Anndy Lian's Blog, page 100

September 5, 2022

XRP to USD forecast: Can Ripple price finally reverse long-term downward trend?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

XRP to USD forecast: Can Ripple price finally reverse long-term downward trend?

Ripple is one of the most talked about coin.

– What has been affecting the Ripple coin price recently?

The on-going, never ending and changing lawsuit is one of the key uncertainties. SEC has a different angled strategy against Ripple through Wahi complaint. This added insider trading allegations against 2 other Coinbase employees and putting 9 other cryptocurrencies as securities. If the SEC wins the case, this would set a precedent and would cause more problems for the crypto industry as a whole.

This outcome for Ripple might affect their On-Demand Liquidity (ODL) service. And if U.S. banks are not going with the ODL plans, this will then weaken Ripple’s CBDC setup and investors will not be very happy.

– Where could the token be headed in the future

According to CoinMarketCap price prediction function, 1222 users voted and predicted that the price of XRP will be around $0.4905 by 30 September 2022. This is a 47.86% increase in the current price. I must say that the supporters are still considerably bullish on the coin and hope they can get out of the lawsuit quickly.

I am more realistic at this point. I hope to see more signed partnerships that are actually useful, not for PR purposes and see more real implementations in a larger manner, not purely news on how they help streamline Japan-Thailand money transfers. I hope to see more details. I am sure the investors at large want to see more too.

XRP to USD forecast: Can Ripple price finally reverse long-term downward trend?

Ripple (XRP/USD) is among the top 10 largest cryptocurrencies by market capitalisation. Dubbed a “better alternative to bitcoin”, Ripple aims to futurise global payments.

However, in recent years the company has been caught in the midst of a US Securities and Exchange Commission (SEC) filing, with its native cryptocurrency, XRP, struggling to reach past highs…for over four years.

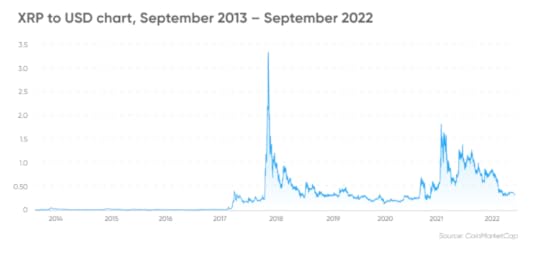

Down by 90.3 % since its 2018 all-time high of $3.3778, at the time of writing (5 September) the XRP to USD exchange rate stood at $0.3275. Can the token repeat the record levels, and what is the latest news on the SEC case?

What is XRP/USD and Ripple?Ripple was created in 2011 by engineers David Schwartz, Jed McCaleb and Arthur Britto. They began developing the XRP Ledger (XRPL), a decentralised, permissionless, open-source, public blockchain.

The Ripple platform is a payment settlement system and currency exchange network using XRP Ledger Consensus Protocol. The network prides itself in its transaction speed, which according to its website, can take between three and five seconds and has low transaction fees that are “typically” under $0.01.

Ripple’s distributed consensus mechanism uses designated servers called validators, who have to agree on the order and outcome of transactions on the platform to enable them. Transactions are made in XRP coins, the platform’s native cryptocurrency.

The token can be sent to other users directly without the need of a central intermediary. XRP coins are freely exchanged on the open market and used in the real world for enabling cross-border payments and microtransactions.

Upon the token’s launch, XRPL’s founders gifted 80 billion XRP to the company. Ripple has since put the majority in escrow. As of August 2022, 44bn tokens remain in escrow.

What is your sentiment on XRP/USD?XRP/USD price analysis

Unlike many of its rival cryptocurrencies that gained popularity in late 2021, XRP achieved its first success in the early months of 2018 as it was teaming up with a number of legacy financial institutions, like American Express and Santander. The token spiked to the all-time high of $3.3778 in January 2018, yet the rally was short-lived as XRP fell below $1 in late February.

After two years of fluctuating between $0.60 and $0.10, the XRP coin price rebounded to $1.8391 on 14 April 2021 amid wider cryptocurrency bull run.

Throughout the remainder of 2021, the XRP to USD chart suffered fluctuations, rising as high as $1.3894 at the start of September 2021 and dropping as low as $0.7993 by mid-December.

At the start of 2022, XRP was holding steady at $0.80. It dropped to $0.30 as Russia’s invasion of Ukraine and surging inflation started to affect broader cryptocurrency sentiment. As of 5 September, the current exchange rate of XRP to USD stood at $0.3275.

SEC’s case against Ripple

In December 2020, Ripple found itself in the midst of a SEC filing, which accused the company’s top executives, co-founder Christian Larsen and CEO Bradley Garlinghouse, of misleading XRP investors by selling $1.3bn worth of coins without reporting to the commission. The SEC had also accused the executives of profiting from the trade by around $600m.

In March 2022, the court denied the SEC’s request to strike Ripple’s fair notice defence, which argued that contrary to the case, the company did not receive a fair warning that its sales of XRP coins could be in violation of security laws.

In July 2022, Ripple won a ruling that will allow the company to access emails from the SEC about a 2018 speech where a former official declared that Ethereum was not a security. The evidence could help Ripple in arguing that XRP cannot be labelled as such. The SEC, however, continued to battle this ruling and filed a brief arguing that the speech drafts “are not relevant to any claim or defense in this case”.

On 19 August, Ripple filed a motion to seal the identities of non-parties, some company employees and the personal financial information of employees. The SEC replied, clarifying that in doing so, it “does not concede that the above categories of information should properly be sealed for summary judgement briefing, and reserves its rights to oppose similar sealing requests for summary judgement.”The judge granted the SEC’s request to file a 90-page long reply to its motion that seeks to exclude the testimony of Ripple Labs’ witnesses.

The outcome of the court proceedings could remain the key factor affecting the movements on the XRP chart. As of 5 September, analysts and investors await 9 September, when both parties are expected to seal any portion of the filings together with proposed redaction.

Responses to the motion must be submitted by 16 September. Motions for summary judgement are expected by 15 September, and any opposition to that must be received by 18 October and answered by 15 November. The coming months will be of great importance for Ripple enthusiasts.

“The ongoing, never ending and changing lawsuit is one of the key uncertainties. SEC has a different angled strategy against Ripple through Wahi complaint. This added insider trading allegations against two other Coinbase employees and put nine other cryptocurrencies as securities,” said Anndy Lian, chief digital advisor of the Mongolian Productivity Organisation.“If the SEC wins the case, this would set a precedent and would cause more problems for the crypto industry as a whole,” he told Capital.com.On 21 July, the SEC filed a complaint against Ishan Wahi, Coinbase’s manager in its assets and investing products division, and two other employees, accusing them of insider trading and securities fraud. In the filing, the commission noted that the nine coins Wahi and other defendants traded were “crypto asset securities”.

XRP to USD forecast for 2022 and beyond

Despite the latest downward price action, algorithm-based forecasting service Wallet Investor gave a bullish XRP to USD crypto exchange rate prediction as of 5 September. The site noted that XRP is “an outstanding long-term investment”, adding that it has a long-term earning potential amounting to 284.71%.

Based on its analysis of past price performance, Wallet Investor predicted that the token could trade at $0.517 in 2023 and reach $1.258 by 2027.

DigitalCoinPrice supported the positive XRP to USD future exchange rate forecast at the time of writing, expecting the token to grow to $0.48 by the end of 2022 and reach $1.50 by the end of 2025.

By the end of 2027, the site predicted that the exchange rate of XPR to USD could reach $1.63. The website’s long-term forecast for the token showed that the cryptocurrency could surge to $4.63 by 2030.

Mark Fidelman, founder of SmartBlocks, was bullish on XRP to USD exchange rate, yet noted that the outcome of the SEC case will play a crucial role in shaping Ripple’s future.

“If [Ripple wins] the lawsuit, it should be heading back up to over a buck by the end of year, maybe more…It’s more effective and more efficient than anything that the banks are doing, so it should scare the banks and should help crypto,” he told Capital.com.

Note that predictions about the future of XRP can be wrong. Forecasts and analyst expectations shouldn’t be used as a substitute for your own research. Always conduct your own due diligence looking at the latest news, price charts. technical and fundamental analysis.

Remember that past performance does not guarantee future returns. And never trade money that you cannot afford to lose.

Source: https://capital.com/xrp-usd-forecast-dollar-ripple-price

The post XRP to USD forecast: Can Ripple price finally reverse long-term downward trend? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Ethereum Merge’s impact on NFTs- Coming back? Maybe? Or maybe not?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Ethereum Merge’s impact on NFTs- Coming back? Maybe? Or maybe not?

The number of unique NFT buyers falls below 500,000. It seems like #EthereumMerge is the savior.

Ethereum merge and transition from proof-of-work to proof-of-stake (PoS) will further deliver changes to the NFT market. The Ethereum merge is expected to increase the diversification of Ethereum and revamp the tokenomics of the entire market. We could also see a short-term increase in NFT’s pricing.

Anndy Lian commented on his previous post on Anndy.com: The core message that I was trying to say is that the NFT market is at the rebuilding stage right now. The previous highs that were in the bull market are in a challenging stage. The prices were unsustainable, and it will continue this way as the macro environment is not looking too optimistic now.

There are many contributing factors to this current state but is this the end of the NFT markets? It is not.

Right now there are more projects in the markets working hard behind the scene working on content, books, music, and better gaming assets and experiences. The speculation market has died down, and this is actually very healthy for all of us to grow.

This is a time to go back to basics. We can look at the 5Ps of marketing- Product, Price, Promotion, Place, and People.

When we are in the bull market, whatever products can sell without doing anything. But in the current times, we need to look at the product. Is it value for money?

Pricing is another factor to look at. PFP in the good times can start at a 1 ETH floor price. We should watch our pricing more carefully right now. Take my NFT book, for example, I choose to launch it on Bybit NFT Marketplace at $2.99, not $29.99. This decision was made after looking at the market and the demand from my communities.

Lastly, I think people and community are what we should be building too. If you do not have this, this is the best time to look into it now. This will also help you to get better results when the market turns better.

Source: The Daily Forkast – September 2, 2022, presented by Joel Flynn.

The post Ethereum Merge’s impact on NFTs- Coming back? Maybe? Or maybe not? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 4, 2022

Anndy Lian Talks about his new book NFT: From Zero to Hero at Bitcoinlive

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Anndy Lian Talks about his new book NFT: From Zero to Hero at Bitcoinlive

Anndy Lian is an all-rounded business strategist in Asia. He has provided advisory across a variety of industries for local, international, public listed companies and governments. He is an early crypto adopter and experienced blockchain serial entrepreneur, book author, investor, board member and keynote speaker. He has launched his new book titled NFT: From Zero to Hero.

The book was first launched on Bybit NFT Marketplace. 8,000 copies of this book were sold out on 15th August 2022. He then launched it on Amazon Books and Google books subsequently.

He speaks to Nick from Bitcoinlive on his new book. Zero to Hero is a call to anyone and everyone excited about the prospect of the world of NFT. Bound by imagination only, the NFT space is still in its early days and early adopters can be a “hero” in their search for new possibilities.

They talked about:

– Are we missing out NFT copyrights?

– How is the NFT market is evolving?

– Should we be wary of NFT finance products?

– Is gaming sector the space to look out for?

– What are NFT utilities?

“Nft market is not dying and it will hold on for live.”

“NFT PFP collections are often the ones making the biggest headlines, but these are not what NFT is all about.”

– Anndy Lian

The post Anndy Lian Talks about his new book NFT: From Zero to Hero at Bitcoinlive appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

From Zero to Hero Podcast With Anndy Lian- Hosted by Briseman

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

From Zero to Hero Podcast With Anndy Lian- Hosted by Briseman

Anndy Lian, Author of NFT: From Zero to Hero was invited to Briseman Podcast on 3 September 2022.

Anndy Lian is an all-rounded business strategist in Asia. He has provided advisory across a variety of industries for local, international, public listed companies and governments. He is an early blockchain adopter and experienced serial entrepreneur, best-selling book author, investor, board member, and keynote speaker.

Started his cryptocurrency journey in 2013 and went full-time on blockchain in 2017; he is one of the experts you need to listen to. In his first book, titled “Blockchain Revolution 2030” and published by Kyobo, the largest bookstore chain in South Korea, NFTs are one of the core topics that he talked about.

The digital age comes with its own lexicon, a bewildering array of buzz words and acronyms designed to confuse as much as they are to inform. Many new terms have found their way into our everyday vocabularies, although the meanings often get confused and blurred. NFT is one of them. Anndy’s new book aims to address all these.

At the podcast, they talked about the contents of the book and Anndy’s opinion on the NFT industry.

– What are buyers looking for?

– What makes NFT popular?

– Is it profitable to invest in NFT?

– Is NFT just PFP?

NFT: From Zero to Hero is available on Amazon: https://www.amazon.com/gp/product/9811850887/ref=dbs_a_def_rwt_hsch_vapi_tpbk_p1_i0.

And if you want to experience firsthand on what NFT book is all about and what else it can do. Get yours on Bybit: https://www.bybit.com/en-US/nft/collection/detail?code=1006691081657516032.

“NFTs are slowly but surely becoming a part of our everyday lives.”

“Everyone is a hero.”

– Anndy Lian

The post From Zero to Hero Podcast With Anndy Lian- Hosted by Briseman appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 2, 2022

Going back to basics. Do I really need another picture of an ape? NFT market slumps in August

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Going back to basics. Do I really need another picture of an ape? NFT market slumps in August

The article did reflect some of my views but also did not. The core message that I was trying to say is that the NFT market is at the rebuilding stage right now. The previous highs that were in the bull market are in a challenging stage. The prices were unsustainable, and it will continue this way as the macro environment is not looking too optimistic now.

There are many contributing factors to this current state but is this the end of the NFT markets? It is not.

Right now there are more projects in the markets working hard behind the scene working on content, books, music, and better gaming assets and experiences. The speculation market has died down, and this is actually very healthy for all of us to grow.

This is a time to go back to basics. We can look at the 5Ps of marketing- Product, Price, Promotion, Place, and People.

When we are in the bull market, whatever products can sell without doing anything. But in the current times, we need to look at the product. Is it value for money?

Pricing is another factor to look at. PFP in the good times can start at a 1 ETH floor price. We should watch our pricing more carefully right now. Take my NFT book, for example, I choose to launch it on Bybit NFT Marketplace at $2.99, not $29.99. This decision was made after looking at the market and the demand from my communities.

Lastly, I think people and community are what we should be building too. If you do not have this, this is the best time to look into it now. This will also help you to get better results when the market turns better.

Anndy Lian

Do I really need another picture of an ape? NFT market slumps in AugustThe NFT hype from earlier in the year is dying off as the market continues its downward path into the final third of the year. Fire sale coming for apes and cats?

The number of unique non-fungible token (NFT) buyers in August fell below 500,000 for the first time in a year and extended the drop in purchasers to four consecutive months, according to NFT aggregation site CryptoSlam.

Due to an increase in Ethereum prices in early August, total sales rose to US$730 million from July’s US$650 million, but remain a long way short of this year’s January peak of US$4.5 billion.

Yehudah Petscher, NFT relations strategist for CryptoSlam, said the NFT market has caught up with the rest of the world, as traditional markets have been hammered by concerns about rising inflation and interest rates, as well as other global developments.

“People are being much more selective with what they buy and questioning, ‘Do I really want to buy this picture of an ape or a cat for $500?’” Petscher told Forkast in an interview. “You used to give no pause before and you would buy that and you were happy to. And now no, now you need a product. You need something more than just the picture.”

NFTs are regarded as a crucial component of the reimagined Internet of Web3 — in which gaming, social media and financial services are run through decentralized applications controlled by user’s wallets – so a lagging NFT market could hamper adoption.The previous high prices in the NFT market were unsustainable, said Anndy Lian, author of the new book “NFT: From Zero to Hero,” in an email response to questions. The “[NFT] environment is not looking too optimistic,” he said, though added that price retrenchments are also when companies build anew.

The MergeOne event on the horizon could further disrupt the NFT market — Ethereum’s Merge planned for later in September.

The Merge will see the world’s second-largest blockchain, which has a market cap of just under US$200 billion and accounted for almost 70% of all NFT transactions in August, move from a proof-of-work (PoW) consensus algorithm to proof-of-stake (PoS).

The buzz around the Merge, saw Ethereum prices almost double in a month to reach as high as US$2,022 in mid-August. Ethereum Classic, the original blockchain from which Ethereum was forked, also more than doubled in the same period to a five-month high of US$45.51.

Both have since fallen back, with Ethereum trading at US$1,587 on Friday in Asia and Ethereum Classic at US$32.67.

“The Merge will cause a short-term price increase in the markets [which] would also help the NFT market in general,” said Lian, adding that the positive impact may stretch for 3-6 weeks. But “I do not think the Merge will start another bull run because the [macro] market conditions do not allow that to happen.”Petscher said the Merge might “introduce a little chaos” to the market.

As part of the Merge, all NFTs currently hosted on the PoW blockchain must be replicated on the new PoS network to become the “official” versions of the NFTs.

OpenSea, by far the industry’s largest marketplace, announced Thursday that they will only be supporting the PoS versions of NFT collections, but that doesn’t mean a market for the PoW versions won’t emerge, Petscher said.

“The original minted version that was rather historic and birthed this scene — that’s important to me,” said Petscher, “so, I would try to collect that if I could, and I wonder if we’ll see some of those on discount.”Deja vu?This situation is not without precedent. A debate emerged earlier this year surrounding the authenticity of CryptoPunks – one of the market’s leading collections with over US$2 billion in sales – as the current collections are actually re-issues designed to fix a bug in the original run, now known as V1 CryptoPunks.

While the CryptoPunks creators, Lava Labs, originally sought to discredit the V1 collection, collectors pushed back and now V1 CryptoPunks are traded in their own right as a piece of NFT history — though with much smaller total sales of US$75 million.

Aside from the Merge, Petscher said it will take a significant catalyst from outside the NFT industry to shake off the current market slump. One example could be Apple Inc. releasing its long-awaited virtual reality (VR) headset, which Petscher says has huge potential for NFT integration.

He also said significant advancements in blockchain protocols are needed to onboard more users to allow the industry to grow as most platforms remain difficult for newcomers to navigate and become fully engaged.“It’s going to require something big like that,” he said. “Unless, of course, the world changes; if suddenly the war ends and the traditional stock market starts improving, that would lead to the good times again.”

“But I don’t think anybody sees that on the horizon right now.”

Source: https://forkast.news/picture-ape-nft-market-slumps-august/

The post Going back to basics. Do I really need another picture of an ape? NFT market slumps in August appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 1, 2022

From centralisation to decentralisation; how blockchain-oriented fintech can benefit the financial sector

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

From centralisation to decentralisation; how blockchain-oriented fintech can benefit the financial sector

Additional comments.

Blockchain has the potential to digitize the entire trade finance lifecycle while increasing security and efficiency, lower fraud, human error, and overall counterparty risk.

From a productivity stand point, blockchain intervention allows the whole banking process to be automated within a given set of variables and guidelines and certain banking functions can work 24/7 instead of 9 to 5. In the example of payment, the current system for cross border transactions can take up to a week to clear, with the help of blockchain the amount can be cleared instantly.

On top of everything, it can enable more transparent governance as all the transactions are trackable and traceable on the blockchain.

Anndy Lian

—-

From centralisation to decentralisation; how blockchain-oriented fintech can benefit the financial sectorAs stated by experts, blockchain has the capability to digitise the trade finance ecosystem with increment in security and efficiency, reduction in fraudulent practices and human errors, and overall fall in counterparty risksFrom what it seems one of the burgeoning technology blockchain is expected to have an impact across sectors including finance. Insights from a study conducted by Market Research Future, a market analysis company, have shown that blockchain within the fintech market will be valued at $31.4 billion by 2030, thereby clocking a 47.90% compound annual growth rate (CAGR). “Blockchain’s influence on the fintech sector can play a key role in boosting privacy and reduction of risks, while transactions are conducted. With no intermediaries involved, customers can conduct transactions at a reduced cost. As the financial industry starts to use blockchain, the potential to provide reliable and transparent transactions will become prevalent,” Prashant Kumar, founder, and CEO, weTrade, a cryptocurrency startup, told FE Digital Currency.

As stated by experts, blockchain has the capability to digitise the trade ecosystem with increment in security and efficiency, reduction in fraudulent practices and human errors, and overall fall in counterparty risks. A blog by International Business Machines (IBM) Corporation, a technology corporation, mentioned that 54% of banks surveyed said that transformative technologies such as blockchain, digital trade, and online trade platforms are priority areas of development with regard to future growth. “From a productivity standpoint, blockchain’s intervention will allow the banking system to be automated within a given set of variables, to allow them to function 24×7. Moreover, it can enable transparent governance, as transactions will become traceable on blockchain,” Anndy Lian, chief digital advisor, Mongolian Productivity Organisation, a governmental organisation, said.

Currently, market behaviour suggests that blockchain-enabled fintech can benefit the banking and finance sector through a faster procession of digital securities, and help with digitisation of financial instruments to ensure connectivity between products, services, assets, and holdings. Data from Jupiter Research, a digital technology market research company, recommends that blockchain deployments will enable banks to realise savings on cross-border settlement of transactions of up to $27 billion by the end of 2030, through cost reduction of more than 11%. “Blockchain has demonstrated disruptive economics, to create cost advantages against different technologies. I believe financial institutions will acknowledge that use of distributed ledger technology (DLT) protocol will help them save billions of dollars over the years,” Amanjot Malhotra, country head- India, Bitay, a cryptocurrency exchange, noted.Source: https://www.financialexpress.com/digital-currency/how-blockchain-oriented-fintech-can-benefit-the-financial-sector/2651346/

The post From centralisation to decentralisation; how blockchain-oriented fintech can benefit the financial sector appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

August 30, 2022

The X-to-Earn model: Eat, sleep, do almost anything and get paid in crypto

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

The X-to-Earn model: Eat, sleep, do almost anything and get paid in crypto

Are you a good runner? Or eater? Or sleeper? Chances are whatever you’re good at, there’s a Web3 project out there to reward you in crypto. But do the tokenomics stack up?

Are you a good runner? Or eater? Or sleeper? Chances are whatever you’re good at, there’s a Web3 project out there to reward you in crypto. But do the tokenomics stack up?Axie Infinity — a non-fungible token-based online video game that’s generated over US$4 billion in secondary NFT sales — is credited with kicking off the so-called “play-to-earn” (P2E) craze, allowing gamers to earn money while playing. While the Axie hype has somewhat died down, it also spawned a series of copycat projects that pay users to perform everyday activities.

These projects have developed into an industry of their own; a sort of “X-activity-to-earn” (X2E) model, now including tie-ins with brands from Asics to European soccer clubs, paying users in cryptocurrency for running, eating or even sleeping.

Perhaps not surprisingly, questions are being raised about the economic principles many of these projects are founded on.

“The problem with some of these X2E models is that it seems like a really good innovation, but then it is just purely a Ponzi [scheme],” said Anndy Lian, author of the new book “NFT: From Zero to Hero,” in an interview with Forkast, though he did not mention any by name. “And it’s actually very disturbing, to be really honest.”

Without ongoing revenue to support what is being paid out, Lian said, the X2E model risks becoming an unsustainable compensation structure, relying on the hope that more people will come in to “pay” for the tokens that were previously dropped.

There were similar accusations leveled at Axie Infinity after a period of explosive growth failed to generate earlier returns for its users, as its native token SLP is now trading at US$0.004 at press time after reaching as high as US$0.41 in May 2021.

Running tokenomicsOne of the more popular variations of this new industry model is the “Move-to-Earn” (M2E) project StepN, which pays users in cryptocurrency for walking, jogging or cycling by tracking their movements via GPS on their phone.

To participate in the project, users buy NFT sneakers and hold them in their wallets on their phones when they go for a walk and are then compensated for the exercise in the project’s native currency, Green Satoshi Tokens (GST).

Users then cash out GST for profit or invest it back into the project to mint additional NFTs for other users to buy.

Brian Lu, founding partner of investment fund Infinity Ventures Crypto, is more optimistic about the outlook for these projects than Lian, however, telling Forkast in an interview there are ways such projects can be successful.

“There’s always going to [need to] be people to support the token or the token has to have some type of utility [for the project to work],” he said.

StepN does this by allowing users to cash out their GST for profit or by investing it back into the ecosystem to mint more sneaker NFTs. This was the tokenomics model initially adopted by Axie Infinity, which allowed users to cash out their SLP or to re-invest it back to create more “Axies” — Pokémon-like creatures that players bred and battled to earn more SLP.

After launching in December, GST reached a high of US$9.03 in late April before the crash along with the rest of the crypto market in May. Despite tie-ins with sports-brand Asics and Spanish soccer club Atlético de Madrid, GST had fallen to under US$1 by early June, and has been trading under US$0.10 since early July.

Sleeping on the jobPositioning itself in direct response to the Move-to-Earn projects, Gang Azit Social Club (GASC) has taken a different approach, and wants to remind users that it’s important for one’s mental health to take a break and relax from time to time, and incentivizes this practice by paying them to do just that.

Calling itself a “Relax-to-Earn” project, GASC detects when users are within a predetermined zone using GPS and pays them in the project’s HIPS token if they press a “relax” button on their phone while in the space.

If anyone needs an incentive to eat, Esca — an online marketplace for food consumers and vendors — promises to pay customers, restaurants and at-home chefs in both Bitcoin and USDC. According to its website, Esca thinks the commissions charged by most food delivery platforms are too high and is using cryptocurrency to balance the equation.

So many projects have popped up promising to pay users to sleep that there is even its own category of finance for the industry — SleepFi.

The Sleepee app pays users based on their sleep quality score in its native currency, which can be converted to buy products or services in their store. Even the Move-to-Earn app MetaGym offers a SleepFi feature that pays users in its native token that can be spent in-app or cashed out for USDC.

The future of Web3 and gamingMeasuring the success of these projects over the past few months has been difficult amid the broader crypto downturn, which has seen even well-established crypto funds and businesses file for bankruptcy or needing a bailout.

If the situation doesn’t improve soon, Lu says there are other options available to such projects.

“These X2E projects that are coming up [are] going to start learning to advertise their users and their user’s behavior [and] user data to marketing companies that are willing to pay for it,” said Lu, explaining this process will become more commonplace as brand tie-in continues to gain traction.

Selling user data may seem against the ethos of Web3, which is often touted to offer a new incentive model to break away from the data mining method of business which has led to massive wealth concentration from a few giant tech companies.

But Lu says this is only using data that is publicly available on the blockchain anyway.Back to the genre that started it all, Lu says the industry has learned its lesson from the short-lived success of Axie Infinity and is shifting from Play-to-Earn to Play-and-Earn, or Web 2.5.

These projects are putting gameplay back at the center of the game, with the option to earn money — sometimes even in fiat — a bonus element rather than making a game whose main draw card is earning.

Lian is hopeful these types of games can still survive in the meantime, but says it will be a long time before the mainstream gaming industry adopts Web3 in any meaningful way.

“I don’t think the super app is coming anytime soon,” said Lian, who explained the technology is there but the US$300 billion a year gaming industry has little incentive to change. “[Game studios] might not be agreeable to how it is actually going to help them since they are really making millions of dollars in revenue every year.”

Source: https://forkast.news/x-to-earn-model-eat-sleep-anything-paid-crypto/

The post The X-to-Earn model: Eat, sleep, do almost anything and get paid in crypto appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Why are people earning more on blockchain?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Why are people earning more on blockchain?

Why are people earning more on blockchain? Blockchain could slash the cost of transactions and reshape the economy.

How does X-to-earn work? Take play-to-earn as an example. Through the lens of aligned incentives, the concept of play-to-earn games on a blockchain excites venture capitalists. The play-to-earn model on its own is unsustainable. Given the nature and what the business model is like, it creates an unsustainable pyramid scheme-like system where old player are given tokens that is valuable if there is a continuous stream of new players buying afterwhich.

Traditional hedge funds are slowly embracing cryptocurrency investments but are keeping their exposure limited. According to a PwC report, of traditional hedge funds surveyed, 38% are currently investing in digital assets, compared to 21% a year ago.

The following experts share their views on the topics:

– Brian Lu, Founding Partner, Infinity Ventures Crypto

– Anndy Lian, Book Author, NFT: From Zero to Hero

– Anthony Demartino, CEO, Matrixport US

00:00 – Introduction

01:34 – What’s driving the rise of X-to-earn?

09:56 – Traditional hedge funds increasing crypto exposure.

This segment is recorded and produced by The Daily Forkast on August 30, 2022, presented by Joel Flynn for the latest in blockchain & crypto news.

The post Why are people earning more on blockchain? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

August 27, 2022

Panel Discussion on DAOs- Can DAO be the mainstream?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Panel Discussion on DAOs- Can DAO be the mainstream?

A decentralized autonomous organization (DAO) is a system developed to distribute decision-making, management, and entity ownership. It is an entity with no central leadership. Decisions get made from the bottom-up, governed by a community organized around a specific set of rules enforced on a blockchain. DAOs are internet-native organizations collectively owned and managed by their members.

Ideally, DAOs are being used for many purposes such as investment, charity, fundraising, borrowing, or buying NFTs, all without intermediaries. The panel discussion will share their point of view on DAOs.

1. 각자 DAO는 무엇인지 정의해 달라.

What is DAO. Each of you defines DAO.

2. 인간은 사회적 동물이다. 그리고 조직을 구성해 왔다. 그리고 그 조직은 언제나 리더가 이끌어왔다. 리더가 없는 조직, DAO 구현 가능할까.

Humans are social animals, and have formed organizations from the past. Any kinds of organizations always have a leader. Is it possible an organization without a leader (a.k.a DAO) in reality?

3. 다오의 의사결정과정은 다른 조직에 비해 상대적으로 비효율적이다. 그러한 비효율성에도 불구하고 다오가 주요한 조직의 형태가 될 수 있을까.

Decision making process of DAO is relatively inefficient than normal organizations. Can DAO be the mainstream forms of organizations, even if that kind of inefficiency?

4. 지금까지 유의미하게 성공한 다오가 있을까. 있다면 무엇이며, 없다면 그 이유는 뭘까.

5. 가장 극단적으로 중앙화된 조직의 형태 중 하나가 국가가 아닐까 한다. 그렇다면 국가와 다오는 공존할 수 있을까.

I think one of the extremely central organization forms is government. If so, can the government and DAOs coexist?

“Human are social animals ….. many DAOs effectively are centralized if you look at how they execute their decision process. Snapshot proposals are bullshit. A few calls and a few meetings outside the decentralized sphere changed the decisions. DAO can be very efficient, especially the single-purpose ones.

Yes, government and organizations can surely coexist vis DAOs. Look at Korea. The association/ lobby groups are a kind of DAO. Decisions are made by the community by votes. They lobby against the government for certain matters. Isn’t this the same as what we see in the crypto native space?” Anndy Lian, Book Author “NFT: From Zero to Hero” commented.

This event is held during the Korea Blockchain Week 2022. This sub-event brought many local Korean experts together.

When a DAO achieves success, it can then increase the value of the tokens. This helps tackle the issues related to generating capital. Anndy also mentioned that DAOs should find self-sustaining revenue and income.

Let’s DAO be a decentralized autonomous organization and not DOA (dead on arrival).

The post Panel Discussion on DAOs- Can DAO be the mainstream? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

August 24, 2022

Factors impacting crypto market with Anndy Lian | Crypto Masters | 3.0 TV

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Factors impacting crypto market with Anndy Lian | Crypto Masters | 3.0 TV

In a conversation with Anndy Lian of the Mongolian Productivity Organization, we discussed issues with the cryptocurrency market and a potential slowdown in the U.S. economy.

Cryptocurrencies are trying to recover from a rout this year that’s wiped more than 60% of its value since hitting a high in November 2021. Virtual coins were battered by the Fed’s shift to monetary tightening and ensuing leveraged blowups, such as crypto hedge fund Three Arrows Capital. To explain the current situation of the cryptocurrency market and its way forward we have invited a special guest to watch this special interaction only on 3.0 TV.

3.0 TV is a news channel which gives you the latest news on blockchain and cryptocurrency on a daily basis which include Bitcoin (BTC), Ethereum, LUNA, UST, DogeCoin, etc. We also give information related to NFTs, Metaverse, crypto scams and other educational information.

The post Factors impacting crypto market with Anndy Lian | Crypto Masters | 3.0 TV appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.