors already licking their wounds following the collapse of Terraform Labs, Three Arrows Capital and Celsius NetworkThe cryptocurrency market continued its death spiral for the second consecutive day after Binance scrapped a deal to acquire rival exchange FTX.

Prices of major digital assets tumbled to monthly lows, led by Bitcoin, which headed towards $15,000 before rebounding to about $16,800, still down about 10% over the past 24 hours.

Ethereum, the second-largest cryptocurrency by market capitalisation, dropped to $1,087.08 before staging a mini-rally and settling at about $1,180, about 10 percent lower over the past day.

It’s been a turbulent week for cryptocurrencies as the market reacted to reports surrounding two of the biggest cryptocurrency exchanges in the world. Binance, the world’s largest digital asset exchange by volume, said on November 8 it agreed to buy FTX and rescue billionaire Sam Bankman-Fried’s startup from a liquidity crunch.

However, Binance made a U-turn barely 24 hours later. It said that after due diligence and reports regarding mishandled customer funds and alleged US agency investigations, it decided to not pursue the FTX acquisition.

According to a Coindesk report, the native FTT tokens of the FTX, which are also owned by the company, were found in large quantities on the balance sheet of Alameda Research, a cryptocurrency trading company run by Bankman-Fried, prompting widespread criticism of the token.

This meant that Alameda was primarily based on a coin that a sister company created rather than on a standalone asset like fiat money or another cryptocurrency.

Fretting investors

Scurrying for cover amid rumours that the FTX would go bankrupt, investors liquidated their FTX-linked coins to reduce possible losses. Binance, which had more than $500 million worth of FTT on its books, began to sell its holdings, exacerbating the woes of an already ailing market.

The blow-hot-blow-cold relationship between Binance CEO Changpeng Zhao and Bankman-Fried shook the market’s confidence as investors fretted over every development in a sector already licking its wounds following the collapse of Terraform Labs, Three Arrows Capital and Celsius Network.

Among other major cryptocurrencies, Binance (BNB) was down 10 percent, Ripple (XRP) was 5 percent lower, Cardano (ADA) dropped 6 percent, Dogecoin (DOGE) declined 7 percent, and Solana (SOL) had plunged 30 percent when this was written.

While some experts said this may be an opportune time for institutional investors, others emphasised the urgent need for greater regulation of the crypto market.

Raj Kapoor, founder of India Blockchain Alliance, said individual investors may become inactive for a while and institutional investors will probably take advantage of the current discounts and hedge their bets.

“This development will give other exchanges a boost and investors should transfer their altcoins into Bitcoin, Ethereum, and other stablecoins and store them in a cold wallet until the market stabilises and wait for the upswing,” Kapoor said.

He added that the FTT fall may trigger a chain reaction of liquidations because FTX’s lenders may also collapse, taking investors down with them.

“I see a lot of other businesses and endeavours going out of business or filing for bankruptcy,” Kapoor said.

Sharat Chandra, cofounder of India Blockchain Forum, said the FTX fiasco exposes the lack of disclosure and transparency that afflict the current digital asset ecosystem.

Investor protection

“After the Terra Luna debacle, the FTX incident presents another opportunity to regulators to frame stringent regulations, which might end up stifling innovation. It’s time the G-20 members act swiftly and frame global regulations to avoid regulatory arbitrage and ensure investor protection,” he said.

Anndy Lian, author of NFT: From Zero to Hero, said if there is no bailout for FTX, this would be another Black Swan event. Looking at the ecosystem’s liquidity gap, Defi (decentralised finance) loan products and various parties such as leading venture funds, sovereign wealth funds and pension funds involved, the numbers can go very high.

“The domino effects could be greater than the Terra/UST event. If you are not part of the FTX ecosystem and have no exposure to them, you should continue to focus on your community, continue to build and ignore the noises. If you have exposure to FTX, my advice is to protect your principal investment, exit while you can to stay afloat. The ride will be very bumpy,” Lian said.

The post The domino effects from FTX’s issue. Bitcoin, Ether in a sea of red. What next for the cryptocurrency market? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.