Anndy Lian's Blog, page 10

September 11, 2025

The calm before the surge: Fed easing, crypto clarity, and markets at a crossroads

Anndy Lian

The calm before the surge: Fed easing, crypto clarity, and markets at a crossroads

The softer-than-expected Producer Price Index data for August, which showed a 0.1 per cent month-over-month decline, has fuelled expectations for a 25 basis point rate cut at the upcoming Fed meeting. July’s figures also underwent a downward revision, reinforcing the narrative of cooling inflation pressures that could ease the burden on consumers and businesses alike.

This development arrives at a pivotal moment, with core PPI rising 2.8 per cent year-over-year, below forecasts, suggesting that demand may soften further in the coming months. Traders now price in the rate cut with near certainty, viewing it as a supportive measure for economic growth without igniting undue inflationary risks.

This measured approach by the Fed strikes a balance, preventing overly aggressive easing that might destabilise the dollar while providing enough stimulus to sustain the ongoing recovery.

Legal twist in Fed leadershipAmid this backdrop, a notable legal twist has emerged in the Federal Reserve’s leadership dynamics. A US district court granted a temporary injunction blocking President Trump’s attempt to remove Fed Governor Lisa Cook, allowing her to remain in her position during ongoing legal proceedings. The ruling, issued by Judge Jia Cobb, underscores the protections embedded in the Federal Reserve Act, which permits removal of governors only for cause, though the term lacks a precise definition.

Cook, appointed during the prior administration, has advocated for policies emphasising economic equity and data-driven decisions, often clashing with the current White House’s preferences. The administration plans to appeal, but for now, this decision maintains continuity at the Fed, potentially averting disruptions ahead of key policy announcements.

From my perspective, such interventions highlight the importance of institutional independence, ensuring that monetary policy remains insulated from short-term political pressures, which ultimately benefits market stability.

Market reactions in equities and bondsUS equities reflected this buoyant sentiment, with major indices posting gains on September 10, 2025. The S&P 500 climbed 0.3 per cent to close at a record high of 6,512.61, driven by strength in the energy sector as oil prices rose. The Nasdaq Composite edged up 0.03 per cent, also hitting fresh peaks, as technology stocks were buoyed by anticipation of lower borrowing costs.

In contrast, the Dow Jones Industrial Average slipped 0.5 per cent, weighed down by select under-performers in industrial and consumer goods. Energy stocks led the advance, capitalising on heightened geopolitical tensions that pushed crude prices higher. Bond markets echoed this positivity, with the two-year Treasury yield dropping 1.5 basis points to 3.544 per cent and the 10-year yield falling 4.3 basis points to 4.045 per cent following robust demand at a recent note auction.

These movements signal investor confidence in a soft landing scenario, where inflation tames without derailing growth. This is a healthy rotation, with bonds attracting inflows as equities consolidate gains, setting the stage for sustained upward momentum if the Fed delivers as expected.

Currency and commodity movementsCurrency and commodity markets displayed mixed but generally stable behaviour.

The US Dollar Index ended flat at 97.78, hovering near recent lows as rate cut bets tempered its appeal. Gold consolidated around US$3,640 per ounce, maintaining its safe-haven allure amid global uncertainties, though it faced mild profit-taking after recent highs. Brent crude advanced 1.7 per cent, climbing toward US$67 per barrel, propelled by escalating tensions between Russia and Poland alongside persistent Middle East instability.

These dynamics underscore the interplay between geopolitics and energy supply, with potential disruptions keeping prices elevated. Asian equity indices showed varied performance in early trading on September 11, while US futures pointed to a higher open, suggesting the positive mood could spill over.

In my opinion, commodities like oil and gold serve as barometers for broader risk appetite, and their current trajectories align with a world navigating recovery amid lingering threats.

SEC’s pivot on crypto regulationShifting focus to the regulatory landscape, SEC Chair Paul S. Atkins delivered a pivotal address at the Inaugural OECD Roundtable on Global Financial Markets in Paris on September 10, 2025, marking a transformative moment for digital assets. Atkins boldly proclaimed that crypto’s time has come, critiquing past reliance on enforcement actions that he argued stifled US competitiveness and drove innovation abroad. He highlighted how entrepreneurs wasted resources on legal defences rather than business development, labelling that era as history.

Introducing Project Crypto, Atkins outlined a shift toward a structured regulatory framework, promising transparent and predictable rules to foster domestic growth. This initiative aligns with President Trump’s directive to position America as the global leader in cryptocurrency, drawing on the President’s Working Group on Digital Asset Markets.

Key elements include modernising securities rules for blockchain, ensuring on-chain capital raising, and declaring that most crypto tokens do not qualify as securities. Atkins advocated for super-app platforms that integrate trading, lending, and staking under a single regulatory umbrella, with flexible custody options to empower users.

He praised Europe’s MiCA framework and called for international collaboration, emphasising the need for minimal intervention to protect investors while fostering competition. Reactions on social media platforms like X have been overwhelmingly positive, with users hailing it as a new dawn for the industry.

In my view, this pivot represents a long-overdue acknowledgment of crypto’s potential, rectifying years of adversarial oversight that hampered progress. By prioritising clarity over confrontation, the SEC could unlock trillions in economic value, attracting talent and capital back to US shores and solidifying the nation’s leadership in fintech.

Bitcoin’s technical and market outlookThis regulatory optimism has invigorated the cryptocurrency market, particularly Bitcoin, which trades above US$114,000 as of September 11, 2025, reflecting a 2.5 per cent gain over the past 24 hours. Technical indicators bolster a bullish outlook, with Bitcoin reclaiming its 7-day simple moving average at US$111,475 and 30-day exponential moving average at US$112,609. The MACD histogram has turned positive at +466.15, signalling building momentum, while the RSI-14 sits at 54.32, indicating neutral territory without overbought risks.

Historic Bollinger Bands have tightened to extreme levels, often preceding significant volatility. A completed cup-and-handle pattern suggests upward breakout potential. A shakeout pattern analysis points to the next milestone around US$130,000, with weakening resistance levels paving the way.

Institutional demand for Bitcoin ETFs continues to rise, countering the classic bull cycle correction phase. Holding above the 61.8 per cent Fibonacci retracement at US$113,836 affirms bullish control, and a close over US$115,864 could propel prices toward the US$120,000 to US$124,457 resistance zone. However, trading volume, up only 19.88 per cent from the 24-hour average, warrants caution regarding the rally’s sustainability. Discussions on X echo this sentiment, with analysts predicting surges to US$300,000 based on these metrics.

Personally, I align with the user’s prediction of US$150,000 by year-end, viewing it as achievable given the confluence of regulatory tailwinds, technical setups, and macroeconomic easing. Yet, I temper enthusiasm with realism, noting that low volumes could invite pullbacks if external shocks arise.

Final thoughtsLooking ahead, the interplay between these elements paints a promising picture for global finance. The Fed’s impending rate cut, combined with the SEC’s pro-crypto stance, could catalyse a virtuous cycle of investment and innovation. Bitcoin’s trajectory, supported by robust fundamentals, positions it as a bellwether for digital assets, potentially drawing in more mainstream adoption.

Challenges remain, including geopolitical risks that buoy oil but unsettle equities, as well as the ongoing legal battles at institutions such as the Fed. Nevertheless, the current buoyancy in risk sentiment feels grounded in data rather than hype.

I believe this moment heralds a maturation phase for crypto, where regulation enhances rather than hinders progress. If Project Crypto delivers on its promises, the US could indeed become the epicentre of blockchain advancement, benefiting investors, entrepreneurs, and the economy at large. The path forward demands vigilance, but the foundations appear stronger than ever.

The post The calm before the surge: Fed easing, crypto clarity, and markets at a crossroads appeared first on Anndy Lian by Anndy Lian.

September 9, 2025

The Fed, tariffs, and digital assets: What investors are watching

Anndy Lian

The Fed, tariffs, and digital assets: What investors are watching

Investors appear to shrug off the ongoing global uncertainties, focusing instead on positive economic signals and the prospect of monetary policy easing from central banks. This resilience comes at a time when the world economy navigates a complex landscape of inflationary pressures, supply chain disruptions, and shifting alliances.

Markets have demonstrated an ability to adapt, with equity indices pushing higher and volatility remaining contained. Yet, beneath this calm surface lies a web of risks that could unsettle the balance if not managed carefully. The ongoing conflicts in regions like Ukraine and the Middle East add layers of unpredictability, influencing everything from energy prices to investor confidence.

Despite these challenges, the broader appetite for risk assets suggests that participants believe in the underlying strength of global growth, particularly in developed economies.

The latest data from the US Bureau of Labour Statistics has painted a clearer picture of the labour market’s trajectory, revealing a significant downward revision in payroll numbers. Officials adjusted the figures by 911,000 jobs for the 12-month period ending in March, exceeding estimates of a 700,000 reduction.

This equates to roughly 76,000 fewer jobs per month than previously reported, signalling a softer employment landscape than many had anticipated. Such revisions often stem from more comprehensive data sources, like tax records, which provide a fuller view of hiring trends. This adjustment has reinforced expectations that the Federal Reserve will act decisively to support the economy, with a rate cut appearing imminent at the next meeting.

Lower interest rates typically stimulate borrowing and investment, helping to sustain growth amid signs of cooling. However, this data also highlights vulnerabilities, as slower job creation could translate into reduced consumer spending if not offset by wage gains or other supports.

Analysts have noted that while the revision implies average monthly gains of about 71,000 jobs, the overall labor market remains robust by historical standards, avoiding the sharp contractions seen in past downturns.

Tariff escalation and trade tensionsPresident Trump’s escalation of tariff threats has introduced fresh volatility into international trade relations, targeting key players like India and China while proposing up to 100 per cent duties on Russia to pressure it into de-escalating tensions with Ukraine.

This move, contingent on similar actions from the European Union, aims to use economic leverage to influence geopolitical outcomes. Tariffs of this magnitude could disrupt global supply chains, raising costs for importers and potentially slowing economic activity in affected sectors.

For instance, India’s role as a major processor of Russian oil has drawn scrutiny, with US imports of these products highlighting the interconnected nature of energy markets. Critics argue that such policies risk retaliatory measures, echoing the trade wars of previous years that hampered growth. Russia has responded by downplaying the threats, suggesting efforts to strengthen ties with alternatives like China and India.

This tariff strategy reflects a broader shift toward protectionism, which could undermine multilateral efforts to resolve conflicts. While intended to bolster US negotiating power, the approach may strain alliances and complicate recovery in a post-pandemic world still grappling with inflation and debt.

Equity market rally on Fed hopesUS equities have surged to new record highs, buoyed by the payroll revision that has heightened anticipation of Federal Reserve intervention to prop up the economy. The S&P 500 advanced 0.3 per cent, the Nasdaq gained 0.4 per cent, and the Dow Jones rose 0.4 per cent, reflecting broad-based optimism across sectors.

Technology stocks led the charge, as investors bet that lower borrowing costs would benefit growth-oriented companies. This rally occurs against a backdrop of solid corporate earnings and improving consumer sentiment, though some caution that valuations are stretched. The market’s reaction underscores a belief in a soft landing, where the Fed engineers a slowdown without tipping into recession.

Historical precedents show that rate cuts often ignite equity booms, but they also carry risks if underlying economic weaknesses persist. With futures indicating mixed openings, traders are closely monitoring upcoming data releases for confirmation of this trajectory.

Bond yields and dollar movementsBond yields have rebounded after a brief dip, with the 2-year Treasury yield climbing 7.2 basis points to 3.558 per cent and the 10-year yield up 4.8 basis points to 4.088 per cent. This movement suggests that investors are adjusting to the likelihood of a rate cut while pricing in persistent concerns about inflation. Higher yields typically signal expectations of stronger growth or stickier prices; however, in this context, they may reflect a normalisation following recent declines.

The dynamics of the yield curve play a crucial role in banking profitability and lending activity, influencing everything from mortgages to corporate debt. As the Fed prepares to ease, these shifts could ease financial conditions, encouraging investment. However, if yields rise too sharply, they might tighten conditions prematurely, countering the central bank’s intentions.

The US Dollar Index strengthened 0.3 per cent to 97.79, benefiting from safe-haven flows amid global uncertainties. This appreciation pressures emerging markets, making dollar-denominated debt more expensive to service. Gold, conversely, retreated 0.3 per cent to US$3,674 per ounce, as the stronger dollar and rising yields diminished its appeal as a non-yielding asset.

Brent crude oil edged up 0.6 per cent, driven by escalating tensions between Israel and Qatar, which raise fears of disruptions in key supply routes like the Strait of Hormuz. Oil’s sensitivity to geopolitical events underscores its role as a barometer for global stability, with prices fluctuating based on perceived risks to production and transit.

Asian equity indices opened mostly higher today, extending the positive momentum from Wall Street. This uptick reflects regional resilience, though concerns over trade tariffs linger. US equity futures point to a mixed start, suggesting caution as investors digest the latest developments.

Metaplanet expands Bitcoin strategyTurning to the cryptocurrency space, Japan-based Metaplanet has announced plans to issue 385 million new shares, aiming to raise approximately US$1.4 billion to fuel its Bitcoin acquisition strategy. The company priced the shares at ¥553 each, upsizing from an initial 180 million shares, with proceeds primarily allocated to purchasing Bitcoin and enhancing its income-generation operations.

As of September 1, Metaplanet holds over 20,000 Bitcoins, accumulated since early 2024, and has generated significant revenue from Bitcoin options trading, reporting ¥1,904 million in the second quarter of 2025. This move positions Metaplanet as Asia’s equivalent to MicroStrategy, emphasising Bitcoin as a core treasury asset.

The firm’s strategy includes using earnings to pay dividends on preferred shares, blending yield generation with cryptocurrency holding. Institutional interest, such as a US$30 million investment from KindlyMD’s subsidiary Nakamoto, underscores growing confidence in this approach.

Metaplanet’s actions highlight a broader trend where corporations integrate digital assets into balance sheets, seeking inflation hedges and growth potential.

Bitcoin and Ethereum stanceBitcoin’s price path depends on a dynamic interplay between institutional adoption and regulatory advancements. Spot Bitcoin ETFs have seen inflows of US$14.8 billion year-to-date, providing a buffer against selling pressures and indicating sustained demand from traditional finance. Legislative efforts to establish a US Bitcoin reserve, holding around 198,000 BTC, could solidify its status as a strategic asset, anchoring long-term value.

Technical upgrades like BIP-119, which introduces covenants for enhanced scalability and security, are under debate and may reach consensus by year’s end, potentially reshaping Bitcoin’s utility. These factors collectively suggest Bitcoin is maturing beyond speculative trading, evolving into a foundational element of global finance.

Ethereum has encountered resistance in its recent price movements, declining below US$4,450 and consolidating around key levels. The asset struggles to breach US$4,400, trading below this mark and the 100-hourly simple moving average. A bearish trend line forms resistance at US$4,340 on the hourly chart, with immediate hurdles at US$4,350 and US$4,380. If Ethereum clears these, it could initiate a recovery wave, targeting higher zones.

However, failure to do so might lead to further tests of support near US$4,260. Analysts predict Ethereum could fluctuate between US$4,000 and US$5,000 in September 2025, driven by network upgrades and institutional interest. The cryptocurrency’s performance ties closely to broader market sentiment, with potential for upside if rate cuts materialise and DeFi adoption accelerates.

Outlook and risks aheadIn my view, the current market environment demonstrates a remarkable capacity for adaptation in the face of adversity. Equities reaching records despite downward data revisions and tariff escalations point to a collective bet on central bank support and economic resilience. The Fed’s likely intervention could extend this bull run, but overreliance on monetary easing risks inflating asset bubbles.

Geopolitically, Trump’s tariff tactics, while bold, may backfire by fragmenting trade and inviting retaliation, reminiscent of past protectionist pitfalls that deepened downturns. On the crypto front, initiatives like Metaplanet’s aggressive Bitcoin stacking and potential US reserves signal a paradigm shift, where digital assets transition from fringe to mainstream. Ethereum’s technical challenges notwithstanding, the sector’s institutional inflows and innovations bode well for long-term growth.

Overall, while short-term volatility looms, particularly with September’s historical weakness, the foundational trends favor cautious optimism. Investors who navigate these waters with diversified strategies stand to benefit, as the interplay of policy, technology, and sentiment continues to shape outcomes in unpredictable ways. This moment underscores the importance of vigilance, as today’s robustness could swiftly give way to tomorrow’s corrections if key supports falter.

Source: https://e27.co/the-fed-tariffs-and-digital-assets-what-investors-are-watching-20250910/

The post The Fed, tariffs, and digital assets: What investors are watching appeared first on Anndy Lian by Anndy Lian.

Bitcoin as a Macro Hedge in a Fracturing Fiat World

Anndy Lian

Bitcoin as a Macro Hedge in a Fracturing Fiat World

In a world where fiat currencies face unprecedented erosion from inflation, geopolitical brinkmanship, and central bank overreach, Bitcoin has emerged as a compelling—if imperfect—tool for strategic asset allocation. The cryptocurrency’s role as a macro hedge has evolved dramatically since 2020, reflecting both its growing institutional legitimacy and the persistent challenges of volatility and regulatory uncertainty.

Bitcoin’s Dual Identity: Risky Asset or Inflation Hedge?Bitcoin’s performance during periods of monetary instability reveals a duality. In 2020–2021, its price surged alongside inflation expectations, peaking at $109,300 amid pandemic-era stimulus measures [1]. This suggested a potential role as an inflation hedge. However, the narrative shifted in 2022, when rising interest rates triggered a 60% correction in Bitcoin’s price, mirroring the behavior of equities and tech stocks [1]. By 2023–2025, Bitcoin’s correlation with stock indices like the S&P 500 strengthened, while its link to inflation indicators weakened [1]. Data from Glassnode confirmed that Bitcoin’s correlation with the U.S. CPI index in 2024–2025 averaged just 0.15, underscoring its identity as a risk-on asset rather than a traditional safe haven [1].

Ask Aime: Is Bitcoin a reliable hedge against inflation or a risky asset?

Yet, Bitcoin’s utility as a hedge persists in localized contexts. In hyperinflationary economies like Argentina and Turkey, it has served as a de facto store of value, preserving purchasing power when local currencies collapsed [1]. This duality—global risk asset and local inflation hedge—reflects Bitcoin’s unique position in a fragmented financial landscape.

Strategic Allocation in a Fracturing Fiat WorldThe 2025 macroeconomic environment has accelerated Bitcoin’s integration into institutional portfolios. Over 1,000 corporations and investment firms now hold Bitcoin as part of their treasuries, including the U.S. government’s newly established Strategic Bitcoin Reserve [1]. This shift is driven by Bitcoin’s fixed supply of 21 million coins, which contrasts sharply with the expanding money supply of fiat currencies and the low yields of U.S. Treasuries [1].

Bitcoin’s programmable scarcity and global liquidity make it a compelling complement to traditional assets. While U.S. Treasuries offer stability, their appeal has waned as the Federal Reserve’s balance sheet expanded to $9 trillion, eroding purchasing power [1]. Meanwhile, gold—long the benchmark for safe-haven assets—faces competition from Bitcoin’s digital accessibility and regulatory progress. The approval of U.S. spot Bitcoin ETFs in 2024, for instance, injected $132 billion in inflows, signaling growing institutional confidence [6].

Geopolitical Catalysts and Macroeconomic TailwindsBitcoin’s performance in Q3 2025 was shaped by a volatile geopolitical backdrop. A 30% price slump in early April followed escalating tariff tensions and Middle East conflicts, but the asset rebounded sharply in May as negotiations eased and the Fed signaled rate cuts [3]. This resilience highlights Bitcoin’s sensitivity to risk-on/risk-off sentiment, a trait shared with equities but absent in traditional inflation hedges like gold [5].

Central bank liquidity also played a critical role. Historical patterns show Bitcoin typically follows global liquidity trends with a two-month lag [3]. In Q3 2025, liquidity stabilized below $30 trillion, supporting Bitcoin’s consolidation between $100,000 and $120,000 [3]. Meanwhile, institutional adoption—driven by 401(k) integration and corporate treasury strategies—provided structural support, with analysts projecting a $190,000 price target by year-end [4].

Bitcoin vs. Gold: A New Era of DiversificationWhile gold remains a cornerstone of central bank reserves—valued at $2.2 trillion in Q1 2024—Bitcoin’s rise as a strategic asset reflects changing investor priorities [6]. Both assets outperformed traditional investments in 2025, with Bitcoin peaking at $122,000 and gold hitting $3,433 per ounce [2]. However, Bitcoin’s volatility (40% annualized) still lags behind gold’s historical stability, though it has narrowed in recent months [3].

Bitcoin’s advantages lie in its censorship resistance and programmability. During crises like the Russia-Ukraine war, it enabled sanctions evasion and cross-border aid, while gold’s physical nature limited its utility [4]. Conversely, gold’s millennia-old track record as a store of value ensures its place in conservative portfolios, particularly for institutions like BlackRock and Ray Dalio’s hedge funds [3].

Risks and the Road AheadBitcoin’s macro-hedging potential is not without caveats. Regulatory headwinds, such as the SEC’s crackdown on anonymous transactions, and the rise of CBDCs, could dampen its appeal [1]. Additionally, its performance during the 2022 liquidity crisis—when it fell in tandem with equities—challenges its status as a true safe haven [1].

However, the 2025 macroeconomic environment has created a unique tailwind. With the Fed expected to cut rates from 5.25% to 3.25% by early 2026, non-yielding assets like Bitcoin and gold have gained traction [3]. The U.S. dollar’s 11% decline over six months and geopolitical tensions—from U.S.-China trade talks to the Israel–Palestine conflict—have further driven demand for alternative reserves [2].

Conclusion: A Portfolio for the 21st CenturyBitcoin’s role in strategic asset allocation is best understood as part of a diversified framework. While it cannot replace gold’s stability or Treasuries’ liquidity, its fixed supply and global accessibility make it a powerful hedge against fiat devaluation and geopolitical risk. Institutional adoption, regulatory clarity, and macroeconomic tailwinds suggest Bitcoin will remain a critical component of forward-thinking portfolios in a fracturing fiat world.

As the lines between digital and traditional assets blur, investors must balance Bitcoin’s volatility with its potential to outperform in a world of monetary uncertainty. The 2025 experience underscores one truth: in an era of perpetual crisis, the only constant is the need for reinvention.

Source:

[1] Is crypto still a hedge against inflation? A data-based look [https://medium.com/@info_32840/is-cry...]

[2] Bitcoin as a Strategic Reserve Asset: The Economic Rationale [https://coinshares.com/us/insights/re...]

[3] Q3 2025 Cross-Asset Outlook: Decoding the Macro Shift Ahead [https://permutable.ai/q3-2025-cross-a...]

[4] 25Q3 Bitcoin Valuation Report by Tiger Research [https://www.coingecko.com/learn/25q3-...]

[5] Bitcoin: An inflation hedge but not a safe haven – PMC [https://pmc.ncbi.nlm.nih.gov/articles...]

[6] The crypto catalyst: How inflation, rates, and risk sentiment … [https://www.linkedin.com/pulse/crypto...]

Source: https://www.ainvest.com/news/bitcoin-macro-hedge-fracturing-fiat-world-2509/

The post Bitcoin as a Macro Hedge in a Fracturing Fiat World appeared first on Anndy Lian by Anndy Lian.

Web4 Explained: A Vision for Practical, AI-Integrated Blockchain- Anndy Lian

Anndy Lian

Web4 Explained: A Vision for Practical, AI-Integrated Blockchain- Anndy Lian

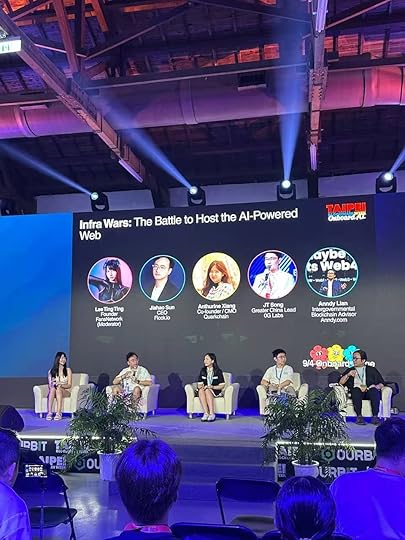

Rejecting calls for ideological purity in Web3, Singapore-based fund manager and intergovernmental advisor Anndy Lian has unveiled a vision for “Web4,” a practical, AI-integrated internet. Speaking at Taipei Blockchain Week 2025, Lian argued that security, user-centric design, and financial incentives—not abstract ideals—are the keys to driving mainstream adoption.

Key PointsIntroducing Web4: AI-native, decentralized framework focused on usability and practical application over ideology.Zero Data AI Architecture: AI operates without storing raw user data, with blockchain verifying privacy.Incentives Over Ideals: Financial rewards, such as AI-powered trading agents, are the most effective driver for mainstream adoption.Cutting Through the HypeWeb3 has long promised a decentralized internet, but Lian argues that many platforms only offer an illusion of decentralization, replicating centralized power structures behind a blockchain veneer. Speaking on the “Infra Wars” panel, he presented a grounded approach, prioritizing functionality and security over rigid adherence to decentralization for its own sake.

“Full decentralization, you know right now, remains a big challenge,” Lian said. “I just want to keep things very simple: computing part is definitely a must, storage if you can do it decentralized, I think it’s great, but we should always find ways to make sure that the security part of things in the infrastructure is well managed.”

Lian’s stance positions him as a pragmatist in an industry often dominated by idealists. Success, he argues, is measured not by how decentralized a system is, but by how effectively it operates without hacks or user losses.

Introducing Web4Lian coined the term Web4 to describe a next-generation internet built with AI as a native infrastructure component. Autonomous AI agents could function as independent economic participants, such as AI-powered liquidity providers or community moderators that operate and earn within the system without direct human intervention.

“If there’s a chance for us to redo it again with all these AI experts, something like Web4 will be a lot better,” he said.

A cornerstone of this vision is the “zero data AI architecture.” In this model, AI operates without storing raw user data, while blockchain serves as a trust layer, cryptographically verifying that user data was not retained. This approach addresses privacy concerns while allowing AI to function efficiently—a balance between Big Tech data monopolies and the ideals of full decentralization.

Related: Lian Warns Against Hasty Bitcoin Adoption, Urges Foundational PolicymakingDriving Adoption Through IncentivesBeyond technical design, Lian emphasized the challenge of bringing mainstream users to decentralized platforms. Economic incentives, not ideology, are the most effective driver.

“The best way for people to experience AI and blockchain is to teach them how to make money,” he said, highlighting AI-powered trading agents as a practical entry point. This focus reflects a broader industry shift toward creating tools with real-world utility, moving beyond speculative applications.

The Pragmatic Path ForwardUltimately, Lian’s Web4 framework proposes a middle path: balancing technological ambition with human behavior and market reality. “Success isn’t about AI or decentralization alone,” he concluded. “It’s about protecting users, creating value, and making technology approachable. Web4 is my roadmap for that balance.”

Source: https://news.shib.io/2025/09/09/web4-explained-a-vision-for-practical-ai-integrated-blockchain/

The post Web4 Explained: A Vision for Practical, AI-Integrated Blockchain- Anndy Lian appeared first on Anndy Lian by Anndy Lian.

Global markets ride the Fed wave, but can the rally last?

Anndy Lian

Global markets ride the Fed wave, but can the rally last?

Global markets showed a resilient spirit as investors largely brushed aside brewing political storms in key regions like Japan, France, and parts of the emerging world. Traders focused instead on the promise of easier monetary policy from the Federal Reserve, which propelled US stocks toward fresh peaks.

The S&P 500 gained 0.21 per cent, the Nasdaq Composite climbed 0.45 per cent to a record close of 21,798.70, and the Dow Jones Industrial Average rose 0.25 per cent. This upbeat mood reflected growing bets on a rate cut at the Fed’s September 17 meeting, with markets now pricing in a strong chance of a 50 basis point reduction following recent weak jobs data.

Economists at Standard Chartered and Bank of America adjusted their forecasts accordingly, pointing to cooling labour market signals as the trigger for bolder action from policymakers.

In my view, this optimism makes sense because the US economy still hums along with solid consumer spending and corporate earnings, but the Fed needs to act decisively to prevent any slowdown from gaining traction. A half-point cut could juice risk assets further without igniting inflation fears, especially with core PCE readings holding steady around 2.6 per cent.

Bonds, dollar, and gold respondBond markets echoed this sentiment as yields dipped across the curve. The two-year Treasury yield dropped 2.3 basis points to 3.486 per cent, while the ten-year yield fell 3.4 basis points to 4.040 per cent. Investors piled into Treasuries as a safe haven amid the political noise overseas, but the real driver came from expectations of lower short-term rates. The US Dollar Index weakened 0.3 per cent, easing pressure on exporters and giving multinational companies a breather on their overseas profits.

Gold, meanwhile, advanced 0.7 per cent to close at US$3,636 per ounce, benefiting from the dollar’s slide and persistent safe-haven demand tied to geopolitical flare-ups in the Middle East and Europe. I see gold’s rally as a classic hedge play, but its lofty levels also hint at broader concerns about fiscal sustainability in the US, where deficits continue to balloon past US$2 trillion annually. If the Fed cuts rates too aggressively, it could fuel even more gold buying from central banks in Asia and the Middle East.

Oil steadies on OPEC+ restraintOver in commodities, Brent crude oil settled 0.8 per cent higher at US$66 per barrel after OPEC+ surprised markets with a smaller-than-expected supply hike. The group, comprising eight key members, agreed to boost output by just 137,000 barrels per day starting in October, a fraction of the 555,000 barrels per day increases seen in prior months. This cautious approach stems from sticky demand worries amid slowing global growth and ample non-OPEC supply from the US shale patch.

Geopolitical tensions, including Houthi attacks in the Red Sea and sanctions on Russian exports, kept a floor under prices, preventing a deeper slide. OPEC+’s restraint buys time for oil producers to navigate the energy transition, but it also underscores the cartel’s waning influence as electric vehicles proliferate and renewable investments surge. If China’s economy rebounds more forcefully than expected, we could see Brent push toward US$70 by year-end, but recession risks in Europe temper that upside.

Asia reacts to US momentumAsian stock indexes mostly climbed on Monday, buoyed by the US rally and hopes for synchronised global easing. Japan’s Nikkei 225 surged to a milestone 44,000 for the first time, fuelled by optimism around trade deals and consumer spending data that beat forecasts. The index pulled back slightly in early Tuesday trading as Prime Minister Shigeru Ishiba’s potential departure added to policy uncertainty, with the yen weakening further against the dollar.

Political turbulence in Europe and emerging marketsIn France, the government’s collapse under Prime Minister François Bayrou marked yet another chapter in political instability, raising fears of snap elections and fiscal gridlock that could drag on the eurozone’s recovery. Emerging markets faced their own headwinds, but the standout story came from Indonesia, where the Jakarta Composite plunged 1.28 per cent ahead of President Prabowo Subianto’s announcement replacing Finance Minister Sri Mulyani Indrawati with economist Purbaya Yudhi Sadewa.

Mulyani, a globally respected figure who steered the economy through the pandemic, leaves a void that could spark market jitters, especially with Indonesia’s rupiah already under pressure from capital outflows. Early Tuesday sessions saw most Asian bourses edge higher, with Hong Kong’s Hang Seng up 0.5 per cent on tech gains and South Korea’s Kospi adding 0.3 per cent.

These political shifts, while disruptive, are priced mainly in the months following, and markets will pivot back to fundamentals, such as earnings growth. That said, Indonesia’s move feels riskier; losing Mulyani at a time of high public debt could invite rating agency scrutiny and higher borrowing costs for Southeast Asia’s largest economy.

Crypto consolidates amid uncertaintyTurning to cryptocurrencies, Bitcoin grappled with resistance around US$112,500, consolidating after a recovery from the US$110,000 support zone. The flagship coin traded above US$111,000 and its 100-hour simple moving average, with a bullish trend line holding at US$110,800 on the hourly chart sourced from Kraken data. Bulls pushed past the 50 per cent Fibonacci retracement of the recent swing from US$113,372 to US$110,039, but bears dug in near US$112,600, capping upside.

A break below US$110,800 could trigger a sharper pullback, while staying under US$113,000 might signal more downside. Recent whale activity added pressure, with large holders offloading 112,000 BTC over the past month, hinting at September’s historical weakness for the asset.

On X, analysts noted Bitcoin boxing between US$112,000 and US$114,000 ahead of key CPI data, urging caution in a video breakdown that highlighted macro tailwinds from Fed cuts. Another post from Swiss Whale Intelligence flagged massive sales of over 5,000 BTC each, underscoring exchange inflows that could weigh on sentiment.

In my opinion, Bitcoin’s current stall reflects a broader crypto market awaiting clarity on US policy, but the setup favours bulls if rate cuts materialise. With mining difficulty hitting all-time highs, network security remains robust, and institutional inflows via ETFs could propel BTC toward US$116,000 if it clears US$113,000 resistance. September often proves choppy for Bitcoin, but this cycle’s momentum from halvings and adoption suggests any dip below US$110,000 offers a buying opportunity rather than a bear trap.

Dogecoin’s speculative swingsDogecoin, the perennial meme coin darling, sparked endless debates on its trajectory, blending community fervour with technical scrutiny. After a strong first-quarter rebound above US$0.40, DOGE retreated to around US$0.22, testing support amid waning hype. Recent charts from CryptoELITES on X show resistance at US$0.27 and US$0.31, with a breakout requiring fresh institutional spark or viral momentum.

The REX-Osprey ETF filing emerged as a potential catalyst, promising easier access for big players and clearer regulations that could mirror Bitcoin’s ETF boost. Changelly’s forecasts paint a measured path: US$0.21 to US$0.24 in 2025, dipping to US$0.14 to US$0.19 in 2026 before rebounding to US$0.36 in 2027 and US$0.45 to US$0.53 in 2028.

By 2030, they eye highs near US$1.13, driven by broader crypto adoption and Dogecoin’s utility in payments via integrations like Twitter’s tipping features. Other analysts diverge; Wallet Investor sees an average US$0.279 by the end of 2025, while CoinCodex predicts a 16 per cent rise to US$0.276 by October, contingent on the altcoin season kicking in as Bitcoin dominance fades.

I lean toward the conservative side here; Dogecoin thrives on Elon Musk’s tweets and meme culture, but sustained growth requires real-world use cases, such as microtransactions or DeFi integrations. At current levels, it carves a potential bottom, and a push to US$0.54 on ETF approvals feels plausible, but US$5 remains a stretch without massive hype cycles. Speculators aiming for US$1 by 2030 should watch for volume spikes and correlation with Bitcoin’s movements, as DOGE often amplifies broader crypto trends.

Final thoughts: Risk appetite intactLooking across these developments, global risk appetite holds firm despite the political crosswinds, and I expect that trend to persist into the week’s CPI release and Fed meeting. US equities near records underscore the strength of tech and consumer sectors, but watch for overvaluation in megacaps like Nvidia and Apple, where earnings multiples exceed 30 times forward profits.

Political risks in Japan and France could spill over if they delay reforms, hurting export-dependent economies, while Indonesia’s finance minister swaps tests emerging market resilience. In commodities, oil’s modest uptick buys time for OPEC+, but non-OPEC supply growth caps gains. Crypto, with Bitcoin’s consolidation and Dogecoin’s speculative allure, mirrors the macro divide between steady growth and high-volatility bets.

Overall, I view this as a constructive setup for risk assets, provided the Fed delivers on cuts without signalling distress. Investors should trim exposures in volatile pockets like emerging equities and meme coins, while adding to quality US names and gold as hedges. The next few days will clarify if this shrug-off of uncertainties proves prescient or premature, but the data points to a continued upward grind amid easing cycles worldwide.

Source: https://e27.co/global-markets-ride-the-fed-wave-but-can-the-rally-last-20250909/

The post Global markets ride the Fed wave, but can the rally last? appeared first on Anndy Lian by Anndy Lian.

September 8, 2025

Is September a Critical Risk Threshold for Bitcoin?

Anndy Lian

Is September a Critical Risk Threshold for Bitcoin?

Bitcoin’s September performance has long been a focal point for investors, oscillating between historical bearishness and recent bullish surges. This month, often dubbed a “critical risk threshold,” now faces a confluence of macroeconomic pressures, leveraged market dynamics, and diverging investor sentiment. As the U.S. tariff war escalates and derivatives markets grow increasingly overheated, the question of whether September 2025 will mark a turning point—or a tipping point—demands closer scrutiny.

Ask Aime: Will Bitcoin’s September performance be defined by historical bearishness or recent bullish trends?

Seasonal Trends: From Bearish Legacy to Bullish AnomalyHistorically, September has been a weak period for Bitcoin. In 2024, the cryptocurrency fell below $55,000 during the month, reflecting a pattern of profit-taking and macroeconomic uncertainty [1]. However, 2025 shattered this narrative. By August 27, 2025, Bitcoin had surged to an all-time high of $111,842.71, driven by the approval of U.S. Bitcoin ETFs and a weakening U.S. dollar [2]. This 11% September rally—the best in a decade—defied historical trends, signaling a shift in market sentiment from risk-off to risk-on [3].

The divergence underscores Bitcoin’s evolving role. While traditional safe-haven assets like gold have delivered a mere 6% compound annual growth rate (CAGR) from 2015 to 2025, Bitcoin’s CAGR of ~115% has repositioned it as a growth asset rather than a hedge [4]. Yet, this transformation does not negate September’s inherent volatility. The month remains a battleground for macroeconomic forces, where institutional flows and geopolitical shocks can amplify price swings.

Macroeconomic Triggers: Tariffs, Dollar Weakness, and Diverging FlowsThe unresolved U.S. tariff policies under President Donald Trump have injected unprecedented uncertainty into global markets. By 2025, tariffs had pushed the average U.S. tariff rate from 2.5% in 2024 to 16.5%, disrupting supply chains and triggering retaliatory measures from trade partners [5]. While Bitcoin initially dipped amid tariff-driven economic anxiety, its inverse correlation with the U.S. dollar has since become a tailwind. The Dollar Index (DXY) hit a multi-year low in late 2024, bolstering Bitcoin’s appeal as a hedge against fiat devaluation [3].

Meanwhile, investor flows between Bitcoin and gold have diverged sharply. Gold, traditionally a store of value, has struggled to compete with Bitcoin’s speculative allure. Data from 2015 to 2025 shows Bitcoin’s market cap expanding from ~$1 billion to over $1 trillion, while gold’s growth has remained stagnant [6]. This shift reflects a broader reallocation of capital toward assets perceived to outperform in inflationary environments, even as leveraged derivatives markets amplify systemic risks.

Leveraged Market Fragility: Derivatives and the Amplification of VolatilityThe Bitcoin derivatives market has reached unprecedented levels of activity. By Q3 2025, open interest (OI) in BTC derivatives exceeded $73.59 billion, with institutional participation driving concentrated positions on exchanges like CME and Binance [7]. While leverage ratios have not shown sustained spikes, the sheer volume of speculative bets creates fragility. A single macroeconomic shock—such as a tariff-related market selloff—could trigger cascading liquidations, exacerbating price swings.

This fragility is compounded by the lack of regulatory clarity. Unlike traditional markets, crypto derivatives operate in a gray zone, where leverage limits and margin requirements vary widely across platforms. As of June 2025, leveraged longs accounted for 60% of total OI, with short positions struggling to gain traction amid bullish sentiment [8]. Such imbalances heighten the risk of a “gamma squeeze” if prices move sharply against leveraged positions.

Strategic Implications: Cautious Positioning in a High-Stakes EnvironmentFor investors, the convergence of these factors suggests a need for cautious positioning. While Bitcoin’s September 2025 rally hints at strong institutional confidence, the interplay of tariffs, dollar weakness, and leveraged markets creates a volatile cocktail. Key considerations include:

1. Hedging Against Derivatives Risk: Diversifying exposure across spot and derivatives markets to mitigate liquidation risks.

2. Monitoring Macro Triggers: Closely tracking U.S. tariff announcements and Federal Reserve policy shifts, which could disrupt both Bitcoin and gold.

3. Leveraging Divergent Flows: Allocating capital to Bitcoin for growth while maintaining a smaller gold position to hedge against systemic shocks.

September 2025 has emerged as a critical juncture for Bitcoin, where historical volatility collides with macroeconomic tailwinds and leveraged fragility. While the cryptocurrency’s surge defies traditional seasonal patterns, the unresolved U.S. tariff war and derivatives-driven speculation create a high-risk environment. Investors must balance optimism with prudence, recognizing that Bitcoin’s role as a macro hedge—and its susceptibility to systemic shocks—is far from settled.

Source:

[1] Bitcoin surges 11% in best September in a decade [https://www.etoro.com/news-and-analys...]

[2] Bitcoin price history Aug 27, 2025 [https://www.statista.com/statistics/3...]

[3] Bitcoin’s price history: From its 2009 launch to its 2025 [https://www.aol.com/finance/bitcoin-p...]

[4] XAUUSD vs. Bitcoin – A Decade of Data (2015-2025) [https://www.tradingcup.com/learn/xauu...]

[5] The Trade Deficit Delusion: Why Tariffs Will Not Make … [https://www.intereconomics.eu/content...]

[6] Bitcoin Value Graph 2015-2024 [https://www.statmuse.com/money/ask?q=...]

[7] The New Gold standard? Bitcoin’s macro hedge role amid… [https://www.linkedin.com/pulse/new-go...]

[8] CoinGlass Crypto Derivatives Outlook-2025 Semi annual [https://www.coinglass.com/learn/semi-...]

Source: https://www.ainvest.com/news/september-critical-risk-threshold-bitcoin-2509/

The post Is September a Critical Risk Threshold for Bitcoin? appeared first on Anndy Lian by Anndy Lian.

The market just hit a nerve: Is this the start of a 7 per cent crash?

Anndy Lian

The market just hit a nerve: Is this the start of a 7 per cent crash?

The narrative of a year-end rally persists but faces headwinds from softening labour data and geopolitical shifts. In my view, this moment represents a healthy pause in an otherwise robust bull market that began surging after the dramatic events of April 2025. That month marked what President Trump dubbed Liberation Day on April 2, when he unveiled sweeping tariffs across nearly all sectors of the US economy.

The announcement sparked immediate panic and a sharp sell-off, but markets quickly rebounded as companies announced massive onshore investments to sidestep the trade barriers. This rally propelled the S&P 500 and Nasdaq to impressive heights over the summer. Still, now signs of fatigue emerge in both the US and China, the two economic powerhouses driving global growth.

Market exhaustion and sector pressuresThe United States stock market showed clear exhaustion last Friday, with major indices closing lower amid broader concerns about the pace of economic expansion. The S&P 500 declined by 0.32 per cent, the Nasdaq Composite edged down 0.03 per cent, and the Dow Jones Industrial Average fell 0.48 per cent. Energy and financial sectors led the downturn, as traders reacted to softer-than-expected labour figures and anticipation of Federal Reserve actions.

Nvidia, the bellwether of the technology sector, dipped below its 50-day moving average for the first time in weeks, trading around US$172 per share, while the average hovered at US$172.32 per share. This technical breach signals potential volatility in tech-heavy indices, where Nvidia’s performance often sets the tone.

The AI hype meets realityInvestors poured billions into artificial intelligence plays earlier this year, fuelled by the post-Liberation Day optimism, but now they demand tangible results rather than vague promises. Companies must demonstrate how AI translates into revenue and efficiency gains, or risk sharp corrections.

Salesforce exemplified this shift last week when its shares faced pressure amid fierce competition in the AI arena. The company rolled out new AI products under its Agentforce platform, aiming to empower small and medium-sized businesses with autonomous agents for tasks like customer service and data analysis.

However, rivals like Microsoft and Google intensified their offerings, with integrations that challenge Salesforce’s dominance in customer relationship management. Salesforce executives highlighted predictions that AI agents will transform industries by 2025, enabling smaller firms to compete with giants through more intelligent automation. Yet, market reaction turned skeptical as earnings reports revealed slower adoption rates than anticipated.

In my opinion, Salesforce remains well-positioned for the long term because its ecosystem seamlessly integrates AI across sales, marketing, and service tools. However, short-term hurdles from competition could cap the upside until proof of widespread deployment materialises. This evolving AI theme underscores a broader market maturation, where hype gives way to fundamentals.

Currency markets and the dollar debateOn the currency front, bets against the US dollar appear overly aggressive at this juncture. The Dollar Index closed 0.6 per cent lower last Friday at around 97.93, reflecting heightened expectations for Federal Reserve rate cuts. A steadier US economy, combined with persistent inflation above the Fed’s target, suggests fewer cuts than the market currently prices in, anticipating about five 25-basis-point reductions through September 2026.

The August non-farm payrolls report added fuel to this fire, showing only 22,000 jobs added, far below the forecasted 75,000, while June figures were revised to an outright loss. Unemployment climbed to 4.3 per cent, the highest in nearly four years, prompting traders to bake in a 25 basis point cut for the September 17 meeting and even 12 per cent odds of a 50 basis point move.

Yet, I believe the dollar’s downside remains limited. President Trump’s administration has secured over US$5 trillion in new onshore investments from companies and countries alike, including a US$1 trillion commitment from Japan and US$600 billion from Saudi Arabia over the next four years.

These inflows, aimed at bolstering domestic manufacturing amid the trade war, will sustain demand for the greenback. If the Dollar Index surges past 100, it could pressure US equities, particularly megacap stocks like those in the Magnificent Seven, which derive significant revenue from overseas operations.

Seasonal corrections and buying opportunitiesA pullback of five to seven per cent in the S&P 500 seems likely, and perhaps steeper for the Nasdaq given its outsized gains since the Liberation Day rebound. The index wiped out all 2025 losses by mid-May, climbing from April lows around 6,000 to current levels near 6,450. No major negative catalysts loom on the horizon, such as earnings disappointments or policy shocks, so any correction should prove shallow and short-lived.

Strong buy orders cluster at key support levels, like the 200-day moving average for the S&P around 6,200, which could absorb selling pressure and preserve constructive sentiment heading into the traditional post-September rally. Historically, markets often experience the “September blues” but rebound strongly into year-end, especially when central banks ease their policy. With the Fed poised for cuts and global liquidity ample, I see this dip as a buying opportunity for long-term investors focused on AI and infrastructure themes.

Global macro landscapeTurning to the macro landscape, global risk appetite found some relief after US indices trimmed losses from recent peaks. Traders parsed the soft labor data, which highlighted a cooling job market without tipping into recession territory. The Bureau of Labor Statistics reported that average hourly earnings rose 0.3 per cent to US$36.53, indicating that wage pressures persist and could keep inflation sticky.

US Treasuries extended their rally, with the two-year yield dropping 7.9 basis points to 3.51 per cent and the ten-year yield falling 8.7 basis points to 4.07 per cent. This flight to safety reflects bets on aggressive Fed easing, but longer-term yields remain elevated due to fiscal expansion under the current administration. Gold prices climbed 1.2 per cent to hold above US$3,500 per ounce, reaching US$3,590 on Monday as a hedge against uncertainty.

Brent crude oil retreated 2.2 per cent toward US$65 per barrel, with OPEC+ signalling plans to increase production amid ample supply and softening demand forecasts. S&P Global analysts predict dated Brent could slide to US$55 by year-end, pressured by trade tensions and slower global growth.

Asia’s market resilienceAsian equity markets opened stronger on Monday, buoyed by political developments in Japan. The Nikkei 225 advanced 1.62 per cent to 43,714, leading gains after Prime Minister Shigeru Ishiba announced his resignation over the weekend. Ishiba stepped down following his Liberal Democratic Party’s historic election losses in July, which eroded his support and raised questions about fiscal policy continuity.

The yen weakened against the dollar on fears that political instability would delay Bank of Japan rate hikes, trading near 150 yen per chat. South Korea’s Kospi rose 0.24 per cent to 3,212, while Australia’s ASX 200 dipped 0.45 per cent.

Investors now await China’s August trade data, released later today, to assess the trade war’s toll. Exports grew at the slowest pace in six months, missing forecasts as shipments to the US declined sharply despite a brief truce in tariffs. Imports fell even more, signaling weak domestic demand. The US imposed tariffs up to 145 per cent on Chinese goods this year, escalating the conflict and prompting Beijing to retaliate with measures on American agriculture and tech.

In my assessment, China’s economy faces headwinds from this standoff, but stimulus measures, such as fee cuts in its US$4.9 trillion mutual fund industry, could provide a buffer. Overall, Asian markets demonstrate resilience, with tech and value stocks trading below their estimated worth, offering attractive entry points.

Crypto markets: Signs of recoveryThe cryptocurrency market mirrored broader risk assets, with Bitcoin staging a modest recovery after three weeks of declines from its all-time high of US$124,474. The leading digital asset steadied at around US$110,900 on Monday, up nearly three per cent for the week. Technical indicators support further upside if momentum builds. The Relative Strength Index on the daily chart rose to 46, indicating a shift toward the neutral 50 level as bearish pressure subsides.

The Moving Average Convergence Divergence flashed a bullish crossover on Saturday, signalling improving sentiment and potential buy opportunities. Should Bitcoin push past its daily resistance at US$116,000, it could extend the rally toward US$120,000, driven by institutional inflows and halving cycle dynamics. However, a breakdown below US$105,573 in support might trigger a deeper correction toward US$100,000, especially if equity markets wobble.

Ethereum, meanwhile, consolidated between US$4,232 and US$4,488 for nine straight days, trading around US$4,300 after bouncing from the lower boundary. The RSI hovered near 50, reflecting trader indecision. A close above US$4,488 could propel Ethereum toward its record high of US$4,956, bolstered by network upgrades and ETF approvals.

Conversely, a drop below US$4,232 risks testing the 50-day exponential moving average at US$4,077. In the crypto realm, I remain bullish on both assets as adoption accelerates, but volatility tied to macro events like Fed decisions warrants caution. Bitcoin’s role as digital gold strengthens amid dollar strength debates, while Ethereum’s utility in decentralised finance positions it for outsized gains if AI integrations proliferate.

Closing thoughts: A balanced outlookIn reflecting on this market snapshot, I advocate a balanced yet optimistic stance. The post-Liberation Day rally transformed the economic landscape, channeling trillions into US onshore projects that promise job creation and supply chain resilience. Sure, trade wars with China inflict pain, curbing export growth and inflating costs, but they also spur innovation and domestic investment.

The weak jobs report underscores the need for Fed easing, which should lubricate markets without igniting inflation spirals. Political turbulence in Japan adds uncertainty, but history shows such transitions often lead to pro-growth policies.

For investors, focus on quality names in AI, renewables, and infrastructure to navigate the pullback. A five to seven per cent dip offers a chance to accumulate, as year-end tailwinds from holiday spending and tax strategies loom large.

Crypto enthusiasts should view Bitcoin’s technical rebound as a sign of resilience, while Ethereum’s consolidation suggests a breakout if global liquidity flows in. Overall, markets are taking a breather now, but the underlying momentum remains upward. Prudent positioning today sets the stage for substantial rewards by 2026.

Source: https://e27.co/the-market-just-hit-a-nerve-is-this-the-start-of-a-7-per-cent-crash-20250908/

The post The market just hit a nerve: Is this the start of a 7 per cent crash? appeared first on Anndy Lian by Anndy Lian.

Identifying High-Potential Meme Coins in 2025: The Synergy of Community and On-Chain Momentum

Anndy Lian

Identifying High-Potential Meme Coins in 2025: The Synergy of Community and On-Chain Momentum

In 2025, the meme coin market has evolved from a niche, humor-driven phenomenon to a $68.49 billion industry, where community engagement and on-chain metrics are the twin engines of value creation [2]. Investors seeking to identify high-potential meme coins must now look beyond viral memes and focus on structured tokenomics, active social ecosystems, and blockchain-level performance indicators. This article dissects the key factors driving success in 2025’s meme coin landscape, drawing on real-world examples and data from leading crypto analysts.

Community-Driven Growth: The New Foundation of Meme Coin SuccessThe most successful meme coins in 2025 are those that have transformed their communities into active participants in ecosystem development. Projects like Shiba Inu (SHIB) and Dogecoin (DOGE) have long demonstrated the power of decentralized communities, but newer entrants like Brett (BRETT) and Snek (SNEK) are redefining the playbook. Brett, for instance, operates on Coinbase’s Base blockchain and boasts 150.7K followers on X and 38K members on Telegram. Its fixed supply and no-transaction-tax model have attracted long-term holders, despite a post-launch correction due to insider disclosures [1]. Similarly, Snek, built on Cardano, leverages energy-efficient transactions and gamified NFT integrations to engage 19.4K Telegram members [1].

Data from 2025 underscores the correlation between social media traction and price performance. Meme coins with 10K+ active social media participants are 3–5x more likely to outperform market benchmarks [4]. For example, Fartcoin (FARTCOIN), with a market cap of $1.4–1.6 billion, has integrated VR silent discos and a “Dodgeball Metaverse,” creating a cultural identity that drives emotional investment [1]. Meanwhile, Arctic Pablo Coin (APC) used influencer-led expeditions and token bonuses to generate FOMO (fear of missing out), resulting in a 20x value surge [3].

However, not all social traction is equal. A study on social media engagement and cryptocurrency performance warns that excessive interactions—especially those driven by bots—can signal artificial hype rather than organic growth [4]. Investors must prioritize projects with authentic community activity, such as decentralized governance models, interactive events, and transparent communication channels.

Ask Aime: Which meme coin has the highest potential for growth in 2025 based on its community engagement and on-chain metrics?

On-Chain Momentum: The Invisible Hand of Meme Coin ValuationWhile community metrics set the stage, on-chain data provides the proof of concept. In 2025, platforms like Solana and Base have become critical infrastructure for meme coins, offering high transaction throughput and low fees. Solana, for instance, recorded 35.3 billion monthly transactions in July 2025, driven by micro-transactions and tokenized assets like xStocks [6]. This infrastructure supports projects like BONK, a Solana-based meme coin that saw significant whale activity and ETF speculation in mid-2025 [4].

Key on-chain indicators to monitor include:

1. Wallet Distribution: A decentralized holder base (e.g., low concentration in top 100 holders) correlates with price stability and resistance to manipulation [3].

2. Smart Money Inflows: Projects like MEME have seen over $100 million in Solana transaction volume and inflows from institutional-grade wallets [3].

3. Transaction Volume Trends: Sustained growth in daily active addresses and micro-transactions signals utility beyond speculation. For example, XYZVerse (XYZ) has burned 17.13% of its supply to create scarcity, while its on-chain activity reflects a 40% increase in monthly transactions [1].

The 2025 meme coin market is increasingly favoring projects that blend humor with tangible utility. Wall Street Pepe (WEPE), for instance, has leveraged its cross-chain presence and high staking APY to attract a trading community of 50K+ members [6]. Similarly, MoonBull (MOBU) offers elite staking programs and exclusive presale access, creating a flywheel of liquidity and loyalty [5].

Structured incentives are also critical. Comedian (BAN) rewards users for generating content, tying token value directly to community contributions [5]. Meanwhile, AI Companions (AIC) and SLERF (SLERF) integrate AI-driven mechanisms to stabilize volatility and enhance utility [5]. These innovations align with the broader industry trend of prioritizing transparency, real-world applications, and anti-bot measures [6].

Risks and Mitigation StrategiesDespite the optimism, the meme coin market faces challenges. Oversaturation has fragmented liquidity, while automated trading bots and front-running on decentralized exchanges complicate retail participation [6]. Regulatory scrutiny and Bitcoin’s dominance also pose risks. To mitigate these, investors should:

– Diversify across projects with audit credibility and deflationary tokenomics.

– Avoid tokens with centralized ownership or unproven use cases.

– Monitor whale accumulation patterns and presale participation rates as timing indicators [3].

The 2025 meme coin market is no longer about viral jokes—it’s about building sustainable ecosystems. Projects that combine strong community engagement, positive on-chain metrics, and innovative tokenomics are poised to lead the next wave of growth. While volatility remains a reality, the sector’s focus on utility and transparency offers a compelling case for long-term investors willing to navigate its complexities.

Source:

[1] Meme Coins 2025: Uncovering the Next Wave of Community-Driven Innovation [https://www.ainvest.com/news/meme-coi...]

[2] The Meme Coin Market in 2025: Trust, Community, and the End of Hype [https://www.linkedin.com/pulse/meme-c...]

[3] 2025 Meme Coin Gold Rush: Late-Stage Entry Strategies and Viral Crypto Trends [https://www.ainvest.com/news/2025-mem...]

[4] Top 10 Meme Coins Dominating in 2025: It’s Not Just Dogecoin and Shiba Inu Anymore [https://coincentral.com/top-10-meme-c...]

[5] The Future of Meme Coins: Community-Driven Value and Tokenomic Innovation [https://www.ainvest.com/news/future-m...]

[6] Gate Research: Web3 On-Chain Data Insights for July 2025 [https://www.gate.com/learn/articles/g...]

The post Identifying High-Potential Meme Coins in 2025: The Synergy of Community and On-Chain Momentum appeared first on Anndy Lian by Anndy Lian.

September 5, 2025

Gold slumps, oil tanks, Bitcoin hangs by a thread: The global market meltdown no one saw coming

Anndy Lian

Gold slumps, oil tanks, Bitcoin hangs by a thread: The global market meltdown no one saw coming

Economists projected a modest addition of 75,000 jobs, barely edging out the 73,000 from July, with whispers of a downward revision to the prior month’s figures adding an extra layer of uncertainty. This report carried significant weight, as it could sway the Federal Reserve’s decision on interest rates later in the month, especially amid signs of a cooling labour market.

Initial jobless claims surged to 237,000 for the week ending August 30, marking the highest level since June and underscoring a gradual softening in employment trends. Traders positioned themselves defensively, knowing that a weak print might fuel expectations for aggressive rate cuts. At the same time, a stronger-than-expected number could dampen hopes for monetary easing and pressure risk assets.

US equities managed a solid rebound on September 4, with the S&P 500 climbing 0.8 per cent to close at a fresh record high of around 6,506 points, buoyed by robust July services activity data that exceeded forecasts. The Nasdaq Composite advanced 1.0 per cent, reflecting renewed enthusiasm in technology stocks, while the Dow Jones Industrial Average matched the S&P’s gain at 0.8 per cent.

This rally provided a brief respite from recent volatility, as market participants digested the implications of a resilient services sector amid broader economic slowdown signals. Investors appeared to interpret the data as supportive of a soft landing scenario, where growth moderates without tipping into recession, though the looming payrolls report tempered any excessive exuberance.

Bond markets also drew attention, with Treasuries attracting bids that pushed yields lower. The benchmark 10-year US Treasury yield dropped six basis points to 4.161 per cent, flirting with levels not seen in over a year and signalling investor flight to safety ahead of key data. Shorter-dated two-year yields hovered near one-year lows, highlighting expectations for Federal Reserve action. This movement in yields reflected broader concerns about economic momentum, as lower rates typically encourage borrowing but also hint at underlying weaknesses in growth prospects.

Currency and commodity markets offered mixed signals. The US Dollar Index strengthened by 0.2 per cent to settle at 98.35, benefiting from the relative stability in US data compared to global counterparts. Gold, often viewed as a haven during uncertain times, slipped 0.4 per cent after an eight-day winning streak, trading around US$3,552 per ounce as some profit-taking emerged amid the dollar’s firmness.

Brent crude oil declined 1.0 per cent to US$68 per barrel, pressured by ongoing demand worries and ample supply, though OPEC’s potential output decisions loomed as a wildcard. These shifts underscored a market grappling with inflation fears receding but growth risks mounting.

In Asia, equity benchmarks largely trended lower on September 5, dragged by underperformance in major hubs. Hong Kong’s Hang Seng index fell 1.1 per cent, while the Shanghai Composite dropped nearly two per cent, reflecting investor unease over domestic economic stimulus measures and lingering trade tensions. Other markets like Tokyo and Seoul bucked the trend with modest gains, but the overall tone remained subdued, influenced by the anticipation of US data that could ripple through global trade and capital flows.

Amid this backdrop, the debut of American Bitcoin Corp on the Nasdaq captured headlines, intertwining politics, family business, and cryptocurrency in a way that raised eyebrows across Wall Street. The Bitcoin mining company, partially owned by Donald Trump’s sons Eric and Donald Jr., saw its shares surge as high as US$14.52 before closing up 16.5 per cent at US$8.04, valuing the firm at billions and the brothers’ 20 per cent stake at over US$1.5 billion.

Eric Trump, serving as executive vice president of the Trump Organisation, appeared at Bitcoin Asia 2025 in Hong Kong, further spotlighting the family’s pivot from real estate to digital assets. This move expanded the Trump empire into cryptocurrency, with the company planning to mine and hold Bitcoin while raising funds for growth, including partnerships such as one with Hut 8.

From my perspective, this development strikes me as a potent mix of opportunity and peril. The Trump family’s foray into Bitcoin aligns with a broader trend where influential figures leverage their platforms to enter high-growth sectors, potentially accelerating mainstream adoption. It also invites scrutiny over conflicts of interest, especially given the administration’s crypto-friendly policies that could directly benefit such ventures.

Critics point to the risk of blurred lines between public office and private gain, a concern amplified by the family’s history in real estate and now extended to volatile digital assets. While supporters hail it as innovative entrepreneurship, I see it as emblematic of how political dynasties adapt to new economic frontiers, often at the expense of transparency. The stock’s volatile debut, doubling in value before pulling back, mirrors the crypto market’s own unpredictability, and it will be fascinating to watch if this boosts or burdens Bitcoin’s legitimacy in traditional finance circles.

Turning to Bitcoin itself, the cryptocurrency traded near US$110,700 on September 5, clinging just above the short-term holder realised price of US$107,600. This critical support level gauges the average entry point for newer investors. A rare signal emerged on Binance, where the Bitcoin-to-stablecoin ratio approached parity at 1, a threshold that historically signaled major cycle bottoms, as seen in March 2025 when it preceded a rally from US$78,000 to US$123,000.

However, the current consolidation phase lacks the deep capitulation of past bottoms, raising doubts about whether this indicates a genuine rebound or merely turbulence ahead. Stablecoin reserves on Binance hit a record US$37.8 billion, suggesting ample liquidity is sidelined and ready to deploy, which could fuel a surge if sentiment shifts.

Longer-term metrics painted a bullish picture despite short-term jitters. The overall realised price stood at US$52,800, with long-term holders’ realised price at US$35,600, indicating firm conviction among seasoned investors. The net unrealised profit/loss ratio hovered at 0.53, firmly in profit territory but below euphoric peaks, implying room for growth without immediate overheating.

A key risk loomed: Bitcoin’s 50-week simple moving average, a reliable trend indicator since 2018, sat near US$95,000. A drop below this level could trigger the cycle’s first bearish signal, potentially leading to prolonged declines akin to the 63 per cent drop in 2018 or the 67 per cent decline in 2022. Bitcoin has held above this average since March 2023; however, its current positioning places it perilously close.

In my view, these signals highlight Bitcoin’s maturation as an asset class, blending technical rigor with on-chain insights that traditional markets envy. The Binance ratio’s reappearance excites me because it underscores crypto’s unique data-driven edge, where exchange flows offer real-time glimpses into capital movements. That said, the absence of capitulation worries me; markets often need pain to purge excess before true bottoms form. If Bitcoin slips below US$95,000, it might test investor resolve.

Still, I suspect that sidelined stablecoins and improving macroeconomic conditions, such as potential Fed cuts, could cap the downside and propel a fourth-quarter rally. September has historically been Bitcoin’s weakest month, averaging negative returns, but 2025’s cycle dynamics, including ETF inflows and political tailwinds, might defy the pattern. Analysts eye US$150,000 by year-end if supports hold, a target that feels ambitious but plausible given the asset’s resilience.

To expand on the labor market dynamics, the August nonfarm payrolls report arrives at a time when other indicators already suggest a deceleration in the economy. For instance, the JOLTS report from earlier in the week showed job openings dipping to their lowest since early 2021, with hires and quits also moderating, signalling reduced churn in the workforce.

Economists attribute this to a normalisation after the post-pandemic hiring frenzy, but persistent weakness could prompt the Fed to accelerate its pivot toward easing. Chair Jerome Powell has emphasised the importance of data dependence, and a subpar jobs number might solidify bets for a 50-basis-point cut at the September meeting, rather than the standard 25-basis-point cut. Markets currently price in about a 40 per cent chance of the larger move, up from negligible levels a month ago, reflecting how quickly sentiment can shift.

Equities’ Thursday rally built on gains in sectors such as technology and consumer discretionary, with companies like Nvidia and Amazon leading the charge after positive analyst notes on AI demand. The services PMI from ISM came in at 55.7, well above the 52.5 consensus, indicating expansion and alleviating fears of a broader slowdown spilling over from manufacturing.

This divergence between goods and services has characterised the current cycle, with services proving more resilient due to steady consumer spending. However, with personal consumption expenditures showing signs of fatigue amid high interest rates, the sustainability of this strength remains in question.

In the Treasury space, the yield curve’s subtle steepening warrants attention, as the spread between two-year and 10-year notes has widened slightly to around 15 basis points. Historically, an inverted curve precedes recessions, and its gradual normalisation could signal the end of that inversion phase, potentially heralding better growth prospects ahead. Traders also monitored auction results for new debt issuances, which absorbed smoothly despite elevated supply, thanks to foreign demand and domestic institutions seeking duration.

The dollar’s modest uptick occurred against a basket where the euro and yen weakened, the former due to uncertainty over ECB policy and the latter amid the Bank of Japan’s cautious tightening path. Gold’s pullback interrupted a rally driven by central bank purchases and geopolitical tensions, but fundamentals like real yields remaining low support its medium-term appeal. Oil’s slide extended a multi-week downtrend, with inventories building unexpectedly and global demand forecasts revised lower by agencies like the EIA, though Middle East risks provide a floor.

Asian markets’ weakness stemmed partly from China’s ongoing property woes and export slowdown, with recent stimulus announcements falling short of investor hopes for aggressive fiscal support. Hong Kong’s drop amplified regional contagion, as property developers faced renewed selling pressure. In contrast, Japan’s Nikkei edged higher on exporter gains from a weaker yen, illustrating how currency dynamics can offset broader pessimism.

The Trump sons’ Bitcoin venture adds a layer of intrigue to an already politicised crypto landscape. American Bitcoin Corp aims to capitalise on the mining boom, leveraging cheap energy sources and advanced hardware to build a substantial hash rate. Their stake’s valuation surge on debut day highlights the froth in crypto-related stocks, reminiscent of the 2021 bull run when similar firms commanded premium multiples. Eric Trump’s public engagements, including speeches at industry conferences, position the family as advocates for deregulation, aligning with the president’s pro-crypto stance that has included proposals for a national Bitcoin reserve.

This familial involvement raises ethical concerns, as policy decisions regarding digital assets could impact personal holdings. Observers note parallels to past Trump Organisation dealings, where real estate projects benefited from zoning changes or tax incentives.

In the crypto industry, the push for clearer regulations may expedite approvals for mining operations or ETF expansions, indirectly boosting the company’s prospects. Supporters argue it democratises access to Bitcoin wealth, but skeptics see it as another avenue for influence peddling in a lightly regulated space.

Bitcoin’s price action around US$110,700 reflects a tug-of-war between bulls holding the line and bears testing supports. The short-term holder realised price acts as a psychological barrier, where breaches often lead to cascading liquidations. On-chain data from Glassnode shows exchange inflows rising modestly, but not to panic levels, suggesting sellers are tactical rather than capitulatory. The Binance ratio nearing 1 implies balanced reserves, historically a precursor to volatility resolution upward.