Anndy Lian's Blog, page 7

October 6, 2025

From Tokyo to crypto: How political shifts and policy bets are reshaping global markets

Anndy Lian

From Tokyo to crypto: How political shifts and policy bets are reshaping global markets

The recent victory of Sanae Takaichi in the Liberal Democratic Party leadership race marks a pivotal moment for Japan, positioning her to step into the role of the country’s first female prime minister by mid-October. Investors caught off guard by this outcome quickly adjusted their positions, leading to notable shifts across Japanese markets. The yen weakened significantly, closing above 150 against the US dollar, while Japanese government bonds faced pressure and equities surged in response.

Takaichi’s strong advocacy for expansive fiscal and monetary policies fuelled this immediate reaction, as markets anticipated a push toward reflationary measures. Her focus on sectors such as defence, nuclear energy, and consumer support promises to drive targeted investments, potentially invigorating economic growth in areas that have long been overdue for attention.

From my perspective, this development injects a fresh dynamism into Japan’s economy, which has grappled with stagnation for years. A leader willing to embrace bold stimulus could finally break the cycle of timid reforms, though the path ahead carries risks that demand careful navigation.

Markets reacted swiftly to Takaichi’s win, reflecting a broader repricing that favoured equities over safer assets. The Nikkei 225 climbed 1.9 per cent on Friday, reaching an all-time high amid a rally in tech and semiconductor shares across Asia. Investors now expect further upside in Japanese stocks, particularly in sectors aligned with Takaichi’s priorities.

Defence and nuclear stocks stand out as prime beneficiaries, given her strategic emphasis on bolstering national security and energy independence. Infrastructure plays and domestic demand-oriented companies also look poised for gains, as her policies aim to stimulate household spending and support small caps.

Exporters benefit from the yen’s depreciation, which enhances their competitiveness abroad. Banks, however, faced initial selling pressure, as expectations for a Bank of Japan rate hike in the fourth quarter diminished under the assumption of Takaichi’s influence.

Yet, this dip presents an opportunity, in my view, because her reflationary approach could boost loan growth, and the central bank might still raise rates to manage volatility in the yen and bond markets. Overall, this sector rotation highlights a market that is betting on policy-driven growth, where winners emerge from areas tied to fiscal expansion.

Macro risks loom large in this scenario, tempering the enthusiasm. The yen’s weakness raises concerns about imported inflation and currency stability, particularly given Japan’s debt-to-GDP ratio, which exceeds 260 per cent. Such high leverage amplifies worries over fiscal sustainability if expansive policies lead to overshooting.

The Bank of Japan may be compelled to hike front-end rates, although many now anticipate a delay into 2026 amid persistent inflation and negative real yields. Policy uncertainty adds another layer, as Takaichi’s administration must balance bold promises with execution.

Investors should monitor how her government addresses these challenges, as any misstep could erode confidence. In my opinion, while the immediate rally feels justified, the long-term success hinges on disciplined implementation. Japan has seen reformist leaders falter before, so Takaichi’s ability to deliver tangible results will determine whether this surge sustains or fizzles.

Shifting to the investment thesis, the stimulus-led upside appears compelling for Japanese equities in the near term, particularly in sectors aligned with Takaichi’s agenda. A risk-adjusted strategy favours reflation beneficiaries, with appropriate hedges to mitigate volatility. The market places its bets on her delivering bold policy changes, but execution risk remains a critical factor. Fiscal discipline will prove essential to avoid exacerbating debt issues.

From where I stand, this moment offers a buying opportunity for those optimistic about Japan’s potential under new leadership. The rally could extend if Takaichi assembles a cohesive cabinet and pushes through her agenda swiftly, drawing in foreign capital seeking exposure to Asia’s third-largest economy.

On the global front, risk sentiment stayed muted due to the ongoing US government shutdown, as the Senate repeatedly failed to pass a funding bill with lawmakers sticking to their stances. This impasse delayed key data releases, including September’s non-farm payrolls, which investors awaited on Friday but never received.

In contrast, Sanae Takaichi’s LDP win captured headlines, highlighting a stark difference in political momentum between the two nations. Wall Street closed mixed on Friday, with the Dow Jones up 0.51 per cent, the S&P 500 edging higher by 0.01 per cent, and the Nasdaq dipping 0.28 per cent as the tech rally paused. US Treasury yields climbed despite services data falling short of expectations, with the 10-year yield rising 3.7 basis points to 4.119 per cent and the two-year yield also up 3.7 basis points to 3.576 per cent.

The US dollar index slipped 0.1 per cent to 97.72, while gold advanced 0.8 per cent to 3886 dollars per ounce. Brent crude gained 0.7 per cent to 64.53 dollars per barrel, buoyed by President Trump’s warnings to Hamas regarding his plan to end the Gaza war. Asian equities ended higher on Friday, driven by tech and semiconductor stocks, although early trading on Monday showed mixed results. US equity futures indicate a higher open, suggesting some resilience amid uncertainty.

Looking ahead, the week features speeches from Federal Reserve officials, including Governor Stephen Miran on Wednesday and Chair Jerome Powell on Thursday. Delays in US data persist, affecting August trade figures, initial jobless claims, and the September federal budget balance.

These events could shape market expectations, particularly around monetary policy. The US shutdown exacerbates economic fog, pushing investors toward safe havens like gold while pressuring equities. Yet the interplay with Japan’s developments creates intriguing cross-currents, where Asian stimulus might offset some Western headwinds.

Turning to the crypto market, it rose 1.04 per cent over the last 24 hours, building on its 7-day gain of 9.07 per cent and 30-day advance of 10.76 per cent. Several factors drove this momentum, starting with macro tailwinds from the US shutdown and weak jobs data, which heightened bets on Federal Reserve rate cuts.

Bitcoin surged 12 per cent last week following the shutdown and ADP jobs report showing a drop of 32K against expectations of plus 50K. Markets now see a 98 per cent chance of a cut by October 29, according to TokenPost. Gold’s 48 per cent year-to-date rise mirrored crypto’s rally as a hedge against uncertainty.

The high correlation between crypto and equities, at 0.82 over seven days versus the Nasdaq-100, amplified these gains as traders shifted into risk assets. Investors should watch Powell’s October 29 speech and FOMC minutes for insights into the rate path. This environment favors crypto as a speculative play, where dovish signals could propel further upside.

Binance’s ecosystem provided another bullish pillar, with the exchange achieving 2.55 trillion dollars in monthly futures volume, a 2025 high, and capturing 87 per cent of Bitcoin taker buy volume per CMC. Its new AI-powered Trading Signals feature boosted activity in the BNB ecosystem, lifting BNB by 18.42 per cent weekly.

Binance’s liquidity depth, holding 41.1 per cent global market share, and institutional tools draw in capital, fostering network effects for its token and partners. This dominance reinforces confidence, making Binance a linchpin in the market’s resilience. I see this as a sign of maturing infrastructure in crypto, where platforms like Binance evolve from mere exchanges to comprehensive ecosystems, attracting serious investors amid broader volatility.

Altcoin developments added a mixed but largely positive influence. Ethereum climbed 9.96 per cent weekly, approaching 4500 dollars ahead of December’s Fusaka upgrade. Solana’s Alpenglow upgrade, reducing block finality by 40 per cent, spurred 13 per cent weekly gains.

However, Bitcoin dominance increased to 58.55 per cent as traders secured profits from alts. These upgrades sustain narratives around altcoins, though Bitcoin’s seven-day RSI of 87.4 indicates overbought territory. The key question revolves around Ethereum’s post-Fusaka momentum, especially as staking yields compress. From my standpoint, altcoins offer diversification in a bull run, but their reliance on upgrades highlights the sector’s innovation-driven nature, which can yield outsized returns when executed well.

In conclusion, today’s market dynamics blend opportunity with caution. Japan’s shift under Takaichi promises stimulus-fuelled growth, potentially lifting equities and sectors like defence and nuclear, while the yen’s weakness and debt concerns warrant vigilance.

Globally, the US shutdown clouds data and sentiment, yet it bolsters rate-cut expectations that benefit risk assets, including crypto. The crypto surge, driven by macro bets, Binance’s strength, and altcoin catalysts, reflects a Goldilocks scenario for bulls. Nonetheless, resistance at Bitcoin’s 125K level and potential Fed hawkishness could prompt pullbacks.

I believe the overarching trend leans positive for investors willing to embrace calculated risks, as political and economic shifts create fertile ground for gains. Takaichi’s leadership could herald a new era for Japan, complementing crypto’s resilience in uncertain times, but success depends on policy delivery and central bank responses. This interconnected landscape demands agility, where staying informed on speeches and upgrades will separate winners from the rest.

The post From Tokyo to crypto: How political shifts and policy bets are reshaping global markets appeared first on Anndy Lian by Anndy Lian.

October 5, 2025

Decentralizing the Next Layer of Ethereum Infrastructure with Anti-Slashing & ZK-Readiness

Anndy Lian

Decentralizing the Next Layer of Ethereum Infrastructure with Anti-Slashing & ZK-Readiness

At the Scaling Summit Singapore, a pivotal conversation unfolded on the Ethereum Stage, where builders, researchers, and visionaries gathered to confront one of the ecosystem’s most pressing dilemmas: How do we scale Ethereum without sacrificing its foundational ethos of decentralization? Moderated by Luca Donno, a researcher at L2Beat, the panel featuring Amir (Puffer Finance), Mike Massari (Redstone), Ian Wallis (Linea), and Anndy Lian (Intergovernmental Blockchain Advisor) delved into the tension between idealism and pragmatism in blockchain infrastructure.

The Centralization Conundrum

The discussion opened with a stark reality: while decentralization remains Ethereum’s “biggest asset,” market forces often incentivize centralization for speed and user experience. As Amir of Puffer Finance noted, “If you look at where biggest asset holders are now parking their assets… they’re trusting Ethereum for a reason.” He pointed to USDT and USDC 45% and nearly 100% of their supplies, respectively, reside on Ethereum precisely because of its trustless nature.

The path to mass adoption is rarely pure. Luca framed the dilemma: “We were very much in a situation in which decentralization was the most important thing… Now it’s not anymore. That is not the focus of institutions.” This shift demands a recalibration. Anndy Lian, speaking from a macroeconomic lens, admitted bluntly: “Most users, including VCs like myself, you know, we don’t really care [about decentralization]… we want to make money.” His candid remark underscored a broader truth user incentives today prioritize yield and UX over ideological purity.

But the panelists agreed: decentralization must remain the north star, even if the journey begins with centralized stepping stones. “It is okay to start slightly more centralized,” Amir argued, “but having decentralization on the roadmap as the main goal is the only way we can scale the entire blockchain to its full capacity.”

Anti-Slashing: Guardrails for a Risky Landscape

A key innovation discussed was anti-slashing a critical safeguard in the era of liquid staking tokens (LSTs). With LSTs now dominating Ethereum’s staking landscape, systemic risk looms large. As Luca observed, many protocols hold more LSTs than native ETH, creating concentration points that threaten network security.

Amir explained how Puffer Finance addresses this: “We didn’t stop at permissionless restaking. We launched bonded validators operators must stake their own capital. If slashing occurs, it’s their money on the line.” This “skin in the game” model, combined with hardware-based anti-slashing modules (like trusted execution environments, or TEEs), prevents malicious or accidental validator misbehavior. “These modules act like a Ledger wallet,” Amir said, “but even more restricted you can only sign permitted transactions.”

Mike Massari echoed the sentiment: “The moment you detach risk from the person managing the capital, you create systemic risk.” Anti-slashing, therefore, isn’t just technical it’s economic alignment.

Ian Wallis added context from Linea’s perspective, noting their plan for a “native yield” bridge that stakes ETH directly, reducing reliance on dominant LST providers like Lido. “We’re consulting closely with the Ethereum Foundation,” he said, emphasizing collaboration over competition in securing the ecosystem.

ZK: Promise, Peril, and Patience

The conversation then turned to zero-knowledge (ZK) technology the cornerstone of Ethereum’s scaling roadmap. While optimistic about ZK’s potential, the panelists acknowledged its immaturity. “ZK is still experimental,” Luca warned, citing recent bugs in foundational libraries like Circom and Halo2. “A multi-billion-dollar bug on Ethereum L1 could shatter trust in the entire paradigm.”

Amir, however, offered a solution in progress: “We’re researching 2FA for ZK running a full Ethereum client inside a TEE alongside the ZK prover. If outputs mismatch, you halt the transaction.” This dual-verification approach could catch bugs before they cascade.

Ian, whose team at Linea operates a ZK-EVM rollup, remained bullish: “Compare where we were five years ago to now we’re light years ahead. ZK improvements are coming quarterly.” He pointed to Swift’s recent partnership with Linea as validation: “If the kings of centralized finance see potential here, that’s an endorsement.”

Anndy Lian urged patience: “Give the technology time. The big boys are coming. Adoption will follow.”

Toward a Redistributed Future

Ultimately, the panel converged on a shared vision: Ethereum must evolve progressively. As Luca summarized, “We shouldn’t decentralize for decentralization’s sake but where user funds are at stake, decentralization equals security, and security equals good UX.”

The road ahead involves balancing short-term pragmatism with long-term principles. Whether through anti-slashing economics, ZK verifiability, or middleware that enforces decentralization standards, the goal remains clear: build infrastructure that can onboard trillions not just billions without compromising Ethereum’s soul.

As Amir put it: “If we want to bring repo markets or supply chains onchain, it has to be fully decentralized and secure. Hyperliquid won’t cut it for JP Morgan.”

In that spirit, the Scaling Summit didn’t just showcase technology it reaffirmed a covenant: scale with integrity, or don’t scale at all.

The post Decentralizing the Next Layer of Ethereum Infrastructure with Anti-Slashing & ZK-Readiness appeared first on Anndy Lian by Anndy Lian.

October 4, 2025

Hong Kong isn’t the loophole Chinese crypto firms think it is

Anndy Lian

Hong Kong isn’t the loophole Chinese crypto firms think it is

China’s crypto ban has been in place since 2021, but that hasn’t stopped companies from chasing what they believe are ways to reenter.

Hyped-up stablecoin announcements in Hong Kong and overseas listings that hint at digital assets are just some of the ways companies are testing boundaries. Each time, Beijing responds with fresh warnings — a stark reminder that China’s crypto U-turn isn’t around the corner.

Hong Kong’s RWA and stablecoin activity picked up as new licensing rules took effect. (

Anndy Lian

)

Hong Kong’s RWA and stablecoin activity picked up as new licensing rules took effect. (

Anndy Lian

)The latest warning reportedly came from the China Securities Regulatory Commission, which advised companies to pause real-world asset ventures in Hong Kong. It followed a state-owned company scrubbing announcements about tokenizing bonds and other enterprises revealing RWA projects, piling on recent warnings against stablecoins after Hong Kong introduced its licensing framework.

To understand why these illusions of loopholes keep appearing — and why they collapse — Magazine spoke with Joshua Chu, co-chair of the Hong Kong Web3 association.

This conversation has been edited for clarity and length.

Magazine: Crypto has been banned for years in China, so why do regulators keep issuing fresh warnings? Countless social media accounts predicted Beijing would reverse its crypto ban, but it hasn’t moved so far. (

DeFiMadara

)

Countless social media accounts predicted Beijing would reverse its crypto ban, but it hasn’t moved so far. (

DeFiMadara

)Chu: The challenge is that many new lawyers in Hong Kong moving into Web3 don’t have much experience with cross-border issues. That’s created fragmentation and a lot of confusion. Some journalists and lawyers even claimed there was a 180-degree reversal on crypto policy. China doesn’t do 180-degree turns in policy. The only U-turn in recent memory was the rollback of COVID-19 mandates.

The crypto ban from 2021 is a good example: Speculative assets are not meant for the retail sector. The People’s Republic of China is still a communist country, and if an unsophisticated investor loses money gambling on crypto, in the government’s view, that’s losing money for the state. That’s why the only entities we’ve seen handling crypto assets are the government or state-owned enterprises.

Magazine: How do you explain this cycle where Chinese firms repeatedly attempt to enter a trendy crypto venture through Hong Kong, only for mainland regulators to push back?Chu: The issue is how they’re doing it. Even big companies with money can act in a less-than-sophisticated way. There’s a difference between state-owned enterprises and private institutions. The government is comfortable with blockchain infrastructure and foreign direct investment. What it won’t tolerate is speculation because speculation equals bubbles.

That’s why regulators crack down on projects designed to hype markets or pull value from retail investors. It’s the same logic behind China’s real estate policy: Buying to live in is fine, but speculation isn’t. You can think of it as a parental style of governance: Just as parents wouldn’t let children gamble with family savings, the state won’t let retail investors gamble away wealth in crypto.

Crypto Is Alive and Well, Though Skeptics Say It’s ‘Not Money’

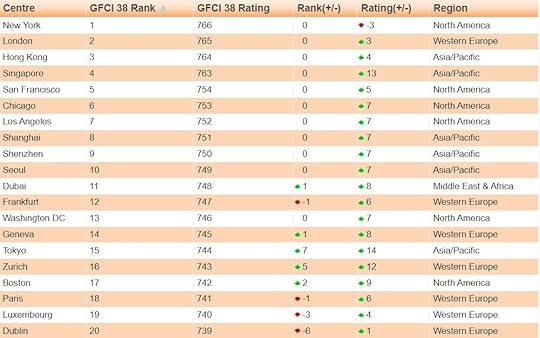

At the end of the day, companies see profit potential, which is why they want in. But regulators will only support ventures that are sophisticated, compliant and responsible. That’s also why Hong Kong can hold itself out as one of the world’s top three financial hubs — its reputation depends on keeping the system clean, and the same principle applies to virtual assets.

Hong Kong aims to strengthen its financial center rating through cryptocurrencies. (

Long Finance

)Magazine: Isn’t the real problem that Chinese firms are hunting for loopholes and Hong Kong lawyers aren’t equipped to stop them?

Hong Kong aims to strengthen its financial center rating through cryptocurrencies. (

Long Finance

)Magazine: Isn’t the real problem that Chinese firms are hunting for loopholes and Hong Kong lawyers aren’t equipped to stop them?Chu: Unfortunately, that happens a lot. If your whole business is founded on loopholes, you’re already on shaky ground. Regulators don’t create loopholes for you to exploit; they expect you to build something sustainable and compliant.

But because of the 2021 crypto ban, you have an entire market that’s been shut out. Human psychology kicks in, and people think: “Maybe this is my way back in.” That’s why you see companies making loud announcements before they’ve even filed an application. Take the stablecoin regime: Some firms were hyping plans to apply for licenses just to pump their stock price. Naturally, regulators step in.

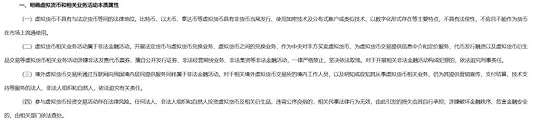

China’s 2021 crypto ban defines crypto-related businesses as illegal financial activities. (

China State Administration of Foreign Exchange

)

China’s 2021 crypto ban defines crypto-related businesses as illegal financial activities. (

China State Administration of Foreign Exchange

)We’ve seen this pattern before. When initial coin offerings were being sold as a cheaper alternative to initial public offerings, companies said you didn’t need a prospectus or compliance. But there’s a reason those safeguards exist: to protect investors. So, when players start cutting corners and shouting about it, it draws scrutiny. And that’s when clampdowns happen.

Magazine: When Chinese firms listed in Hong Kong or the US gain crypto exposure, is this regulatory arbitrage?Chu: When a Chinese company lists on Nasdaq, it’s absorbing foreign investment, which triggers a different response than if it were raising funds domestically. The real question is how they structure these RWA or tokenization projects.

If they’re putting Chinese corporate data on a public blockchain, that creates cross-border data transfer issues. Remember, even listed companies have run into problems with US auditors because of China’s strict rules on what information can leave the country. Blockchain raises those concerns all over again.

There’s also the financial side. Many of these treasury strategies look risky, especially when driven by institutional FOMO at the peak of a bull cycle. Without strong internal risk controls, volatility can overwhelm the market cap of these firms. That’s exactly the kind of contagion risk regulators want to avoid.

If that happens, the scrutiny won’t just come from Beijing; it will come from the SEC as well.

Source: https://cointelegraph.com/magazine/hong-kong-isnt-loophole-chinese-crypto-firms-think/

The post Hong Kong isn’t the loophole Chinese crypto firms think it is appeared first on Anndy Lian by Anndy Lian.

October 3, 2025

Bullish on chips, bearish on congress: The strange calm behind Wall Street’s record run

Anndy Lian

Bullish on chips, bearish on congress: The strange calm behind Wall Street’s record run

The US stock market’s ascent on Thursday reflects a confluence of technological optimism, political uncertainty, and shifting macroeconomic signals that together paint a complex but compelling picture of current investor sentiment. All three major indices, the Nasdaq Composite, the S&P 500, and the Dow Jones Industrial Average, closed at new record highs, with gains of 0.4 per cent, 0.1 per cent, and 0.2 per cent respectively.

This continued rally builds on the momentum from the previous session, when the S&P 500 crossed the 6,700 threshold for the first time in its history. The driving force behind this sustained upward movement remains the artificial intelligence trade, which has reinvigorated investor enthusiasm across the semiconductor and broader tech sectors. Nvidia, the undisputed leader in AI chips, reached another all-time high, while peers like AMD and South Korea’s SK Hynix also posted notable gains.

But the real spark this week came not from hardware manufacturers but from OpenAI, whose private valuation reportedly surged to US$500 billion following an internal employee share sale. This development effectively dethroned Elon Musk’s SpaceX as the world’s most valuable private company and injected fresh confidence into the AI narrative, even as sceptics warn of a potential bubble.

What makes this rally particularly striking is its resilience in the face of significant political turbulence. A partial US government shutdown is now underway, with no clear resolution in sight before the weekend. Former President Donald Trump, who remains a dominant figure in Republican politics, has escalated his rhetoric, threatening to fire thousands of federal workers and cancel billions in federal funding directed to states that lean Democratic.

He also announced a Thursday meeting with Office of Management and Budget Director Russ Vought to identify which so-called “Democrat Agencies” should face budget cuts. Despite this volatility in Washington, financial markets have shown remarkable indifference, a testament to how deeply investor focus has shifted toward technological disruption and away from short-term fiscal standoffs. That said, the shutdown is not without consequences.

The Bureau of Labour Statistics has almost certainly delayed the release of the September jobs report, originally scheduled for Friday. This data blackout deprives the Federal Reserve of a key input as it prepares for its October policy meeting, where labour market conditions will weigh heavily on the decision to hold or cut interest rates. In the absence of official economic indicators, traders are turning to alternative signals, including movements in Bitcoin and institutional flows into digital assets.

Speaking of Bitcoin, the cryptocurrency posted a 1.92 per cent gain over the past 24 hours, extending its seven-day advance of 10.14 per cent and 30-day climb of 8.56 per cent. This sustained bullish trend stems from three interlocking catalysts: growing speculation around sovereign Bitcoin reserves, strong inflows into US spot Bitcoin ETFs, and favourable technical indicators supported by shifting macro expectations.

The idea of nation-states holding Bitcoin as a reserve asset is no longer confined to outliers like El Salvador. On October 2, Swedish lawmakers formally proposed the creation of a national Bitcoin reserve, while in the US, Representative Nick Begich introduced legislation calling for a “Strategic Bitcoin Reserve.” Though these proposals remain in early stages, their mere existence signals a gradual normalisation of Bitcoin as a potential store of value at the sovereign level.

If even a fraction of these ideas materialise, say, a US acquisition of 1 million BTC, representing roughly 4.76 per cent of the total supply, the market impact would be profound. At current prices, such a purchase would cost approximately US$120 billion and significantly tighten available liquidity. Even smaller-scale adoption, such as the Czech Republic’s rumoured consideration of allocating five per cent of its foreign exchange reserves to Bitcoin, reinforces the “digital gold” thesis that underpins long-term institutional interest.

Parallel to these geopolitical developments, institutional demand through regulated financial products continues to accelerate. On October 1 alone, US spot Bitcoin ETFs recorded US$430 million in net inflows, reversing a prior week of outflows. This surge coincided with heightened anxiety over the government shutdown, suggesting that some investors view Bitcoin as a hedge against political and fiscal instability. BlackRock’s IBIT ETF now holds US$77 billion worth of Bitcoin, underscoring the scale of institutional participation.

With total assets under management in spot Bitcoin ETFs approaching US$153 billion, the buying pressure from these vehicles has become a structural feature of the market. Unlike retail traders who may react emotionally to news cycles, ETF-driven demand tends to be more consistent and less price-sensitive, creating a floor beneath Bitcoin’s valuation. Corporate treasuries are also contributing to this trend.

Japanese firm Metaplanet recently added 5,268 BTC to its balance sheet in a US$615 million purchase, joining a growing list of companies treating Bitcoin as a strategic reserve asset. This dual wave of sovereign and corporate accumulation, though still nascent, is reshaping Bitcoin’s supply dynamics in ways that favour long-term price appreciation.

From a technical standpoint, Bitcoin’s price action supports this optimistic outlook. The asset reclaimed key support levels and broke above the 50 per cent Fibonacci retracement at US$112,591, stabilising around the US$113,877 pivot. The Relative Strength Index sits at 62.97, firmly in bullish territory but not yet overbought, suggesting room for further upside before encountering resistance near US$121,421, which corresponds to the 127.2 per cent Fibonacci extension.

Traders interpret consolidation above US$117,000 as a sign of underlying strength, particularly when paired with improving macro conditions. Indeed, weaker-than-expected US labour data released on October 2 has increased the probability of a Federal Reserve rate cut in the near term, with markets now pricing in a 78 per cent chance.

Lower interest rates typically benefit risk assets by reducing the opportunity cost of holding non-yielding investments like Bitcoin. Caution remains warranted, however. A Sharpe-like ratio of 0.18 indicates that while returns are positive, the risk-adjusted payoff is modest, pointing to a market that is optimistic but not euphoric.

In sum, the current market environment reflects a delicate balance between technological exuberance and political fragility. US equities continue to scale new heights, propelled by AI-driven narratives and record-setting valuations for private tech giants like OpenAI.

At the same time, Bitcoin is carving out a parallel rally, fuelled by institutional adoption, sovereign curiosity, and technical momentum. Both markets are operating in a data vacuum created by the government shutdown, forcing investors to rely on alternative signals and forward-looking indicators.

The Federal Reserve’s next move will be pivotal, and while the odds favour a dovish pivot, any surprise hawkish stance could disrupt the current equilibrium. For now, however, the prevailing mood is one of cautious confidence, a belief that innovation, whether in artificial intelligence or digital money, will ultimately outweigh the noise from Washington.

As we approach the Fed’s October 30 decision and monitor legislative developments in both the US Congress and Sweden’s Riksdag, the intersection of technology, policy, and finance will remain the central axis around which markets revolve.

Binance Square:

#Bouncebit ($BB) – BounceBit is a BTC restaking chain with an innovative CeDeFi framework.

#WalletConnect ($WCT)- WalletConnect is an open-source protocol that enables secure and seamless connections between cryptocurrency wallets and decentralized applications (dApps) across multiple blockchains.

#Dolomite ($DOLO)- Dolomite is the only lending and borrowing platform that can support over 1,000 unique assets.

#PythNetwork ($PYTH)- Pyth Network is a decentralized first-party financial oracle delivering real-time market data on-chain in a secure, transparent manner without third-party middlemen (nodes).

#Mitosis ($MITO)- Mitosis introduces a protocol that transforms DeFi liquidity positions into programmable components while solving fundamental market inefficiencies.

#Somnia ($SOMI) – Somnia is an EVM-compatible L1 blockchain with a focus on mass consumer applications such as games and entertainment products.

#OpenLedger ($OPEN)- OpenLedger is the AI Blockchain, unlocking liquidity to monetize data, models, and agents. OpenLedger is designed from the ground up for AI participation.

#Plume ($PLUME)- Plume is a modular Layer 2 blockchain network developed to support real-world asset finance (RWAfi).

#Boundless ($ZKC)- Boundless is a zero-knowledge proving infrastructure designed to provide scalable proof generation for blockchains, applications, and rollups.

#Holoworld AI ($HOLO)- Holoworld AI focuses on addressing major gaps in today’s digital landscape, where creators often lack scalable AI-native tools,

The post Bullish on chips, bearish on congress: The strange calm behind Wall Street’s record run appeared first on Anndy Lian by Anndy Lian.

October 2, 2025

Record gold, falling yields, and rising Bitcoin: The interwoven narrative of modern risk assets

Anndy Lian

Record gold, falling yields, and rising Bitcoin: The interwoven narrative of modern risk assets

Despite weaker-than-expected private payroll data and the onset of a US federal government shutdown, risk appetite remained surprisingly resilient. This resilience is not born of complacency but rather of a recalibration in expectations around monetary policy, particularly the growing conviction that the Federal Reserve may soon pivot toward rate cuts.

The ADP National Employment Report showed a decline of 32,000 private-sector jobs in September, following a revised 3,000 decrease in August, standing in stark contrast to the median Bloomberg survey forecast of a 51,000 gain. This miss reinforced market bets that the labour market is cooling, thereby increasing the likelihood of a dovish shift from the Fed later this month.

The immediate market reaction was telling: US Treasury yields fell, with the 10-year yield dropping 5.2 basis points to close at 4.098 per cent, while the US Dollar Index edged down 0.07 per cent to 97.7. Simultaneously, gold surged to a record high of US$3,865.70 per ounce, a classic safe-haven move that also signals growing confidence in lower-for-longer rate expectations.

Equity markets responded with cautious optimism. Wall Street closed higher on Wednesday, with the Dow Jones gaining 0.09 per cent, the S&P 500 up 0.3 per cent, and the Nasdaq climbing 0.4 per cent. The healthcare sector provided strong support, suggesting investors are rotating into defensive yet growth-oriented segments amid macro crosscurrents.

Asian equities followed suit, mainly ending higher and continuing their upward trajectory in early Thursday trading, led by gains in semiconductor and broader technology stocks. US equity index futures pointed to further upside at the open, underscoring a broader narrative: markets are pricing in a soft landing scenario, where economic data deteriorates just enough to prompt Fed accommodation without triggering a full-blown recession.

This nuanced outlook has created fertile ground for alternative assets, particularly cryptocurrencies, which have begun to reassert their role not just as speculative instruments but as potential macro hedges.

The crypto market rose 3.91 per cent over the past 24 hours, extending a seven-day gain of 4.11 per cent. This sustained rally is not driven by retail FOMO alone but by structural developments that signal deeper institutional entrenchment and regulatory progress.

Three key catalysts stand out: the launch of institutional-grade Bitcoin options, regulatory maturation in Asia, particularly Hong Kong, and a surge in decentralised finance (DeFi) liquidity through major platform integrations. Each of these factors contributes to a more robust and credible ecosystem, one that increasingly appeals to traditional finance participants seeking exposure to digital assets without compromising on risk management or compliance.

The debut of Bitcoin options on Bullish Exchange on October 8 marks a significant milestone in the institutionalisation of crypto. Backed by heavyweight players such as BlackRock, Galaxy, Cumberland, and Wintermute, this offering arrives at a time when open interest in crypto derivatives has already reached a yearly high of US$1.24 trillion, up 30 per cent month-over-month.

Weekly inflows into Bitcoin ETFs reached US$571 million, further validating demand from regulated investment vehicles. Options markets deepen liquidity, enable sophisticated hedging strategies, and reduce volatility over time by allowing large players to manage risk without selling spot holdings.

The immediate market response was telling: perpetual funding rates surged 207 per cent within 24 hours, indicating a sharp increase in leveraged long positioning. This suggests that institutional participants are not just passively investing but actively expressing bullish macro views through derivatives. If trading volume on the new options platform proves robust, it could cement Bitcoin’s status as a legitimate macro hedge akin to gold but with asymmetric upside potential in a low-rate environment.

Parallel to this institutional build-out, Asia is emerging as a critical regulatory laboratory for crypto adoption. Hong Kong’s Monetary Authority (HKMA) has received 36 applications for stablecoin licenses, with submissions coming from established banks and major tech firms.

This signals a shift from regulatory ambiguity to structured oversight, a prerequisite for large-scale institutional capital deployment. Stablecoins serve as the on-ramp and off-ramp for digital asset ecosystems, and their formal regulation removes a major friction point for traditional finance integration.

In South Korea, SK Planet’s adoption of Moca Network’s decentralised identity system triggered a 60 per cent rally in ZEN, illustrating how real-world utility can drive value in privacy-focused protocols. Crucially, crypto-equity correlations remain elevated at +0.76 against the Nasdaq, meaning that positive sentiment in tech equities continues to spill over into digital assets. As Asian regulators provide clearer guardrails, they reduce the jurisdictional risk that has long deterred pension funds, asset managers, and corporate treasuries from entering the space.

Meanwhile, DeFi is experiencing a quiet but significant expansion in accessibility. Coinbase’s integration of 1inch’s Swap API now grants its users access to millions of tokens across decentralised exchanges. This move contributed to a 17.92 per cent spike in spot trading volumes, though derivatives still dominate 84 per cent of total crypto volume.

The integration lowers the barrier to entry for retail investors seeking exposure to emerging narratives such as privacy coins like Zcash, which jumped 60 per cent. However, the Altcoin Season Index dipped 3.23 per cent, suggesting that while capital is exploring beyond Bitcoin and Ethereum, it has not yet committed to a broad-based rotation.

This hesitation may reflect lingering caution or simply the time lag between infrastructure development and narrative adoption. Either way, the trend points toward a more interconnected and liquid DeFi landscape, where centralised platforms act as bridges to decentralised liquidity.

Taken together, these developments paint a picture of a maturing asset class. The current rally is not a speculative bubble but a reflection of tangible progress on multiple fronts: institutional infrastructure, regulatory clarity, and technological interoperability. The confluence of Bullish Exchange’s options launch, Hong Kong’s stablecoin licensing momentum, and Coinbase’s DeFi integration represents a trifecta of credibility-building measures.

These are the foundations upon which a sustainable, long-term bull market can be built, not on hype, but on infrastructure. The path forward will not be linear, and leverage remains a double-edged sword, but the structural tailwinds are stronger than they have ever been. Traders must remain vigilant.

Open interest has risen 14 per cent in a single day, indicating that leverage is building rapidly. In a market still sensitive to macro surprises, a sudden shift in sentiment, perhaps triggered by stronger-than-expected US jobs data, could spark a short squeeze or a wave of liquidations.

The upcoming US nonfarm payrolls report, though potentially delayed due to the government shutdown, remains a critical inflection point. fA weak print would likely reinvigorate rate-cut expectations, further boosting risk assets and strengthening the correlation between crypto and traditional markets. Conversely, a resilient labor market could force a reassessment of the dovish narrative, testing the durability of this rally.

In essence, the crypto market is at a crossroads. It is no longer solely driven by retail enthusiasm or macro liquidity cycles. Instead, it is being reshaped by institutional architecture, regulatory milestones, and real-world utility. As such, the current price action should be viewed not as a fleeting surge but as the market pricing in a new phase of digital asset evolution.

Binance Square:

#Bouncebit ($BB) – BounceBit is a BTC restaking chain with an innovative CeDeFi framework.

#WalletConnect ($WCT)- WalletConnect is an open-source protocol that enables secure and seamless connections between cryptocurrency wallets and decentralized applications (dApps) across multiple blockchains.#Dolomite ($DOLO)- Dolomite is the only lending and borrowing platform that can support over 1,000 unique assets.#PythNetwork ($PYTH)- Pyth Network is a decentralized first-party financial oracle delivering real-time market data on-chain in a secure, transparent manner without third-party middlemen (nodes).#Mitosis ($MITO)- Mitosis introduces a protocol that transforms DeFi liquidity positions into programmable components while solving fundamental market inefficiencies.#Somnia ($SOMI) – Somnia is an EVM-compatible L1 blockchain with a focus on mass consumer applications such as games and entertainment products.#OpenLedger ($OPEN)- OpenLedger is the AI Blockchain, unlocking liquidity to monetize data, models, and agents. OpenLedger is designed from the ground up for AI participation.#Plume ($PLUME)- Plume is a modular Layer 2 blockchain network developed to support real-world asset finance (RWAfi).#Boundless ($ZKC)- Boundless is a zero-knowledge proving infrastructure designed to provide scalable proof generation for blockchains, applications, and rollups.#Holoworld AI ($HOLO)- Holoworld AI focuses on addressing major gaps in today’s digital landscape, where creators often lack scalable AI-native tools,The post Record gold, falling yields, and rising Bitcoin: The interwoven narrative of modern risk assets appeared first on Anndy Lian by Anndy Lian.

October 1, 2025

Diverging signals: Dow rises, gold breaks records, and crypto faces derivatives squeeze

Anndy Lian

Diverging signals: Dow rises, gold breaks records, and crypto faces derivatives squeeze

As the United States inches closer to a federal government shutdown, with no resolution in sight after talks between congressional leaders and President Donald Trump ended without progress on Monday, investors are navigating a complex web of signals.

Wall Street stays resilient amid shutdown fearsDespite the looming administrative paralysis, Wall Street closed higher on Tuesday, extending its winning streak into a second consecutive quarter. The Dow Jones Industrial Average rose 0.2 per cent, the S&P 500 gained 0.4 per cent, and the Nasdaq added 0.3 per cent.

This resilience suggests that market participants either believe the shutdown will be short-lived or have already priced in its limited economic impact, given that past shutdowns have rarely derailed broader market trends for long.

Treasury yields and gold signal investor anxietyBeneath the surface, subtle shifts in asset prices reveal deeper unease. US Treasury yields moved in opposite directions, reflecting a classic flight-to-quality dynamic mixed with short-term policy uncertainty. The 10-year yield inched up by one basis point to 4.148 per cent, while the 2-year yield fell by two basis points to 3.612 per cent.

This flattening of the yield curve often signals that investors expect near-term economic disruptions, such as a government shutdown, to weigh on growth, even if longer-term inflation or fiscal concerns remain elevated. Meanwhile, the US Dollar Index declined 0.1 per cent to 97.8, indicating a modest retreat in safe-haven demand for the greenback.

In contrast, gold surged 0.6 per cent to a record high of US$3,858.18 per ounce, underscoring its enduring role as a hedge against political and institutional instability. The precious metal’s ascent to unprecedented levels speaks volumes about the depth of investor anxiety, even as equities hold firm.

Oil and Asian markets reflect fragile demandCommodities tell a different story. Brent crude oil dropped 1.4 per cent to US$67 per barrel, pressured by expectations that OPEC+ may accelerate its planned output increases in the coming months. This potential supply boost comes at a time when global demand outlooks remain fragile, particularly with China, the world’s largest oil importer, entering its week-long National Day holiday.

Asian equities reflected this caution, trading mixed on Tuesday and lower in early sessions on Wednesday, with mainland China and Hong Kong markets shuttered for the festivities. The absence of Chinese participation in regional trading has amplified volatility and reduced liquidity, leaving other markets more exposed to external shocks, including developments in Washington and shifts in US monetary policy expectations.

Crypto faces a risk-off correctionThe crypto market declined 0.51 per cent over the past 24 hours, aligning with the broader theme of risk-off behaviour and profit-taking following recent rallies. Two distinct forces are shaping this correction: regulatory evolution and the dynamics of the derivatives market.

On the regulatory front, the Securities and Exchange Commission (SEC) issued new guidance allowing state-chartered trust companies, such as those operated by Coinbase, to act as custodians for investment advisers managing crypto assets.

At first glance, this appears to be a significant step toward institutional legitimacy. Long-term, it could pave the way for greater participation from traditional finance players who have long cited custody as a primary barrier to entry.

However, the guidance comes with stringent requirements, including mandatory annual audits and strict asset segregation protocols. These conditions have sparked operational concerns among crypto firms, many of which now face the prospect of higher compliance costs and structural overhauls.

As a result, the short-term market reaction has been one of caution rather than celebration. The progress is real, but the path to implementation remains uncertain, and the industry is watching closely for follow-up rule-making and clarity on adoption timelines from major platforms.

Simultaneously, the derivatives market is flashing warning signs. Perpetual futures open interest, a key gauge of leveraged positioning, fell by 5.48 per cent even as trading volume surged by 16.78 per cent. This divergence suggests that traders are actively unwinding leveraged long positions rather than initiating new ones. Compounding the pressure, average funding rates spiked to 0.0068, a staggering 354 per cent increase over 24 hours.

In perpetual futures markets, funding rates represent the cost of maintaining leveraged positions; when they turn sharply positive, it often indicates excessive bullish sentiment that becomes unsustainable. The recent surge suggests that longs were willing to pay a premium to stay in the market, creating a fragile equilibrium that ultimately collapsed under the weight of profit-taking and margin calls.

Notably, US$50 million in liquidations hit the XPL token alone, highlighting how concentrated leverage in smaller altcoins can amplify broader market selloffs. Historically, such spikes in funding rates precede heightened volatility, and if rates turn persistently negative, it could signal a deeper bearish shift as shorts dominate the market.

The current dip in crypto prices thus reflects a tug-of-war between structural progress and cyclical risk reduction. On one side, regulatory clarity around custody could eventually unlock billions in institutional capital, particularly if traditional asset managers gain confidence in secure, compliant infrastructure.

On the other hand, traders are aggressively trimming exposure in anticipation of near-term headwinds not just from potential SEC enforcement actions but also from macro crosscurrents like the US government shutdown and shifting Treasury dynamics.

This tension is further exacerbated by outflows from crypto ETFs, which have seen US$418 million exit Bitcoin funds and US$248 million leave Ethereum products recently. These outflows suggest that even regulated vehicles are not immune to sentiment swings, and that spot market demand may be insufficient to absorb the selling pressure from leveraged traders and cautious institutions alike.

The weeks aheadLooking ahead, the critical support level for Bitcoin sits at US$113,000. A decisive break below this threshold could trigger further technical selling, especially if derivatives markets remain unstable.

Conversely, holding above this level might attract bargain hunters, particularly if the SEC’s custody framework begins to translate into tangible institutional inflows. Altcoins like Aster and Hyperbot face additional challenges due to supply-side constraints, which could either cushion their downside or exacerbate volatility depending on market liquidity.

Ultimately, the next few weeks will test whether the cryptocurrency market can decouple from macroeconomic noise and regulatory ambiguity, or whether it remains tethered to the same risk calculus that governs traditional assets. For now, prudence prevails, and the record highs in gold alongside muted equity gains suggest that even in a world of rising asset prices, uncertainty remains the dominant currency.

The post Diverging signals: Dow rises, gold breaks records, and crypto faces derivatives squeeze appeared first on Anndy Lian by Anndy Lian.

September 30, 2025

8 Ways Blockchain Can Revolutionize IP Licensing for AI Firms

Anndy Lian

8 Ways Blockchain Can Revolutionize IP Licensing for AI Firms

Generative AI, with its ability to create text, images, audio, and other forms of content, has ushered in a new era of technological innovation. It also faces a severe intellectual property (IP) licensing crisis. Generative AI firms often struggle with copyright infringement risks and unauthorized data usage issues due to opaque and inefficient traditional licensing systems, which pose significant legal and ethical challenges. As blockchain technology continues to evolve, it offers a promising solution to address the IP licensing dilemmas of generative AI firms. Below is a detailed exploration of this topic in my perspective.

The IP Crisis in Generative AIGenerative AI systems require vast amounts of data for training, often sourcing it from platforms like the internet. A significant portion of this data is protected by IP rights, and the data usage permissions are often unclear. Generative AI algorithms analyze massive volumes of unstructured data, such as news articles and images, to identify patterns and relationships. During this process, details like IP rights and compensation terms are frequently overlooked, raising concerns among content creators. The Getty Images lawsuit against Stability AI is a prime example. In 2023, Getty Images filed a case against Stability AI of unlawfully copying and processing millions of copyrighted images to train its software for commercial gain, seeking up to $1.8 trillion in damages.

The traditional IP licensing system worsens these issues. It is often opaque, inefficient, and lacks transparency. For instance, creators may struggle to track how their works are used by generative AI firms and whether they receive fair compensation. Meanwhile, AI firms may inadvertently infringe on IP rights due to complex and lengthy licensing procedures, leading to legal disputes. I was at a conference early this year and I remember the speaker said that over 60% of generative AI firms have encountered IP licensing-related challenges, with 30% facing legal lawsuits. If this is true, someone or some tech got to try to fix this. The first thing I can think of would be “blockchain”.

Blockchain’s Core StrengthsBlockchain technology, characterized by decentralization, security, and transparency, can effectively address the inefficiencies and trust deficits in current IP licensing models. Blockchain operates as a distributed ledger where all transaction records are stored across multiple nodes, making data tamper-proof and immutable. This ensures the authenticity and traceability of IP ownership and usage rights. Additionally, blockchain employs advanced cryptographic techniques to protect data security, preventing unauthorized access and tampering.

Smart contracts, a key feature of blockchain, enable the automation of licensing agreements. Once predefined conditions are met, smart contracts automatically execute the terms of the agreement, reducing reliance on intermediaries and minimizing human intervention. This ensures the objectivity and fairness of the licensing process while lowering administrative costs.

Blockchain Solutions for Generative AI’s IP Licensing Issues1. Smart Contracts for Automated LicensingBlockchain-based smart contracts can automate licensing agreements, ensuring that creators are promptly and fairly compensated while helping AI firms easily comply with licensing requirements. For example, when a photographer’s image is used in generative AI training, a smart contract can automatically trigger a payment to the photographer once the image is accessed. This eliminates the need for lengthy negotiations and manual payments, reducing costs and improving efficiency. Based on my observations, smart contracts could probably reduce IP licensing costs by 30%–50% while enhancing transparency and fairness. This is a win-win scenario.

2. Immutable Provenance for Ownership ClarityBlockchain’s immutable ledger permanently records data ownership and licensing history, providing a reliable basis for resolving IP disputes. Each piece of data on the blockchain carries a unique digital signature and timestamp, making it easy to trace its origin and usage history. This prevents unauthorized use and infringement, protecting creators’ rights. For instance, when a dataset is licensed to a generative AI firm, the blockchain records every detail of the licensing process, including the licensing party, terms, and duration. Any unauthorized use of the dataset can be quickly identified and addressed.

3. Decentralized Marketplaces for Cost ReductionBlockchain enables the creation of decentralized IP licensing marketplaces where creators and AI firms can directly engage in peer-to-peer transactions, bypassing intermediaries and reducing costs. Traditional licensing often involves multiple middlemen, such as licensing agencies and law firms, which increases costs and complexity. On a blockchain-based decentralized marketplace, creators can directly publish and license their works, while AI firms can browse and purchase licenses based on their needs. This not only reduces licensing costs but also increases revenue for creators. For example, there are decentralized data marketplaces that allow data owners to control access to their data and receive compensation.

4. Enhanced Security Against FraudBlockchain’s cryptographic security mechanisms ensure the integrity and authenticity of licensing records, preventing fraud. All licensing information on the blockchain is encrypted and verified by multiple nodes, making it nearly impossible to forge or tamper with. This protects both creators and AI firms from false claims and ensures the reliability of each transaction. Another example that I would like to quote- fake licenses cannot be validated on the blockchain, preventing AI firms from suffering losses due to fraudulent licenses and safeguarding creators’ rights.

5. Transparency to Build AccountabilityThe open and transparent nature of blockchain makes all licensing transactions visible to all parties, fostering trust and simplifying compliance for AI firms and regulators. Creators can track the usage of their works in real time, while AI firms can demonstrate compliance with licensing agreements to regulators and the public. This transparency helps build trust between creators and AI firms, fostering collaboration. Take the European Union’s Artificial Intelligence Act for instance, which took initial effect in August 2024, requires generative AI models to disclose the copyrighted works used during training. A blockchain-based platform could provide detailed records of training data sources and usage, helping AI firms meet regulatory requirements.

6. Tokenization for Flexible LicensingThrough tokenization, blockchain can transform IP assets into digital tokens, enabling flexible and scalable licensing models. Creators can issue tokens representing the usage rights to their works and sell them on blockchain platforms. AI firms can purchase the tokens they need based on their requirements. This not only provides creators with new revenue streams but also offers AI firms greater flexibility in accessing data. A musician could tokenize the licensing rights to their songs and sell them to generative AI firms. These firms could then use the songs to train music generation models while paying the musician via token-based payments.

7. Global Scalability and ComplianceBlockchain technology operates across borders, enabling generative AI firms to manage IP licensing on a global scale while complying with international regulations. Different countries have varying IP laws and regulations, making cross-border licensing complex. Blockchain’s standardized protocols and rules can simplify cross-border licensing processes, reduce legal risks, and facilitate global collaboration. Blockchain platforms could manage datasets licensed from multiple countries, ensuring compliance with each country’s IP laws while streamlining licensing procedures.

8. Future-Proofing for AI’s EvolutionBlockchain’s adaptability allows it to address emerging IP challenges as generative AI evolves, offering a long-term solution. As generative AI technologies advance, new IP issues may arise, such as ownership disputes over AI-generated content. Blockchain’s smart contracts and decentralized architecture can evolve to meet these new challenges. Future smart contracts could define usage rights and revenue-sharing mechanisms for AI-generated content, ensuring fair compensation for all stakeholders.

Existing Challenges and ProspectsDespite blockchain’s potential to resolve generative AI’s IP licensing issues, several challenges remain. First, technical barriers need to be overcome. Blockchain technology is still evolving, and its integration with generative AI systems requires significant technical effort. Achieving real-time tracking and recording of data usage in generative AI training while ensuring blockchain performance and scalability is a complex technical challenge.

Second, regulatory uncertainty persists. The legal status of blockchain-based IP licensing and the regulatory requirements for smart contracts remain unclear in many countries. This creates uncertainty for both creators and AI firms. Third, market adoption is slow. Transitioning from traditional licensing models to blockchain-based ones requires time and effort. Both creators and AI firms need to adapt to new technologies and processes, and the market requires time to mature.

In my view, the future prospects are promising. As blockchain technology matures and regulatory frameworks gradually improve, its application in generative AI IP licensing is likely to expand. More creators and AI firms will recognize the benefits of blockchain and adopt it for IP licensing. It could become the standard solution for addressing IP licensing issues in generative AI, driving the healthy development of the generative AI industry.

In conclusion, generative AI firms face a severe IP licensing crisis, while blockchain technology offers a powerful solution. By leveraging blockchain’s decentralization, security, transparency, and smart contracts, among other features, generative AI firms can address IP licensing challenges, protect creators’ rights, and achieve sustainable development. Although challenges remain in areas like technology, regulation, and market adoption, with ongoing advancements in blockchain technology and increased collaboration among stakeholders, blockchain is expected to play an increasingly significant role in resolving generative AI’s IP licensing issues. It will pave the way for the healthy growth of the generative AI industry and foster innovation and development in the digital economy era.

Source: https://www.securities.io/8-ways-blockchain-can-revolutionize-ip-licensing-for-ai-firms/

The post 8 Ways Blockchain Can Revolutionize IP Licensing for AI Firms appeared first on Anndy Lian by Anndy Lian.

The new market symbiosis: How Fed easing, AI, and crypto ETFs are lifting equities

Anndy Lian

The new market symbiosis: How Fed easing, AI, and crypto ETFs are lifting equities

As markets wrapped up trading on Monday, September 30, 2025, investors witnessed a steady climb in major indices, driven by ongoing negotiations in Congress to prevent a government shutdown. Traders focused on these developments, which injected a dose of optimism into the session.

The Dow Jones Industrial Average climbed 69 points, marking a 0.2 per cent increase. Meanwhile, the S&P 500 advanced 0.3 per cent, and the Nasdaq Composite led the pack with a 0.5 per cent gain. This upward movement highlighted a resilient market mood, even amid earlier fluctuations that tested investor resolve.

Earlier in the day, the Dow showed signs of recovery after a choppy start. It ended up 32 points, or 0.1 per cent, despite spending much of the session in negative territory. This modest rebound came as 18 out of the 30 component stocks turned positive, indicating solid breadth across the index. Such participation from a majority of its members suggested underlying strength, rather than a rally propped up by just a handful of heavyweights.

The S&P 500, for its part, held firm in positive ground throughout, rising 0.2 per cent by early afternoon. It experienced several ups and downs, reflecting the push and pull between buyers and sellers, yet it never dipped into the red for long.

The Nasdaq Composite’s 0.5 per cent advance stood out, fuelled by renewed interest in artificial intelligence-related names and the broader Big Tech sector. This dip-buying behaviour explained much of the divergence, as tech enthusiasm lifted the index while others lagged slightly.

The Dow faced headwinds mid-session, slipping 45 points or 0.1 per cent after an initial pop higher. Only 14 of its 30 stocks gained ground at that point, underscoring its relative underperformance compared to peers. Unlike the Nasdaq or S&P, the Dow carries fewer pure-play AI and tech exposures, and it prices its components by share value rather than overall market capitalisation. This structure amplified the drag from laggards.

Notably, Apple, one of the Dow’s key holdings, traded lower despite its recent strong run, which further weighed on the index. In contrast, the Nasdaq benefited from its heavier tilt toward innovative sectors, where investors scooped up shares on any weakness, perpetuating the rally in tech darlings.

Shifting focus to broader influences, several macroeconomic tailwinds and regulatory advancements played a pivotal role in bolstering sentiment. The Federal Reserve’s rate cut in September, which brought the target range to 4.00 per cent to 4.25 per cent, eased borrowing pressures across the economy. Coupled with this, the GENIUS Act streamlined rules for exchange-traded funds, enhancing liquidity prospects.

The Securities and Exchange Commission approved ETFs for alternative coins and unified derivatives regulations, which cleared away much of the fog surrounding crypto investments. These steps actively drew in more capital from institutions, fostering a positive spillover into equities. Crypto’s seven-day correlation to the Nasdaq 100 stood at +0.72, illustrating how shared economic drivers linked these assets.

Investors now anticipate the SEC’s October 10 deadline for approving a Solana ETF, with analysts pegging the odds above 95 per cent. This potential green light could further integrate digital assets into traditional portfolios, amplifying the bullish momentum seen in stocks.

Binance’s recent initiatives added another layer of institutional momentum to the mix. The exchange introduced a white-label platform allowing banks and brokerages to integrate crypto offerings seamlessly, echoing a similar launch by Coinbase in June. This development sparked a sharp uptick in activity, with spot trading volume surging 58.47 per cent over 24 hours and derivatives volume jumping 77.41 per cent.

Such increases pointed to heightened engagement from professional players, bridging the gap between traditional finance and digital assets. Tokens like BNB rose 3.78 per cent, while Mantle climbed 7.41 per cent, buoyed by corporate adoptions such as CEA Industries’ US$160 million purchase of BNB for its treasury.

These moves signalled growing confidence in crypto as a viable reserve asset. Looking ahead, Binance’s full rollout of this service in the fourth quarter will serve as a crucial gauge for enduring demand from institutions, potentially sustaining the uplift in related equities.

On the technical and on-chain front, the picture presented a blend of encouraging and cautionary signals. BNB’s Maxwell hard fork reduced block times to 0.75 seconds, accelerating network efficiency and spurring greater usage. Bitcoin’s market dominance edged up to 58.05 per cent, hinting at a shift toward established large-cap cryptos amid uncertainty.

Total open interest in crypto reached US$1.14 trillion, up 9.66 per cent in the last 24 hours, which underscored robust speculative interest. However, the MACD histogram dipped to -10.59 billion, flagging potential overheating in derivatives markets. This duality captured the market’s current state: enthusiasm tempered by risks of excess leverage.

In my opinion, this Monday’s market action marks a turning point where policy easing and innovation converge to propel assets higher, albeit with vulnerabilities. I view the Fed’s dovish stance as a foundational support, lowering costs and encouraging risk-taking that benefits both stocks and crypto. The rate cut directly contributes to improved liquidity, which in turn supports the Nasdaq’s outperformance through investments in AI and tech.

Regulatory clarity, especially around ETFs and derivatives, removes barriers that once deterred big money, and the high odds for Solana’s approval excite me as a catalyst for fresh inflows. Binance’s push feels like a game-changer, actively pulling traditional finance into the fold and driving those volume spikes that ripple into broader markets. The corporate buys, like CEA Industries’ sizable BNB stake, convince me that we’re seeing real adoption, not just hype.

I remain watchful of the mixed technicals. The rise in Bitcoin dominance suggests investors favor safety in giants, which could cap gains in smaller names and indirectly pressure diversified indices like the S&P. The open interest boom is thrilling, but that negative MACD reading worries me about overextension in derivatives, where unwinds could spark volatility. Spot ETF assets under management at US$147.75 billion provide a buffer, yet if leverage risks escalate, they might not hold the line.

Overall, I lean bullish, believing macro tailwinds and institutional integration outweigh the froth. The Dow’s recovery, with 18 components advancing, reassures me of broad participation, while the Nasdaq’s 0.5 per cent gain highlights sector leadership. If Congress averts the shutdown, this could extend the grind higher.

The post The new market symbiosis: How Fed easing, AI, and crypto ETFs are lifting equities appeared first on Anndy Lian by Anndy Lian.

September 29, 2025

The Fed’s first rate cut: What it means for equities, risk, and crypto

Anndy Lian

The Fed’s first rate cut: What it means for equities, risk, and crypto

The Federal Reserve has officially initiated its rate cut cycle, a move long anticipated by markets that have already priced in approximately 3.8 cuts over the next 12 months. I forecast two additional reductions on October 29 and December 12.

Historically, the period immediately following the first rate cut has been marked by heightened volatility as markets recalibrate their expectations, reassess risk premiums, and digest the implications of a new monetary regime.

This transitional phase is particularly delicate because it often coincides with divergent signals from economic data, political uncertainty, and evolving investor positioning. All of these factors are present in today’s environment.

Equities and the magnificent seven effectEquity markets, led by the S&P 500’s impressive 32 per cent rally from its recent lows, reflect a strong recovery narrative driven disproportionately by the so-called Magnificent Seven (Mag7) stocks. These technology and growth-oriented giants continue to post earnings growth roughly four times that of the remaining 493 companies in the index, underscoring their outsized influence on overall market performance.

However, this concentration introduces significant risk. Mag7 valuations now exceed 30 times forward earnings, not yet at their historical peaks but certainly in elevated territory. While historical backtesting suggests that equities generally perform well in the 12 to 24 months following the start of a Fed easing cycle, the current context differs in important ways.

The market’s narrow leadership, combined with stretched valuations, makes indiscriminate exposure to these names increasingly perilous. Chasing performance at this juncture could expose investors to sharp corrections if earnings disappoint or if macro risks materialise. Diversification, not just across sectors but across geographies and asset classes, emerges as a critical defensive and offensive strategy.

Investor positioning and market signalsInvestor positioning data reveals that asset managers hold high equity allocations, though not at extreme levels that typically precede major drawdowns. Meanwhile, equity volatility remains subdued, a condition that historically correlates with lower forward returns over the subsequent six to twelve months.

This low-volatility complacency can lull investors into underestimating tail risks, especially when other asset classes also appear expensive. Gold, for instance, has seen renewed inflows into bullion-backed ETFs and now trades near US$3,760 per ounce, supported by geopolitical tensions and a modestly weaker US dollar, which closed at 98.152.

Yet gold positioning is once again crowded, suggesting limited room for further upside without a significant catalyst such as a sharp escalation in global instability or a deeper-than-expected economic slowdown. Similarly, credit markets show tight bond spreads, indicating that investors are not demanding much compensation for credit risk. In such an environment, security selection becomes paramount.

Broad exposure to high-yield or investment-grade debt may not suffice. Instead, bottom-up analysis of issuer fundamentals is essential.

Mixed economic signals and political risksThe macroeconomic backdrop offers mixed signals. August’s Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, rose 0.3 per cent month-over-month, resulting in a 2.7 per cent annual headline rate. Core PCE, which excludes food and energy, stood at 2.9 per cent year-over-year after a 0.2 per cent monthly increase.

This remains above the Fed’s two per cent target but shows signs of gradual moderation. The data came in largely in line with expectations and did not provoke a strong market reaction, suggesting that investors have already internalised a path of gradual disinflation. However, political risks loom large.

The September 30 deadline for US government funding is fast approaching, and with congressional negotiations stalled, the probability of a partial shutdown is rising. While past shutdowns have had limited economic impact, they inject uncertainty into market psychology and could delay fiscal policy decisions or data releases, further complicating the Fed’s communication strategy.

Wall Street’s reaction and treasury yieldsMarket reactions to recent events have been muted but telling. Wall Street closed higher last Friday, ending a three-day losing streak, with the Dow Jones up 0.7 per cent, the S&P 500 gaining 0.6 per cent, and the Nasdaq rising 0.4 per cent.

Notably, markets barely flinched at the announcement of new sector-specific tariffs by the Trump administration, signalling either desensitisation to trade rhetoric or confidence that such measures will not significantly disrupt the broader economic trajectory. Treasury yields reflected this calm.

The 10-year yield edged up just one basis point to 4.183 per cent, while the two-year yield dipped two basis points to 3.645 per cent, flattening the yield curve slightly. This dynamic suggests that while near-term rate expectations are stable, longer-term growth and inflation concerns persist.

Asia’s cautious mood and key data aheadIn Asia, equities dipped on Friday as resilient US data prompted a modest reassessment of rate cut expectations. US equity index futures point to a higher open, indicating that global investors remain cautiously optimistic. The coming week will be pivotal, with the September nonfarm payrolls report on October 3 serving as a key barometer of labor market health.

Additional insights will come from the JOLTS job openings data on Tuesday and the ADP private payroll report on Wednesday. Labour market strength remains the Fed’s primary concern. If employment data remains robust, it could delay further rate cuts or reduce their magnitude, directly impacting risk asset valuations.

Bitcoin’s technical recoveryMeanwhile, Bitcoin has staged a “reasonable” technical recovery, rising 2.24 per cent in the past 24 hours to US$111,966 after a 7-day decline of 2.23 per cent. This rebound appears driven by three converging factors. First, price action held firm at the US$108,680 support level, breaking a bearish trend line and reclaiming the US$111,000 mark.

Hourly indicators, including a bullish MACD crossover and an RSI stabilising around 47-48, suggest that short-term momentum has shifted in favour of buyers. The 200-day exponential moving average at US$106,200 continues to act as a structural support, reinforcing the asset’s resilience.

However, the critical test lies ahead. A sustained close above US$112,500, the 50 per cent Fibonacci retracement of the recent decline, could pave the way for US$113,700 to US$115,000. Failure to break this resistance may invite profit-taking and a retest of the lower support level.

On-chain metrics and corporate adoptionSecond, on-chain metrics show improving demand dynamics. The 60-day Buy/Sell Pressure Delta has entered what analysts describe as an opportunity zone, indicating reduced selling pressure.

The decline in sending addresses and stable miner reserves, holding steady at 1.8 million BTC, suggests that long-term holders are not capitulating. That said, the 90-day delta remains cautious, reflecting lingering uncertainty among larger participants. The Coinbase Premium Index, currently at +0.041, will be a key gauge of sustained US institutional interest.

Third, corporate adoption continues to provide narrative support. The rebranding of 164-year-old Japanese textile firm Marusho Hotta to Bitcoin Japan and its announcement of a BTC treasury business, while small in absolute scale, aligns with a growing trend among Asian corporations seeking alternative stores of value amid declining traditional revenues.

Firms like Metaplanet and Kitabo have similarly adopted Bitcoin, reinforcing its digital gold thesis in a region that is increasingly skeptical of fiat stability.

Final thoughts: Selectivity over momentumIn sum, the current market environment demands a nuanced approach. While the Fed’s pivot to easing should, in theory, support risk assets over the medium term, the combination of expensive valuations, narrow market leadership, and external risks ranging from a potential government shutdown to geopolitical flare-ups calls for disciplined selectivity.

Investors should avoid chasing momentum in already crowded trades and instead focus on quality earnings, global diversification, and tactical entry points during pullbacks.

Source: https://e27.co/the-feds-first-rate-cut-what-it-means-for-equities-risk-and-crypto-20250929/

The post The Fed’s first rate cut: What it means for equities, risk, and crypto appeared first on Anndy Lian by Anndy Lian.

September 27, 2025

Crypto Isn’t The Real Threat – It’s Regulatory Chaos

Anndy Lian

Crypto Isn’t The Real Threat – It’s Regulatory Chaos

The Crypto Crossroads: How Fragmented Regulation Threatens A Global Financial Revolution

The Crypto Crossroads: How Fragmented Regulation Threatens A Global Financial RevolutionLast spring, I was watching a young entrepreneur named Chinedu send $500 to his family in rural countryside using Bitcoin. “This is how I survive,” he said, tapping his phone. “Traditional banks charge too much, and our currency is falling daily.” Just weeks later, I was told he was detained by authorities for operating an unlicensed crypto exchange.

This duality, crypto as both lifeline and liability, defines the global debate.

The Surging Adoption: A Silent Revolution

Between 2023 and 2025, the number of people globally using cryptocurrency has significantly increased. In 2023, there are approximately 420 million people who own cryptocurrency. In 2024, this number grew to 562 million people, and in 2025, the total is estimated to be around 580 million users, potentially reaching as high as 861 million by other reports.