Anndy Lian's Blog, page 5

October 16, 2025

Anndy Lian: Crypto fun drives economic potential

Anndy Lian

Anndy Lian: Crypto fun drives economic potential

Anndy Lian highlights the vibrant dynamics of the cryptocurrency community, emphasizing its unique cycle from memes to monetary benefits.

Lian, a noted figure in the cryptocurrency sphere, argues that the essence of crypto lies in its ability to engage communities through fun, which, in turn, brings significant financial returns. By connecting the presence of communal entertainment with attention and investment, Lian stresses the innate potential of the crypto market to evolve and profit. This model reflects the increasing influence of community-driven activities on the digital currency landscape, suggesting that social connections play a pivotal role in financial outcomes within the sector.

Lian’s perspective on the interplay between community engagement and financial innovation aligns with his broader commentary on the sector. His observations on the impact of communal forces in crypto complement past warnings about market manipulation and the influence of online opinion leaders. Furthermore, his emphasis on community-driven growth reinforces continued advocacy for security, having previously highlighted the necessity for robust storage solutions such as cold wallets to safeguard digital assets amidst market volatility.

Source: https://tradersunion.com/news/market-voices/show/677291-crypto-fun-profits/

The post Anndy Lian: Crypto fun drives economic potential appeared first on Anndy Lian by Anndy Lian.

Between diplomacy and panic: Markets navigate a fractured narrative

Anndy Lian

Between diplomacy and panic: Markets navigate a fractured narrative

There is a fundamental dissonance in today’s market narrative, one that pits the cautious choreography of global diplomacy against the raw, unfiltered mechanics of financial panic.

On the surface, officials like US Treasury Secretary Scott Bessent project calm, insisting that Washington has no desire to escalate trade tensions with Beijing even as President Donald Trump prepares for a high-stakes meeting with Chinese President Xi Jinping in South Korea.

Beneath this veneer of control, markets are reacting not to words but to the tangible consequences of prolonged uncertainty: a fifteen-day US government shutdown that has frozen critical economic data releases, including the weekly jobless claims report, and a palpable retreat from risk across asset classes. This backdrop sets the stage for a market caught between macro fragility and microstructural stress, where even a modest dip in equities or a shift in Treasury yields can trigger outsized reactions.

The mixed performance of US equities on Wednesday, Dow down 0.04 per cent, S&P 500 up 0.40 per cent, Nasdaq up 0.66 per cent, reflects this indecision. Investors are neither fully embracing risk nor fleeing to safety in a coordinated manner. Instead, they are parsing every signal with heightened sensitivity.

Treasury yields ticked higher, with the 10-year yield climbing one basis point to 4.03 per cent and the two-year yield jumping three basis points to 3.50 per cent, suggesting that despite the shutdown and trade anxieties, the bond market is not yet pricing in a sharp economic contraction.

Simultaneously, the US Dollar Index slipped 0.26 per cent to 98.79, indicating a modest loss of confidence in the greenback as a safe haven. In stark contrast, gold surged 1.3 per cent to US$4,193.39 per ounce, having breached the US$4,200 mark for the first time ever on Wednesday.

This milestone is not incidental. Gold’s ascent to these unprecedented levels aligns with data showing it reached US$4,179.48 on October 14, 2025, before climbing further. By October 16, it had hit US$4,215.64, underscoring a relentless flight to safety driven by inflation fears, geopolitical strain, and institutional distrust in fiat stability.

Meanwhile, Asian markets offered a flicker of optimism, led by Korea’s KOSPI Index, which jumped 2.7 per cent. This regional rebound may reflect anticipation of the Trump-Xi meeting or simply a technical bounce after recent weakness. Such gains remain fragile, tethered to developments in Washington and Beijing that are inherently unpredictable. The oil market tells a more pessimistic story.

Brent crude fell 0.8 per cent to US$61.89 per barrel, weighed down not only by US-China trade friction but also by the International Energy Agency’s projection of a supply surplus in 2026. When energy prices falter amid trade tensions, it often signals weakening global demand expectations, a red flag for growth-oriented assets.

Into this volatile mix steps a novel financial innovation: Calamos Investments’ Bitcoin Laddered Structured Protection ETFs. These products represent a significant evolution in the integration of digital assets into traditional finance. Designed to provide upside exposure to Bitcoin while offering structured downside protection, they aim to neutralise the extreme volatility that has historically deterred conservative investors.

The flagship offering, the Calamos Laddered Bitcoin Structured Alt Protection ETF (ticker: CBOL), seeks to match the positive price return of the CME CF Bitcoin Reference Rate while limiting losses through a laddered protection mechanism. This structure diversifies risk across multiple strike levels, making the ETF more compatible with model portfolios and risk-managed strategies. In theory, such instruments could transform Bitcoin from a speculative gamble into a legitimate component of diversified asset allocation, particularly for institutions bound by fiduciary constraints.

The current crypto market environment offers little support for optimism. Bitcoin’s price action is being overwhelmed by three converging bearish forces. First, leverage is unwinding at an alarming pace. Derivatives open interest has plunged 19.6 per cent over the past week, with a sharp 4.35 per cent drop in just 24 hours.

Perpetual funding rates have collapsed by 76 per cent this week, signalling a dramatic retreat from speculative long positions. This deleveraging echoes the catastrophic US$19 billion market wipeout witnessed earlier in October 2025, where low liquidity turned modest corrections into cascading liquidations.

Second, Bitcoin dominance has surged to 58.79 per cent, its highest level since June 2025, as investors flee altcoins in favour of perceived safety within the crypto ecosystem. Altcoin dominance has correspondingly collapsed to 28.34 per cent, and the Altcoin Season Index has plunged 59 per cent month-over-month to just 29, a clear signal that we are deep in “Bitcoin Season.” This capital rotation starves emerging projects of liquidity, stifling innovation and reinforcing Bitcoin’s role as a digital reserve asset.

Third, new token listings are increasingly triggering profit-taking rather than accumulation. The case of YieldBasis (YB) is emblematic: after listings on Binance and OKX, its price dropped 14.25 per cent as early backers sold tokens acquired during the presale at US$0.10. A similar dynamic played out with PancakeSwap, which fell 10.6 per cent following its CAKE.PAD event.

These “sell the news” episodes are no longer isolated incidents but a recurring pattern that injects localised selling pressure into an already fragile market. The cumulative effect is a toxic feedback loop: macro uncertainty fuels risk aversion, which accelerates leverage unwinds and altcoin abandonment, while new token launches become catalysts for distribution rather than adoption.

In this context, the launch of Calamos’ structured Bitcoin ETFs arrives at a paradoxical moment. On one hand, the product is precisely what the market needs to broaden Bitcoin’s investor base and stabilise its price dynamics over the long term. On the other hand, its immediate impact may be muted by the prevailing fear and low liquidity.

Bitcoin’s seven-day RSI currently sits at 30.62, flirting with oversold territory. Historically, such levels have preceded short-term relief rallies, but without a macro catalyst such as a de-escalation in US-China tensions, resolution of the government shutdown, or a clear signal from the Federal Reserve, any bounce is likely to be shallow and short-lived.

Ultimately, the market is navigating a period of profound transition. Traditional safe havens, such as gold, are redefining their ceilings, while digital assets are being repackaged to fit within institutional risk frameworks. Until the macro fog lifts and derivatives markets stabilise, volatility will remain the dominant theme. For now, caution is not just prudent, it is the only rational response.

Source: https://e27.co/between-diplomacy-and-panic-markets-navigate-a-fractured-narrative-20251016/

The post Between diplomacy and panic: Markets navigate a fractured narrative appeared first on Anndy Lian by Anndy Lian.

October 15, 2025

Anndy Lian criticizes crypto leaders over decentralized defamation issues

Anndy Lian

Anndy Lian criticizes crypto leaders over decentralized defamation issues

Anndy Lian, a notable figure in the crypto industry, has voiced concerns over the conduct of leaders within decentralized networks. He suggests that actions often seen within the crypto space, which would amount to defamation, libel, or slander in regulated environments, are seemingly acceptable in decentralization.

Lian’s remarks point to a culture within the industry where leaders and their followers attack each other without accountability, leveraging the unregulated nature of decentralized systems. This situation raises questions about the boundaries of free speech and the extent of legal immunity enjoyed by crypto entities. As decentralized finance (DeFi) continues to grow, stakeholders may need to consider the ethical implications of communication within this space.

Lian’s observations on the challenges of accountability in decentralized environments align with his longstanding scrutiny of industry practices, including past commentary on the prevalence of market manipulation and influencer conduct within the crypto domain. His commitment to responsible participation in the digital asset space is further underscored by previous guidance urging users to prioritize cold wallet storage and enhanced security measures amid the sector’s rapid evolution.

Source: https://tradersunion.com/news/market-voices/show/670532-crypto-leaders-defamation/

The post Anndy Lian criticizes crypto leaders over decentralized defamation issues appeared first on Anndy Lian by Anndy Lian.

Risk-off ripples: Trade fears, rate cuts, and a crypto sell-off collide

Anndy Lian

Risk-off ripples: Trade fears, rate cuts, and a crypto sell-off collide

A noticeable step back yesterday after President Donald Trump floated the idea of halting trade in cooking oil with China. This comment stirred up new uncertainties in the already fragile ties between the two economic giants, reminding everyone how quickly trade disputes can escalate and ripple through markets. Investors reacted by pulling back from riskier assets, seeking shelter in safer havens.

At the same time, Federal Reserve Chair Jerome Powell offered some stability with his remarks. He noted that the economic picture looked much the same as it did during the September meeting, and he hinted strongly at another quarter-point cut in interest rates coming up later this month. These words from Powell helped temper some of the anxiety, as markets priced in the likelihood of easier monetary policy to support growth amid these tensions.

US stocks wrapped up Tuesday with mixed results, reflecting the push and pull between trade worries and Fed expectations. The Dow Jones Industrial Average climbed 0.44 per cent, showing resilience in some blue-chip names, while the S&P 500 slipped 0.16 per cent, and the Nasdaq dropped a steeper 0.76 per cent.

Tech-heavy indexes felt the brunt of the caution, as investors worried about how trade frictions might hit supply chains and corporate earnings. Bond markets told a similar story of caution. Treasury yields declined as people flocked to government debt for safety. The 10-year yield dropped three basis points to 4.02 per cent, and the two-year yield fell five basis points to 3.47 per cent. This movement underscores how quickly sentiment can shift toward defence when geopolitical headlines dominate.

The dollar weakened a bit in response, with the US Dollar Index down 0.22 per cent to 99.04. Gold, on the other hand, gained 0.4 per cent to reach 4126.47 dollars per ounce. This uptick in gold prices makes sense given the dual drivers of an anticipated Fed rate cut and the safe-haven appeal amid trade and geopolitical strains.

Oil markets faced their own pressures. Brent crude settled 1.47 per cent lower at 62.39 dollars per barrel, influenced by the International Energy Agency’s warning about a massive supply glut looming in 2026. That kind of forecast weighs heavily on energy prices, as it signals potential oversupply that could keep lids on any rebounds.

Asian stocks mostly ended lower on Tuesday, mirroring the global unease, but they perked up in early trading today. Optimism around the possible Fed rate cut boosted moods, leading to gains that suggest some recovery in sentiment. US equity futures pointed to a higher open stateside, which could carry over if the positive vibes hold. From my perspective, this back-and-forth highlights the market’s sensitivity to policy signals right now.

Trump’s offhand remark about the cooking oil trade might seem niche, but it taps into broader fears of escalating tariffs or restrictions that could disrupt global supply chains. Powell’s steady hand provides a counterbalance, and I see the Fed’s path as a stabilising force, potentially cushioning against worse outcomes if trade talks sour further. The mixed stock closes remind us that not all sectors benefit equally from lower rates, especially tech, which relies on smooth international flows.

Looking to the cryptocurrency space, the market endured a 1.66 per cent drop over the last 24 hours, building on a 7.57 per cent slide over the week. This downturn stems from a combination of regulatory pressures and a major scam revelation, which together amplified the risk-off mood. Technical signals indicate oversold territory, suggesting a potential bounce if sentiment shifts; however, caution remains the order of the day.

Regulatory developments hit hard, with US authorities charging Chen Zhi, the chairman of Cambodia’s Prince Holding Group, in connection with laundering 14 billion dollars through crypto scams, as reported by Nikkei Asia. At the same time, Japan outlined plans to prohibit insider trading in crypto by 2026, also per Nikkei Asia. These moves rattled investors, reinforcing the view that digital assets carry significant oversight risks. Institutions grew wary, and retail traders sold off, fearing broader crackdowns.

In my humble perspective, these regulatory steps mark a maturing phase for crypto, where governments aim to curb abuses that have plagued the sector. The 14 billion dollar scam case stands out as a stark example of how fraud can undermine trust, and Japan’s insider trading ban signals a push toward mainstream financial standards.

While this might sting in the short term, it could build longer-term credibility if implemented thoughtfully. Investors should monitor the evolving details of Japan’s legal changes and any potential spillover from the seizure in the scam probe. Such events often lead to temporary sell-offs but can pave the way for more robust frameworks that attract serious capital.

Derivatives markets showed clear signs of stress, adding to the bearish tone. Total open interest in derivatives decreased 1.73 per cent to 989.73 billion dollars, and average funding rates plummeted 36.3 per cent in just 24 hours. Perpetual contracts volume rose 1.69 per cent to 697.74 trillion dollars, indicating frantic trading amid the panic.

This unwind of leverage came after Bitcoin dipped briefly below 105 thousand dollars, sparking 19 billion dollars in liquidations earlier in the week. The spot-to-perpetual ratio of 0.21 underscores how speculation dominated, making the market vulnerable to sharp corrections.

I think this leverage purge reflects a healthy, if painful, reset. High funding rates often signal overextended positions, and their sharp drop shows traders rushing to exit as prices fall. The surge in perpetual volume points to knee-jerk reactions, where fear drives more activity rather than conviction.

In broader terms, this dynamic exposes crypto’s volatility, amplified by leveraged bets that can turn minor dips into cascades. From an optimistic angle, clearing out excess leverage might set the stage for more sustainable growth, reducing the risk of even larger blowups down the line.

Sentiment metrics captured the prevailing fear. The Crypto Fear and Greed Index slid to 37, squarely in fear territory, down from 42 the day before. This drop illustrates eroding confidence, as participants grapple with the regulatory and market pressures. Technically, the picture looked grim too.

The overall crypto market capitalisation stood at 3.84 trillion dollars, below the 50 per cent Fibonacci retracement level of 3.98 trillion dollars. The seven-day Relative Strength Index hit 28.38, indicating extreme oversold conditions, while the MACD histogram at negative 33.12 billion confirmed ongoing bearish momentum. Bitcoin’s dominance climbed to 58.59 per cent, suggesting a shift toward it as a relatively safe haven within the crypto ecosystem.

From where I stand, these technical breakdowns reveal how algorithms and momentum traders can exacerbate declines. Crossing below key Fibonacci levels often triggers automated selling, and the low RSI screams oversold, which historically precedes rebounds in other markets. But in crypto, with its unique mix of retail enthusiasm and institutional hedging, the MACD’s bearish read might prolong the pain.

The rise in Bitcoin dominance tells me investors are hunkering down in the biggest name, viewing it as less risky than altcoins during turmoil. Overall, this setup feels like a capitulation phase, where fear dominates but could flip if positive catalysts emerge, like clearer Fed actions or easing trade tensions.

Source: https://e27.co/risk-off-ripples-trade-fears-rate-cuts-and-a-crypto-sell-off-collide-20251015/

The post Risk-off ripples: Trade fears, rate cuts, and a crypto sell-off collide appeared first on Anndy Lian by Anndy Lian.

October 14, 2025

Gold soars, crypto bleeds: The fragile balance of a world on the brink of trade war

Anndy Lian

Gold soars, crypto bleeds: The fragile balance of a world on the brink of trade war

At the heart of this financial storm lies former President Donald Trump’s announcement of a sweeping 100 per cent tariff on Chinese imports, set to take effect on November 1, 2025. This policy declaration, made via Truth Social, has sent shockwaves through equities, commodities, and digital asset markets alike, effectively dismantling the fragile optimism that had built up around potential US-China trade détente.

Far from being an isolated political gesture, this move has functioned as a macroeconomic detonator, exposing the deep interconnections between traditional finance and the crypto economy, and triggering the largest single-day liquidation event in cryptocurrency history.

Markets had initially responded with cautious optimism to signals that both Washington and Beijing remained open to dialogue. US equities posted strong gains on Monday, with the Nasdaq surging over two per cent as AI-related semiconductor deals buoyed tech sentiment.

Simultaneously, gold prices soared to unprecedented levels, reaching US$4,106 per ounce, a figure corroborated by multiple market data sources that place the price of gold on October 14, 2025, firmly in the US$4,145 to US$4,154 range. This record-breaking rally in the ultimate safe-haven asset was not a sign of confidence but a clear signal of deep-seated anxiety about the future.

Investors were hedging against a dual threat: the immediate risk of a new trade war and the longer-term expectation of aggressive interest rate cuts by the Federal Reserve to counter the resulting economic slowdown. The rise in the US Dollar Index to 99.27 further underscores this flight to safety, even as Brent crude oil held steady at US$63.80 per barrel, supported by the faint hope that high-level talks between the two superpowers might yet avert disaster.

However, this fragile equilibrium was shattered by the full implications of Trump’s tariff plan. The proposed 100 per cent duty, targeting critical sectors like semiconductors and e-commerce, is not merely a trade policy but a declaration of economic warfare. The market’s reaction was instantaneous and brutal.

Asian equities, particularly Hong Kong’s Hang Seng Index, plunged as the region braced for the direct impact on its export-driven economies. This risk-off sentiment bled directly into the cryptocurrency market, which has, for all the talk of “digital gold” and macro decoupling, proven to be acutely sensitive to shifts in the S&P 500, with its 24-hour correlation spiking to +0.52. The narrative that crypto had evolved into a separate, uncorrelated asset class evaporated overnight, revealing it to be just another risk asset in a global liquidity crunch.

The actual carnage, however, unfolded in the opaque world of crypto derivatives. The market had been swimming in a sea of excess leverage, with open interest having ballooned by 91 per cent month-over-month to a staggering US$947 billion. This created a highly combustible environment where any sharp price move could trigger a cascade of forced selling.

Trump’s announcement provided the spark. In a matter of hours, over US$19 billion in leveraged positions were liquidated, marking the largest single-day wipeout since the market turmoil of March 2020. The data is unequivocal: 87 per cent of these liquidations were long positions, indicating a market that was overwhelmingly bullish and entirely unprepared for a sudden reversal.

This “leverage flushout” was not a natural market correction but a systemic purge, where the architecture of perpetual futures contracts and high-leverage trading turned a macro shock into a self-reinforcing spiral of selling. The pain was not distributed evenly; altcoins bore the brunt of the selloff, as evidenced by the ETH/BTC ratio collapsing to a three-year low of 0.22, signaling a flight to the relative safety of Bitcoin within the crypto ecosystem itself.

This event represents a profound reset in market sentiment. The Fear & Greed Index’s plunge from “Greed” at 62 to “Neutral” at 42 is a stark indicator of the psychological shift. Traders who had grown complacent in a low-volatility environment were abruptly reminded of the inherent risks of a highly leveraged, globally interconnected market. The negative funding rates in perpetual futures markets, which flipped to incentivise short sellers, further cemented the bearish momentum.

Yet, within this chaos, there are signs of potential stabilisation. The premium on Tether (USDT) above its US$1 peg, currently at US$1.005, suggests that a significant pool of sidelined cash is waiting on the sidelines, ready to re-enter the market once the dust settles. This “dry powder” could fuel a powerful relief rally should there be any sign of de-escalation from either Washington or Beijing.

In conclusion, the current market downturn is not a simple correction but the result of a perfect storm. A geopolitical shockwave from a proposed 100 per cent tariff has collided with a structurally over-leveraged crypto market, creating a feedback loop of forced liquidations and panic selling. While technical indicators like the RSI-7 at 33.6 suggest the market is oversold and primed for a bounce, any sustainable recovery hinges on external factors beyond the market’s control.

The path forward depends almost entirely on the next moves in the US-China standoff. Should China respond with its own aggressive measures, such as curbing exports of critical rare earth minerals, the risk-off environment could deepen and prolong the pain. Conversely, a diplomatic breakthrough or even a softening of rhetoric could trigger a powerful short-covering rally.

Let’s see.

The post Gold soars, crypto bleeds: The fragile balance of a world on the brink of trade war appeared first on Anndy Lian by Anndy Lian.

October 13, 2025

Dogecoin Founder Slams ‘Uptober’ Talks; DOGE Dips

Anndy Lian

Dogecoin Founder Slams ‘Uptober’ Talks; DOGE Dips

Dogecoin’s (DOGE) founder Billy Markus a.k.a Shibetoshi Nakamoto has had enough of ‘Uptober’ promises. “Anyone who said ‘Uptober’ should be slapped in the face”, – fiercely spat out the computer virtuoso. Understandably, this came out past midnight on Saturday, when the general crypto markets took in a staggering $19 billion deficit in liquidations.

https://x.com/anndylian/status/197677...

The brutal correction came after Donald Trump imposed a 100% tariff on all exported Chinese goods, but there’s more to it. Binance, the leading crypto exchange across the globe, witnessed unexpected hiccups due to an activity overload, which preceded the United States President’s ground-breaking announcement that sent both stock & crypto markets on a free-fall.

The Biggest Liquidation Flash Crash In History

Some crypto aficionados on X were blatantly honest and remarked that the flash crash “looks like Trump put 100% tariffs on crypto”, while others were more optimistic and marked the cycle bottom. For Dogecoin (DOGE), the turbulent journey over the past 30 days has pushed the top dog coin from $0.25 to $0.18, resembling a 29% monthly drop, followed by a rebound to $0.21.

https://x.com/CryptoMichNL/status/197...

With Dogecoin’s (DOGE) founder lambasting the excessive optimism of October, popularly referred to as ‘Uptober’ due to historically-bullish price movements for Bitcoin (BTC) & top alts, this paints a perfect example of Fear Of Missing Out (FOMO). In this psychological instance, crypto traders rush into buying digital assets based on expectations rather than fundamentals.

Source: https://dailycoin.com/dogecoin-founder-slams-uptober-talks-as-doge-dips-29/

The post Dogecoin Founder Slams ‘Uptober’ Talks; DOGE Dips appeared first on Anndy Lian by Anndy Lian.

Memecoins, mayhem, and market recovery: Crypto’s wild ride after the trade war jolt

Anndy Lian

Memecoins, mayhem, and market recovery: Crypto’s wild ride after the trade war jolt

On Friday, October 10, 2025, global markets absorbed a seismic shock when former President Donald Trump, now back in office, announced a sweeping new trade measure: a 100 per cent tariff on all imports from China, set to take effect on November 1. This announcement instantly reignited fears of a full-blown trade war, not merely as a continuation of past tensions but as a dramatic escalation rooted in the strategic control of critical resources.

The move came in direct response to China’s recent export restrictions on rare earth elements, which constitute roughly 70 per cent of the global supply and are indispensable to modern high-tech manufacturing. The interplay between these two actions, China’s export controls and America’s retaliatory tariffs, has created a volatile feedback loop that threatens to destabilise global supply chains, inflate consumer prices, and inject deep uncertainty into financial markets already navigating a fragile post-pandemic recovery.

The immediate market reaction was swift and severe. US equities plunged, with the Dow Jones Industrial Average falling 1.90 per cent, the S&P 500 dropping 2.71 per cent, and the tech-heavy Nasdaq shedding 3.56 per cent. Investors fled to safety, pushing the yield on the 10-year US Treasury note down by nine basis points to 4.05 per cent and the two-year yield to 3.52 per cent. The US dollar weakened, sliding 0.6 per cent to 98.98 on the Dollar Index, while gold, a traditional haven in times of geopolitical stress, jumped 0.8 per cent to US$4,007.39 per ounce.

Even crude oil markets reflected the anxiety, with Brent futures tumbling 3.8 per cent to US$62.73 per barrel. Across the Pacific, Asian indices mirrored the downturn, with Hong Kong’s Hang Seng down 1.8 per cent and Japan’s Nikkei off one per cent , the latter compounded by domestic political instability. Yet, by Monday’s pre-market session, US equity futures hinted at a rebound, suggesting that some investors viewed Friday’s selloff as an overreaction or a buying opportunity ahead of the critical November 1 deadline.

The industries most vulnerable to this trade standoff span both strategic and consumer sectors. In the United States, high-tech manufacturing stands at the epicenter. Rare earth elements are essential for producing permanent magnets used in electric vehicle motors, wind turbines, defense systems like precision-guided munitions, and semiconductor fabrication equipment. Without reliable access to these materials, American companies face production delays, cost inflation, and potential loss of competitive edge.

Beyond tech, the new tariffs directly impact steel, aluminum, copper, furniture, and household appliances, sectors already burdened by existing duties that average 40 per cent . The cumulative tariff burden, now potentially reaching 130 per cent , would drastically raise input costs for manufacturers and, inevitably, retail prices for consumers. European economies, though not directly targeted, remain exposed through their deep integration into global supply chains, particularly in automotive and electronics, where components often traverse multiple borders before final assembly.

China’s imposition of export controls on rare earths is not merely an economic manoeuvre but a calculated geopolitical lever. By restricting the flow of these critical minerals, Beijing asserts its dominance over a supply chain it has methodically consolidated over decades. While China frames these controls as necessary for national security and environmental protection, Washington interprets them as coercive economic statecraft.

The irony is palpable: the US, which has long criticised China’s trade practices, now responds with tariffs so steep they risk self-inflicted economic harm. Yet, the asymmetry in dependency is stark. The US and its allies rely heavily on Chinese rare earths, whereas China’s economy, while vast, may be less immediately dependent on access to specific American software or services. This imbalance suggests that Trump’s tariff threat, while aggressive, may ultimately serve as a bargaining tactic, a high-stakes gambit to force China back to the negotiating table before the scheduled high-level diplomatic talks on November 1.

Indeed, early signals indicate that de-escalation remains possible. Despite the fiery rhetoric, behind-the-scenes channels appear active, with reports suggesting the US has already signaled willingness to negotiate. This aligns with historical patterns where tariff threats function more as leverage than as irreversible policy. Markets, ever forward-looking, may be pricing in this possibility, which could explain the tentative recovery in futures trading.

For investors, the key is vigilance without panic. The S&P 500’s technical support levels at 6400 and 6150 will serve as critical markers of market sentiment in the coming weeks. Additionally, the flood of third-quarter earnings reports from 36 S&P 500 companies will offer real-time insights into how corporate America is navigating these headwinds. Comments from bellwether firms in tech, manufacturing, and retail will be scrutinised for mentions of supply chain disruptions, cost pressures, or shifting sourcing strategies.

Meanwhile, the crypto market experienced its own drama in the wake of the announcement. Bitcoin plunged 17 per cent in what traders dubbed Black Friday, triggering over US$19 billion in liquidations as leveraged positions collapsed under the weight of panic selling. However, within 24 hours, the market staged a 4.86 per cent recovery, driven by a confluence of factors. Institutional activity provided a floor: Grayscale’s filing for a Bittensor (TAO) Trust signalled growing interest in AI-integrated blockchain projects, propelling TAO up 35 per cent .

Simultaneously, retail speculation surged on BNB Chain, where memecoins like 4 and SKYAI skyrocketed on viral narratives and “endorsements” from figures like CZ. Daily decentralised exchange volumes on BNB Chain hit US$963 million, reflecting intense, if speculative, participation. Yet this rebound remains fragile. Negative funding rates on perpetual futures eased selling pressure temporarily, but Bitcoin still trades seven per cent below its 30-day moving average. The looming US$1.07 trillion options expiry this Friday adds another layer of potential volatility.

In sum, the events of October 10 represent more than a policy announcement. They mark a pivotal moment in the evolving economic cold war between the world’s two largest economies. The tariff threat and rare earth controls are not isolated incidents but symptoms of a deeper decoupling trend that spans technology, security, and industrial policy. While short-term market gyrations reflect fear and uncertainty, the longer-term implications hinge on whether this confrontation hardens into permanent fragmentation or yields to pragmatic negotiation.

Investors should brace for continued turbulence but avoid knee-jerk reactions. The next three weeks, leading up to November 1, will be decisive. Corporate earnings, central bank commentary, including Fed Chair Jerome Powell’s upcoming speech, and any diplomatic overtures will shape the narrative far more than Friday’s headlines. In such an environment, patience, diversification, and a keen eye on technical and fundamental indicators remain the best strategies.

The post Memecoins, mayhem, and market recovery: Crypto’s wild ride after the trade war jolt appeared first on Anndy Lian by Anndy Lian.

October 11, 2025

Anndy Lian warns of cryptocurrency market manipulation

Anndy Lian

Anndy Lian warns of cryptocurrency market manipulation

Anndy Lian, a notable figure in the cryptocurrency scene, has raised concerns about manipulation in the market. In a recent tweet, he criticized influencers who engage in over-the-counter (OTC) deals without actual trading experience.

Lian emphasized the lack of genuine involvement by these personalities, suggesting that their actions contribute to a manipulated market landscape. His statement reflects a growing scrutiny over the integrity of influence within the crypto sector.

This comes amid increasing debates about transparency and ethical practices in digital currency trading, where credible knowledge and direct market involvement are seen as crucial for fostering trust and legitimacy.

Lian’s critique joins a broader conversation on market security and confidence, areas he has addressed extensively. His prior recommendations on the use of cold wallets for safeguarding crypto assets underscore an ongoing concern for user protection. Additionally, his perspective on BNB as a proxy for confidence in crypto infrastructure highlights the importance of trustworthy market participants in sustaining industry stability amid persistent challenges around transparency and ethical conduct.

Source: https://tradersunion.com/news/market-voices/show/641668-crypto-market-manipulation/

The post Anndy Lian warns of cryptocurrency market manipulation appeared first on Anndy Lian by Anndy Lian.

YZi Labs-Backed Perp DEX Aster Delays Airdrop Over Data Issues

Anndy Lian

YZi Labs-Backed Perp DEX Aster Delays Airdrop Over Data Issues

Aster (ASTER), the decentralized exchange backed by Binance founder Changpeng Zhao’s investment firm YZi Labs, has postponed its upcoming airdrop after identifying “potential data inconsistencies.”

Key Takeaways:

Aster delayed its airdrop after uncovering potential data inconsistencies affecting some user allocations.

The postponement follows user complaints about inaccurate results from the project’s “S2 airdrop checker” tool.

DeFiLlama also suspended Aster’s trading data amid Binance-like volume correlations.

Originally set for October 14, the airdrop will now take place on October 20, pending internal verification, the team announced on Friday.

Aster Promises Fair Adjustments After Users Flag Airdrop Allocation ErrorsThe Aster team said it would update “certain users’ allocations where needed,” noting that “for most users, allocations should not fall below the final snapshot RH% in each epoch.”

The cause of the discrepancies was not fully detailed, but the decision follows user complaints about inaccurate results from the “S2 airdrop checker” tool released earlier in the day.

One trader claimed an allocation of only 336 ASTER tokens despite having generated over $9 million in trading volume. In total, 153,000 wallets are eligible for the Aster Genesis: Stage 2 airdrop.

Formerly known as APX Finance, Aster is a cross-chain perpetual futures DEX operating on Solana, Ethereum, Arbitrum, and BNB Chain.

The platform, which aims to rival Hyperliquid, recorded more than $420 billion in trading activity last month, according to The Block.

At the time of writing, ASTER is trading near $1.69, largely steady despite broader market weakness driven by renewed trade tensions following Donald Trump’s announcement of 100% tariffs on Chinese imports.

Last week, DeFiLlama temporarily removed trading volume data for Aster after detecting unusually high correlations with Binance’s perpetual volumes.

Co-founder 0xngmi announced the delisting on October 5, citing data integrity concerns after Aster’s XRP/USDT and ETH/USDT pairs showed nearly 1:1 correlation ratios with Binance.

The analytics site said it lacks the granular data needed to confirm potential wash trading, prompting the suspension until verification becomes possible.

The move has divided the crypto community, sparking debate over whether the volumes were manipulated or simply reflected a liquidity migration from Binance to Aster.

Blockchain investigator ZachXBT criticized Anndy Lian for downplaying the issue, while Lian argued that volume alignment across major projects is normal and that Aster’s activity mirrors broader market behavior.

He added that aggressive spending to gain market share is a business decision, not necessarily manipulation.

Aster Reimburses Traders After XPL Price Glitch Triggers LiquidationsLast month, Aster reimbursed users in USDT after a sudden price spike in the XPL perpetual contract triggered forced liquidations.

The anomaly, which occurred during the transition from pre-launch to live trading, saw the price of XPL briefly surge to over $4, well above its $1.30 average on other platforms.

The exchange responded quickly, completing the first round of reimbursements within hours and compensating affected traders for liquidation and trading fees.

While the exact cause remains unconfirmed, early speculation points to a misconfigured index price or missing sync with live market data. Aster has pledged to continue its investigation into the incident.

The glitch followed the mainnet launch of Plasma, a stablecoin-focused Layer 1 whose native token XPL rapidly hit a $12 billion valuation.

Source: https://finance.yahoo.com/news/yzi-labs-backed-perp-dex-112000943.html

The post YZi Labs-Backed Perp DEX Aster Delays Airdrop Over Data Issues appeared first on Anndy Lian by Anndy Lian.

October 10, 2025

CZ’s Google account targeted by ‘government-backed’ hackers

Anndy Lian

CZ’s Google account targeted by ‘government-backed’ hackers

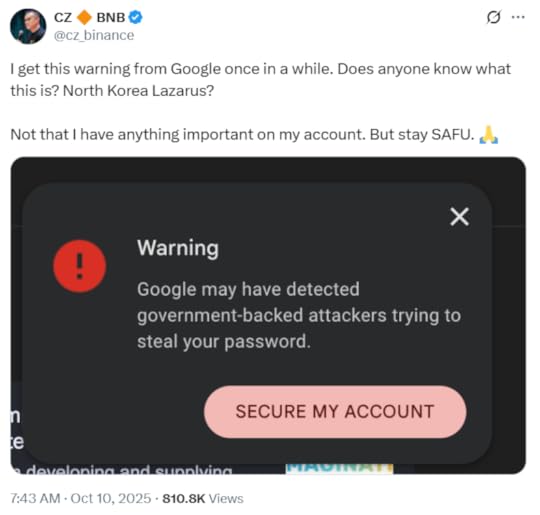

Hackers attempted to infiltrate the account of Binance co-founder Changpeng “CZ” Zhao, signaling potential attacks from state-backed hacker groups, such as the North Korean Lazarus Group.

“Government-backed attackers” were attempting to steal Zhao’s Google password, according to a Google warning shared by CZ, who suggested that it may be another attempt by North Korea’s Lazarus Group.

“I get this warning from Google once in a while. Does anyone know what this is? North Korea Lazarus? Not that I have anything important on my account,” said Zhao in a Friday X post.

The infamous North Korean Lazarus Group is the main suspect behind some of the most devastating cryptocurrency exploits, including the $1.4 billion Bybit hack, the industry’s largest to date, which occurred on Feb. 21.

Source:

Changpeng Zhao

Source:

Changpeng Zhao

US intelligence reports highlight a “sophisticated network of agents posing as remote IT workers, which has funneled significant funds back to Pyongyang,” Anndy Lian, author and intergovernmental blockchain adviser, told Cointelegraph, adding:

“I personally know that a government official who got a similar prompt as CZ, saying that his account is detected with government-backed hackers trying to steal his password.”

“They tried to contact Google for more information, but nothing was given due to security reasons,” he said.

Zhao sounds alarm on growing threat of North Korean impersonatorsThe attempted breach follows a period of renewed threats from North Korean hackers. It comes three weeks after Zhao sounded the alarm on the growing threat of North Korean hackers seeking to infiltrate crypto companies through employment opportunities and bribes.

“They pose as job candidates to try to get jobs in your company. This gives them a “foot in the door,” specifically for employment opportunities related to development, security and finance, wrote Zhao in a Sept. 18 X post.

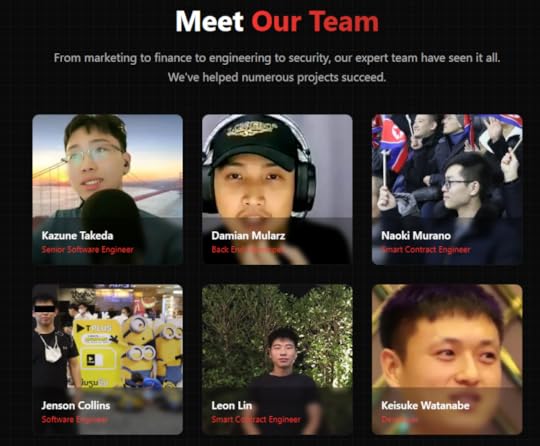

Zhao’s warning came as a group of ethical hackers called Security Alliance (SEAL) compiled the profiles of at least 60 North Korean agents posing as IT workers under fake names seeking to infiltrate US crypto exchanges and steal sensitive user data.

SEAL team repository of 60 North Korean IT worker impersonators. Source: lazarus.group/team

SEAL team repository of 60 North Korean IT worker impersonators. Source: lazarus.group/teamCoinbase suffered a data breach in May that exposed sensitive information from less than 1% of the exchange’s transacting monthly users.

The data breach may cost the exchange up to $400 million in reimbursement expenses, Cointelegraph reported on May 15.

Later in June, four North Korean operatives infiltrated multiple other crypto firms as freelance developers, stealing a cumulative $900,000 from these startups.

Throughout 2024, North Korean hackers stole over $1.34 billion worth of digital assets across 47 incidents, a 102% increase from the $660 million stolen in 2023, according to Chainalysis data.

Cryptocurrency companies need to strengthen their security measures against these attackers by implementing dual wallet management and real-time artificial intelligence threat monitoring, according to cybersecurity experts.

Source: https://cointelegraph.com/news/zhao-google-government-backed-hackers

The post CZ’s Google account targeted by ‘government-backed’ hackers appeared first on Anndy Lian by Anndy Lian.