Anndy Lian's Blog, page 92

January 9, 2023

TMRW Dubai: Ready for the new world â beyond financial freedom?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

TMRW Dubai: Ready for the new world â beyond financial freedom?

Digital assets are here to stay, and their future is brighter than ever. But the world of crypto, NFT, and Metaverse is updating very rapidly, and there is a constant need to satisfy the passionate curiosity that crypto enthusiasts are known for. Although located and connected in the virtual and digital world, it is very important to bring the community together in person.

In 2022, the TMRW conference was one of the first that was held offline after the pandemic. Following the major debut success in Belgrade (Serbia), with 21,000 in-person and online participants from 100 countries, more than 50 speakers, and 250 crypto-related companies, the TMRW conference is ready to conquer the Middle east!

According to the organizers, from February 8-10, the worldâs greatest crypto and NFT minds will gather at Dubai Festival City to consider all aspects of blockchain and cryptocurrencies and find out more about the future of digital currency.

âThe TMRW Dubai is a three-day experience where attendees will be exposed to the most innovative crypto, NFT, and Metaverse projects and get the chance to network with their mastermind creators. Imagine a place where 6,000 people who work in and around the crypto world come together for three days to learn from 80 keynotes and world-renowned experts about the latest trends and technologies through presentations, workshops, and panels. And now imagine how precious it is to network with all these people!â â said Zoran TadiÄ, program director of the TMRW conference.

When it comes to TMRW speakers, some big names have already been announced, but the list will be updated in the upcoming period. According to organizers, speakers are pioneers in the industry, and also the most well-known international names, including Craig Sellars, Founder of Tether, Joel Dietz, CEO of MetaMetaverse, Nikita Sachdev, CEO & Founder of Luna PR, Mark van Rijmenam, better known as The Digital Speaker, Sharad Agarwal, Chief Metaverse Officer of Cyber Gear, Anndy Lian, an all-rounded business strategist and serial blockchain entrepreneur from Asia, Loretta Joseph, global regulatory advisor at AP Capital, and Dr. Michael Gebert, chairman of the European Blockchain Association also known as an expert in building new business models with a critical and provocative view for a realistic roadmap to develop the new digital now. More speakers will be announced in the following days.

When asked what the topics of the conference will be, TadiÄ explained in detail: âTMRW Dubai will cover the latest in crypto, for example, the impacts of European Crypto-Assets regulation (MiCA) on the global economy. We will also touch on the energy crisis: is PoS exactly what the world needs? NFT in 2023 should be about utility and not (only) collectibility. We will discuss whether the NFT royalties are indeed a thing of the past and mention the benefits for NFT holders. What is the connection between cancel culture and NFTs, are there controversies on the horizon? We will bluntly speak about healthcare in Metaverse and why the future us needs it. Also, our speakers will demonstrate everything you need to know about next-gen civilization. In one sentence, TMRW Dubai will bring experts in various domains, who will educate attendees on the crypto technologyâs potential and impact on our lives and the world as we know it.â

Aside from the planned day program which will present the latest world trends in this sphere, the conference will also create an environment for attendees to connect, make business partnerships, discover fresh ideas, and build their networks with potential collaborators and investors through exclusive parties, VIP dinners, and interactive workshops.

Two types of ultra-early bird tickets are currently on sale. Regular tickets for in-person attendees, and virtual â for those who canât make it to Dubai in February. For more info visit tmrwconf.net.

Website:Â https://tmrwconf.net/dubai-conference-2023-crypto-nft-metaverse/

Instagram:Â https://www.instagram.com/tmrwconf/?hl=en

Telegram:Â https://t.me/tmrwconference

Twitter:Â https://twitter.com/tmrwconf

YouTube:Â https://www.youtube.com/channel/UCXQ_qjF1Dd9ozdOMMwxfjqw/featured

TikTok:Â https://www.tiktok.com/@tmrwconf

Linkedin:Â https://www.linkedin.com/company/78431580/admin/

Facebook:Â https://www.facebook.com/tmrwconf/

The post TMRW Dubai: Ready for the new world â beyond financial freedom? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

January 3, 2023

NFTs Don’t Work The Way You Might Think: Misconceptions About NFTs

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

NFTs Don’t Work The Way You Might Think: Misconceptions About NFTs

Let me bring up this misconception about NFTs that “NFTs are dead”. I chatted with an editor, and he said NFTs are over; they cannot be the next big thing; the hype is over. This is 100% wrong. At the time of writing, Donald Trump’s NFT collection sold out. 45,000 NFTs sold for $99 each in 12 hours. Seems like the NFT is very much alive.

An NFT, or non-fungible token, is a unique digital asset that cannot be exchanged for other assets on a one-to-one basis. NFTs are often used to represent ownership of digital items, such as art, collectibles, and other unique digital assets. They are typically built on blockchain technology, which allows them to be traded securely and verifiably on the internet. The NFT will always be on the blockchain and not disappear. They are certainly not constrained to profile pictures, which many deem useless.

NFTs can be bought and sold like other assets. Their value can fluctuate depending on several factors, including the perceived value and uniqueness of the digital asset, the creator’s popularity, and the market’s current state. In the case of Donald Trump’s NFT, it answers all the factors above.

Trump is popular and has strong supporters. The current state of the market has been down for months. Trump and his team caught the right timing and gave the down NFT market a push, feeding both crypto natives and non-natives an NFT that seems to be what they want. It also appears to be portraying Trump as a hero.

I saw posts saying: “We need a hero now to save the country from recession.”. Again, I think Trump caught the right angle fitting the current narrative to “save the day”.

The thought that NFT is dead to me is a misconception.

Let’s walk you through 10 misconceptions that I see often.

NFTs are only used for buying and selling digital art. While NFTs are often used for buying and selling digital art, they can also be used for a wide range of other purposes, including representing ownership of physical assets, collecting unique digital items in games, and verifying the authenticity of digital content.NFTs are always a good investment. The value of an NFT can fluctuate just like any other asset, and the market for NFTs is still relatively new and volatile. It’s essential to do your own research and invest wisely.NFTs are only usable on the blockchain where they were created. While an NFT may be created on a specific blockchain, it can often be used on other platforms that support that type of NFT. For example, an NFT built on the Ethereum blockchain can often be used on other applications and platforms that support Ethereum-based NFTs.NFTs are a form of cryptocurrency. While some NFTs may be bought and sold using cryptocurrencies, NFTs are not themselves a form of cryptocurrency. NFTs are unique digital assets that can be traded on a blockchain, while cryptocurrencies are digital currencies that use blockchain technology for transactions.NFTs are always expensive. The price of an NFT can vary widely depending on a number of factors, including the uniqueness and perceived value of the digital asset, the creator’s popularity, and the market’s current state. Some NFTs may be relatively inexpensive, while others can sell for thousands or even millions of dollars.NFTs are not subject to counterfeit.

While the use of blockchain technology makes it difficult to counterfeit NFTs, it is not impossible. It’s important to do your own research and verify the authenticity of an NFT before buying it.

NFTs are not subject to any regulations. Like any other asset, the buying and selling of NFTs may be subject to certain regulations, depending on the jurisdiction and the specific nature of the NFT. It is a must for you to familiarize yourself with the relevant laws and regulations before buying or selling NFTs.NFTs are not environmentally friendly. The use of blockchain technology for NFTs can require a significant amount of energy, which has raised concerns about their environmental impact. However, some blockchain platforms are implementing measures to reduce their energy consumption, and the overall impact of NFTs on the environment is still a topic of debate.NFTs are not useful for anything other than buying and selling digital art. As mentioned above, NFTs have a wide range of potential uses beyond buying and selling digital art. They can be used for representing ownership of physical assets, verifying the authenticity of digital content, and many other purposes.NFTs are a passing fad. While the popularity of NFTs may fluctuate over time, the use of blockchain technology for representing and trading unique digital assets is likely here to stay. As the technology and infrastructure around NFTs continue to evolve, their potential uses and applications may continue to expand.It is true that NFTs are digital assets that are unique and cannot be exchanged for other assets on a one-to-one basis. It is also true that NFTs are often built on blockchain technology and can be bought and sold like other assets.

It is untrue that NFTs are only usable on the blockchain where they were created, that they are always a good investment, or that they are not subject to counterfeiting or regulations. It is also untrue that NFTs are only useful for buying and selling digital art or that they are a passing fad.

It is important to understand what NFTs can really do, and what they cannot do. This will help you make better decisions when it comes to buying, selling, or using NFTs.

NFTs don’t work the way you might think.Here are some key things to consider when it comes to the capabilities and limitations of NFTs:

⢠NFTs can represent unique digital assets and verify their ownership, but they cannot guarantee the value or quality of the underlying asset. ⢠NFTs can be traded on the internet, but their value can fluctuate and is not guaranteed. ⢠NFTs can be used on various blockchain platforms and applications, but they may not be compatible with all systems. ⢠NFTs can provide some protection against counterfeiting, but they are not immune to it. ⢠NFTs may be subject to certain regulations, depending on the jurisdiction and the nature of the NFT. ⢠The environmental impact of NFTs and their potential uses beyond buying and selling digital art are still being explored and debated.

Huobi’s recent crypto report stated that NFT is one of the most discussed crypto term worldwide. NFT is well integrated with various industries, such as sports, arts, entertainment, and cultural creations, expanding the application scenarios on a larger scale. The same report also stated that Asia has a top interest in NFT. NFTs have recently been recognized to be virtual property subject to legal protection by mainland Chinese courts. This is a significant move in light of the nation’s strict crypto crackdown, which started in 2021. I am bullish on NFT, honestly.

I am ending with a quote and some food for thought.

“If you do not have a digital asset, make an NFT. It will also address many misconceptions you hear from the media or friends. First-hand experience will change your mind. This action will also open thousands of new opportunities for you and the next generation.” â Anndy Lian (me)

Whatever the case, it’s important to do your research and carefully consider the potential risks and benefits of NFTs before buying, selling, or using them. It would help if you experienced it. Not just hearsay.

Source: https://hackernoon.com/nfts-dont-work-the-way-you-might-think-misconceptions-about-nfts

The post NFTs Don’t Work The Way You Might Think: Misconceptions About NFTs appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

January 2, 2023

Panel Discussion: How to survive and strive in Web3?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Panel Discussion: How to survive and strive in Web3?

Web3 refers to the third generation of the World Wide Web, which focuses on decentralized technologies such as blockchain and peer-to-peer networks. Web3 technologies have the potential to disrupt traditional centralized models and enable greater user control, privacy, and security.

There are a few reasons why Web3 is gaining popularity:

Decentralization: Web3 technologies are decentralized, meaning they are not controlled by a single entity or organization. This can give users greater control over their data and assets and reduce the risk of censorship or interference.

Security: Web3 technologies are designed to be more secure than their centralized counterparts. For example, blockchain networks are secured through cryptographic techniques, making them resistant to tampering and fraud.

Privacy: Web3 technologies can help preserve user privacy by allowing individuals to control their own data and assets rather than relying on a third party.

Interoperability: Web3 technologies are designed to be interoperable, meaning they can work together and exchange data seamlessly. This can enable the development of new and innovative applications and services.

The popularity of Web3 technologies is driven by the potential for greater control, security, privacy, and interoperability in the digital world.

But does the wider audience in the crypto space think the same? How do we survive and strive in the Web3 environment? This topic is covered by a panel of experts at Twitter Spaces on 30th Dec 2022 at 21:00 SGT.

Hosted by Blockcast (https://twitter.com/Blockcastcc) and

Co-Hosted: Bybit NFT (https://twitter.com/Bybit_NFT) and Bybit Web3 (https://twitter.com/Bybit_Web3).

It was moderated by Scott Tripp, Marketing Lead of Blockcast.cc.

With the following guests discussing the Web3 topic:

– Allan, Head of Operation, Moledao (https://moledao.io)

– Anndy Lian, Book Author, NFT: From Zero to Hero (https://anndy.com)

– Grace, CMO of TwitterScan

– Jenny Zheng, BD Lead of Bybit NFT (https://www.bybit.com)

– Yoka, Secretary General of ABGA

In conclusion, here are a few tips that might help you survive and thrive in the Web3 ecosystem:

Keep learning: The Web3 ecosystem is constantly evolving, so it’s important to stay up-to-date on the latest developments. This can be done through online courses, attending conferences, and following industry leaders on social media.

Network: The Web3 ecosystem is still small and tight-knit, so networking with other professionals can be incredibly valuable. Join online communities, attend meetups, and participate in hackathons to meet others in the industry.

Focus on a specific area: While it’s important to have a broad understanding of the Web3 ecosystem, it can also be helpful to focus on a specific area and become an expert in that field. This could be a particular protocol, platform, or application.

Experiment: The Web3 ecosystem is still in its early stages, so there is much room for experimentation and innovation. Don’t be afraid to try new ideas and approaches, and be open to learning from your failures.

Stay positive: The Web3 ecosystem is full of challenges and setbacks, so staying positive and maintaining a growth mindset is essential. Keep an open mind and remain resilient, and you’ll be well-equipped to handle whatever comes your way.

The post Panel Discussion: How to survive and strive in Web3? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

December 31, 2022

27 stats about NFTs in 2022 â who are the big winners

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

27 stats about NFTs in 2022 â who are the big winners

âWeb 3.0 brings endless opportunities to many people, changes lives in Kenya, removes barriers in India and empowers developers in China to service global audiences during the COVID lockdown period. Your gateway to Web 3.0 is just one click away. Letâs innovate.â

â Anndy Lian.

At the beginning of the year, when the crypto market was red hot, it was extremely tough to understand what was going on in the NFT industry.

At the beginning of the year, when the crypto market was red hot, it was extremely tough to understand what was going on in the NFT industry.

The massive influx of collections, new marketplaces, and easy money in the space created the perfect mix of incentives for fraudulent activity. As we know, I published an article in October about NFT wash trading, several âOpenSea killersâ were built entirely on fake activity, and not everything was as it seemed when you looked at NFT collection leaderboards. As the market crashed, so did activity across the board (both fake and organic).

But not all was negative. Several highly innovative NFT collections broke the mold of zany PFP images and proved a market for digital, non-fungible art existed.

While there was a proliferation of small collections and grassroots community-building in some corners of the industry (e.g., Solana and Magic Eden), the year also saw consolidation with the birth of the first NFT megacorp in Yuga Labs.

Instead of telling you what to think about 2022 and where the NFT world is heading in 2023, this article has the essential stats from last year so you can create your own analysis.

9 Stats about the NFT Industry1. Total sales of NFTs in 2022 was $55.5B

This is up 175%Â from $20.2B in 2021. When you compare 2020 to 2022 total sales, it is 390X more.

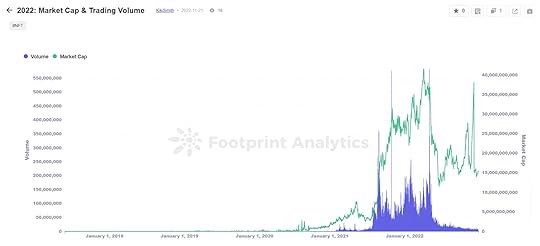

2. The market capitalization of the NFT industry peaked on April 4th at $41.5B

Market capitalization is calculated as the sum of each NFT valued at the greater of its last traded price and the floor price of the collection, respectively. Suspected wash trades have been filtered out.

2022 Market Cap & Trading Volume

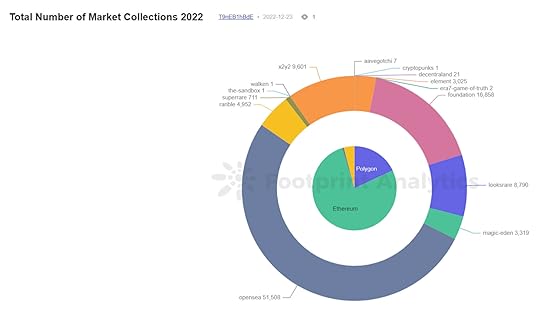

2022 Market Cap & Trading Volume3. Roughly 85K NFT collections were launched last year

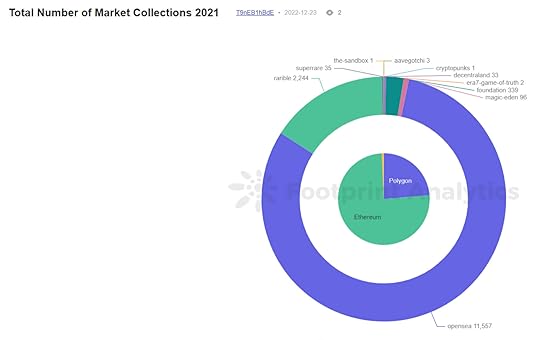

In 2021, there were around 14.5K collections, while the number nearly reached 99K by the end of 2022. Notice that Opensea remains the leader in both years.

Total Number of Market Collections 2021

Total Number of Market Collections 2021 Total Number of Market Collections 2022 /Â Reference:Â

Total Number of Market Collections 2021

vsÂ

Total Number of Market Collections 2022

Total Number of Market Collections 2022 /Â Reference:Â

Total Number of Market Collections 2021

vsÂ

Total Number of Market Collections 2022

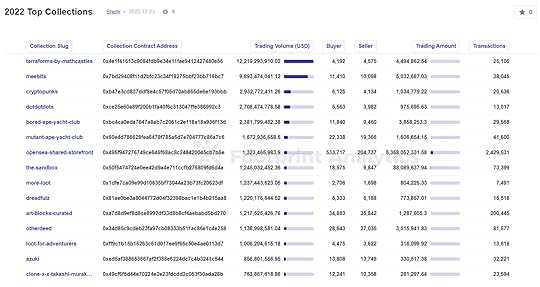

4. About 7,700 collections had trading volume over $100K

Do note that the majority of this activity did not come from a legitimate, organic interest in the project based on the date collected.

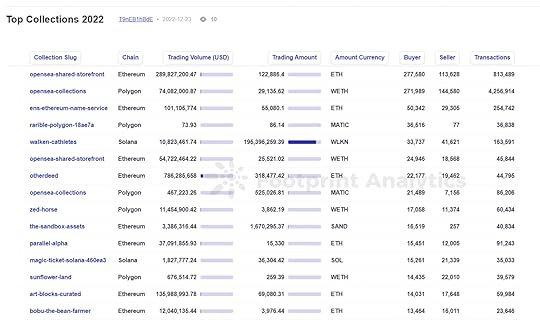

2022 Top Collections /Â Reference:Â

Top Collections 2022

2022 Top Collections /Â Reference:Â

Top Collections 2022

5. Only 2,623 collections had more than 1000 unique buyers

As with all stats in the NFT industry, this one should be taken with a grain of salt due to the significant amount of wash trading, especially during the yearâs first half.

Top Collections 2022

Top Collections 2022Reference:Â Top Collections 2022

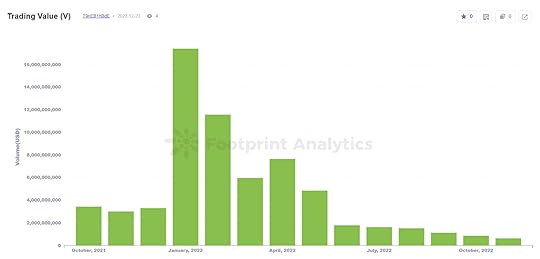

6. NFT trading volume reached its 2022 peak in January, with $17.4B in value

This was more than a 4x jump from the previous month (December 2021). This was also the month when Google searches for the keyword âNFTâ reached their all-time high.

NFT Trading Value

NFT Trading ValueReference:Â Trading Value (V)

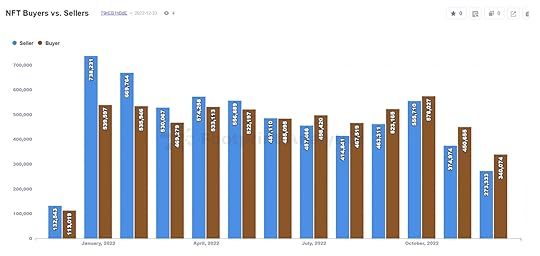

7. The biggest gap between the number of sellers and buyers was in January, with about 200K more sellers than there were buyers.

Yet January was also the hottest month for NFT prices for most major collections, indicating that using these metrics as an analog for supply and demand has flaws.

NFT Buyers vs. Sellers

NFT Buyers vs. SellersReference:Â NFT Buyers vs. Sellers

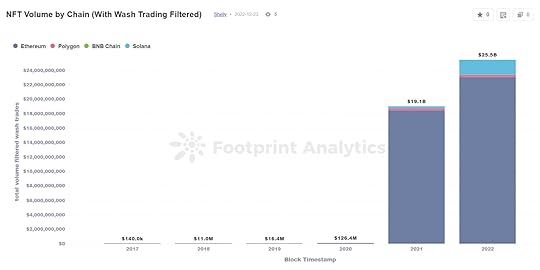

8. Last year, 46% of total NFT trading volume was likely to be caused by wash trading

There are several indicators and filters to detect suspicious activity. To identify these types of transactions, I use Footprint Analyticsâ filters to separate transactions to the following formula:

a.) Overpriced NFT trades (10x OpenSea Average Price)b.) Collections with 0% royalties (except CryptoPunks and ENS)c.) An NFT bought more than a normal amount of times in a day (currently filtered for more than 3 )d.) An NFT bought by the same buyer address in a short period (currently filtered for 120 minutes) NFT Volume by Chain /Â Reference:Â

NFT Volume by Chain (With Wash Trading Filtered)

vs.Â

NFT Volume By Chain

6 Stats about NFT Collections

NFT Volume by Chain /Â Reference:Â

NFT Volume by Chain (With Wash Trading Filtered)

vs.Â

NFT Volume By Chain

6 Stats about NFT Collections9. The collection with the largest market cap by the end of the year was CryptoPunks at $1.1B

Crypto Punks, launched by Larva Labs in 2017, was the first NFT collection to become a household name and have the highest floor price in the industry. Yuga Labs acquired the IP of the collection in March 2022.

Reference:Â 2022: Top Collections by Market Cap

10. Trading volume of major collections in the YugaverseâYuga Labsâ portfolio of productsâwas $3.1B

This sum includes Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Otherside, and CryptoPunks. It excludes Meebits, which had more trading volume than all of these combined,

Reference:Â Yuga Labs (Trading Volume in 2022)

11. Yuga Labsâ portfolio accounts for about 20% of the total market cap of the entire NFT industry

This sum includes Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, Otherside, CryptoPunks and Meebits.

12. Without any wash trade filtering, Terraforms by Mathcastles had an astounding $12B in trading volume, more than any other collection, across 11,341 transactions

However, 99.8% of the volume and 46.3% of transactions were detected as wash trading.

Reference:Â NFT â Collections

13. When filtering out wash trading, CryptoPunks had the highest volume ($2.9B) followed by Bored Ape Yacht Club ($2.3B)

Reference:Â 2022: Top Collections by volume

14. ArtBlocks Curated was the 4th most traded collection by volume and amassed a market cap $325M

ArtBlocks demonstrated that there is a market for high-end artistic NFTsâit stands out among Yuga PFP projects, and metaverse land NFTs at the top of the rankings

15. There were 7 major collections whose volume was over 95% wash trading

For this stat, âmajorâ means having over $1M in real trading volume. Terraforms by Mathcastles, More Loot, dotdotdots, Dreadfulz, Audioglyphs, CryptoPhunksV2, and Meebits.

6 Stats about Chains and Markets for NFT Projects16. Ethereum had 95% percent of volume, 47% of transactions, and 71% of protocols

These figures are almost the same as in 2021. Based on the data, Ethereum is still the most widely used for NFT.

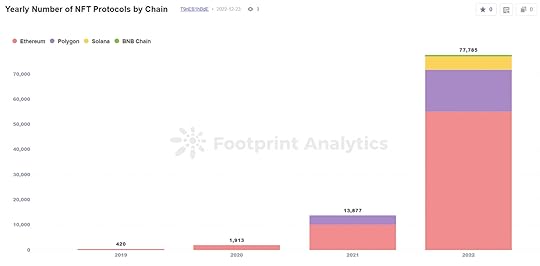

Reference: 2022 Market Share of Transactions by Chain  and 2022 Market Share of Trading Volume by Chain  and Yearly Number of NFT Protocols by Chain

17. Solana went from having no NFT protocols in 2021 to 5,335 in 2022

Solana is ranked third globally at the point of writing.

Another thing to note is that Ethereum grew from 420 in 2019 to 55,144 in 2022.

Yearly Number of NFT Protocols by Chain /Â Reference:Â

Yearly Number of NFT Protocols by Chain

Yearly Number of NFT Protocols by Chain /Â Reference:Â

Yearly Number of NFT Protocols by Chain

18. OpenSea hosted 53% of all total collections

OpenSea remained the marketplace of choice for Ethereum and Polygon. However, Magic Eden capitalized on its Solana first-mover advantage to be the marketplace of choice for collections on this chain (OpenSea started listing them in April.) Note: a collection can list on multiple marketplaces.

Reference:Â 2022: Number of Marketplace Collections by Chain

19. Solana had more active users in October, with 411K, than Ethereum, with 392K

While most of the blue-chip collections and collectors transact on OpenSea and Ethereum, Solana built up a sizable community of NFT enthusiasts in 2022. Solanaâs active users hovered between 20-45% of the total market shareâOctober was the only month it overtook Ethereum for this metric

Reference:Â Chain Monthly Active User

20. OpenSea had 96,459 unique wallets make a transaction on the protocol on Feb. 2

This is more transactions than any other marketplace on any other day.

Reference:Â 2022 Marketplace Daily Active User

21. Over $903M in platform fees were generated on OpenSea, going to both the marketplace and creators

This made OpenSea the most profitable marketplace in terms of fees generated from trading (which went to the platform and are disbursed to creators.)

Reference:Â Top Marketplaces

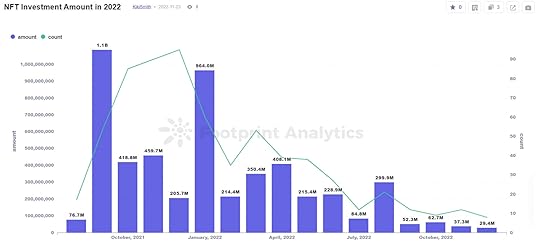

6 Stats about NFT Investment & Fundraising22. The NFT industry received a total of $2.98B in fundraising in 2022

The highest was in January 2022 at $964M. The lowest is in December at $29.4M.

NFT Investment Amount in 2022 /Â Reference:Â

NFT investment Amount in 2022

NFT Investment Amount in 2022 /Â Reference:Â

NFT investment Amount in 2022

23. Animoca Brands closed the largest round of the year, $358M led by Liberty City Ventures

Animoca has said it will use the funding for strategic acquisitions and investments, develop its games and metaverse products, and acquire licenses for popular intellectual properties.

Reference:Â 2022 NFT Fundraising Details

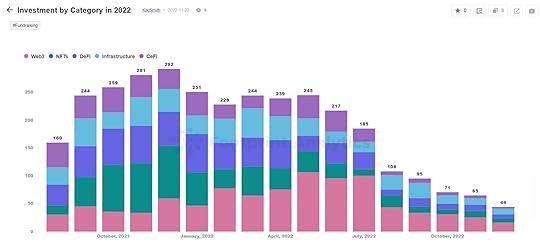

24. There were 1,992 total fundraising rounds in 2022, 756 more than in 2021

Reference:Â Investment by Category in 2022

25. While NFT-related projects were the most popular category among VCs by the number of rounds, they were the 2nd-least popular in 2022

In 2022, general Web3 projects closed the most rounds (711), followed by DeFi (362), infrastructure (331), NFTs (326), and, finally, CeFi (257).

NFT Investment by Category in 2022 /Â Reference:Â

Investment by Category in 2022

NFT Investment by Category in 2022 /Â Reference:Â

Investment by Category in 2022

26. Seed rounds made up 81% of total NFT funding rounds

Reference:Â NFTs Funding Rounds

27. The 2 largest rounds for pure NFT projects went to OpenSea ($300M) and Dapper Labs ($250M)

The OpenSea round was one of only 5 Series C or D rounds in 2022. Dapper Labs is the studio behind the NBA Top Shot collection.

Key TakeawaysAs we can see, Web 3.0 is proliferating. NFT is undoubtedly part of the whole Web 3.0 ecosystem. In the Web 3.0 ecosystem, NFTs are often used to facilitate the buying and selling of unique digital assets on decentralized platforms. These platforms use smart contracts to enable transactions without the need for intermediaries. They can facilitate the buying and selling of NFTs and allow NFT holders to earn passive income by lending out their NFTs. There are many use cases to showcase.

Web 3.0 will continue to draw more investment in 2023 based on some of the deal flows I see in the market.  co-lead a $2 Million seed round for a Web 3.0 decentralized Identity platform. Binance Labs launched a $500M fund to support promising Web 3.0 projects and start-up firms with great potential earlier this year. Du Jun, the co-founder of cryptocurrency exchange Huobi Global, runs ABCDE Capital, a $400M Web 3.0 venture capital fund is dedicated to investing in web3 builders.

Apart from the crypto firms-led firms, itâs also true that traditional investment companies are beginning to take notice of the Web 3.0 ecosystem and are starting to invest in companies and projects that are working on decentralized technologies, such as blockchain and non-fungible tokens (NFTs).

There are several reasons why traditional investment companies might be interested in investing in web3 technologies. One reason is that the Web 3.0 ecosystem is still in its early stages and has much growth potential. Decentralized technologies have the potential to revolutionize many different industries, from finance and real estate to art and collectibles.

Another reason is that the Web 3.0 ecosystem is relatively uncorrelated with traditional financial markets, which can offer diversification benefits for investors. This can be especially appealing in times of economic uncertainty, when traditional financial markets may be more volatile.

Ending with a quote:

âWeb 3.0 brings endless opportunities to many people, changes lives in Kenya, removes barriers in India and empowers developers in China to service global audiences during the COVID lockdown period. Your gateway to Web 3.0 is just one click away. Letâs innovate.â â Anndy Lian.

Source: https://cryptoslate.com/27-stats-about-nfts-in-2022-who-are-the-big-winners/

The post 27 stats about NFTs in 2022 â who are the big winners appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Dogecoin Mascot Kabosu Cheats Death, Bounces Back; Experts Share Investment Strategies For Meme Coin

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Dogecoin Mascot Kabosu Cheats Death, Bounces Back; Experts Share Investment Strategies For Meme Coin

ZINGER KEY POINTSDogecoin mascot makes “miraculous” recovery after illness.Experts advise investors to consider use cases and technical factors before investing in Dogecoin.

ZINGER KEY POINTSDogecoin mascot makes “miraculous” recovery after illness.Experts advise investors to consider use cases and technical factors before investing in Dogecoin.Dogecoin mascot Kabosu, a 17-year-old Shiba Inu, has made a âmiraculousâ recovery after falling âvery dangerouslyâ ill on Christmas Eve.

The Shiba Inu’s owner disclosed on Dec. 26 that Kabosu has a medical history including chronic lymphoma leukemia (cancer) and acute cholangiohepatitis, an inflammatory condition affecting the liver and bile ducts.

According to an Instagram post by her owner Atsuko SatÅ on Friday, Kabosu has fully recovered from her illness and is back to eating chicken tenders and drinking plenty of water.

âShe no longer needs diapers as she can go to the bathroom on her own. Iâm amazed (at) how quickly she bounced back. I took her for a 5-minute walk to the park today. She looked happy in the sun and fresh air,â the dogâs owner said.What started as a joke in 2013, when Markus and Jackson Palmer created the first “meme coin” Dogecoin, has now become a beloved cryptocurrency.

Ethereum founder Vitalik Buterin visited Kabosu and SatÅ in their Tokyo apartment in 2018, further affirming Kabosu’s place in history.The value of Doge shot up over 4,000% after Tesla CEO Elon Musk advocated for the cryptocurrency and called it âthe peopleâs crypto.â

Focus On Dogecoin Use Cases

Experts advise investors to avoid buying the meme coin on the basis the dogâs physical condition and rather, focus on the use cases of the cryptocurrency.

âThere may be some wild swings in the short term basis of the dogâs physical health but investors must know that the dog won’t generate wealth for them. They have to look at a variety of factors before investing in Doge,” Raj A Kapoor, founder of the India Blockchain Alliance, told Benzinga.

“Keep a keen lookout for a change in the use cases for Doge and if there is, there will be long-term wealth creation. Besides on a shorter time frame, check the cryptoâs technicals before investing.”

Anndy Lian, chief digital advisor of the Mongolian Productivity Organization, says investors should use âlogicâ and that the dogâs fate is only important to its owner and not the cryptocurrency.

âI think the retail investors must look at this with a logical mind. The dog’s fate is important to the owner, the dog could be gone but the legacy will continue with Dogecoin. For long-term crypto gains, you should look into Dogecoin’s utility and use cases. Only with adoption, you see a good future,â Lian said.

https://www.finanztrends.de/dogecoin-was-hier-los-3/

The post Dogecoin Mascot Kabosu Cheats Death, Bounces Back; Experts Share Investment Strategies For Meme Coin appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

December 28, 2022

Modern-Day Version of Howey Test For Cryptocurrencies- How Does It Look Like?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Modern-Day Version of Howey Test For Cryptocurrencies- How Does It Look Like?

Howey test, which the Securities and Exchange Commission uses to decide whether a digital asset should be classed as a security, has certain limitations, according to SEC Commissioner Hester Peirce. I can relate to this statement very much. I felt the same way too, especially when they used the same framework for cryptocurrencies. I will walk you through my thoughts on what should the modern-day version look like.

What is Howey Test?The Howey test is used by the U.S. Securities and Exchange Commission (SEC) to determine whether a particular financial product or transaction qualifies as an “investment contract.” If a product or transaction is deemed to be an investment contract, it is subject to certain regulatory requirements under federal securities laws.

The test is named after the 1946 Supreme Court case SEC v. W.J. Howey Co., in which the Court established a four-part test to determine whether a transaction qualifies as an investment contract:

1. It involves an investment of money

2. There is an expectation of profits from the investment

3. The investment of money is in a common enterprise

4. Any profit comes from the efforts of a promoter or third party

If all four of these criteria are met, the transaction is considered an investment contract and is subject to regulation as a security.

What is a Security?Before we look further, let’s look at what is a security. A security is a financial instrument representing an ownership position in a publicly traded corporation (stock), a creditor relationship with a governmental body or a corporation (bond), or rights to ownership as represented by an option.

There are several types of securities, including:

1. Stocks: Stocks represent ownership in a company and entitle the holder to a share of the company’s profits.

2. Bonds: Bonds are a type of debt security that involves borrowing money from an investor for a set period of time at a fixed interest rate.

3. Options: Options are a type of derivative security that gives the holder the right, but not the obligation, to buy or sell a specific asset at a predetermined price within a specific time frame.

4. Mutual funds: Mutual funds are investment vehicles that pool money from multiple investors and use that money to buy a diversified portfolio of stocks, bonds, or other securities.

5. Exchange-traded funds (ETFs): ETFs are investment funds that are traded on stock exchanges, much like stocks. They typically track an index, such as the S&P 500, or a specific sector or theme.

6. Derivatives: Derivatives are financial instruments that are derived from other assets, such as stocks, bonds, commodities, or currencies. They are used to hedge risk or speculate on the price movements of the underlying asset. Examples of derivatives include futures, options, and swaps.

Howey Test Applied to CryptocurrenciesThe Howey test is a well-established legal test used for decades to determine whether a financial product or transaction qualifies as an investment contract and is subject to regulation as a security. While the test was originally developed in the context of traditional securities, it has also been applied to cryptocurrency and initial coin offerings (ICOs).

The four-part test established by the Howey case has generally been applied to cryptocurrency in the same way as it has been used to traditional securities. However, there may be some nuances or specific considerations that apply specifically to cryptocurrency when applying the Howey test.

For example, the first prong of the test, which requires an investment of money, may be satisfied by the purchase of a cryptocurrency using fiat currency (such as U.S. dollars) or by the exchange of one cryptocurrency for another.

The second prong, which requires an expectation of profits, may be satisfied by the potential appreciation of the cryptocurrency’s value or by the ability to earn returns through the use of the cryptocurrency in a particular platform or network.

The third prong, which requires the investment of money to be in a common enterprise, may be satisfied by the pooling of resources or the use of a shared infrastructure or platform.

The fourth prong, which requires any profits to come from the efforts of a promoter or third party, may be satisfied by the involvement of a central authority or the use of a decentralized autonomous organization (DAO) to manage the cryptocurrency or ICO.

Modern-Day Version of Howey Test for CryptocurrenciesThe above pointers may sound familiar to you. You are a project owner and have spoken to a lawyer before; this is the same advice they gave you. My question now is, since the state of play in cryptocurrencies are changing rapidly, should there be an adapted version for the modern day?

The modern-day version might look something like this:

1. Is there an investment of money?

If the crypto digital asset issuer has not sold any assets issued to build its project. It is most likely not considered a security.

2. Is there an expectation of profits from the investment?

If the crypto asset is utility-based, for example, it is used for voting purposes. It is most likely not considered a security.

3. Is the investment of money in a common enterprise?

If the project is decentralized, it is not controlled and operated by a centralized entity. It is most likely not considered a security.

4. Are any profit comes from the efforts of a promoter or third party?

If the profit primarily comes from the community which has nothing to do with the issuance of the crypto asset. It is most likely not considered a security.

Reminding all again, when all four criteria are met, the investment is considered a security and is subject to regulatory requirements of the Securities Act of 1933. The application of the Howey test to cryptocurrency may involve considering the specific characteristics and features of the particular cryptocurrency or ICO in question, as well as the broader market and regulatory context in which it operates.

Take some time to do a self-evaluation based on the above thoughts shared. If you have time, you can ask yourself these questions about the tokens you invested. This is a good exercise for self-reference. I am not a lawyer, and none of the written content is formal advice.

“If you are a retail crypto investor- Do your crypto research. Learning about the regulation side of things can help you with your investment decision, avoiding unnecessary issues down the road.

If you are a project and you claim to be decentralized. Please stay decentralized. This will also avoid getting into any regulatory problems.” – Anndy Lian

The post Modern-Day Version of Howey Test For Cryptocurrencies- How Does It Look Like? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

December 23, 2022

Regulating Cryptocurrencies: Are you Investing in Securities?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Regulating Cryptocurrencies: Are you Investing in Securities?

There is an ongoing legal case between SEC and Ripple Labs. In December 2020, the San Francisco-based corporation and its current and former senior executives were sued by the SEC on charges that they had been selling unregistered securities worth $1.3 billion since the token’s inception. The commission declared XRP as a security. You should have heard of this case if you are in the crypto industry. Many questioned how this happened and will this have any affect on the rest of the cryptocurrencies. What is a security? How SEC determine what is a security? I will try to break it down in this article.

What is Howey Test?The Howey test is used by the U.S. Securities and Exchange Commission (SEC) to determine whether a particular financial product or transaction qualifies as an “investment contract.” If a product or transaction is deemed to be an investment contract, it is subject to certain regulatory requirements under federal securities laws.

The test is named after the 1946 Supreme Court case SEC v. W.J. Howey Co., in which the Court established a four-part test to determine whether a transaction qualifies as an investment contract:

It involves an investment of moneyThere is an expectation of profits from the investmentThe investment of money is in a common enterpriseAny profit comes from the efforts of a promoter or third partyIf all four of these criteria are met, the transaction is considered an investment contract and is subject to regulation as a security.

What is a Security?Before we look further, let’s look at what is a security. A security is a financial instrument representing an ownership position in a publicly traded corporation (stock), a creditor relationship with a governmental body or a corporation (bond), or rights to ownership as represented by an option.

There are several types of securities, including:

Stocks: Stocks represent ownership in a company and entitle the holder to a share of the company’s profits.Bonds: Bonds are a type of debt security that involves borrowing money from an investor for a set period of time at a fixed interest rate.Options: Options are a type of derivative security that gives the holder the right, but not the obligation, to buy or sell a specific asset at a predetermined price within a specific time frame.Mutual funds: Mutual funds are investment vehicles that pool money from multiple investors and use that money to buy a diversified portfolio of stocks, bonds, or other securities.Exchange-traded funds (ETFs): ETFs are investment funds that are traded on stock exchanges, much like stocks. They typically track an index, such as the S&P 500, or a specific sector or theme.Derivatives: Derivatives are financial instruments that are derived from other assets, such as stocks, bonds, commodities, or currencies. They are used to hedge risk or speculate on the price movements of the underlying asset. Examples of derivatives include futures, options, and swaps.Howey Test Applied to CryptocurrenciesThe Howey test is a well-established legal test used for decades to determine whether a financial product or transaction qualifies as an investment contract and is subject to regulation as a security. While the test was originally developed in the context of traditional securities, it has also been applied to cryptocurrency and initial coin offerings (ICOs).

The four-part test established by the Howey case has generally been applied to cryptocurrency in the same way as it has been used to traditional securities. However, there may be some nuances or specific considerations that apply specifically to cryptocurrency when applying the Howey test.

For example, the first prong of the test, which requires an investment of money, may be satisfied by the purchase of a cryptocurrency using fiat currency (such as U.S. dollars) or by the exchange of one cryptocurrency for another.

The second prong, which requires an expectation of profits, may be satisfied by the potential appreciation of the cryptocurrency’s value or by the ability to earn returns through the use of the cryptocurrency in a particular platform or network.

The third prong, which requires the investment of money to be in a common enterprise, may be satisfied by the pooling of resources or the use of a shared infrastructure or platform.

The fourth prong, which requires any profits to come from the efforts of a promoter or third party, may be satisfied by the involvement of a central authority or the use of a decentralized autonomous organization (DAO) to manage the cryptocurrency or ICO.

Modern-Day Version of Howey Test for CryptocurrenciesThe above pointers may sound familiar to you. You are a project owner and have spoken to a lawyer before; this is the same advice they gave you. My question now is, since the state of play in cryptocurrencies are changing rapidly, should there be an adapted version for the modern day?

The modern-day version might look something like this:

Is there an investment of money?If the crypto digital asset issuer has not sold any assets issued to build its project. It is most likely not considered a security.

Is there an expectation of profits from the investment?If the crypto asset is utility-based, for example, it is used for voting purposes. It is most likely not considered a security.

Is the investment of money in a common enterprise?If the project is decentralized, it is not controlled and operated by a centralized entity. It is most likely not considered a security.

Are any profit comes from the efforts of a promoter or third party?If the profit primarily comes from the community which has nothing to do with the issuance of the crypto asset. It is most likely not considered a security.

Reminding all again, when all four criteria are met, the investment is considered a security and is subject to regulatory requirements of the Securities Act of 1933. The application of the Howey test to cryptocurrency may involve considering the specific characteristics and features of the particular cryptocurrency or ICO in question, as well as the broader market and regulatory context in which it operates.

Take some time to do a self-evaluation based on the above thoughts shared. If you have time, you can ask yourself these questions about the tokens you invested. This is a good exercise for self-reference. I am not a lawyer, and none of the written content is formal advice.

“If you are a retail crypto investor- Do your crypto research. Learning about the regulation side of things can help you with your investment decision, avoiding unnecessary issues down the road.

If you are a project and you claim to be decentralized. Please stay decentralized. This will also avoid getting into any regulatory problems.” – Anndy Lian

Source: https://www.securities.io/regulating-cryptocurrencies-are-you-investing-in-securities/

The post Regulating Cryptocurrencies: Are you Investing in Securities? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

December 22, 2022

Binance rolls out new features for Web3-focused social platform Binance Feed

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Binance rolls out new features for Web3-focused social platform Binance Feed

The new Binance Feed version features new utility, including fully customizable user profiles.

The platform has registered more than 1 million daily active users and 1,200 content creators since its launch in October.

Binance Feed offers access to content across 400+ cryptocurrency and Web3-focused topics.

The new Binance Feed version features new utility, including fully customizable user profiles.

The platform has registered more than 1 million daily active users and 1,200 content creators since its launch in October.

Binance Feed offers access to content across 400+ cryptocurrency and Web3-focused topics.

Global cryptocurrency exchange Binance has today unveiled new features for its Web3-focused social platform Binance Feed.

According to details the exchange shared with CoinJournal on Thursday, the new features will allow users to experience crypto news and content creation seamlessly on different devices.

The updated version also features a redesigned profile section that offers full customizability for creators and a ‘poll’ and ‘emoji animations’ section that allows for dynamic and interactive engagements for the community members.

That’s not all.

According to the press release, there’s a “comment” feature that the community can tap into to foster greater engagement and participation.

A platform for latest Web3 news and trendsBinance launched the Binance Feed platform in October this year, designing it as a single touchpoint for the crypto community to access the latest trends and news in crypto and Web3. The social platform brings together content creators, thought leaders and influencers and covers more than 400 topics within the crypto and Web3 space.

“Binance Feed gives me news on the move and at times faster than Twitter. That’s the reason why I am using it. Compared to other platforms, Binance has a more active base of users, and the feeds are more timely,” Anndy Lian, a Binance Feed contributor, said in a statement.

Since its debut, the social platform has registered nearly one million daily active users, with 50% month-over-month growth. There are also more than 1,200 creators currently sharing content, while some of the leading crypto publications have registered more than 30,000 followers already.

The service has been accessible on the App Pro Mode since its launch, and also on desktop from November this year.

The post Binance rolls out new features for Web3-focused social platform Binance Feed appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Binance Feed Upgrades With New Features Or Enhanced Web3 Social Media Experience

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Binance Feed Upgrades With New Features Or Enhanced Web3 Social Media Experience

Highlights

HighlightsBinance launches new features for its Web3 social media platform, Binance Feed.

The new features include a dynamic and interactive platform for readers and offer full control over users’ profiles.

Binance, one of the world’s largest centralized exchanges, announced the launch of new features for its Web3-centric social media platform, Binance Feed this Thursday. The platform’s latest update incorporates new utility, empowering users and creators to customize their profiles, interact on posts and articles, and engage in conversations covering over 400 crypto and Web3-focused topics.

The updated version of Binance Feed includes an enhanced experience on the web interface, allowing users to easily discover and create content on different devices. It also has a redesigned profile page section, giving users and content creators full control over their profiles. In addition, Binance Feed now has the ability to create polls and use emoji animations as a dynamic and interactive tool for community engagement. The platform has also added a “comment” feature to foster engagement between content creators and users and encourage more users to participate in the exchange of thoughts, opinions, and ideas.“Binance feed gives me news on the move and at times faster than Twitter,” Binance Feed contributor Anndy Lian. “That’s the reason why I am using it. Compared to other platforms, Binance has a more active base of users, and the feeds are more timely.”

The platform has grown its social media following to over one million daily active users and over 1,200 content creators, with the numbers growing by the day.

Binance Feed serves as a community-first platform for Web3 content creators, influencers, and thought leaders to share their expertise, insights, and opinions with users, as well as news and updates. The platform covers more than 400 distinct topics related to the crypto economy and adapts to user behaviour by recommending content based on clicks and engagement.

Speaking on the latest updates to Binance Feed, EljaBoom, blockchain portfolio advisor, founder and CEO of Ajoobz, said,

“I have been posting regularly on the feed. It’s easy to create content and push it onto the Feed, given there’s no learning curve. Now, the ability to leave comments and interact with others adds another valuable layer to the activity. Users can leave feedback and suggestions, helping creators like me deliver better content. It’s a win-win for all, especially for the Web3 ecosystem.”

In conclusion, the new features on Binance Feed will provide users with more customization options and facilitate engagement with the platform’s community. The platform’s focus on Web3 and crypto news, as well as its ability to adapt to user behaviour, make it a valuable resource for those interested in the crypto industry.

Source: https://coinpedia.org/information/unlock-the-potential-of-alternative-investments-with-hedgeup/

The post Binance Feed Upgrades With New Features Or Enhanced Web3 Social Media Experience appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Crypto Industry Key Topics to be Explored at Blockchain Fest Singapore

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Crypto Industry Key Topics to be Explored at Blockchain Fest Singapore

On 16-17 February 2023, thousands of professionals in the Blockchain, Exchanges, Cryptocurrencies, NFTs, DeFi, Mining, Gaming, Online Payments, Investment, and FinTech Industries will gather at the Marina Bay Sands Convention Center for the Blockchain Fest Singapore 2023.

The two-day event will feature a range of interactive sessions and panel discussions on a variety of topics, including Blockchain and Cryptocurrency Laws and Regulations 2023, featuring Surya Sarella, CEO of Blocksol Media, Jonathan C. Dunsmoor, founder and principal of Dunsmoor Law, and Anndy Lian, best-selling book author of ‘NFT : From Zero to Hero’. Another highlight of the event will be a discussion on “How Blockchain and Cybersecurity Work Together”

There will be a freeside chat session on the topic. One of the standout topics for the event is “True Digital Ownerships with DeFi & NFTs”, featuring Jonas Thuerig, Head of F10 Asia at F10 Global, and Krinza Momin, Developer Relations Engineer at Ankr.

We also have keynote sessions on “The Opportunities in the Current Market for Established Exchanges”, featuring Toya Zhang, CMO of Bit.com. Other topics to be covered include “Web3 Startup Strategies” by Tobias Bauer, Principal at Blockchain Founders Fund.

Blockchain Fest Singapore 2023 is a must-attend event for professionals looking to stay up-to-date on the latest developments in the industry and connect with like-minded individuals. Another highly anticipated keynote is “Tokenomics : Guaranteeing the Sustainability of Web3”, with Eloisa Marchesoni, Tokenomics Expert and VC Partner. “Insurance as an Enabler to the Crypto Industry” will also be a keynote topic, with Joel Pridmore, Managing Director of the Frontier Global Underwriting, leading the discussion. In addition, El Lee, Digital Treasures Centers, will be presenting on the topic of “Next Crypto Spring Starts with Web3 Payment !”.

We will kick off the second day with a presentation from Dr. Patrick Chin, CMO of Mintable, on“The Phenomenon of NFT”, followed by a talk on “Central Bank Digital Currencies (CBDCs) and Stablecoins : Co-existence or Overlap ?” with Dr. Oriol Caudevilla, FinTech and Blockchain Advisor and host of Digital Tomorrow podcast.

Next, don’t miss the panel discussion on “GameFi 2.0| The Next Big Thing in Crypto ?” featuringRico Pang of Sanctum Global Ventures, Felix Sim from Salad Ventures, Elston Sam of Ethlas, and Jisheng Tan from Playermoon.

Following the panel, we will have a special session on “Women in Crypto”. In the afternoon, we will have a discussion on “Navigating Crypto as a Venture Fund” with Arthur Tan of Metapac Group, Karnika E. Yashwant of Key Difference Media and forward Protocol, and Darius Askaripour, of Varys Capital. We will wrap up the day with a panel discussion from Ryan Liew of Copia Corporation Limited on ”What will the future of NFTs look like for people and companies?”.

Blockchain Fest offers a great deal of networking opportunities and is one of the mostimportant aspects of the event. This is an opportunity for you to meet and network with anumber of experienced individuals at the conference.In addition to bringing together the world’s best investors, industry insiders, and startups,Blockchain Fest also creates unique business and networking opportunities. So, don’t miss outon this event ! Book your ticket now

The post Crypto Industry Key Topics to be Explored at Blockchain Fest Singapore appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.