Anndy Lian's Blog, page 6

October 10, 2025

Profit-taking and peril: Equities consolidate, bonds turn hawkish, and Bitcoin tests its limits

Anndy Lian

Profit-taking and peril: Equities consolidate, bonds turn hawkish, and Bitcoin tests its limits

The past week has seen a noticeable retreat in global risk appetite, with traders and institutional investors adopting a more cautious stance ahead of the third-quarter earnings season. This consolidation phase reflects a natural pause following a strong rally in equities, with market participants reassessing valuations and positioning themselves for potential volatility once corporate earnings reports begin to roll in.

US equities closed lower on Thursday, with the Dow Jones Industrial Average shedding 0.5 per cent, the S&P 500 down 0.3 per cent, and the Nasdaq Composite slipping 0.1 per cent. These modest declines underscore a broader theme of profit-taking rather than panic selling, suggesting that the market remains fundamentally sound but increasingly selective.

Adding to the uncertainty, key US economic data releases have been disrupted by the ongoing government shutdown. Weekly jobless claims and wholesale trade figures, initially scheduled for Thursday, remain delayed, depriving analysts of timely insights into labour market resilience and inventory trends. Market attention now shifts to Friday’s release of the University of Michigan’s preliminary consumer sentiment index for October.

Given that consumer confidence often serves as a leading indicator of spending behaviour and economic momentum, this report could significantly influence near-term market direction, especially if it reveals a sharp deterioration in household outlooks amid persistent inflation concerns or rising borrowing costs.

Meanwhile, the bond market continues to reflect a nuanced outlook on monetary policy. US Treasury yields edged higher, with the benchmark 10-year yield climbing 2.1 basis points to 4.138 per cent and the two-year yield rising 1.2 basis points to 3.593 per cent. The modest uptick in yields suggests that investors are recalibrating expectations for future Federal Reserve rate cuts, possibly in response to resilient economic data or hawkish commentary from central bank officials. This dynamic places additional pressure on equities, particularly growth-oriented sectors that are sensitive to higher discount rates.

Currency and commodity markets also mirrored the prevailing risk-off mood. The US Dollar Index strengthened by 0.6 per cent to reach 99.54, benefiting from its traditional safe-haven status during periods of market caution. Conversely, gold retreated 1.6 per cent to US$3976 per ounce after briefly touching a record high.

The pullback in the precious metal appears driven by profit-taking rather than a fundamental shift in its appeal as a hedge against uncertainty. Similarly, Brent crude oil settled 1.6 per cent lower at US$65.22 per barrel, pressured by easing geopolitical tensions in the Middle East and the broader retreat from risk assets.

In Asia, equity markets displayed a mixed performance. The Chinese CSI 300 index surged 1.48 per cent on Thursday, its first trading day following the week-long National Day holiday. The rally was led by sectors tied to artificial intelligence and gold, reflecting both domestic policy optimism and global commodity trends.

However, early trading sessions on Friday showed more subdued activity, indicating that the initial post-holiday euphoria may be giving way to more cautious positioning. Notably, US equity index futures point to a higher open on Wall Street, suggesting that the recent dip may have created attractive entry points for bargain hunters.

Amid this backdrop, Bitcoin has emerged as a focal point of intense speculation and technical scrutiny. The cryptocurrency is currently trading above US$121,000, yet it faces mounting bearish pressure that could trigger a test of critical support levels. On Thursday, Bitcoin briefly dipped below the psychologically important US$120,000 mark, reaching an intraday low of US$119,810 before recovering slightly. This move, which represented a nearly three per cent decline in a single session, highlights the asset’s vulnerability despite its lofty valuation. Technical indicators reinforce this cautionary tone.

The hourly chart reveals a developing bearish trend line, with resistance forming around US$122,750. Bitcoin now trades below both the US$121,500 level and its 100-hour Simple Moving Average, signalling weakening short-term momentum. Immediate resistance sits at US$121,750, while the hourly MACD shows increasing strength in negative territory and the RSI has fallen below the pivotal 50 level, both classic signs of bearish dominance.

The derivatives market further underscores this fragile sentiment. Total derivatives volume plummeted by 15.24 per cent to US$478.15 trillion, while open interest in perpetual contracts declined by 1.29 per cent. This contraction coincided with Bitcoin’s drop below US$124,000 and triggered approximately US$700 million in liquidations.

The high leverage embedded in the system, evidenced by open interest standing at US$1.12 trillion, amplified the downside as leveraged positions were forcibly unwound. Traders appear to be reducing exposure in response to stretched technical conditions, with the 14-day RSI hovering near 69.88, just shy of overbought territory. Moreover, the spot-to-perpetuals trading ratio of 0.22 indicates that derivatives activity continues to dominate the market, rendering it especially susceptible to sharp swings and cascading liquidations.

Compounding Bitcoin’s challenges, the altcoin ecosystem is experiencing its own wave of selling pressure. New token launches such as ASTER and MIRA have faced immediate post-listing declines, driven by large-scale airdrops and token unlocks. ASTER’s Phase 2 airdrop released four per cent of its total supply, prompting whales to offload 28.3 million tokens and driving the price down by 10 per cent.

Similarly, MIRA’s circulating supply surged by 191 million tokens following its Binance listing, overwhelming market demand. These events highlight a recurring pattern in the crypto space: token unlocks often lead to immediate sell-offs, particularly when projects lack robust utility or sustainable demand drivers. The Altcoin Season Index has consequently fallen by 11.76 per cent, signalling a clear rotation of capital back into Bitcoin as investors seek relative safety within the digital asset class.

Regulatory uncertainty adds another layer of complexity. In the United States, Senate negotiations on comprehensive crypto market-structure legislation have stalled, with Democratic proposals on decentralised finance (DeFi) oversight meeting resistance from Republican lawmakers. This legislative gridlock prolongs the regulatory limbo that has long plagued the industry, creating headwinds for institutional adoption and altcoin valuations.

However, there remains a counterbalancing bullish narrative. Former President Donald Trump’s recent overtures toward establishing a US strategic Bitcoin reserve have reignited speculation about potential pro-crypto policies should he return to office. While purely aspirational at this stage, such rhetoric provides a psychological floor for long-term Bitcoin bulls who view regulatory clarity, even if delayed, as inevitable.

In sum, the current market environment reflects a delicate equilibrium between optimism and caution. Equities are consolidating after a strong run, bonds are pricing in a more hawkish Fed, and commodities are reacting to shifting risk sentiment. Bitcoin, despite its record-breaking price, shows clear signs of technical fatigue and structural vulnerability.

Yet, beneath the short-term turbulence lies a persistent belief in its long-term potential, particularly if it can overcome key resistance levels and navigate the evolving regulatory landscape. For now, investors remain in a holding pattern, awaiting the next catalyst, whether from corporate earnings, economic data, or policy developments, to determine the next major market move.

The post Profit-taking and peril: Equities consolidate, bonds turn hawkish, and Bitcoin tests its limits appeared first on Anndy Lian by Anndy Lian.

October 9, 2025

Anndy Lian: BNB emerges as confidence proxy in crypto infrastructure

Anndy Lian

Anndy Lian: BNB emerges as confidence proxy in crypto infrastructure

Anndy Lian, a prominent figure in the cryptocurrency space, emphasizes the evolving role of BNB. He notes that its value is no longer limited to its utility on exchanges.

Instead, BNB is increasingly seen as a measurement of faith in the broader non-U.S. crypto infrastructure. This shift reflects changing investor sentiments and the growing relevance of decentralized technologies.

Lian’s outlook parallels his previous guidance to crypto users to strengthen security practices, as evidenced by his focus on the critical importance of cold wallets and robust passphrases. Moreover, his recent remarks on BNB’s evolving role recall his critique of the sector’s reliance on crypto exchange listings, where he advocated for prioritizing genuine innovation over short-term financial incentives.

Source: https://tradersunion.com/news/market-voices/show/627916-bnb-confidence-proxy/

The post Anndy Lian: BNB emerges as confidence proxy in crypto infrastructure appeared first on Anndy Lian by Anndy Lian.

Redefining risk: Monetary policy, crypto maturation, and the new safe havens

Anndy Lian

Redefining risk: Monetary policy, crypto maturation, and the new safe havens

The convergence of Federal Reserve policy expectations, cryptocurrency market maturation, and ongoing geopolitical challenges has created a multi-layered investment environment where traditional risk metrics are being redefined.

Federal Reserve policy evolution and market responseThe Federal Reserve’s September meeting minutes have revealed a central bank caught between competing economic pressures, with officials displaying marked division over the appropriate course of monetary policy. The decision to implement a quarter-point rate cut, bringing the federal funds rate to a range of four per cent to 4.25 per cent, represents just the beginning of what appears to be a carefully orchestrated policy recalibration. Most committee members expressed support for additional rate reductions throughout the remainder of 2025, though this consensus masks deeper disagreements about the pace and extent of such cuts.

The appointment of Stephen Miran as the newest Fed governor has introduced a particularly dovish voice to the committee, with his advocacy for more aggressive half-point reductions reflecting broader concerns about economic momentum. This internal debate is occurring against the backdrop of a labor market showing signs of deceleration, with initial jobless claims rising moderately to 224,269 in late September. The economic data blackout caused by the ongoing government shutdown has created additional uncertainty, potentially forcing Fed officials to make decisions with incomplete information.

The market’s interpretation of Fed policy has been notably positive for risk assets, with the expectation of continued monetary easing providing support for both equities and alternative investments. Treasury yields have remained relatively stable despite rate cut expectations, with the 10-year yield hovering around 4.12 per cent and the two-year yield at 3.58 per cent. This yield curve positioning suggests that markets are pricing in a measured approach to monetary easing rather than emergency-style cuts.

Cryptocurrency market institutional integrationThe cryptocurrency market’s performance through early October 2025 represents a fundamental shift toward institutional legitimisation, with Bitcoin ETF inflows reaching unprecedented levels and establishing new benchmarks for institutional participation. The seven-day inflow streak totalling over US$5 billion into US spot Bitcoin ETFs demonstrates a level of institutional commitment that extends well beyond speculative positioning. BlackRock’s iShares Bitcoin Trust alone captured US$969.9 million on a single day in October, reflecting the scale of institutional capital allocation.

The cryptocurrency market capitalisation of US$4.26 trillion, with Bitcoin trading near US$122,000-US$124,000 after touching highs above US$126,000, represents a maturation of the asset class that goes beyond retail speculation. The 24-hour crypto-Nasdaq correlation of +0.71 indicates that Bitcoin is increasingly behaving like other risk assets, responding to macroeconomic conditions and monetary policy expectations rather than operating in isolation[provided data].

The Binance ecosystem rally, with BNB surging 27.97 per cent weekly to claim the third-largest cryptocurrency position by market capitalisation, illustrates the diverse nature of crypto market growth. BNB Chain’s transaction volumes have quadrupled since mid-2025, with PancakeSwap processing nearly US$80 billion in September volume, highlighting the infrastructure development supporting this growth. The total value locked across BNB Chain DeFi protocols reaching US$9 billion demonstrates real economic activity rather than purely speculative trading.

Currency market disruption and safe haven dynamicsThe Japanese yen’s dramatic weakness, with USD/JPY reaching 152.68 and extending gains for five consecutive sessions, reflects fundamental shifts in both monetary policy expectations and fiscal policy direction. The surprise victory of Sanae Takaichi in the Liberal Democratic Party leadership election has introduced significant uncertainty about Japan’s economic policy trajectory, with markets interpreting her pro-stimulus stance as potentially inflationary and yen-negative.

The yen’s decline is particularly significant given its traditional role as a safe-haven currency, with the weakening suggesting that investors are reassessing traditional safe-haven relationships in light of fiscal expansion concerns. The possibility of increased government spending under Takaichi’s leadership, combined with the Bank of Japan’s reluctance to tighten monetary policy aggressively, creates a perfect storm for yen weakness.

Gold’s surge past US$4,000 per ounce for the first time, reaching US$4,044.09 with gains of 1.52 per cent, represents a recalibration of safe-haven demand away from traditional currencies toward hard assets. The precious metal’s 54 per cent year-to-date gain, following a 27 per cent increase in 2024, reflects not just geopolitical uncertainty but also concerns about fiat currency stability and central bank policy effectiveness. Silver’s concurrent rally to record highs above US$49 per ounce demonstrates that demand for precious metals extends across the complex.

Energy markets and geopolitical risk assessmentThe energy sector’s performance reflects the complex interplay between geopolitical tensions, supply chain disruptions, and the effectiveness of sanctions. Brent crude’s movement to US$66.25 per barrel, with gains of 1.2 per cent, occurs against a backdrop of intensifying Ukrainian strikes on Russian oil infrastructure and ongoing uncertainty about sanctions implementation. The targeting of Russian refineries has reduced processing capacity by approximately 10 per cent, creating supply chain disruptions that extend beyond crude oil to refined products.

The effectiveness of Western sanctions on Russian energy exports continues to evolve, with Russia managing to redirect substantial volumes to non-sanctioned buyers while accepting deeper price discounts. Russian seaborne crude exports to Price Cap Coalition countries have dropped by 91 per cent, but exports to non-coalition countries have increased by 67 per cent, demonstrating the limited global impact of unilateral sanctions. The maintenance of Russian crude shipments near 16-month highs, despite ongoing military conflict and infrastructure attacks, illustrates the resilience of global energy supply chains.

Market correlation dynamics and risk assessmentThe evolving correlation patterns between asset classes reveal fundamental changes in how markets assess and price risk. The negative correlation between Bitcoin and the Nasdaq of -4.3 per cent as of July 2025, followed by the recent positive correlation of +0.71, demonstrates the dynamic nature of crypto-traditional asset relationships[provided data]. This correlation volatility suggests that Bitcoin is transitioning between different market roles – sometimes behaving as a risk asset correlated with technology stocks, other times functioning as an alternative store of value.

The relationship between gold and other safe-haven assets is also evolving, with gold’s outperformance occurring simultaneously with dollar strength rather than weakness. This decoupling suggests that investors are seeking alternatives to all fiat currencies rather than simply rotating between traditional safe havens. The gold-silver ratio dynamics, with silver outperforming gold on a percentage basis, indicate broad-based precious metals demand rather than flight-to-quality concentrated in gold alone.

Institutional flow dynamics and market structureThe scale of institutional flows into both cryptocurrency and precious metals markets represents a structural shift in portfolio allocation that extends beyond cyclical positioning. Global crypto ETF inflows of US$5.95 billion in a single week, led by US$5 billion in US inflows, demonstrate the magnitude of institutional reallocation. The diversification across Bitcoin (US$3.55 billion), Ethereum (US$1.48 billion), Solana (US$706 million), and XRP (US$219 million) indicates a sophisticated institutional approach rather than concentrated Bitcoin positioning.

The precious metals market is experiencing similar institutional attention, with global gold ETF inflows reaching US$64 billion year-to-date and a record US$17.3 billion in September alone. This institutional participation is occurring alongside central bank purchases, with China and other nations reducing Treasury holdings in favour of gold reserves. The combination of institutional and sovereign demand creates a support level for precious metals that extends beyond traditional economic cycles.

Technology sector integration and network effectsThe growth in blockchain network activity, particularly on BNB Chain, illustrates the maturation of cryptocurrency infrastructure beyond speculative trading. The quadrupling of BNB Chain transactions since mid-2025, combined with the success of decentralised applications and the growth of the DeFi ecosystem, demonstrates real economic utility. The launch of new token launch platforms and the integration of Layer-2 solutions indicate ongoing infrastructure development that supports long-term adoption.

The correlation between network activity and token performance, evident in BNB’s rise to third-largest cryptocurrency status, suggests that utility-driven value creation is becoming increasingly important relative to speculation. The US$154 billion market capitalisation achieved by BNB reflects not just trading demand but the economic value generated by the underlying blockchain infrastructure.

The implications of this market environment extend well beyond short-term trading opportunities. The convergence of institutional cryptocurrency adoption, precious metals accumulation, and currency market disruption suggests a fundamental reassessment of monetary systems and store of value concepts. The Federal Reserve’s policy uncertainty, combined with fiscal policy concerns globally, is driving institutional portfolio diversification that may prove persistent rather than cyclical.

Looking ahead, the sustainability of these trends depends heavily on the resolution of several key uncertainties. The path of Federal Reserve policy, the effectiveness of international sanctions regimes, the stability of currency relationships, and the continued development of alternative financial infrastructure will all play crucial roles in determining whether current market dynamics represent temporary dislocations or permanent structural changes. The upcoming CPI data release, when government operations resume, will provide critical information about the sustainability of current monetary policy expectations and their impact on cross-asset correlations.

The market environment reflects a world where traditional relationships between risk, return, and correlation are being redefined by technological innovation, policy uncertainty, and evolving geopolitical realities. Institutional investors are adapting by diversifying across asset classes that were previously considered uncorrelated or speculative, while maintaining exposure to traditional markets through ETF structures that provide regulatory compliance and operational efficiency.

Source: https://e27.co/redefining-risk-monetary-policy-crypto-maturation-and-the-new-safe-havens-20251009/

The post Redefining risk: Monetary policy, crypto maturation, and the new safe havens appeared first on Anndy Lian by Anndy Lian.

October 8, 2025

Global risk-off sentiment emerges as political instability meets cryptocurrency correction

Anndy Lian

Global risk-off sentiment emerges as political instability meets cryptocurrency correction

Global financial markets experienced heightened volatility as political upheaval in Japan and France sparked concerns about fiscal stability, while cryptocurrency markets underwent a significant correction despite Bitcoin’s recent record highs. The convergence of unexpected political developments, yield curve steepening, and profit-taking activities created a complex backdrop that tested investor confidence across asset classes.

Political instability drives market uncertaintyThe most significant catalyst for Tuesday’s risk-off sentiment emerged from unexpected political developments in two major economies. In Japan, Sanae Takaichi’s surprise victory in the Liberal Democratic Party leadership election sent shockwaves through currency markets. Takaichi, a hardline conservative positioned to become Japan’s first female prime minister, represents a stark departure from market expectations and has already begun reshaping the political landscape.

The implications of Takaichi’s victory extended beyond domestic politics. Her appointment of key allies to senior positions, including Suzuki Shunichi as secretary-general and Arimura Haruko as chairperson of the General Council, signaled a consolidation of conservative power within the LDP. These developments have raised concerns about the party’s ability to maintain its coalition with the centrist Komeito party, as the Buddhist-affiliated group has expressed “significant worries and concerns” about Takaichi’s positions.

The political uncertainty in Japan was compounded by an equally dramatic crisis unfolding in France. Prime Minister Sébastien Lecornu resigned after merely 26 days in office, becoming the third government to collapse in recent months. Lecornu’s departure highlighted the persistent political gridlock that has plagued France since President Emmanuel Macron’s decision to call snap elections in 2024 resulted in a hung parliament.

France’s political instability has deep structural roots. The country’s deficit reached 5.8 per cent of GDP in 2024, while national debt stands at 114 per cent of GDP, representing the third-highest public debt burden in Europe. This fiscal strain has made it increasingly difficult for any government to secure parliamentary support for necessary budget measures, creating a cycle of political instability that shows no signs of abating.

Currency markets react to political developmentsThe Japanese yen bore the brunt of the political uncertainty, extending its decline to 151.90 against the dollar, marking its weakest level since February. This continued weakness reflects market concerns about Takaichi’s pro-stimulus stance and her potential impact on Bank of Japan monetary policy. Currency traders have reduced their expectations for aggressive interest rate hikes, given Takaichi’s historical support for accommodative monetary policy.

The yen’s decline represents part of a broader trend that has seen the currency lose more than one-third of its value since early 2021. The fundamental driver remains the substantial interest rate differential between Japan and other major economies, with US short-term rates at 5.25-5.5 per cent compared to Japan’s 0-0.1 per cent range. This gap has created attractive carry trade opportunities, where investors borrow yen at low rates to invest in higher-yielding currencies.

Meanwhile, the US Dollar Index strengthened for a second consecutive day, reaching 98.58. This rise reflected both safe-haven demand amid global political uncertainty and the relative stability of US economic fundamentals. The dollar’s strength was broad-based, with gains registered against all G-10 currencies as investors sought refuge in what they perceived as the world’s most liquid and stable currency market.

Bond markets signal fiscal concernsThe global yield curve steepening that accompanied Tuesday’s political developments reflected renewed concerns about fiscal sustainability. US Treasury yields provided a mixed picture, with the 2-year yield declining 2.5 basis points to 3.564 per cent while the 10-year yield fell 2.9 basis points to 4.123 per cent. This flattening of the yield curve suggested that while investors remained concerned about near-term economic growth, longer-term inflation expectations remained elevated.

The bond market movements were particularly significant given the backdrop of the ongoing US government shutdown. The political stalemate in Washington, which began on October 1, has delayed key economic data releases and heightened policy uncertainty. Despite this domestic political challenge, US Treasuries continued to benefit from safe-haven flows as investors sought quality assets amid global uncertainty.

The government shutdown has created operational challenges across multiple federal agencies. The Labor Department indicated that only 3,100 of its roughly 12,900 employees would remain on the job, while the Bureau of Labor Statistics would operate with just one employee. These staffing reductions have delayed critical economic data releases, including the Consumer Price Index, which could impact Social Security cost-of-living adjustments.

Equity markets show mixed performanceUS equity markets declined overnight, with the S&P 500 falling 0.4 per cent, the Nasdaq dropping 0.7 per cent, and the Dow Jones decreasing 0.2 per cent. The technology sector led the decline as investors engaged in profit-taking following a strong recent run. This correction came despite generally positive underlying economic fundamentals and continued optimism about artificial intelligence applications.

The contrast was stark in Asian markets, where Taiwan’s TAIEX surged 1.68 per cent to a fresh record high as the island resumed trading after a holiday. The rally was driven by continued optimism about artificial intelligence demand, with Taiwan’s semiconductor sector benefiting from robust global appetite for AI-related hardware and applications. Taiwan’s market performance highlighted the geographic divergence in investor sentiment, with Asian markets showing greater resilience to global political uncertainty.

Taiwan’s exceptional performance reflected its central position in the global technology supply chain. The TAIEX has gained 28 per cent in 2024, making it the best-performing major Asian market. This outperformance has been driven primarily by electronics shares, which account for more than 70 per cent of TWSE market capitalisation and have surged 43.2 per cent on the continued AI boom and US tech stock rallies.

The strength in Taiwanese equities also extended to individual companies. TSMC, the world’s largest contract chip manufacturer, has seen its shares rise significantly as the company continues to benefit from the growing demand for artificial intelligence. Other technology companies, including Foxconn and Quanta Computer, have also seen their shares rise, driven by the surge in demand for AI servers.

Commodity markets reflect global uncertaintyCommodity markets provided mixed signals as investors grappled with competing forces. Brent crude oil settled marginally lower at US$65.45 per barrel as traders assessed OPEC+’s latest supply decisions. The oil cartel’s decision to increase collective production by 137,000 barrels per day starting in November was smaller than market expectations, providing some support to prices.

The modest nature of OPEC+’s output increase reflected the group’s cautious approach amid concerns about global demand and potential oversupply. Analysts noted that the decision fell short of market expectations for a more aggressive increase, suggesting that OPEC+ members remain concerned about the outlook for oil consumption. The group’s restraint was particularly notable, given predictions for a global supply surplus in both the fourth quarter and the following year.

Gold, traditionally viewed as a safe-haven asset, gained 0.6 per cent to reach a new record high, driven by the US government shutdown and the political crisis in France. The precious metal’s rally reflected its enduring appeal during periods of political and economic uncertainty. Gold prices have surged over 31 per cent this year, breaking several previous records as investors seek protection against inflation and currency debasement.

The gold rally was particularly pronounced during Asian trading hours, suggesting strong demand from emerging market investors and central banks. This geographic pattern has become increasingly common in 2024, with much of gold’s price appreciation occurring outside traditional Western trading hours. The trend reflects the growing influence of Asian investors and central bank purchasing in driving gold demand.

Cryptocurrency market correctionDespite Bitcoin reaching a new all-time high above US$126,000 earlier in the week, the cryptocurrency market fell 2.69 per cent in the past 24 hours. This correction was driven by a combination of profit-taking after recent gains, ETF outflow concerns, and high leverage unwinding. The pullback highlighted the volatile nature of digital asset markets and their sensitivity to both technical and fundamental factors.

The most significant concern emerged from ETF flow reversals. Grayscale’s Bitcoin ETF experienced US$28.6 million in outflows, marking its first negative day in three weeks. This development was particularly noteworthy given that Bitcoin ETFs had been experiencing strong inflows, with total net inflows reaching US$3.2 billion in the first week of October.

The cryptocurrency market’s leverage structure amplified the correction. Perpetuals volume spiked 22 per cent to US$540 billion, with over US$20 million in liquidations adding downward pressure to prices. This leverage flush turned what might have been a routine pullback into a more significant correction, as over-leveraged positions were forced to close.

Market sentiment indicators reflected the changing mood among cryptocurrency investors. The Fear & Greed Index dropped from 62 (Greed) to 55 (Neutral) as Bitcoin failed to hold its US$126,000 all-time high. This shift from greed to neutral territory suggested that some of the speculative excess had been removed from the market, potentially setting the stage for more sustainable price appreciation.

Central bank policies and market outlookThe divergent monetary policy stances of major central banks continued to influence market dynamics. The Federal Reserve’s gradual approach to interest rate normalisation contrasted sharply with the Bank of Japan’s ultra-accommodative stance, creating opportunities for carry trades that have contributed to yen weakness.

Market participants are closely watching for signs of policy coordination among major central banks. The current environment of divergent monetary policies has created significant cross-border capital flows and currency volatility that could become destabilising if left unchecked. The political developments in Japan and France have added another layer of complexity to this already challenging policy environment.

Looking ahead, investors will be monitoring several key developments. The resolution of political crises in Japan and France will be crucial for market stability. In Japan, Takaichi’s ability to maintain the LDP’s coalition with Komeito will determine the government’s effectiveness and longevity. In France, President Macron’s next steps will determine whether the country can break out of its current political gridlock.

The global economic outlook remains uncertain, with multiple factors contributing to market volatility. Political instability in major economies, divergent monetary policies, and ongoing geopolitical tensions have created a complex environment for investors. While some markets, particularly in Asia, have shown resilience, the broader trend suggests that volatility will remain elevated as these various factors continue to evolve.

The current market environment underscores the interconnected nature of global financial systems. Political developments in individual countries can quickly spread, affecting currency, bond, and equity markets worldwide. This interconnectedness means that investors must remain vigilant about political developments across multiple jurisdictions, as local events can have global implications for portfolio performance and risk management strategies.

The post Global risk-off sentiment emerges as political instability meets cryptocurrency correction appeared first on Anndy Lian by Anndy Lian.

October 7, 2025

Anndy Lian suggests utilizing free demo accounts on crypto exchanges

Anndy Lian

Anndy Lian suggests utilizing free demo accounts on crypto exchanges

Anndy Lian proposes using demo accounts on some crypto exchanges for trial purposes, particularly for beginners.

He emphasizes there is no rush to invest real money. Additionally, some exchanges provide free coupons or vouchers, sometimes amounting to $100. Lian advises using these opportunities to gain experience without financial risk.

Lian’s recommendations on cautious engagement with demo accounts align with his consistent focus on risk management and security. His advocacy for hands-on learning complements earlier guidance encouraging crypto users to secure assets in cold wallets with robust passphrases. Addressing broader industry practices, Lian has also underscored the importance of fostering innovation in crypto exchange listings over mere financial incentives.

Source: https://tradersunion.com/news/market-voices/show/613870-crypto-exchange-demos/

The post Anndy Lian suggests utilizing free demo accounts on crypto exchanges appeared first on Anndy Lian by Anndy Lian.

AI dreams, crypto magic and shutdown realities: The contradictions fuelling today’s market rally

Anndy Lian

AI dreams, crypto magic and shutdown realities: The contradictions fuelling today’s market rally

The current macro landscape presents a fascinating juxtaposition of caution and exuberance, where geopolitical friction and fiscal paralysis coexist with a surge in risk appetite driven largely by artificial intelligence optimism and institutional crypto adoption.

At the heart of this duality lies the extended US government shutdown now in its sixth day, a development that would typically trigger risk-off behaviour across global markets. Yet investor sentiment has not only held firm but advanced, propelled by a confluence of factors that underscore a deeper structural shift in how capital allocates across traditional and digital assets.

Wall Street’s mixed performance on Monday reflects this nuanced environment. The Dow Jones Industrial Average edged lower by 0.1 per cent, signalling lingering unease among industrial and legacy sectors. In contrast, the S&P 500 climbed 0.4 per cent and the Nasdaq surged 0.7 per cent, both reaching new all-time highs. This divergence is not random. The rally in chipmakers, companies at the epicentre of AI infrastructure development, has become the primary engine of equity market gains.

Investors are betting that the AI boom is not a fleeting narrative but a multi-year secular trend, and they are positioning accordingly. This tech-led optimism has spilt over into other risk assets, including cryptocurrencies, which posted a 1.43 per cent gain over the past 24 hours, extending weekly and monthly advances of 8.76 per cent and 12.58 per cent, respectively.

Simultaneously, traditional safe-haven assets are also rallying, which at first glance seems contradictory. Gold surged 1.9 per cent to a record high of USD3961 per ounce. This move is directly tied to the US government shutdown, which has injected fresh uncertainty into the coordination of fiscal and monetary policy. With Congress unable to pass a budget, questions linger about the government’s ability to manage debt, respond to economic shocks, or even maintain consistent data reporting, all of which erode confidence in the US dollar as a stable store of value.

The US Dollar Index rose modestly by 0.4 per cent to 98.11, but this uptick appears more technical than fundamental, especially as Treasury yields climbed amid global bond market turbulence. The 10-year yield rose 3.3 basis points to 4.152 per cent, pressured by soaring long-end Japanese yields and political instability in Europe. These crosscurrents illustrate how investors are simultaneously hedging against systemic risk while pursuing growth in high-conviction themes, such as AI and digital assets.

The crypto market’s recent strength cannot be divorced from this macro backdrop. Institutional demand has emerged as the dominant force behind the rally, with spot Bitcoin ETFs recording US$627 million in inflows over a 24-hour period and Ethereum ETFs adding US$307 million. Total assets under management in Bitcoin ETFs now stand at US$161.6 billion, while Ethereum ETFs hold US$25.73 billion. These are not speculative retail bets but deliberate allocations by traditional finance players who increasingly view crypto, particularly Bitcoin, as a macro hedge akin to gold.

The correlation between crypto and gold over the past 24 hours reached 0.74, a striking signal that both assets are being used interchangeably as hedges against inflation and policy uncertainty. This institutional embrace is occurring against a backdrop of cooling inflation data and growing expectations of Federal Reserve rate cuts in 2025, which lowers the opportunity cost of holding non-yielding assets like Bitcoin and gold.

The rally is not solely driven by fundamentals. Derivatives markets are amplifying price action through a surge in leveraged activity. Perpetual futures volume spiked 53.7 per cent to US$1.71 trillion in 24 hours, with funding rates jumping 475 per cent on a weekly basis to 0.0083 per cent. Binance alone accounted for 87 per cent of Bitcoin futures taker volume, underscoring its outsized role in price discovery.

While this derivatives frenzy fuels momentum, it also introduces fragility. Open interest, though near yearly highs, declined 1.24 per cent over the past day, a potential early warning sign of profit-taking or de-leveraging. With the 14-day Relative Strength Index for Bitcoin at 73.3, the market is entering overbought territory, increasing vulnerability to sharp corrections if sentiment shifts.

Adding another layer to this dynamic is the performance of Binance ecosystem tokens, which rose 0.97 per cent in 24 hours and 8.76 per cent for the week. BNB hit an all-time high of US$1,190, supported by the exchange’s record US$2.55 trillion in monthly futures volume and the launch of new AI-powered trading tools.

Binance’s dominance, capturing 41 per cent of global spot trading, provides a sense of stability to the broader crypto market, as its operational strength reassures participants during periods of macro stress. However, this leadership masks underlying retail fatigue. Active addresses across major blockchains have declined by 57 per cent since June, suggesting that while institutions and sophisticated traders are driving volume, everyday users remain on the sidelines. This dichotomy raises questions about the sustainability of the rally if it remains confined to professional players.

Looking ahead, several key inflection points could reshape the current trajectory. The most immediate is the October 18 decision on Grayscale’s Ethereum ETF application. An approval would likely unlock another wave of institutional capital, particularly from firms that have thus far remained cautious about direct crypto exposure.

Conversely, a rejection could trigger a short-term pullback, especially if it coincides with a slowdown in ETF inflows or a reversal in tech stock momentum. The Nasdaq’s performance remains critical, given the 0.72 correlation between crypto and the tech-heavy index. Should volatility return to US equities, perhaps triggered by renewed inflation concerns or a deeper fiscal crisis, the crypto market may struggle to decouple.

In sum, today’s market moves reflect a delicate balance between fear and greed, where institutional confidence in digital assets as a legitimate macro hedge is colliding with leveraged speculation and geopolitical uncertainty. The US government shutdown, rather than derailing risk appetite, has reinforced the case for alternative stores of value.

The very forces driving gains, ETF inflows, derivatives leverage, and exchange dominance, also create conditions for heightened volatility. As we navigate this complex environment, the interplay between traditional macro drivers and crypto-specific catalysts will determine whether this rally evolves into a sustained bull market or unravels under the weight of its own momentum.

For now, the data suggests that institutional adoption has fundamentally altered crypto’s role in the global financial system, transforming it from a fringe asset into a core component of modern portfolio construction.

The post AI dreams, crypto magic and shutdown realities: The contradictions fuelling today’s market rally appeared first on Anndy Lian by Anndy Lian.

October 6, 2025

DefiLlama to Delist Aster Volume Data Over Suspected Wash Trading

Anndy Lian

DefiLlama to Delist Aster Volume Data Over Suspected Wash Trading

DeFiLlama has removed perpetual futures volume data for Aster, a decentralized exchange backed by figures linked to former Binance CEO Changpeng Zhao, after detecting trading volumes that mirrored Binance’s nearly 1:1 across multiple trading pairs.

Co-founder 0xngmi announced the delisting on October 5, 2025, citing concerns over data integrity.

According to the announcement, Aster’s volumes for pairs like XRP/USDT matched Binance perpetual volumes with a correlation ratio of approximately 1, whereas competitor Hyperliquid showed decorrelation in similar pairs.

The analytics platform cannot access lower-level data, such as maker and taker order information from Aster, to verify whether wash trading occurred, prompting the temporary removal until such verification becomes possible.

0xngmi noted that correlation patterns appeared even more extreme for other assets, such as ETH, with similar patterns visible across all trading pairs.

The DeFiLlama co-founder emphasized that the decision centered on maintaining data integrity for users who make investing decisions based on the platform’s analytics.

Crypto Community Splits Between Wash Trading Accusations and Liquidity Migration DefenseThe delisting triggered sharp divisions within the crypto community, with critics questioning DeFiLlama’s centralization while defenders attributed the correlation to legitimate liquidity migration from Binance.

Blockchain investigator ZachXBT criticized industry figure Anndy Lian for normalizing wash trading, after Lian argued that “all crypto projects have washed trades” and questioned why observers were “acting so saintly” about the situation.

Lian, who holds positions in both leading perpetual DEX tokens, claimed that most projects are not fully decentralized and that alignment in open interest and price action is common across top projects that draw charts similar to Bitcoin.

He argued that if a project and its backers agree to spend money acquiring market share, the level of spending is their prerogative.

ZachXBT countered that Lian’s post history showed zero mentions of HYPE and only two posts referencing Hyperliquid, where Aster was also mentioned, while almost every other post focused on Aster.

Supporters of Aster argued that Binance’s liquidity was moved on-chain to the platform, explaining why volumes appeared to be synchronized.

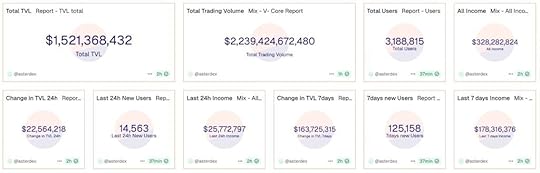

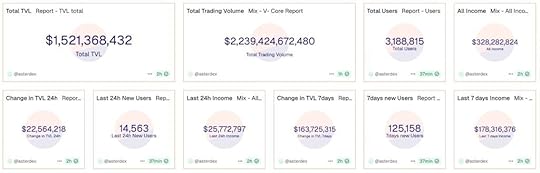

Multiple community members pointed to Dune Analytics data showing Aster’s total trading volume exceeding $2.2 trillion, with a total value locked of $1.52 billion, 3.18 million total users, and $328.28 million in all-time income.

The platform added 14,563 new users in the last 24 hours and 125,158 over seven days, according to the dashboard.

Source: Dune Analytics

Source: Dune AnalyticsDashboard creator Odbtc clarified that he used DeFiLlama’s public API as the data source, while Dune served only as a visualization layer to compare Aster, Hyperliquid, and Lighter.

He defended DeFiLlama’s decision, noting that the platform aggregates protocol-reported data while Dune allows users to query or visualize it, with dashboard quality depending entirely on the builder’s query logic.

Aster Launches Stage 3 Rewards Program as Binance Confirms ListingAster concluded its Genesis Stage 2 rewards program on October 5 and immediately launched Stage 3 Dawn, offering participants either their ASTER airdrop or a full refund of Stage 2 trading fees.

The claim page opens on October 10 for 48 hours, with airdropped tokens available on October 14.

Stage 3 runs for five weeks, ending November 9, introducing spot trading rewards, multi-dimensional scoring, symbol-specific boost multipliers, and team boosts that accumulate throughout the stage rather than resetting weekly.

At the same time, Binance announced it will list ASTER with a Seed Tag applied, while Aster implemented VIP fee tier updates starting October 6.

The platform updated its Market Maker Program with preferential fees and a monthly reward pool to strengthen liquidity.

The moves come as Aster recorded $493.61 billion in 30-day trading volume according to earlier DeFiLlama data, capturing nearly 50% of the perpetual DEX market share before the delisting.

At the time of publication, ASTER trades at $2.08 with a fully diluted valuation of $16.5 billion, having increased by over 29 times within four days following CZ’s endorsement, before reaching above $2.

The token was launched with an initial fully diluted valuation of $560 million at its token generation event.

On the other end, Hyperliquid’s HYPE token trades at $48.89 with a fully diluted valuation of $48.9 billion, maintaining approximately 70% of the perpetual DEX market share despite rising competition.

Source: https://cryptonews.com/news/defillama-to-delist-aster-volume-data-over-suspected-wash-trading/

The post DefiLlama to Delist Aster Volume Data Over Suspected Wash Trading appeared first on Anndy Lian by Anndy Lian.

DefiLlama to Delist Aster Volume Data Over Suspected Wash Trading

Anndy Lian

DefiLlama to Delist Aster Volume Data Over Suspected Wash Trading

DeFiLlama has removed perpetual futures volume data for Aster, a decentralized exchange backed by figures linked to former Binance CEO Changpeng Zhao, after detecting trading volumes that mirrored Binance’s nearly 1:1 across multiple trading pairs.

Co-founder 0xngmi announced the delisting on October 5, 2025, citing concerns over data integrity.

According to the announcement, Aster’s volumes for pairs like XRP/USDT matched Binance perpetual volumes with a correlation ratio of approximately 1, whereas competitor Hyperliquid showed decorrelation in similar pairs.

The analytics platform cannot access lower-level data, such as maker and taker order information from Aster, to verify whether wash trading occurred, prompting the temporary removal until such verification becomes possible.

0xngmi noted that correlation patterns appeared even more extreme for other assets, such as ETH, with similar patterns visible across all trading pairs.

The DeFiLlama co-founder emphasized that the decision centered on maintaining data integrity for users who make investing decisions based on the platform’s analytics.

Crypto Community Splits Between Wash Trading Accusations and Liquidity Migration Defense

We’ve been investigating aster volumes and recently their volumes have started mirroring binance perp volumes almost exactly

Chart on the left is XRPUSDT on aster, you can see the volume ratio vs binance is ~1

Chart on the right is XRP perp volume on hyperliquid, where there’s… pic.twitter.com/MwVD7rRyEn

— 0xngmi is hiring (@0xngmi) October 5, 2025

The delisting triggered sharp divisions within the crypto community, with critics questioning DeFiLlama’s centralization while defenders attributed the correlation to legitimate liquidity migration from Binance.

Blockchain investigator ZachXBT criticized industry figure Anndy Lian for normalizing wash trading, after Lian argued that “all crypto projects have washed trades” and questioned why observers were “acting so saintly” about the situation.

Such an awful take normalizing wash trading is bad for the industry

“I am commenting on this fairly as an observer”

>Zero posts about HYPE and only two posts mentioning HL which Aster was also referenced

>Meanwhile almost every other post is about Aster

Worst thing Aster… pic.twitter.com/UoE1WX4OHm

— ZachXBT (@zachxbt) October 6, 2025

Lian, who holds positions in both leading perpetual DEX tokens, claimed that most projects are not fully decentralized and that alignment in open interest and price action is common across top projects that draw charts similar to Bitcoin.

He argued that if a project and its backers agree to spend money acquiring market share, the level of spending is their prerogative.

ZachXBT countered that Lian’s post history showed zero mentions of HYPE and only two posts referencing Hyperliquid, where Aster was also mentioned, while almost every other post focused on Aster.

Supporters of Aster argued that Binance’s liquidity was moved on-chain to the platform, explaining why volumes appeared to be synchronized.

People calling this “wash trading” have no idea what’s really happening

Binance liquidity literally moved on-chain to Aster, that’s why the volumes look synced

Funny how this FUD drops right when the airdrop news hits, timing too perfect to be random

Through all this noise,… https://t.co/v2ANAopDWp pic.twitter.com/RlGSspFbtL

— Sr Peters (@SrPetersETH) October 5, 2025

Multiple community members pointed to Dune Analytics data showing Aster’s total trading volume exceeding $2.2 trillion, with a total value locked of $1.52 billion, 3.18 million total users, and $328.28 million in all-time income.

The platform added 14,563 new users in the last 24 hours and 125,158 over seven days, according to the dashboard.

Source: Dune Analytics

Source: Dune AnalyticsDashboard creator Odbtc clarified that he used DeFiLlama’s public API as the data source, while Dune served only as a visualization layer to compare Aster, Hyperliquid, and Lighter.

He defended DeFiLlama’s decision, noting that the platform aggregates protocol-reported data while Dune allows users to query or visualize it, with dashboard quality depending entirely on the builder’s query logic.

Aster Launches Stage 3 Rewards Program as Binance Confirms Listing

Lot of noise today around Aster, @DefiLlama & @Dune

Quick context from the guy who actually built the Dune dashboard everyone’s quoting @dethective

This started off with DeFiLlama shutting down Aster’s API after seeing signs of wash trading

But @ShiLLin_ViLLian decided to… pic.twitter.com/OcUfJmRCjy

— odbtc.sol (@Overdose_BTC) October 5, 2025

Aster concluded its Genesis Stage 2 rewards program on October 5 and immediately launched Stage 3 Dawn, offering participants either their ASTER airdrop or a full refund of Stage 2 trading fees.

The claim page opens on October 10 for 48 hours, with airdropped tokens available on October 14.

Stage 3 runs for five weeks, ending November 9, introducing spot trading rewards, multi-dimensional scoring, symbol-specific boost multipliers, and team boosts that accumulate throughout the stage rather than resetting weekly.

At the same time, Binance announced it will list ASTER with a Seed Tag applied, while Aster implemented VIP fee tier updates starting October 6.

The platform updated its Market Maker Program with preferential fees and a monthly reward pool to strengthen liquidity.

Perp DEXs hit $1 trillion monthly volume for the first time as Aster and Hyperliquid lead a surge challenging centralized exchange dominance.#Perps #Dexshttps://t.co/rDhsLASOLf

— Cryptonews.com (@cryptonews) October 2, 2025

The moves come as Aster recorded $493.61 billion in 30-day trading volume according to earlier DeFiLlama data, capturing nearly 50% of the perpetual DEX market share before the delisting.

At the time of publication, ASTER trades at $2.08 with a fully diluted valuation of $16.5 billion, having increased by over 29 times within four days following CZ’s endorsement, before reaching above $2.

The token was launched with an initial fully diluted valuation of $560 million at its token generation event.

On the other end, Hyperliquid’s HYPE token trades at $48.89 with a fully diluted valuation of $48.9 billion, maintaining approximately 70% of the perpetual DEX market share despite rising competition.

The post DefiLlama to Delist Aster Volume Data Over Suspected Wash Trading appeared first on Cryptonews.

The post DefiLlama to Delist Aster Volume Data Over Suspected Wash Trading appeared first on Anndy Lian by Anndy Lian.

Aster Crypto Price Drops Over 10% as DefiLlama Delisting Sparks Wash Trading Concerns

Anndy Lian

Aster Crypto Price Drops Over 10% as DefiLlama Delisting Sparks Wash Trading Concerns

Aster, a fast-rising decentralized exchange (DEX) and emerging rival to Hyperliquid, has seen its native token drop by over 10% in the past 24 hours. The sharp decline followed DefiLlama’s decision to delist Aster’s perpetual trading data, raising questions about the platform’s trading integrity and transparency.

DefiLlama Raises Red FlagsThe controversy began when DefiLlama’s pseudonymous founder, 0xngmi, took to X (formerly Twitter) to share unusual data showing that Aster’s trading volumes mirrored those of Binance, the world’s largest centralized exchange.

Charts shared by 0xngmi revealed that Aster’s volume patterns began closely tracking Binance’s perpetuals market late Saturday and continued through Sunday an unusual correlation that quickly caught the attention of the DeFi community.

According to 0xngmi: “Aster doesn’t make it possible to get lower-level data such as who is making and filling orders. Until we can verify if there’s wash trading, Aster’s perpetuals will be delisted.”

This statement raised potential wash trading concerns — a practice where artificial trading volumes are created to inflate rankings or attract new traders.

Market Panic and Airdrop FalloutThe DefiLlama delisting triggered a wave of market panic. Aster’s token, which had recently topped DefiLlama’s leaderboard for daily DEX trading fees and volume, tumbled more than 10% as traders reacted to growing uncertainty.

The timing was especially damaging. The delisting came just as Aster was preparing for its Genesis Stage 2 airdrop, which will unlock 4% of the total token supply with no lock-up period.

While the Aster team framed the airdrop as a move to promote fairness and reward early adopters, traders feared it could flood the market with unlocked tokens, increasing sell pressure and further driving down prices.

Crypto analyst Duo Nine cautioned that ASTER’s price could drop further, saying the token may “test the $1 level before stabilizing.”

Analyst Says the Panic Is OverblownAmid the mounting skepticism, crypto strategist Anndy Lian urged the community to maintain perspective.

“Wash trading is common across the crypto industry — no one is a saint here,” Lian said. “Many projects are only partially decentralized and often display trading patterns similar to Bitcoin. That doesn’t automatically mean manipulation.”

He added that aggressive spending to gain market share shouldn’t always be viewed negatively:

Trust and Transparency Will Define What’s Next“If teams choose to spend strategically to grow, that’s a business decision — not wrongdoing. There’s no need to act so saintly. Regulators are aware of these CeDeFi dynamics, and the sector is still evolving under the banner of innovation.”

For now, Aster’s biggest challenge lies in rebuilding trust and transparency. Whether this delisting turns out to be a temporary setback or a deeper credibility issue will depend on how quickly the team clarifies its data and reassures users.

In the rapidly changing DeFi market, transparency isn’t just a virtue — it’s essential for survival.

The post Aster Crypto Price Drops Over 10% as DefiLlama Delisting Sparks Wash Trading Concerns appeared first on Anndy Lian by Anndy Lian.

ZachXBT Highlights Aster’s Ties to ‘Known Grifters’ Wynn and Shillin Amid Wash-Trading Fallout

Anndy Lian

ZachXBT Highlights Aster’s Ties to ‘Known Grifters’ Wynn and Shillin Amid Wash-Trading Fallout

Blockchain investigator ZachXBT has criticized defenders of the decentralized exchange Aster amid growing concerns that the platform is inflating its trading volumes through wash trading.

The on-chain sleuth also highlighted the project’s connections to “known grifters,” including James Wynn and Alex “Shillin_Villain,” calling these associations the worst move Aster has made so far.

ZachXBT vs. Anndy LianZachXBT’s comments followed remarks from Singaporean economist Anndy Lian, who defended the exchange and claimed that “all crypto projects have washed trades,” arguing such practices are commonplace in the industry.

“All crypto projects have washed trades. Only those that did not make it are not washed. No one is a saint here. Also, it depends on how much is washed,” Lian wrote on X.

Wash trading occurs when a trader or automated system simultaneously buys and sells the same asset to create the illusion of high trading volume, misleading investors about market liquidity and activity.

In response, ZachXBT wrote, “Such an awful take—normalizing wash trading is bad for the industry.”

He also questioned Lian’s claim of being “an observer,” suggesting bias in his commentary.

ZachXBT shared screenshots showing that Lian had written “zero posts about HYPE and only two posts mentioning Hyperliquid,” while “almost every other post is about Aster,” implying a lack of neutrality.

ZachXBT Calls Out GriftersZachXBT further alleged that Aster’s collaboration with “known grifters” in its promotional efforts was “the worst thing” the project could have done. He specifically named crypto traders Wynn and Shillin.

James Wynn, a pseudonymous trader, gained notoriety earlier this year for making massive leveraged bets on perpetual futures exchanges such as Hyperliquid.

His high-risk strategies attracted a large online following but also criticism after several well-documented liquidations reportedly wiped out most of his holdings.

Wynn has also faced accusations of promoting speculative tokens and memecoins without disclosing his potential financial interests.

“Shillin Villain,” another pseudonymous influencer, derives his name from the crypto slang term “shilling,” meaning the undisclosed promotion of a project for personal gain.

Aster’s DefiLlama DelistingThe controversy follows Aster’s delisting from data aggregator DefiLlama amid concerns about potential wash trading.

On Sunday, Oct. 5, DefiLlama’s founder, 0xngmi, wrote on X that the platform’s investigation had found Aster’s trading volumes “starting to mirror Binance perp volumes almost exactly.”

The founder shared charts showing Aster’s volume patterns, closely tracking Binance’s perpetuals market from late Saturday through Sunday.

“Aster doesn’t make it possible to get lower-level data such as who is making and filling orders. Until we can verify if there’s wash trading, Aster’s perpetuals will be delisted,” 0xngmi wrote.

The post ZachXBT Highlights Aster’s Ties to ‘Known Grifters’ Wynn and Shillin Amid Wash-Trading Fallout appeared first on Anndy Lian by Anndy Lian.