Nabil Shabka's Blog, page 2

March 25, 2020

Austerity or trickle up - time to choose

Austerity or trickle up — time to choose

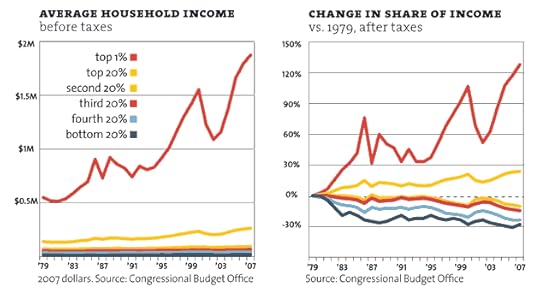

As the US and the UK debate massive spending plans, once again, the same top down approach that focuses on companies is being utilised (trickle down) as in 2008. That led to the past 12 years of austerity and the widening gap in financial inequality. This time, how about we focus on people for a change, not just businesses. Trickle up. Let’s see what trickle up could have accomplished if that had been the approach in 2008.

Austerity or Trickle-Up?

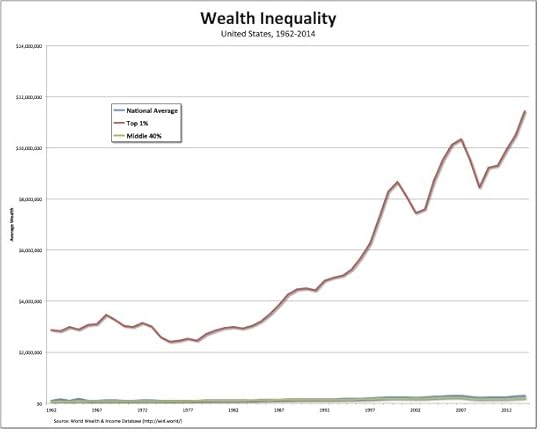

Since 2008, households have had to endure ‘austerity’ to pay for the government bailout of financial institutions and the financiers. Households have increased their debt to survive, social services have been cut and the gap between the super-rich and middle class grew like it was on steroids. Why? We might wonder. The answer is straight forward. It’s that trickle-down theory again.

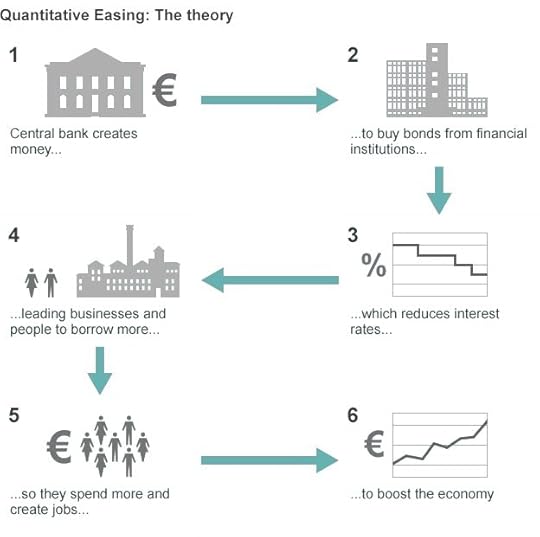

You see, the central banks decided that if they printed more money, $3.7 trillion in the US and £445 billion in the UK, and used that money to buy back bonds from the rich, then the rich would invest and spend this money and this would stimulate the economy and stop a crash like in the 1920’s. They called it ‘quantitative easing’ instead of trickle-down, but it’s essentially the same thing. And the results were the same. The rich got richer and bought more assets and the middle classes got poorer and had to borrow more money from the rich to simply stay afloat. Here’s a nice image courtesy of the BBC to illustrate the quantitative easing theory and it looks suspiciously like trickle-down economics. Thank you Gordon Brown, the Labour politician who made all this possible and ‘saved’ the world.

Courtesy BBC

This theory didn’t really pan out well. Austerity happened for most of the population and wealth inequality increased.

We know that 70% of the economy is being driven by consumer spending. If the goal was to boost the economy (picture #6), then surely stimulating consumer spending should have been the objective. Seems to me, the rational thing to have done, would have been to stimulate spending by consumers, trickle-up economics.

But, what would have happened had trickle-up been the route taken instead of trickle-down? People would have spent more money; government tax revenues would have been up; jobs would have been created; government services would not have been cut and austerity would have been avoided.

Let’s play with the exact same amount of money that the governments spent on quantitative easing so that we have a fair comparison and see what would have happened. Like-for-like spending. That’s £445 billion in the UK and $3.7 trillion in the US.

First, how could the government have motivated people to spend more? Here’s an idea. Total UK consumer debt today, including student loans, is £428 billion in the UK and $4 trillion in the US. The governments could have used that same quantitative easing money and paid off the ENTIRE country’s consumer debt, student loans, credit cards, auto loans and personal loans. Just imagine, no more debt. Without going back into debt, consumers would have had more money to spend, simply because they wouldn’t have been making loan repayments. I reckon that would have put a smile on many people’s faces and they would have been out there spending — boosting the economy. Wow. I can imagine that that would have kick-started some serious consumer spending. The opposite of austerity would have happened.

And where would that quantitative easing money have gone? To the retail banks, the ones that lend money to real people and real businesses. The retail banks would have had money in the till. They could then have started lending money to businesses that would then have had money to expand and invest in the future.

Using the images in the trickle-down theory, let’s look at it in reverse.

Start at step 1, we need the money after all, but then let’s go to step 6 and work backwards to step 3. We’ll skip step 2, as I’ll explain.

6) Consumer spending would have boosted the economy

5) This would have created more jobs and enticed businesses to expand and invest more

4) Lending to businesses would have increased

3) Interest rates could have gone down, if they even needed to, as banks would have been flush

The only thing missing is step 2, ‘buy bonds from financial institutions’, i.e. buying bonds from investment banks — in other words, buying bonds from the financiers who created the crisis in the first place.

What would not buying the bonds have meant? Some investment banks would have gone tits up and the financiers wouldn’t have had the taxpayers picking up their gambling tab. And, of course, they wouldn’t have been able to keep on gambling so easily. As well as this, the widening gap between the super-rich and the middle-classes would have slowed down. Result. I doubt many of us would have been shedding a tear for the financiers.

Hmm, trickle-up economics sounds pretty good. Wish we’d done that, so we didn’t end up with this.

Trickle-down economics simply does not work. You can only have so many Ferraris, masseuses, personal trainers, houses, gardeners and yachts. After that, the extra money is used to buy the world’s assets. It does NOT trickle-down. It gushes up into a few people’s pockets.

Trickle-down does the opposite of what it says on the tin. It reduces investment and consumer spending — it actually hurts the economy. As Billionaire investor, Nick Hanauer pointed out in his controversial TED talk, ‘Businesses and the rich do not create jobs. Jobs are created by a feedback loop between customers and businesses that is set in motion by consumers increasing their demand.’[i]

You have to wonder how people come up with such obviously lame ideas like trickle-down. Perhaps they know it is a bad idea, but they just need a justification for taking more. Just a thought.

You know what the financiers would have been saying to an idea like this? It would be, ‘this is socialist and we’d be rewarding people for getting into debt’.

What the financiers are really trying to say is that taxpayers paying off the financiers’ gambling debts, the debts that got them their toys and almost brought down the financial system, is fine. It’s capitalism. Yet, taxpayers paying off all of a country’s loans in one go — student loans, credit cards and payday loans, but not yacht loans, I might add — so they can boost the economy, is presented as socialist. That’s nuts. Millions of people would have disposable income and breathe a sigh of relief.

The financier gamblers were the ones who were rewarded for bad behaviour. Perhaps we should have let them fail and lose their beach houses.

Austerity is the result of trickle-down economics and financiers. We must sort this out, as financial inequality is a threat to democracy and capitalism.

Page 100 Read more

[i] https://en.wikipedia.org/wiki/Nick_Hanauer

The post Austerity or trickle up - time to choose appeared first on come the evolution.

March 24, 2020

Star Trek or Blade Runner – Universal Income Explained

For the first time ever the world is united against a common foe. Instead of fighting one another, we’re working together. People are reconnecting even though we have physical social isolation. We’re going back to basics and when we come out of this (it won’t be in 6 weeks), the world will be a different place.

And the decisons we make today to address the economic calamity facing us will decide our fate, Star Trek or Blade Runner.So, we need to look at the big picture. BEFORE spending tax payer money. We have a once in a generation opportunity to rebuild for tomorrow, not prop up yesterdays problem industries. The economic solutions we put in place today will dictate our future.

The first thing we need to do is buy time by getting cash to people NOW. The simplest and easiest solution is Universal Income immediately - for three years - to give us some breathing space while we examine our values and plan forward. Trickle down doesn’t work, let’s do trickle up.Stare

Universal Income (UI)

Before getting into the nitty-gritty of this, let’s take a quick look at the economy: we know that consumer spending accounts for about 70% of it and that almost year-on-year, since the 50’s, the share of the economy driven by consumer spending has continued to increase.

So, that means people spending money is the best way to help the economy.

By spending, people create demand for goods and services. This creates jobs and raises more taxes for the government. Makes sense.

If people have money, they spend it. That being the case, it would seem logical to find a way to make sure people have enough money to spend.

Trickle-down doesn’t work. The cock-eyed theory that if the rich pay less in tax they will spend and invest more doesn’t happen in real life.

But trickle-up will work. Give the average person $1,000 and they spend it on goods and services. It trickles up. It helps the economy and the community. Give a wealthy person $1,000 and it makes no difference on their spending.

Universal Income (UI) is not a new idea. In fact, it’s been tested in a number of places with outstanding results. Alaska created its own Sovereign Wealth Fund and since 1982 has been paying residents a UI. In 2015, a family of four in Alaska would have received $8,288. US democratic candidate Andrew Yang wants to give all Americans $1,000 a month. And there are many places trying it out around the world, including the US. Sadly, Ontario just cancelled a popular three-year experiment that started in 2017 but stopped after two years due to its new right-wing government. It was an experiment that was going well and had positive effects on people and the local community. People ate better, health improved, people helped local charities and even helped to keep museums open that would have had to close, if not for their ‘free’ work.

We need to simplify things. We know we can pay everyone a UI. So, what would be the benefits? For starters, not just would it significantly reduce stress, but it would actually SAVE money.

In the UK, welfare currently accounts for more than half the income of 4.3 million families and cost £112 billion in 2017. If each family is roughly four people, it means 8.6 million adults and 8.6 million children (a total of 17.2 million people), rely on welfare. That’s 26% of the entire UK population.

Cost wise, that’s £12,900 per adult. So why not give every adult a UI income of £12K per year? No hassles, no stress, and loads of people get to do more productive things with their time. This also happens to be the amount people can earn currently before they are taxed. We can get rid of the expensive bureaucracy that supports welfare as well as reduce the hassle and stress associated with getting it. And we’re already spending the money anyway – but in an extremely inefficient way.

People would be able to work and not worry about losing their ‘benefits’. This is a common problem welfare recipients face. If they earn money, they lose their benefits which means that they must have secure full-time jobs that will pay more than their benefits. They can’t do part-time or short-term work. The existing system currently forces them to remain on benefits.

With UI, they can earn more money, help the economy and pay tax with no fear of going hungry or homeless – and with a hell of a lot less stress.

Then, there are pensions, on which the UK spends £156 billion annually. There are 5.3 million pensioner families. If half these families are made up of two people, that equates to 7.95 million people. That’s 12% of the total UK population. Cost wise, that’s £19,622 per person (multiply this x 2 for couples).

26% welfare + 12% pensions = 38%

This means that 38% of the population are already essentially receiving UI! But, it’s in a very convoluted way that is expensive to run, demoralising and stressful for most.

Remember, this is forest, not trees. Think about the concept, not the transitioning. There are others who can do a far better job at it than me. But, I believe UI is eminently doable and should be done. Now.

What about everyone else? By coincidence, they are already receiving a UI. It’s the £12,000 tax-free allowance.

To keep things simple, everyone needs to receive the same UI. Everyone. On the day of the month they were born would be practical. While some people may not work as well, they will still be contributing to the economy by spending their UI and I really can’t see the bulk of the adult population stopping working because of a UI of £12K. Who’s going to give up a £20K, £50K or £100K salary and that lifestyle for 12K?

With UI, every adult receives £1,000 monthly from the government. Everyone can work and earn as much as they want, and it has no impact on their UI. The UI is not taxed. When they work, they contribute 25% of their earnings to Social Tax. If someone were earning £100K, they would contribute 25% of the £100K (£25K) in Social Tax.

UI also makes dealing with the declining population easier as raising children now is quite expensive. Whether losing one person’s income to stay at home or paying for day-care, it takes money to raise and support children. Let’s make it easier to have children and raise them, not harder as it is now. They are our most important assets and our future.

The guardian of the child, until age eighteen, can receive another 50% of UI or £500 in this case. There is always a maximum allowance of two children (we need 2.1 to maintain our population). If the population is dropping, the number of children the guardian can receive UI for, can be increased temporarily to say three.

If we gave every adult in the country a UI of £12,000 per year it would cost us less than we spend now. Look at the benefits: every child and adult would have a floor, a basic minimum living standard. The angst of bureaucracy navigation or the stress of putting food on the table would be eliminated for 9.6 million people. Kids wouldn’t go hungry. No one would need to live on the streets. Crime would drop. Think about it. Think about people you know, friends, family and those you interact with daily. What kind of an impact would it have on them psychologically – and on you? You can almost hear the giant national (global) exhale of stress. It’s wonderful.

Let’s also not forget the entrepreneurial spirit that UI would help foster. If people, especially those with fewer family resources to fall back on, had a minimum floor, they would be more tempted to try new things and start new businesses. Whether a new organic fruit café, a new app, or painting, or music, people would be able to pursue their creative dreams without as much worry of ‘failure’.

In ten years, we’ll look back to pre-UI days and shudder. Stress, people going hungry, living on the streets, crime, more stress, and we’ll wonder why we had so much stress in society when much of it could be removed so easily with UI. Britain will be a much happier nation. Even if someone is ‘homeless’ they will, with dignity, be able to afford a room in a ‘homeless’ shelter. And what they’ll pay the shelter will enable it to provide a good and compassionate service to them.

It’s all do-able! What are we waiting for?

Did I mention prisons? Why do many people offend and reoffend? It’s because they need money. When they leave prison, they have no money and no job. It costs £37,000 to keep someone in prison for a year in the UK. £12K is a lot less, plus it has other benefits like socialisation and opportunity. They’d have money to spend on what they want. No need to steal. Of course, I’m not an idiot, I don’t think for a moment that this will stop crime entirely, but it can certainly be argued that it’ll reduce it.

UI also puts a minimum value on each person’s time. If the time is spent doing nothing more than buying things to live, people are still contributing to the economy and the overall health of society. If they have a child, the child brings with them another £500 of value. A parent can then either stay home and take care of the child or spend the money on day-care while they go to work. The choice is theirs, but either way the paid babysitter vs. day-care being part of GDP, is addressed.

UI would also mean that children wouldn’t go hungry at school or be shamed for not being able to afford lunch. 30% of UK children live below the poverty line. In the US it’s 20%.

What kind of a world do we live in where a school will embarrass a five or fifteen-year-old about owing lunch money and make them go hungry – while watching others eat? This is torture and morally wrong.

I don’t think most of us want to live in a world where children go hungry and where a nine-year-old, Ryan Kyote in California, puts us to shame. Ryan was already using his lunch card to pay for lunches at his elementary school when he heard that a five-year-old in Indiana was denied lunch. Ryan turned around and paid off the entire $74.80 lunch debt of his third-grade class by using the pocket money he had saved up over six months. What a wonderful person! We need our society to be that kind. Ryan knows what’s right and sees it. Why can’t we? Most of us can.

While the Chobani founder, Hamdi Ulukaya gallantly stepped up to the plate and paid off the entire amount of the lunch debt of his Rhode Island School district. He shouldn’t have had to. He wouldn’t have needed to if all the super-rich had paid their fair share.

Page 120 – Read more

https://www.reddit.com/r/BasicIncome/...

https://www.vox.com/policy-and-politi...

https://time.com/5571472/basic-income...

https://www.theguardian.com/cities/20...

https://www.inverse.com/article/53466...

https://www.technologyreview.com/s/61...

https://www.ukpublicspending.co.uk/ye...

https://www.ukpublicspending.co.uk/ye...

https://www.chroniclelive.co.uk/news/...

https://cpag.org.uk/child-poverty/chi...

https://people.com/human-interest/rya...

https://abcnews.go.com/US/rhode-islan...

The post Star Trek or Blade Runner – Universal Income Explained appeared first on come the evolution.

March 15, 2020

Time for Trickle Up

Urgent. Time for trickle up, not trickle down

From chaos comes opportunity. Things are about to change and someone is going to benefit from all the turmoil we’re living through. The question is who? This week, as small businesses and the self-employed around the world shut down, the world will be forced to focus for the first time on saving real businesses and real people rather than protecting the banks. How we decide to support small businesses and individuals, and who benefits, will define us.

It’s really quite straight forward. Either banks and financiers will come out on top as governments bail out big businesses and banks. Governments will try to entice banks to loan more money to small businesses and consumers — and these businesses and consumers will go further into debt. Or governments can get this money to the people directly so that they can pay their bills and eat. This would keep the entire ecosystem going as, let’s not forget, consumer spending is responsible for 70% of the economy — and small businesses and people wouldn’t come out of this further in debt to the .1%.

In the past few weeks, Option 1 kicked off. Some countries decided to cut interest rate cuts and the US has already printed trillions of dollars, just like in 2008. Not just did this solve nothing and the markets tanked, but the real problem hadn’t even really begun to be discussed yet. The problem of almost everything shutting down for a month or two and the incredible strain this will put on people and the economy. Some countries are changing sick leave policies and offering tax holidays to companies and the self-employed. All necessary, but not enough. People need cash now.

The far faster, cheaper and easier option to administer would be to get money into the hands of people directly so that people can pay their bills now. If businesses need to cut staff or hours or close temporarily, they can without putting staff out on the street — and the staff of their suppliers. And, as people have money, there will still be customers with some money. This will take the strain off people and businesses that have to shut or have reduced revenue. They can survive — and neither the business nor the people end up further in debt.

The simple way to do this is UI (Universal Income) right now.

PS Let’s not bail out the airlines. This is a good chance to do a complete rethink on transport costs and subsidies.

The post Time for Trickle Up appeared first on come the evolution.