Anndy Lian's Blog, page 93

December 15, 2022

Can the Metaverse Facilitate Sustainable Growth of Defi Systems?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Can the Metaverse Facilitate Sustainable Growth of Defi Systems?

Users could earn and spend virtual currency within the metaverse to buy and sell goods and services.The metaverse could also support the creation and trade of unique digital assets.

Users could earn and spend virtual currency within the metaverse to buy and sell goods and services.The metaverse could also support the creation and trade of unique digital assets.The development of the metaverse, as a virtual world that combines elements of the real world with digital creations and experiences, has the potential to generate a new economy. The metaverse could offer users various activities and applications, including social interaction, entertainment, education, commerce, and more. These activities could generate value and economic opportunities for individuals, businesses, and other entities within the metaverse.

Users could earn and spend virtual currency within the metaverse to buy and sell goods and services or use decentralized finance (DeFi) tools and platforms to manage and trade their assets.

The metaverse could also support the creation and trade of unique digital assets, such as non-fungible tokens (NFTs), which could have value within and outside the metaverse. In addition, businesses and other organizations could use the metaverse for marketing, advertising, and other activities that generate revenue.

In my humble opinion, I think it is possible that the development of the metaverse could facilitate the growth of sustainable decentralized finance (DeFi) ecosystems. The metaverse is a virtual world that combines elements of the real world with digital creations and experiences, and it has the potential to support a wide range of activities and applications, including financial ones.

Decentralized finance (DeFi) refers to a class of financial applications and services built on blockchain technology and designed to operate in a decentralized manner, without the need for a central authority. DeFi encompasses a wide range of financial tools and platforms, such as decentralized exchanges, lending and borrowing platforms, insurance, prediction markets, and more.DeFi’s FutureThese tools and platforms allow users to access and interact with financial services and assets more openly, transparent, and securely, potentially enabling greater financial inclusion and autonomy. DeFi is still a largely nascent and evolving field, and its potential impact and limitations are still being explored and debated. Since both metaverse and DeFi are new and debatable. It has potential upsides.

In a metaverse context, DeFi could potentially offer users a more immersive and interactive experience for managing and using their assets, as well as access to a wider range of financial services and opportunities. This could potentially lead to more sustainable DeFi ecosystems, as the increased accessibility and user engagement could drive adoption and growth.

Thoughts on How Decentralization Can Be Used in Metaverses:1. Use decentralized exchanges to trade assets within the metaverse.

2. Use decentralized lending and borrowing platforms to access credit and earn interest on assets within the metaverse.

3. Use decentralized insurance platforms to protect against risks within the metaverse.

4. Use decentralized prediction markets to speculate on events within the metaverse.

5. Use decentralized governance mechanisms to make decisions and govern communities within the metaverse.

6. Use decentralized identity systems to securely manage and verify identities within the metaverse.

7. Use decentralized reputation systems to assess the trustworthiness of individuals and entities within the metaverse.

8. Use decentralized oracles to provide reliable data and information for use within the metaverse.

9. Use decentralized storage and data management systems to securely store and manage data within the metaverse.

10. Use decentralized automation and smart contract platforms to facilitate and automate transactions and interactions within the metaverse.

In theory, a metaverse could facilitate the growth of decentralized finance (DeFi) systems by providing a platform for people to access and interact with these systems in a more intuitive and user-friendly way.

One potential benefit of a metaverse is that it could make it easier for people to understand and use DeFi systems, which can sometimes be complex and difficult to navigate. By providing a visual representation of DeFi protocols and networks, a metaverse could help to demystify these systems and make them more accessible to a wider audience.

Another potential benefit of a metaverse is that it could provide a more engaging and immersive experience for users of DeFi systems. By allowing people to interact with each other and with digital assets in a virtual environment, a metaverse could make DeFi more fun and engaging, potentially increasing user adoption and participation in these systems.

Will Decentralization Work Better in the Metaverse?Well, decentralization has the potential to offer several benefits in the context of the metaverse, a virtual world that combines elements of the real world with digital creations and experiences. Decentralization could enable users to have greater control and autonomy over their assets and activities within the metaverse, and it could provide a more resilient and secure infrastructure for the metaverse.

Decentralized finance (DeFi) tools and platforms could enable users to manage and trade their assets within the metaverse without relying on a central authority. Decentralized governance mechanisms could allow communities within the metaverse to make decisions and coordinate their activities in a decentralized manner. Decentralized identity systems could provide users with secure and verifiable identities within the metaverse.

It could provide a more resilient and secure infrastructure for the metaverse. Because decentralized systems are distributed across multiple nodes, they are less vulnerable to single points of failure and can continue to operate even if one or more nodes go offline. This could make the metaverse more resilient and less susceptible to attacks or other disruptions. Thus making the metaverse environment a good testing ground for decentralization.

DEXs on Metaverse: The Potential is BigThis could be a really crazy thought here. Centralized exchanges (CEXs) are already under the microscope of many regulators. Their first action is to go decentralized, forming new decentralized exchanges (DEXs). This is not a safe option too, the regulators are not blind, and they know that the operators behind the DEXs are from the same group of people.

Because a metaverse is a virtual shared space, DEXs could operate within it without being subject to the same regulatory constraints as they would in the real world. This could give DEXs greater freedom to innovate and experiment with new business models and technologies.

Operating within a metaverse could provide DEXs with access to a larger and more diverse user base. Because a metaverse is a virtual environment, it could potentially attract users from around the world, regardless of their physical location. This could give DEXs access to a larger and more diverse pool of users, potentially increasing their reach and user adoption.

Perhaps operating from a metaverse can give them a longer pathway.

ConclusionThe global metaverse market size was valued at USD 22.79 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 39.8% during 2022-2030. This is a big market. The potential is enormous.

However, I got to emphasize this again. The development and realization of the metaverse as an economic engine is still a largely untested and evolving concept. It will likely require significant advancements in technology and infrastructure, as well as the coordination and cooperation of various stakeholders, to fully realize the potential of this virtual world.

Summarizing my thoughts with a quote:

“The combination of metaverse and decentralized finance is an enormous potential for the future. Investors have put it in the spotlight as they consider it a great long-term investment opportunity. Many of us see this as one of the megatrends of the coming years. I believe it coming. Do you?” – Anndy Lian

The post Can the Metaverse Facilitate Sustainable Growth of Defi Systems? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

December 14, 2022

6 NFT mistakes to avoid for newbies

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

6 NFT mistakes to avoid for newbies

We all know that the NFT is the next big thing and has many forward-looking potentials and utilities. As you find more NFTs trading in different marketplaces, you start to wonder what you should do next: “to buy or not buy”.

Here are six NFT trading mistakes to avoid for newbies.

Not promoting your NFTAfter buying the NFT that you like, that NFT is yours. Most people have this mentality that the creator should be promoting, and as holders of the NFT, let’s sit back to watch the prices grow.

I’m afraid that’s not right. If you promote your copy of NFT, your unique NFT could be the one that gets sold the fastest. Always remember you control your assets. There is no need to wait for the creator.

Flipping it too fastIn the bull market, you have heard from NFT experts that they flipped their NFT 100X in an hour for millions of dollars.

Yes, this is possible back then. Right now, at this bearish market, you need to think long-term. You bought something that you feel has good value and potential. You bought a low price, and you do not mind keeping it. This kind of mentality will bring you far. “Good things take time”- remember this.

Buying it on the wrong marketplaceThere are many NFT marketplaces in the space right now. Some of them are more controlled; They filter what can be listed and remove items that are unsuitable, not authentic or with copyright issues. While some are more open, adopting an “anyone can list” model, they have minimum supervision, and anyone can list almost anything on their platform.

If you choose the latter, you could be buying a fake and when you realise that, you are too late. There is no one attending to your complaints. And yes, there is no refund too. Hence choose wisely.

Buying an NFT that you do not like itThis is a real example. I have friends flexing their apes and punks as profile pictures to show they are well-to-do. But the fact is they do not like them. One guy told me he wants the tiger more, and it is his good luck animal, but there isn’t a big blue chip tiger NFT project. So he bought the monkey.

My sincere advice is to buy something you like, not just for the value. Last month, I purchased an NFT at US$0.01 from the Bybit NFT marketplace. It is affordable, has potential, and most importantly, I like the colours, and I am keeping it. This is how it should be. There is no stress about it.

Not using the right toolsThere are many groups out there who are giving you tips on which one to buy. You can take their advice, but I suggest you research before agreeing and committing to your first NFT.

Many NFT tools in the market right now help you with your decision. For instance, some tools allow you to check on the rarity types. Some tools will enable you to analyse the volume and tell if any wash trading is involved. Stop guessing. Use the right tools!

Listening to the wrong consultantsNFT creators who listened to the wrong consultants are another common thing. They tend to hire the more expensive consultants thinking they know it all. Based on a survey I have conducted with corporations which have launched their NFT, they paid US$300,000 on average to the consultants to start the ball rolling.

I advise corporations and individuals to look online for resources before hiring consultants. I know of NFT studios who helped fellow creators by sharing their resources for free and helping them to list on platforms with zero cost.

One of the groups that I founded in 2006 is doing just that. They groom NFT rising stars, front the NFTs for them and do not ask a single cent from the creators. I think the spirit of sharing is essential, and they did it all correctly.

I am not here to put up any sale propositions. I want to see more people entering the NFT market with ease. And that is why I launched my book “NFT: From Zero to Hero by Anndy Lian” in August.

An NFT or non-fungible token is a unique digital identifier recorded in a blockchain and used to certify authenticity and ownership. Remember the above. It is not a profile picture or just another speculative product. The real value is in its utility. Do not make this mistake as well.

Source: https://e27.co/6-nft-mistakes-to-avoid-for-newbies-20221212/

The post 6 NFT mistakes to avoid for newbies appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

December 12, 2022

Selecting a derivatives DEX: An overview & comparison

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Selecting a derivatives DEX: An overview & comparison

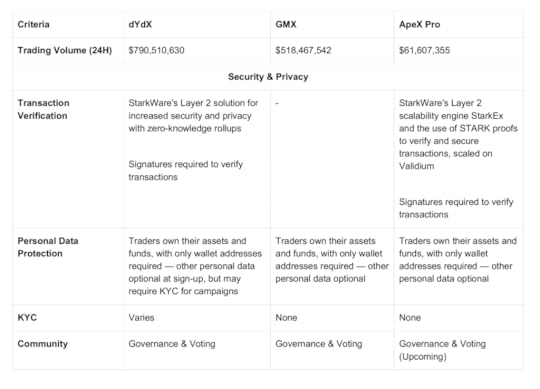

For the purposes of this article, we’ll be looking broadly at these three measures: security and privacy, transaction and cost efficiency and lastly, token ecosystems and reward-generating offerings.

Trading volume on decentralized exchanges (DEXs) hit $32 billion within seven days in mid-November, recording another high since early June this year. This came after an explosive, tumultuous week in the crypto industry, which drove many investors — both seasoned and new alike — to take refuge in self-custodial, permissionless and decentralized trading platforms.

A variety of DEX models are available on the market at present; built on the principles of decentralization and financial freedom for all without restrictions, DEXs have been welcomed for the following reasons:

Removal of intermediaries supervising trades, where traders execute their trades based on immutable smart contractsGreater security and privacy as only traders are privy to their data and such data cannot be shared/seen by othersTraders own their funds and assets, with multiple alternatives for fund recovery in the event of platform service suspensions or disruptions.No access restrictions based on geographical locations or profiles, i.e., no KYC requirementsCommunity-focused, where stakeholders share in the platform’s revenue for providing liquidity, staking, and more.DEXs such as Uniswap dominated the surge in November 2022, and traders are spoilt for choice when choosing a DEX to rely on, given the multiple options on the market. For seasoned traders searching for a derivatives alternative to capture trading opportunities and use every trading signal to the fullest, one could turn to derivatives DEXs — where margin trading and leverage options exist for customizable orders on various popular contracts.

Here’s a comparison of three derivatives DEXs that have shown up on traders’ radars recently, two of which are familiar to most traders — dYdX and GMX. The last DEX we’ll be looking at is the newly-launched ApeX Pro, which has increasingly gained attention after its beta launch back in August with recorded 6,000% growth in trading volume.

Let’s dive into the detaildYdX is a leading decentralized exchange that supports spot, margin and perpetual trading. GMX is a decentralized spot and perpetual exchange that supports low swap fees and zero price impact trades and works on a multi-asset AMM model. And finally, ApeX Pro is a non-custodial derivative DEX that delivers limitless perpetual contract access with an order book model.

Comparison CriteriaFor this article, we’ll be looking broadly at these three measures: (1) security and privacy, (2) transaction and cost efficiency, and lastly, (3) token ecosystems and reward-generating offerings.

The above is a non-exhaustive list of notable highlights from the respective DEXs. dYdX and GMX are trader favorites for good reasons, so let’s see how the new ApeX Pro fares against the other two DEXs.

(1) Security & PrivacyAll three DEXs are on relatively equal grounds regarding privacy-preserving measures, of which self-custody of funds is a common denominator across — the importance of a trading platform that is non-custodial is undeniable in light of recent events.

In particular, both dYdX and ApeX Pro have added safeguards with the integration of StarkWare’s Layer 2 scalability engine StarkEx, allowing the users of both DEXs to access forced requests to retrieve their funds even if the DEXs are not in service. Additionally, STARK proofs are used in both dYdX and ApeX Pro to facilitate the accurate verification of transactions, whereas GMX relies on the safety provisions of Arbitrum and Avalanche.

DEXs are known for their privacy-preserving measures, which is why GMX and ApeX Pro, in true decentralized fashion, are fully non-KYC. dYdX, on the other hand, has, on a previous occasion, implemented KYC to claim rewards for a selected campaign.

Another notable factor would be the provisions for governance and community discussions — on dYdX and GMX, pages to host votes and discussions are readily available. At present, however, ApeX Pro is still working towards creating their community-dedicated space for individuals to carry out activities such as voting and putting up suggestions.

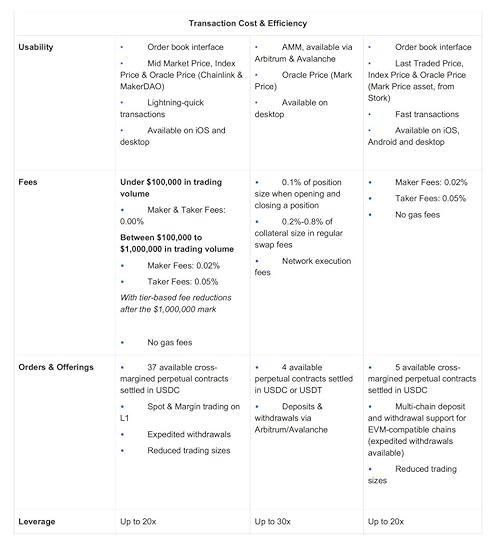

(2) Transaction Cost & EfficiencyApeX Pro has decided to go with the orderbook interface that is found most commonly in CEXs, and like dYdX, this trading model works because it removes the barrier to entry for traditional and aspiring crypto traders to step into DeFi. It also utilizes three price types which help to prevent market manipulation. However, it would be up to a trader’s preference to see Mid-Market Price (dYdX) or Last Traded Price (ApeX Pro) for more accurate trades.

With StarkWare’s integration, it is no surprise that ApeX Pro amped up on transaction speeds to process approximately ten trades and 1,000 order placements every second at no gas fees, together with the low maker and taker fees. dYdX’s tiered fees are incredibly comprehensive and cater to different trader’s different trading sizes; without any gas fees, it is unsurprising that derivatives DEX traders have looked primarily at dYdX.

These tiered fees are also familiar to derivatives traders on CEXs. GMX, on the other hand, does charge network execution fees, which means that gas fees paid by the trader for their trade may vary according to market factors.

ApeX Pro doesn’t have tiered fees just yet but considering that it just launched in November, differential fees are likely to drop soon with an upcoming VIP program, where the staked amount of APEX will determine the discount applied to maker-taker fees.

For traders looking for choices in trading pairs, dYdX remains the DEX with the greatest number of perpetual contracts while also providing access to spot and margin trading at the same time on Layer 1 Ethereum. ApeX Pro and GMX do not offer as many perpetual contracts as dYdX. Still, with new trading pairs being introduced frequently, it’s only a matter of time before traders get access to multitudes of assets and pairs on the remaining DEXs.

What might be notable for all is ApeX Pro’s support for multi-chain deposits and withdrawals on EVM-compatible chains; this is certainly a plus point for traders who engage in dynamic trades across multiple platforms, chains and asset categories in crypto.

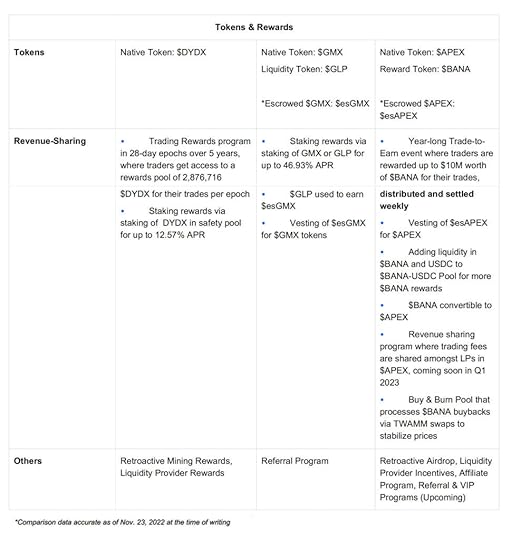

(3) Tokens & RewardsOf all factors, this is probably the one that most traders are interested in — how each DEX helps to multiple rewards and earnings while ensuring that these rewards remain valuable to the individual trader over time.

With dYdX and GMX, the success and popularity of trading events to earn rewards and staking incentives are apparent. It is paramount for DEXs to enable access to revenue-sharing programs for their community members and token holders, which commonly involve the distribution of trading fees accrued over a single period. Rewards and incentives are typically distributed in the platform’s native tokens.

dYdX’s offerings are straightforward, with a Trading Rewards program that distributes 2,876,716 $DYDX to traders based on their trading volume in 28-day epochs. On top of that, users can also stake $DYDX in a pool to receive additional staking rewards. This dual-earning track remains a success amongst traders. GMX, on the other hand, has taken community rewards forward by utilizing escrowed tokens in its staking program to stabilize further and sustain the value of the reward tokens that their traders receive.

ApeX Pro follows in GMX’s footsteps by enriching its token ecosystem with escrowed and liquidity tokens, which allows for more dynamism in maximizing token value and sustaining long-term token use cases for the community than using a single token for all DEX initiatives.

With a total supply of 1,000,000,000 $APEX, 25,000,000 $APEX has been minted to create $BANA. With ApeX Pro’s year-long Trade-to-Earn event and weekly reward distributions in $BANA, traders get to swap rewards for tangible incentives in USDC, and also redeem $APEX tokens after the event ends. Traders can also add liquidity to a $BANA-USDC Pool in exchange for LP Tokens, which they can then exchange for more $BANA.

Moreover, ApeX Pro maintains the stability of $BANA’s value with a Buy & Burn Pool, ensuring that its users’ holdings of either token are maximized at any time. $190,000 worth of $BANA will be distributed weekly for a year — a quick and easy settlement that every trader can certainly appreciate.

ConclusionInnovations in DEX architecture in the nascent DeFi industry abound as DEXs find their footing in a world dominated by CEXs. It’s good news for traders because they can choose DEXs based on the provisions that suit them most or draw their preferred benefits across various platforms. With the growth, it has seen within its first week of mainnet launch and an ecosystem that combines the best of features on existing DEXs, ApeX Pro is one to watch out for in 2023.

Ending with a quote as usual.

“Blockchain-based projects should go back to their roots – decentralization. Decentralization is here to stay and it is the future.”

– Anndy Lian

Source: https://cryptoslate.com/selecting-a-derivatives-dex-an-overview-comparison/

The post Selecting a derivatives DEX: An overview & comparison appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

New to NFTs? Six NFT Mistakes to Avoid

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

New to NFTs? Six NFT Mistakes to Avoid

We all know that the NFT has many forward-looking potentials and utilities. As you find more NFTs trading in different marketplaces, you start to wonder what you should do next- “To buy or not buy”. Here are 6 NFT trading mistakes to avoid for newbies.

Mistake 1- Not promoting your NFTAfter buying the NFT that you like, that NFT is yours. Most people have this mentality that the creator should be the one promoting, and as holders of the NFT, let’s sit back to watch the prices grow.

I’m afraid that’s not right. If you promote your copy of NFT, your unique NFT could be the one that gets sold the fastest. Always remember you control your assets. There is no need to wait for the creator.

Mistake 2- Flipping it too fastIn the bull market, you have heard from NFT experts that they flipped their NFT 100X in an hour for millions of dollars.

Yes, this is possible back then. Right now, at this bearish market, you need to think long-term. You bought something that you feel has good value and potential. You bought a low price, and you do not mind keeping it. This kind of mentality will bring you far. “Good things take time”- remember this.

Mistake 3- Buying it on the wrong marketplaceThere are many NFT marketplaces in the space right now. Some of them are more controlled; They filter what can be listed and remove items that are unsuitable, not authentic or with copyright issues. While some are more open, adopting an “anyone can list” model, they have minimum supervision, and anyone can list almost anything on their platform.

If you choose the latter, you could be buying a fake and when you realize that, you are too late. There is no one attending to your complaints. And yes, there is no refund too. Hence choose wisely.

Mistake 4- Buying an NFT that you do not like itThis is a real example. I have friends flexing their apes and punks as profile pictures merely to show they are well-to-do. But the fact is they do not like them. One guy told me he likes tiger more and is his good luck animal, but there isn’t a big blue chip tiger NFT project. So he bought the monkey.

My sincere advice to all is to buy something you like, not just for the value. I purchased an NFT at $0.01 from Bybit NFT marketplace last month. It is affordable, has potential, and most importantly I like the colours and I am keeping it. This is how it should be. There is no stress about it.

Mistake 5- Not using the right toolsThere are many groups out there who are giving you tips on which NFT to buy. You can take their advice, but I suggest you do your own research before agreeing to their advice and committing to your first NFT.

Many NFT tools in the market right now help you with your decision. For instance, some tools allow you to check on the rarity types. Some tools allow you to analyze the volume and tell if any wash trading is involved. Stop guessing. Use the right tools!

Mistake 6- Listening to the wrong consultantsNFT creators who listened to the wrong consultants are another common thing. They tend to hire the more expensive consultants thinking they know it all. Based on a survey I have conducted with corporations which have launched their NFT, they paid $300,000 on average to the consultants to start the ball rolling.

I would advise corporations and even for individuals to look online for resources before hiring consultants. I know of NFT studios who helped fellow creators by sharing their resources for free and helping them to list on platforms with zero cost. One of the groups that I founded in 2006 is doing just that. They groom NFT rising stars, front the NFTs for them and do not ask a single cent from the creators. I think the spirit of sharing is essential, and they did it all correctly.

I am not here to put up any sale propositions. I want to see more people entering the NFT market with ease. And that is also the reason why I launched my book- “NFT: From Zero to Hero by Anndy Lian” in August.

An NFT or non-fungible token is a unique digital identifier that is recorded in a blockchain and used to certify authenticity and ownership. Remember the above. NFT is not a profile picture or just another speculative product. The real value is in its utility. Do not make this mistake as well.

Featured image generated via HackerNoon Stable Diffusion prompt of ‘bored apes making sales at a lemonade stand.’

Source: https://hackernoon.com/new-to-nfts-six-nft-mistakes-to-avoid

The post New to NFTs? Six NFT Mistakes to Avoid appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

December 9, 2022

Awesome Gang: Interview With Author Anndy Lian

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Awesome Gang: Interview With Author Anndy Lian

Tell us about yourself and how many books you have written.

My name is Anndy Lian. I have provided advisory across a variety of industries for local, international, public listed companies and governments. I am an early blockchain adopter and experienced serial entrepreneur, book author, investor, board member and keynote speaker. I have written two books. The first was “Blockchain Revolution 2030”. The second is “NFT: From Zero to Hero”.

What is the name of your latest book and what inspired it?

NFT: From Zero to Hero is my latest book. Zero to Hero is a call to anyone and everyone excited about the prospect of the world of NFT. Bound by imagination only, the NFT space is still in its early days, and early adopters can be a “heroes” in their search for new possibilities.

Do you have any unusual writing habits?

I like to walk around during the brainstorming periods. And usually lying on the bed when writing.

What authors, or books have influenced you?

Books about Lee Kuan Yew, the founding father of Singapore, influenced me the most. For example, “The Singapore Story: Memoirs of Lee Kuan Yew” is a book about his personal and political life and provides a blow-by-blow chronicle of his dealings with political groups and leaders, both Malaysian and international, on the road to independence.

What are you working on now?

Currently, I am appointed as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. I am still working on good investments on the side. I still hope to contribute my knowledge and expertise to a good crypto company in the near future.

What is your best method or website when it comes to promoting your books?

I do believe being active on social media will help. Of course, having a community that believes in you helps much too. Community-driven, word-of-mouth promotion works the best.

Do you have any advice for new authors?

New authors should look at publishing their books in new formats like NFT or on Web3 platforms too. Trying something new can bring you surprises too.

What is the best advice you have ever heard?

Focus more on the present — Don’t regret the past and don’t be anxious about the future. Appreciate what is happening right now.

What are you reading now?

I am reading “Steve Jobs” by Walter Isaacson right now.

What’s next for you as a writer?

I am working on a picture book and another on cryptocurrency trading strategies.

If you were going to be stranded on a desert island and allowed to take 3 or 4 books with you what books would you bring?

The Universe in a Single Atom: The Convergence of Science and Spirituality by Dalai Lama would be the book. I always wanted to complete this book but did not find the time to finish it.

Adding to the stranded island list would be Proof Of Stake: The Making of Ethereum and the Philosophy of Blockchains Paperback by Vitalik Buterin and The Mamba Mentality: How I Play Hardcover by Kobe Bryant.

Author Websites and ProfilesAnndy Lian’s Social Media Links

Here is the link to my featured author interview post on AwesomeGang.com

https://awesomegang.com/?p=1056616

https://awesomegang.com/author-interviews/

The post Awesome Gang: Interview With Author Anndy Lian appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Hooked Protocol price prediction: What is HOOK?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Hooked Protocol price prediction: What is HOOK?

We’ve heard of earn-to-play tokens but what does a learn-to-earn cryptocurrency exist?

Now it does!

The Hooked Protocol (Hook) is one of the first platforms to incorporate GameFi technologies with learning and cryptocurrencies by teaching new and experienced crypto investors about the world of Web3 through playing games.

Even though its native token, HOOK, was launched on 1 December 2022, the token is already making headlines with a surge of more than 40% on its second day of existence.

What does the Hooked Protocol price prediction suggest?

What is Hooked Protocol (HOOK)?Hooked Protocol is the “on-ramp layer for massive Web3 adoption to form the future of community-owned economies”.

The application was created with the aim of helping everyone, whether they have had previous crypto experience or not, enter, own and earn a share of crypto through a gamified experience. In addition, the platform is providing crypto investors with a number of learning and earning tools, via gamified learning, that will help them enter and adapt to the world of Web3 through playing games.

Its most prominent game is Wild Cash, “the all-in-one Learn-to-Earn dApp [decentralised application]” that rewards users in GOLD tokens for their participation in “delicately tailored quiz challenges”.

According to the Hooked Protocol website, Wild Cash is the first and only Web3 application to dominate a Google Play ranking ever having achieved more than 2.5 million monthly active users, over 50,000 new users and 90% of user participation in three months after its launch (the DApp was launched in the third quarter of 2022).

The platform is targeting “billions of Web2 internet users who can be onboarded to Web3” through its learn-to-earn initiative in order to solve one of the biggest unresolved challenges of the crypto industry – the lack of new users.

“Potentials for intrinsically dynamic modern virtual economy after covid are recognized and scaled up, leading to upsurging demands for trusted cooperation and sustainable economic model in Web3,” Hooked Protocol said in its whitepaper.

The platform has a dual token system:

HOOK: its governance token that reflects the value of the Hooked protocol ecosystemHooked Gold Token (HGT): an in-ecosystem only utility token through which the community is incentivised.Apart from governance, HOOK is also used to pay for gas fees in on-chain activities and staking incentives as holding rewards. In addition, by holding HOOK tokens, community members may gain access to exclusive events and grants to buy limited editions of in-platform non-fungible tokens (NFTs).

“HOOK will be put into innovation practices which overall benefit the ecosystem of both individual participants and businesses, ensuring considerable liquidity and token value will grow in direct proportion for the success of the whole community,” the coin’s whitepaper noted.

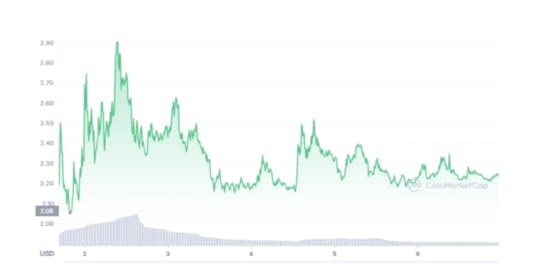

A bullish start in a bear marketHOOK launched on CoinMarketCap on 1 December 2022 and within a day had gained over 40%, up from $2.0626 to $2.9016, its all-time high. In general, HOOK has had a pretty bullish start, a significantly positive aspect in an overall bear market.

The bull run in the coin’s price, however, did not last long as it lost over 20% of its gains on 2 December 2022, dropping to around $2.30 as the platform warned investors on Twitter that all HOOK tokens for sale on PancakeSwap were fake.

HOOK to USD price chart, December 2022

Source: CoinMarketCap

By the following day, the cryptocurrency managed to regain some of its losses, rising 13.8% to $2.617, but soon fell back down to $2.15.

Between 3 and 4 December 2022, HOOK fluctuated between $2.10 and $2.30 before surging twice, first by 15.8% to $2.4904 from $2.15 and then by an additional 1% to $2.517, possibly hiked by the platform’s whitelist giveaway.

Since surging to $2.517 on 4 December 2022, HOOK’s value has been dipping, down by 9.8% to $2.27 as of 7 December 2022.

According to data published on CoinMarketCap, as of 7 December 2022 the total number of HOOK coins in circulation is capped at 500 million. The cryptocurrency does not have a maximum supply, meaning that an unlimited amount of tokens can be mined. HOOK’s circulating supply stands at 50 million.

Latest news driving HOOKPerhaps, some of the biggest news, news driving HOOK in recent days is the token’s listings on major exchanges.

On 2 December 2022, PancakeSwap announced that “the HOOK fam is now live on” the platform, meaning the token was available for purchase on the crypto exchange.

In addition, the HOOK cryptocurrency has been highly driven by the completion of the Hooked Protocol subscription launchpad and its listing on Binance, one of the most popular crypto exchanges worldwide.

According to a press release published by Binance, over 114,000 investors committed more than 9 million BNB during the subscription period, showing high interest for the HOOK cryptocurrency.

In other news, on 5 December 2022 the Hooked Protocol platform announced the end of its very first Hooked Web3 Quiz Maker Contest, which saw the winner scoring $100 equivalent of HOOK, with the platform promising more “fun” to come soon.

In a blog post published on Medium on 5 December 2022, the Hooked Protocol noted that the platform is working on bettering its user acquisition methodology in order to further expand the platform on a more global level.

In addition, the Hooked Protocol will focus on user engagement by “adding more content and developing new features to keep users engaged”.

Finally, “on the user rewards and commitment side” the platform is planning to launch an incentive mechanism in the following weeks.

HOOK is also planning to launch a product roadmap and airdrop plan.

So, what is the overall sentiment on the future Hooked Protocol price prediction?

Hooked Protocol price predictionAccording to data provided by BitNation, as of 7 December 2022 the Hooked Protocol Price prediction for 2023 sees the token surging to $6.29 and reaching $9.44 by 2025. The website’s long-term Hooked Protocol coin price prediction saw the coin rising to $15.52 by 2028 and $22.02 by 2030.

DigitalCoinPrice also supported the bullish Hooked Protocol crypto price prediction, seeing the token averaging $5.73 in 2023. The website’s Hooked Protocol price prediction for 2025 saw the coin surging past an average of $9 and exceeding $11 in 2027.

The website’s Hooked Protocol price prediction for 2030 saw the token passing an average $32.

Anndy Lian, chief digital advisor at the Mongolian Productivity Organisation and author of NFT: From Zero to Hero, told Capital.com that the recent HOOK price surge was due to the cryptocurrency’s listing on Binance:

“Based on past track records for Binance Launchpad projects, users highly value such projects. Hence hitting numbers like this are not uncommon.”He also added that, at the time of launch, only 10% of the tokens were in circulation, which, according to Lian, is an easier amount of currencies to manage.

“I would like to see how Hooked Protocol fairs in the bear market and how ‘quiz-to-earn’ rewards can be sustained over a more extended period. A similar comparison with GMT would be fair too. I remember them jumping to $3.80, and then their price plummeted 90% shortly. If they can manage the rewards, continue to build on its community and use base. They could be a considerable force to reckon with.”

To conclude, Lian noted that in the long run, only time will tell on where the Hooked Protocol price prediction will head.

The Hooked Protocol whitepaper also shared an outlook on what could potentially affect the future HOOK price predictions noting that the coin’s “long-term value is tied with the confidence people hold for the project but as opposed to HGT, supply of HOOK is fixed and designed to be deflationary”.

Note that HOOK/USD predictions can be wrong and shouldn’t be used as a substitute for your own research. Always conduct your own due diligence looking at fundamental and technical analysis, a wide range of commentary and latest news. Remember that past performance does not guarantee future returns. And never trade money that you cannot afford to lose.

Source: https://capital.com/hooked-protocol-hook-price-prediction

The post Hooked Protocol price prediction: What is HOOK? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

December 1, 2022

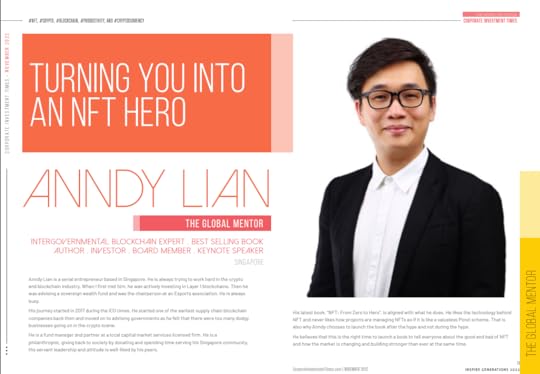

Corporate Investment Times (November 2022): Turning You Into An NFT Hero

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Corporate Investment Times (November 2022): Turning You Into An NFT Hero

Anndy Lian is a serial entrepreneur based in Singapore. He is always trying to work hard in the crypto and blockchain industry. When I first met him, he was actively investing in Layer 1 blockchains. Then he was advising a sovereign wealth fund and was the chairperson at an Esports association. He is always busy.

His journey started in 2017 during the ICO times. He started one of the earliest supply chain blockchain companies back then and moved on to advising governments as he felt that there were too many dodgy businesses going on in the crypto scene.

He is a fund manager and partner at a local capital market services licensed firm. He is a philanthropist, giving back to society by donating and spending time serving his Singapore community. His servant leadership and attitude is well-liked by his peers.

His latest book, “NFT: From Zero to Hero”, is aligned with what he does. He likes the technology behind NFT and never likes how projects are managing NFTs as if it is like a valueless Ponzi scheme. That is also why Anndy chooses to launch the book after the hype and not during the hype. He believes that this is the right time to launch a book to tell everyone about the good and bad of NFT and how the market is changing and building stronger than ever at the same time.

During this interview, he emphasized a few points. Firstly, he wants all to know that mastering the logic behind NFT is not difficult. You need only the correct mindset and set up clear purposes when creating the NFTs. There is also a lot of information online for you to read about, and there is no reason why you cannot understand it.

Secondly, he said that there are many good tools online to help you decide what you can consider buying. He has spent time using some of the tools and listed a handful in his book that he thinks are useful. “Instead of guessing what NFT to buy, use the statistics to aid your decision,” Anndy said.

Anndy also went on to share that data could be contradicting. For example, 10,000 NFTs were sold, but when you look at the on-chain wallet addresses, only 10 of them exist. These are the small details you need to catch when making a decision.

Thirdly, he wants people who read his book and look at the trends ahead. The general public knowledge is very superficial. Many people think that NFT is a quick money scheme and we are purely selling “air”. “The fact that NFT is not just about a jpeg profile picture is not known to many. This is disturbing.”

According to Anndy, we can look at creating medical platforms using NFTs and empowering patients with the ability to control their medical records. We can look at digitizing land title deeds using NFT too. “The NFT usage scenarios are limitless.”

I also took the chance to ask Anndy what we should invest in next. He said to follow the simple rules- Consider investing in projects with good utility, strong community, and always building. “If they do not have the above, there is no need to consider who is on their cap table and how strong their team is. Assuming they have a working tech solution.”

Lian added that some people said that investing in Layer 1 blockchain is a sure win is totally wrong. He said starting layer 1 is not difficult; sustaining it with good usage is the challenging part. You need a lot more money to make it work compared to layer 2.

He said that, similarly, some people hate meme coins and said they have no value. “I don’t see eye to eye on this. The value of a meme coin is in its community and the core team. If the community is strong, anything can happen.” He added that bad management is one of the core reasons why meme coins fail. “The tell-tale signs are obvious.”

Just like the same old Anndy we see on Twitter. He ended by saying, “not financial advice”.

Anndy Lian’s new book has sold more than 8,000 copies during its launch at Bybit NFT marketplace. He has subsequently listed them on leading platforms like Amazon and Google books. At the point of this interview, he told me that he had appointed a Singapore distributor who would put his books in major bookstores in the South East Asia region.

I also read that he was awarded an Honorary Doctoral Degree by the Academic Council of Ulaanbaatar Erdem University in recognition of his contribution to the development of productivity science in Mongolia. He is also completing his PhD soon.

Congratulations Anndy.

Source:

The post Corporate Investment Times (November 2022): Turning You Into An NFT Hero appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Anndy Lian Named Top 50 B2B Thought Leaders & Influencers You Should Work With In 2023 (APAC)

Top 50 B2B Thought Leaders & Influencers You Should Work With In 2023 (APAC)Thought Leader (Alphabetical)Thought Leader Profile & PortfolioTop Ranking Thinkers360 Leaderboards

Top 50 B2B Thought Leaders & Influencers You Should Work With In 2023 (APAC)Thought Leader (Alphabetical)Thought Leader Profile & PortfolioTop Ranking Thinkers360 Leaderboards

Dr. Mazlan Abbas

Dr. Mazlan AbbasCEO at FAVORIOT

Contact Dr. Mazlan AbbasIoT, GovTech, Smart Cities

DV Abhang,C.P.M.,CPSM

DV Abhang,C.P.M.,CPSMVice President & Head -Corporate Procurement & Supply Chain Group at Ram Ratna Group

Contact DV Abhang,C.P.M.,CPSMProcurement, Supply Chain, Change Management

Gokul Alex

Gokul AlexCo-Founder and CTO at Semiott Systems

Contact Gokul AlexBlockchain, Open Innovation, Quantum Computing

Puteri Sofia Amirnuddin

Puteri Sofia AmirnuddinSenior Law Lecturer | Programme Director for Master of Laws Programmes | CIRI Chief Project Officer | International Consultant | Keynote Speaker | E-Learning Strategist | AR, NLP and Gamification Practitioner | Thought Leader in Transformative Higher at Taylor’s University

Contact Puteri Sofia AmirnuddinEdTech, AR/VR, Health & Safety

Jane Anderson CSP

Jane Anderson CSPBusiness Coach to Female B2B Consultants and Thought Leaders at Jane Anderson Communications

Contact Jane AndersonSocial, Sales, Marketing

Bhavana BP

Bhavana BPFounder & Chief Empowerment Officer at LET ME LISTEN

Contact Bhavana BPMental Health, Health & Wellness, Diversity & Inclusion

Arthur Carmazzi

Arthur CarmazziCAO at Directive Communication International (Asia) PTE LTD

Contact Arthur CarmazziCulture, Mental Health, Change Management

Ashley Galina Dudarenok

Ashley Galina DudarenokFounder at ChoZan

Contact Ashley Galina DudarenokMarketing, Digital Disruption, Business Strategy

Apoorv Durga, Ph.D.

Apoorv Durga, Ph.D.Vice President Research and Advisory at Real Story Group

Contact Apoorv Durga, Ph.D.Marketing, Customer Experience, Digital Transformation

Chenthil Eswaran

Chenthil EswaranTop Cloud Apps (ERP/CRM/HCM)/Prop Tech Thought Leader at Aspire Systems (India) Pvt. Ltd

Contact Chenthil EswaranPropTech, CRM, ERP

Alvin Foo

Alvin FooVenture Partner at Chain Valley Capital

Contact Alvin Foo

Samiran Ghosh

Samiran GhoshCo-Founder at unblox Solutions

Contact Samiran GhoshCryptocurrency, Blockchain, FinTech

Luke Jamieson

Luke JamiesonGlobal Content Director at Centrical

Contact Luke JamiesonSportsTech, Future of Work, Customer Experience

Monica Jasuja

Monica JasujaHead of Money Management at GoTo Financial

Contact Monica JasujaFinTech, Digital Disruption

Ratan Jyoti

Ratan JyotiChief Information Security Officer at Ujjivan Small Finace Bank

Contact Ratan JyotiPrivacy, Blockchain, Cybersecurity

Keith Keller

Keith KellerTwitter Video Marketing Specialist at Global Social Media Coaching

Contact Keith KellerSocial, Marketing

Harjeet Khanduja

Harjeet KhandujaSenior Vice President at Reliance Jio

Contact Harjeet KhandujaHR, 5G, Leadership

Aditya Khullar

Aditya KhullarHead – Cyber Security & Data Privacy at Adani Digital Labs

Contact Aditya KhullarRisk Management, Privacy, Cybersecurity

Kashyap Kompella

Kashyap KompellaCEO and Chief Analyst at RPA2AI Research

Contact Kashyap KompellaAI, RPA, Cloud

Dr. Ram Kumar G, PhD

Dr. Ram Kumar G, PhDCyber Security GRC Leader at Nissan Digital

Contact Dr. Ram Kumar G, PhDRisk Management, Cybersecurity, Privacy

Avdhesh Kumbhar

Avdhesh KumbharDirector Marketing Advertising & Communications at Bahama Beach Club Resort

Contact Avdhesh KumbharSales, Public Relations, Startups

Anndy Lian

Anndy LianChief Digital Advisor at Mongolian Productivity Organization

Contact Anndy Lian

Chris Luxford

Chris LuxfordChange Agent and Senior Consultant at The ASPIRE! Group, LLC

Contact Chris LuxfordSales, Customer Experience, Leadership

Adv (Dr.) Prashant Mali [MSc, LLB, LLM, Ph.D.]

Adv (Dr.) Prashant Mali [MSc, LLB, LLM, Ph.D.]Founder & President at Cyber Law Consulting

Contact Adv (Dr.) Prashant Mali [MSc, LLB, LLM, Ph.D.]Privacy, Legal & IP, Cybersecurity

Navin Manaswi

Navin ManaswiFounder & CEO at WoWExp

Contact Navin ManaswiAR/VR, Retail, Startups

Siobhán (Shiv-awn) McHale

Siobhán (Shiv-awn) McHaleExecutive General Manager: People, Culture & Change at DuluxGroup

Contact Siobhán (Shiv-awn) McHaleHR, Future of Work, Culture

Pradeepta Mishra

Pradeepta MishraDirector of Artificial Intelligence at Fosfor by LTI

Contact Pradeepta MishraPredictive Analytics, Analytics, AI

Prof M Nazri Muhd

Prof M Nazri MuhdProf. (AI Practice); Founder / Group CEO, MyFinB Group; Chairman, MyFinB Ventures; Chairman, Centre for AI Innovation (CE.A.I); Honorary Consul, Cabo Verde at MyFinB Group| Centre for AI Innovation (CE.A.I)

Contact Prof M Nazri MuhdAI, Digital Transformation, Predictive Analytics

Vidusha Nathavitharana

Vidusha NathavitharanaFounder / Destiny Architect at Luminary Learning Solutions Private Limited

Contact Vidusha NathavitharanaManagement, Health & Wellness, Leadership

Steve Nouri

Steve NouriFounder at AI4Diversity

Contact Steve NouriNFT, RPA, AR/VR

Arpita (Mukherjee) Pamnani

Arpita (Mukherjee) PamnaniDeputy Vice President HR at Axis Bank

Contact Arpita (Mukherjee) Pamnani

Sameer Paradkar

Sameer ParadkarEnterprise Architect at AtoS

Contact Sameer ParadkarData Center, Design Thinking, Emerging Technology

Kalilur Rahman

Kalilur RahmanNovartis Operations – Data Digital & IT/ Director – Platform Services

Contact Kalilur RahmanAgile, Big Data, Analytics

Pravin Rajpal

Pravin RajpalFounder at INNOVATIONEXT

Contact Pravin Rajpal

Professor M.S. Rao, Ph.D.

Professor M.S. Rao, Ph.D.Founder at MSR Leadership Consultants India

Contact Professor M.S. Rao, Ph.D.Leadership, Entrepreneurship, Business Strategy

Dr Mark van Rijmenam

Dr Mark van RijmenamFuture Tech Strategist at The Digital Speaker

Contact Dr Mark van RijmenamMetaverse, NFT, Blockchain

Marie-Claire Ross

Marie-Claire RossSpeaker | Mentor | Facilitator at Trustologie

Contact Marie-Claire RossHealth & Safety, Health & Wellness, Management

Prof.(Dr.) Sanjay Rout

Prof.(Dr.) Sanjay RoutCEO at Innovation Solution Lab

Contact Prof.(Dr.) Sanjay RoutMergers & Acquisitions, Open Innovation, GovTech

Rahul Sasi

Rahul SasiChief Technology Officer at CloudSEK

Contact Rahul SasiManagement, Cybersecurity, Big Data

Jeremy Scrivens

Jeremy ScrivensDirector at The Emotional Economy at Work

Contact Jeremy ScrivensAgile, Diversity & Inclusion, HR

Akanksha Sharma

Akanksha SharmaGlobal Head ESG – Social Impact, Sustainability & Policy at STL – Sterlite Technologies Limited

Contact Akanksha SharmaCSR, Ecosystems, Sustainability

Roger Smith

Roger SmithSME’s Virtual Chief Information Security Officer (CISO) at Care MIT

Contact Roger SmithCybersecurity, Security, Risk Management

Aarron Spinley

Aarron SpinleyGrowth Anthropologist, Futurist, Speaker at SPINLEY.CO

Contact Aarron SpinleyLean Startup, Customer Experience, Culture

Danielle Stein Fairhurst

Danielle Stein FairhurstFinancial Modeller at Plum Solutions

Contact Danielle Stein FairhurstAnalytics, Management

Robin Tommy

Robin TommyTCS Rapid Lab Head at Tata Consultancy Services

Contact Robin TommyAR/VR, Sustainability, EdTech

Steve Tunstall

Steve TunstallDirector and Owner at Tunstall Associates

Contact Steven Tunstall

Dr. Sunil Kumar Vuppala

Dr. Sunil Kumar VuppalaDirector – Data Science at Ericsson

Contact Dr. Sunil Kumar VuppalaIoT, Emerging Technology, AI

Friska Wirya

Friska WiryaPrincipal Founder at Fresh by Friska

Contact Friska WiryaChange Management, COVID19, Digital Transformation

Dr. Mehmet Yildiz

Dr. Mehmet YildizThought Leader for Architecting Digital Transformation at Digitalmehmet

Contact Dr. Mehmet YildizHealth & Safety, Mental Health, Design Thinking

Sukor Zainal

Sukor ZainalExecutive Director at EFTECH DRILLING SOLUTIONS

Contact Sukor ZainalProject Management, Data Center, Public Relations

Our listing includes members of Thinkers360 and who have curated and shared their thought leadership content – including articles, blogs, books, keynotes, media interviews, panels, podcasts, social media, speaking events, videos, webinars and whitepapers – via our platform.

Our differentiation from the various influencer leaderboards on social media, is that we take a holistic view of thought leaders and experts, beyond their social media activity, and look across all the hats they may wear – such as academic, author, consultant, entrepreneur, influencer and speaker – and all the types of thought leadership content they produce.*

We focus on cutting edge business, technology and sustainability topics including 5G, Agile, AI, Analytics, AR/VR, Autonomous Vehicles, Big Data, Blockchain, Business Continuity, Business Strategy, Change Management, Climate Change, Cloud, COVID-19, CRM, Corporate Social Responsibility, Cryptocurrency, Culture, Customer Experience, Customer Loyalty, Cybersecurity, Data Center, Design Thinking, DevOps, Digital Disruption, Digital Transformation, Digital Twins, Diversity & Inclusion, EdTech, Emerging Technology, Entrepreneurship, ERP, FinTech, GovTech, Health & Safety, Health & Wellness, HealthTech, HR, Innovation, InsurTech, International Relations, IoT, Leadership, Lean Startup, Legal & IP, Management, Marketing, Mental Health, Mergers & Acquisitions, Metaverse, Mobility, National Security, NFT, Open Innovation, Predictive Analytics, Privacy, Procurement, Project Management, PropTech, Public Relations, Quantum Computing, Renewable Energy, Retail, Risk Management, RPA, Sales, Security, Smart Cities, Social, SportsTech, Startups, Supply Chain, Sustainability and Web3.

###

Join us on Thinkers360 — Connecting Global Brands with the World’s Foremost Thought Leaders and Authentic Influencers for Game-Changing Results!Thinkers360 is the world’s first, largest and premier B2B thought leader and influencer marketplace — including academics, advisors, analysts, authors, consultants, executives, influencers and speakers — with over 100M followers on social media combined. We are differentiated by our unique patent-pending algorithms that measure thought leadership and authentic influence looking far beyond social media alone.

Individuals: Connect and work with global brands as an advisor, author, consultant, influencer, speaker and more. Showcase your thought leadership profile and portfolio, build your media kit, amplify your content, and participate in our global leaderboards and opportunity marketplace: Sign-Up (free) | Subscribe to our Newsletter

Enterprise (including brands & agencies): To find and work with experts, consultants and advisors in your niche or to activate and amplify your own corporate executives, thought leaders, employee advocates and content on social media and among our opt-in B2B thought leader and influencer community (100M+ followers on social media combined): Request an Enterprise Consultation | Explainer Video | Subscribe to our Newsletter

Want to find and work with advisors, authors, consultants, influencers and speakers ( including access to our unique thought leader profiles and portfolios, in-depth reports and analytics, warm personal introductions, and our zero-transaction fee speaker bureau)?

Contact us to discuss any of your project needs at info@thinkers360.com

For custom influencer lists, advertising and sponsorship opportunities, please contact info@thinkers360.com.

Our Methodology

* The Thinkers360 patent-pending algorithm helps to produce leaderboards that look across all thought leader roles and across the quantity and quality of their thought leadership content. It provides a valuable measure of thought leadership content, encourages genuine content creation, incorporates social media influence as one of the measures, and encourages richer profiles and portfolios through gamification.

Of course, no measurement system related to influence or thought leadership is perfect, but the thought leadership scoring system within Thinkers360 is a highly-differentiated approach to help you identify authentic thought leaders – looking far beyond social media – serving as the tip of the spear for your B2B influencer marketing objectives.

For more information, contact us today at info@thinkers360.com.

The post appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

November 30, 2022

CeFi, a ‘necessary evil’ today: 7 reasons why trustless DEX is the future

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

CeFi, a ‘necessary evil’ today: 7 reasons why trustless DEX is the future

An increasing number of DEXes are integrating scaling solutions that will massively increase transaction workload while keeping costs low

An increasing number of DEXes are integrating scaling solutions that will massively increase transaction workload while keeping costs lowAmidst talks of growing adoption and decentralisation becoming the norm, the great decentralised exchange (DEX) vs centralised exchange (CEX) debate is more prominent now than ever. This debate has many case studies for us to refer to.

The latest would be FTX. FTX owes nearly US$3.1 billion to the top 50 creditors and is estimated to have “more than 100,000” creditors.

Why trustless DEX is the way forwardIndividual data and asset controlCEX holds custody of your deposited assets and all your personal information. You have no control over how the assets and data are being used. While in a DEX environment, it is non-custodial; typically, only an individual wallet address is connected to the exchange. In other words, you have complete control over your assets.

Liquidity and market depthHistorically, CEX is known for deeper liquidity and market depth. DEXes, in general, are trying to catch up with CEX’s efficiency in matching and executing orders. But the top DEXes have good enough liquidity and market depth for the major coins, and in fact, DEX’s liquidity is more accurate and traceable.

KYC and accessibilityKYC is often required for withdrawals exceeding a specific amount or specific trading products, and it is typically region-locked for most CEXes. While DEX has no KYC, traders only need a wallet address. This helps to drive accessibility to true financial freedom.

User-friendlinessCEX provides a wide range of products, including spot and fiat on-ramps, which is most familiar to traditional and crypto traders, especially beginners. DEX products may be harder to grasp with insufficient onboarding guidelines for traders. Again, this point for DEX is changing.

The user interface and experience have significantly improved; some of the newer DEXes look and function exactly like CEX.

Transaction costsCEX is known for high transaction or platform costs, especially when the system is hugely loaded with trades at a single point in time. An increasing number of DEXes are integrating scaling solutions that will massively increase transaction workload while keeping costs low and passing the savings on to traders.

Community involvementCEXes, are often one-way, non-reciprocal communication from a central operator to traders. Individual traders are seen as clients utilising as service that the CEX provides. While DEXes focus on community-building and involvement, where traders can become stakeholders and have a say in protocol changes or share in transaction fees on the platform.

TransparencyDEXes offer strong execution guarantees and increased transparency into the underlying mechanics of trading. Trades are trackable, traceable and data is permanently on-chain. This is one of the core basics and the beauty behind the ideology of DEXes.

A new DEX eraThe challenge with CeFi and CEXes boils down to a lack of trust and security. This is continually reinforced time and again; this year is no different, with funds, exchanges and even established projects hitting the buffers and leaving behind affected, concerned investors and traders fearing for their assets.

News of increased risk with CEXes come into question of insolvency and possible withdrawal delays, causing widespread panic amongst traders.

I would like to discuss the following DEXes for your reference and research purposes.

dyxX

dYdX is a decentralised exchange (DEX) platform that offers perpetual trading options for over 35 popular cryptocurrencies, including Bitcoin (BTC), Ether (ETH), Dogecoin (DOGE) and Cardano (ADA).

Non-custodial exchange dYdX has climbed to the top of the DEX rankings by trading volume, beating out Uniswap, for the first time. More than US$9 billion has been exchanged on the trading platform in the last 24 hours in 2021, according to data provider CoinMarketCap.

Also during the same time, according to CoinGecko, dYdX has facilitated more than US$4.3 billion worth of trades in the past 24 hours, beating out Coinbase’s US$3.7 billion

They changed how DEXes were perceived back then.

ApeX Pro

ApeX Pro is set out to be a dynamic non-custodial derivatives DEX powered by StarkWare’s Layer two scalability engine StarkEx — all to deliver a made-to-order, permissionless platform designed for precision trading.

This comes after ApeX Protocol’s initial ApeX elastic Automated Market Maker (eAMM) launch, where popular inverse perpetual contracts were supported; automatic, fully permissionless and without needing KYC. With full spectrum asset support, ApeX Protocol was able to uplift decentralised derivatives trades.

To add on, they are multi-chain supported. This responded well to the demand from the market.

Just Ex

Another multi-chain DEX is Just Ex. They are relatively new, and currently, they support APTOS, SUI and Solana. They will support Ethereum and BNB Chain later on. This strategy is also different, as we all know that most of these multi-chain DEXes are usually based on Ethereum first.

At the point of publishing, I have not tried the DEX yet, but the fact that it has no slippage, open trade and infrastructure API ready and that they are order-book based are worth exploring.

As usual, I will end with a quote:

The answer is to return to the basics of what blockchain is supposed to be. It is decentralisation and transparency. DeFi is one of the solutions, and we need to work together to build the future. For now, it cannot replace CeFi completely for obvious reasons, but this will not stop us from trying.

Source: https://e27.co/cefi-a-necessary-evil-today-7-reasons-why-trustless-dex-is-the-future-20221123/

The post CeFi, a ‘necessary evil’ today: 7 reasons why trustless DEX is the future appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

November 27, 2022

What is green satoshi token (GST)? What you need to know about Stepn’s in-game currency token

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

What is green satoshi token (GST)? What you need to know about Stepn’s in-game currency token

The green satoshi token (GST) is the native cryptocurrency of the first-of-its-kind Web3 lifestyle app STEPN, which encourages users to stay active by rewarding them in GST tokens.

The token started 2022 with a kick, seeing its value surge by more than 300% from its debut in late December 2021 at $1.8 to an all-time high of $7.8 on 29 April 2022. Since then, however, the token dipped, losing over 99.7% of its gains down to $0.0223 as of 25 November 2022.

So, what is green satoshi token (GST) and how does it work?

What is green satoshi token (GST)?A pioneer in the move-to-earn (M2E) sphere, STEPN inspires crypto fans to exercise or “move around” while earning the platform’s native coin – the green satoshi token (GST).

According to the STEPN platform’s whitepaper: “With Game-Fi, STEPN aims to nudge millions toward a healthier lifestyle, combat climate change and connect the public to Web 3.0, all while simultaneously hinging on it’s Social-Fi aspect to build a long-lasting platform fostering user generated Web 3.0 content.”

STEPN announced its public beta release on 20 December 2021 and was launched by the Australia-based fintech studio, Find Satoshi Lab.

Users get to purchase and equip themselves with non-fungible tokens (NTFs) in the shape of sneakers that are used for jogging, walking or running outdoors.

The game has four types of NFT Sneakers designed to fit different fitness levels. In addition, STEPN Sneakers are ranked by five different qualities that are given to them at random, thus establishing their rarity.

Users can purchase new Sneakers through the in-game NFT marketplace or create their own by “breeding” two Sneakers they already own through what the platform calls a Shoe Minting Event (SME). Each Sneaker can be bred up to seven times. The more a Sneaker was bred, the more tokens it will cost.

STEPN has three game modes.

Solo Mode: Users are equipped with NFT Sneakers and can earn GST coins through either walking or running. Their progress is tracked via a GPS signal. Users are given a certain amount of energy which allows them to earn GST tokens. Once that energy runs out, tokens can no longer be earned.Marathon Mode: Users can participate in a weekly or monthly marathon of their chosen distance. At the time of writing, the marathon mode was currently under development.Background Mode: Users will be able to continue gaining GST tokens while the STEPN is running in the background. As long as a user owns an NFT Sneaker, the app will be able to collect the user’s step data from their mobile’s health app. At the time of writing, this mode was also under development.How does green satoshi token work?It is important to note that STEPN has a dual token system; the green satoshi token cryptocurrency and the green metaverse token (GMT).

The GST coin is the in-game token of the STEPN ecosystem, while GMT is its governance coin.

So, what is the green satoshi token used for?

GST has an unlimited supply and can be earned by users through moving. GST is paid out for every minute of movement. The amount of GST paid out to users depends on the type of Sneaker they own and its unique attributes.

Because STEPN was built on the Solana (SOL) ecosystem, the GST coin was introduced on the Solana blockchain and then in May 2022 also added to the BNB Chain (BNB), formerly called BNB Smart Chain (BSC).

“To ensure the stability of GST, STEPN is designed with plenty of burn mechanisms. These involve upgrading your in-game assets like shoes and gems, unlocking gem sockets, and repairs. GST is also used to mint new shoes,” STEPN said in a blog post.GST can be notably considered one of the more successful cryptocurrencies of 2022, despite the overall bear market that followed most cryptocurrencies at the start of the year.

The coin surged by around 350% within four months from $1.7443 on 22 December 2021 to $7.8337 on 29 April 2022 – its all-time high – as the company pledged to combat climate change and achieve carbon neutrality through the purchase of $100,000 worth of Carbon Removal Tonnes and the GTS token was listed on the popular crypto exchange Coinbase.

The positive rally did not last long, however, and GST managed to lose over 45% of its gains overnight dropping to $4.121, ahead of the release of the platform’s Public Beta Phase IV. By 3 May 2022, the token managed to resurface, surging past $6.5.

As hype surrounding STEPN and its native cryptocurrency started to decline, and the economic situation worldwide deteriorated, GST embarked on a bear run, losing over 97% of its gains from its 3 May 2022 value, down to $0.1804 by 13 June 2022.

DappRadar’s third-quarter gaming report published in October 2022 noted that STEPN “has cooled down after a torrid Q2” and its monthly active users decreased by 67%, falling to 482,000. In comparison, during Q2, STEPN registered over 2 million monthly users and over 260,000 new wallets.

By 23 November 2022, GST lost an additional 87.6% of its price down to $0.0223.

Latest GST news and price driversSTEPN was the first ever earn-to-move blockchain to be released and with no competition at the time managed to surge to certain heights. However, competition was inevitable with the release of Sweat Economy, another move-to-earn blockchain, which according to DappRadar minted a record-breaking 10,000 NFTs in September 2022.

Additionally, uncertainty surrounding the Solana blockchain has been on the rise since the FTX crypto exchange, which is closely tied to Solana, filed for bankruptcy on 11 November. Since STEPN was built on the Solana blockchain, the GST coin is also affected by either positive or negative movements in Solana’s native cryptocurrency SOL.

In other news, STEPN announced on 18 November that it has launched an in-app event to celebrate the FIFA World Cup, top international sporting events of 2022, and encourage users worldwide to move and participate.

Moreover, STEPN has also partnered with ASICS and Solana to “pave the way for the Web3 fitness industry” by launching a new UI sneakers Collection.

Risk and opportunitiesAnndy Lian, the chief digital advisor at the Mongolian Productivity Organisation and author of ‘NFT: From Zero to Hero’ told Capital.com that GST being built on the Solana network is both a “risk and opportunity” for the token.

“More than $700m has exited Solana-based applications, a 70% drop from the $1bn in TVL on 2 November alone. And please be mindful that this is the beginning of the whole saga.

“If Solana can continue to function and ride through this massive blow, GST being one of the largest ecosystems on Solana would surely be the first few that will benefit from this; Proving to the world that decentralisation actually works this time.”

Crypto advisor Victoria Kennedy added that GST’s biggest pro is its current burn system, which sees more tokens being burned than released, thus keeping the green satoshi token cryptocurrency deflationary. However, she also noted that due to its massive use function within the STEPN ecosystem, the “selling pressure from the players is much bigger, thus pushing the price down”.

Dr Pooja Lekhi, the vice chair of the Department of Quantitative Studies at University Canada West said that the GST coin “is still very new in the crypto market and hence has a limited track record and has no traceable features on trading views”.

On the other hand, Dr. Lekhi noted that GST has certain unique features including “social and community aspects”.

“With Game-Fi, STEPN aims to encourage people toward a healthier lifestyle, combat climate change and connect the public to Web 3.0, which is the next version of the internet. The GST token can be used to purchase Carbon Removal Credits and has received support from top-notch crypto investors, crypto firms, and big businesses.”Note that analyst views are not financial advice and shouldn’t be used as a substitute for your own research. Always conduct your own due diligence, and never invest or trade money you cannot afford to lose.

Source: https://capital.com/green-satoshi-token-gst-stepn-crypto-what-is-ultimate-guide

The post What is green satoshi token (GST)? What you need to know about Stepn’s in-game currency token appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.