Clayton M. Christensen's Blog, page 6

February 13, 2019

After the Breakups: Big Payers Find Vertical Love in New Faces

Creative Destruction Whips through Corporate America

Lifespans of top companies are shrinking, according to an Innosight study of the S&P 500 Index

61-year tenure for average firm in 1958 narrowed to 25 years in 1980—to 18 years now.

A warning to execs: At current churn rate, 75% of the S&P 500 will be replaced by 2027.

To survive and thrive, leaders must “create, operate and trade” their business units without losing control of their company.

Study led by Innosight director Richard N. Foster, co-author of Creative Destruction.

Learn more about how Innosight works with Healthcare companies on their growth strategies

The term “creative destruction” is widely credited to the Austrian-American economist Joseph Schumpeter (1883-1950). Schumpeter studied the formation and bankruptcy of companies in Europe and the United States. He concluded that “economic progress, in capitalist society, means turmoil.” Richard Foster, in his 2001 book Creative Destruction, applied Schumpeter’s theory to the modern practices of management and innovation.

According to Foster, the life span of a corporation is determined by balancing three management imperatives: 1) running operations effectively, 2) creating new businesses which meet customer needs, and 3) shedding business that once might have been core but now no longer meet company standards for growth and return.

download the 2012 full REPORT

UPDATE: Read the Executive Summary and Download the 2016 updated report

Corporate Longevity: Turbulence Ahead for Large Organizations

We’re entering a stretch of accelerating change in which lifespans of big companies are getting shorter than ever, according to Innosight’s study of turnover in the S&P 500.

The 33-year average tenure of companies on the S&P 500 in 1965 narrowed to 20 years in 1990 and is forecast to shrink to 14 years by 2026.

Record M&A activity and the growth of startups with multi-billion dollar valuations are leading indicators that a period of relative stability is ending and that an increasing number of corporate leaders will lose control of their firm’s future.

A storm warning to executives: at our forecasted churn rate, about half of the S&P 500 will be replaced over the next 10 years.

In a related survey on strategic readiness, executives say that growth strategy is being undermined by day-to-day decisions inside companies and that too many companies lack a coherent vision of the future.

DOWNLOAD THE updated 2016 full REPORT

The post After the Breakups: Big Payers Find Vertical Love in New Faces appeared first on Innosight.

January 31, 2019

Cracking Frontier Markets

When a movie is released straight to video, it’s usually a bad sign: Early reviews were negative, the quality is dubious, or backers aren’t confident it will find an audience. Going straight to video, historically, was a way to save face and move on. But in 1992, when the electronics salesman Kenneth Nnebue shot the straight-to-video Nigerian movie Living in Bondage, it was anything but a disaster.

When a movie is released straight to video, it’s usually a bad sign: Early reviews were negative, the quality is dubious, or backers aren’t confident it will find an audience. Going straight to video, historically, was a way to save face and move on. But in 1992, when the electronics salesman Kenneth Nnebue shot the straight-to-video Nigerian movie Living in Bondage, it was anything but a disaster.

Nnebue had received a shipment of blank VHS cassettes to sell in his store but quickly realized that most Nigerians had no use for them. He then had the idea of putting homemade content on the tapes. He wrote a script, found a producer and a director, and hired actors and actresses. The resulting two-part thriller about a down-and-out businessman who uses witchcraft to revive his fortunes was released on those tapes; Nigeria had no operational cinemas at the time. Made on a $12,000 budget, the film went on to sell hundreds of thousands of copies across Africa, in the process catapulting “Nollywood”—the then-nascent Nigerian movie industry—to eminence.

Barely a blip on anyone’s radar 25 years ago, Nollywood today produces about 1,500 movies a year, employs more than a million Nigerians, and is thought to be worth $3.3 billion. In terms of volume, it rivals both Hollywood and Bollywood. This homegrown industry has attracted the attention of banks and other financial institutions, some of which now have “film desks” designed to invest in its productions. By some estimates, Nigeria is home to more than 50 film schools. The government has established funds for training filmmakers and financing new movies and is beginning to take piracy and copyright protection more seriously. In 2018 both New York and Toronto hosted Nollywood film festivals, while Netflix bought its first Nollywood film, Lionheart.

How could a modest investment by an electronics salesman simply looking to sell VHS cassettes trigger the rise of a multibillion-dollar industry in one of the poorest countries in the world—where fewer than 35% of households had access to electricity and only about 20% had a television set? Was Nollywood just a lucky anomaly?

Hardly. Nollywood is among scores of entities that have realized enormous growth by creating entirely new markets where they might least be expected. With emerging-market giants such as Brazil, Russia, India, and China experiencing slowdowns, investors, entrepreneurs, and multinationals are looking elsewhere. They’ve been eyeing so-called frontier economies such as Nigeria, Pakistan, and Botswana with great interest—and enormous trepidation. How can one find serious growth opportunities in economies characterized by extreme poverty and a lack of infrastructure and institutions, and with little or no data about market size and customers’ willingness to pay?

Missing from the conversation is a foundation of theory to help explain why some efforts succeed while others don’t. The reason, in our view, is the power of innovation, and specifically what we call market-creating innovation. It not only generates new growth for companies but catalyzes industries that buoy frontier economies and foster inclusive, sustainable development.

Download the HBR article “Cracking Frontier Markets”

The post Cracking Frontier Markets appeared first on Innosight.

January 30, 2019

Corporate Longevity Update: Creative Destruction Rides High

Read our Full 2018 Corporate Longevity Forecast

Economic turbulence and technological change continued to roil major industry sectors over the past year, particularly in media, healthcare, and energy.

In our biennial Corporate Longevity report, Innosight tracks what economist Joseph Schumpter called “creative destruction” by using turnover in the S&P 500 index as a proxy for disruptive change.

In 2018, a total of 23 companies dropped out of the S&P 500 and were replaced by new ones. That makes four years in a row the number has been above 20 firms (28 in 2015 and 2016 and 26 in 2017).

The 2018 turnover rate is roughly in line with our forecast that the longevity rate of corporations in the S&P will nudge down slowly until 2020. We had forecast the 2018 rolling 7-year average tenure to be 21.4 years–and it came in at 22.3 years.

Among the year’s dropouts were some major acquisition targets such as Aetna, Monsanto, Time Warner, Express Scripts, and Scripps Interactive Networks.

Among the new S&P entrants replacing them were Twitter, WellCare, Abiomed, IPG Photonics, and Keysight Technologies.

Healthcare was one of the most active sectors, with five drop-outs and three additions. The Aetna-CVS merger as well as the Cigna acquisition of ExpressScripts are not just about consolidation but about leaping across prior business boundaries to forge a new customer-centric health experience.

In the energy space, four firms dropped out and four entered the index, as the sector continues to be among the most turbulent, due to the changing mix of fuel sources and the challenges posed by climate change.

In media, just two companies were removed from the index, but they were the result of ground-shifting deals. AT&T’s $100 billion buyout of Time Warner showcased the convergence of distribution and content, while Discovery’s $12 billion buyout of Scripps creates one of the largest content companies for both cable and digital distribution.

We expect transformational change in these and other industries to accelerate. Our longer-term forecast expects the longevity rate to plunge during the next decade—dropping down to a 12-year average lifespan by 2027.

The post Corporate Longevity Update: Creative Destruction Rides High appeared first on Innosight.

January 16, 2019

The Prosperity Paradox

Global poverty is one of the world’s most vexing problems. For decades, we’ve assumed smart, well-intentioned people will eventually be able to change the economic trajectory of poor countries. From education to healthcare, infrastructure to eradicating corruption, too many solutions rely on trial and error. Essentially, the plan is often to identify areas that need help, flood them with resources, and hope to see change over time.

Global poverty is one of the world’s most vexing problems. For decades, we’ve assumed smart, well-intentioned people will eventually be able to change the economic trajectory of poor countries. From education to healthcare, infrastructure to eradicating corruption, too many solutions rely on trial and error. Essentially, the plan is often to identify areas that need help, flood them with resources, and hope to see change over time.

But hope is not an effective strategy.

Purchase the book on Amazon

Clayton M. Christensen and his co-authors reveal a paradox at the heart of our approach to solving poverty. While noble, our current solutions are not producing consistent results, and in some cases, have exacerbated the problem. At least twenty countries that have received billions of dollars’ worth of aid are poorer now.

Applying the rigorous and theory-driven analysis he is known for, Christensen suggests a better way. The right kind of innovation not only builds companies—but also builds countries. The Prosperity Paradox identifies the limits of common economic development models, which tend to be top-down efforts, and offers a new framework for economic growth based on entrepreneurship and market-creating innovation. Christensen, Ojomo, and Dillon use successful examples from America’s own economic development, including Ford, Eastman Kodak, and Singer Sewing Machines, and shows how similar models have worked in other regions such as Japan, South Korea, Nigeria, Rwanda, India, Argentina, and Mexico.

Read the related HBR article “Cracking Frontier Markets”

The ideas in this book will help companies desperate for real, long-term growth see actual, sustainable progress where they’ve failed before. But The Prosperity Paradox is more than a business book; it is a call to action for anyone who wants a fresh take for making the world a better and more prosperous place.

The post The Prosperity Paradox appeared first on Innosight.

January 11, 2019

Upgrade Your Strategy Meetings with Physical Exercises to Help Build Alignment

Your conventional meeting etiquette – sitting, talking, politely listening – may be getting in the way of your team advancing its strategic goals.

A substantial body of research suggests that physically enacting difficult ideas can be a more effective way to bring them to life and encourage discussion.

British cognitive scientist Andy Clark has shown that thinking doesn’t happen only in our minds but “when we crisscross the boundaries of brain, body and world.”

Angela Leung and colleagues at Singapore Management University have examined the effects of physical actions—such as working on puzzles while standing outside a large box versus sitting inside the box—that have distinct benefits for creativity.

Psychologist Garold Stasser and sociologist Laurie Taylor found that the physical positioning of group members has a significant impact on communication and can lead to better outcomes.

Walking the Line

Executives, especially senior ones, can be skeptical of unconventional approaches to meetings. That’s why it’s important that “getting physical” exercises are thoughtfully designed and structured, as well as grounded in behavioral and group dynamics research.

One such exercise–which we call Walk the Line—specifically helps leaders see the degree of disagreement and take steps, literally, toward becoming more unified.

A case in point is our work in helping the executive leadership of the $12 billion telecom company Swisscom achieve a breakthrough their own misalignment around growth strategy, as detailed in our Harvard Business Review feature.

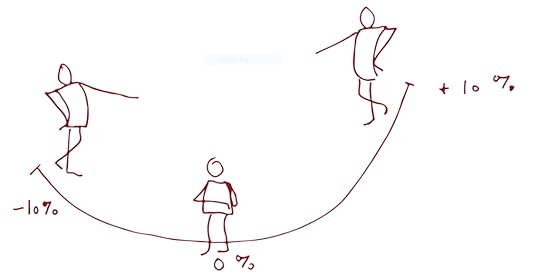

In the meeting room, to facilitate conversation in a concrete way, we laid down a thick strip of tape on the floor five meters long, curved into a semi-circle.

In the meeting room, to facilitate conversation in a concrete way, we laid down a thick strip of tape on the floor five meters long, curved into a semi-circle.

For the 10-member Swisscom leadership team, the tape was marked with the 2025 performance aspiration numbers each person had reported on in the survey, ranging from 2% decline in performance on one end all the way up to +30% on the other.

Everyone was then asked to stand on their mark on the tape.

We instructed each member to argue with the person to his right in an attempt to convince the person to jump to a “more optimistic” number. Then we had each member turn to the left, to convince the person to become “more realistic” about the future.

The arguments in both directions were loud, uncomfortable and filled with moments of surprise, anger, sadness and fear, but once they aired all their views, they shuffled around as stronger visions about future growth opportunities gradually won out.

A consensus emerged that Swisscom couldn’t achieve its full potential through efficiency improvements alone or through growth-focused innovation alone. It needed to do both.

The breakthrough happened when it became clear that digital technologies could fundamentally improve the cost structure, freeing up substantial capital for new-growth areas as well as quality improvements and differentiation in the core.

Building on a new consensus

With those consensus insights, members repositioned themselves a final time, “walking the line” in one direction or another. After all the arguments played out, everyone was surprised to be standing near the same point: a double-digit performance increase by 2025.

It was a shockingly optimistic view of the future, but it was informed by detailed discussions of numerous potential innovations and acquisitions that could close the growth gap.

One member who had started at the lower end of the line came an especially long

way, and it was an emotional experience to get there. “It was a moment of joy and relief,” he said.

The exercise indicated that a strong alignment was possible. Crossing boundaries from brain to body opened up their thinking. Walking the line and moving physically indeed activated more productive discussion and led to a consensus for action.

[VIDEO: Watch delegates at our 2018 Munich CEO summit participate in a “walk the line” exercise to predict Germany’s chances of advancing in the World Cup.]

The post Upgrade Your Strategy Meetings with Physical Exercises to Help Build Alignment appeared first on Innosight.

January 2, 2019

A Simple Way to Get Your Leadership Team Aligned on Strategy

Imagine you call a leadership team meeting to gauge how important the team feels digital transformation is to the company. Would anyone dare say it is not a strategic imperative, even if they privately thought it wasn’t? The meeting ends with seemingly clear agreement that digital transformation is mission critical. But what happens after the meeting, when the person tasked to lead digital transformation asks team members to nominate people to work on the effort? All too frequently, everyone says they can’t spare their scarce resources.

Everyone in the meeting publicly agreed with the direction. But when it came time to allocate resources, the apparent agreement turned into active resistance.

A key to confronting this challenge is to expose misalignments. Rather than letting disagreement simmer beneath the surface, make it crystal clear where your team agrees, and where it doesn’t. We have found that real-time polling tools can bring great clarity to these discussions.

Consider an example from work we did with a privately-held professional services firm. It’s not hard to see how technologies such as blockchain and artificial intelligence could reconfigure the industry. But it’s easy to disagree about the pace and scale of change and therefore the required strategic response.

Learn more about uniting your senior team with our complimentary HBR article

We brought the top team together to review our analysis of industry trends. After a lengthy discussion, we asked each team member to use Pigeonhole Live, a polling solution offered by a Singaporean company, on his or her smart phone to anonymously enter the percent of next year’s profits that they thought the firm should invest in new growth innovation (our firm Innosight uses Pigeonhole Live but has no formal relationship with the company). After the votes were cast, we displayed the data (waiting to unveil the votes helps to combat groupthink) as a word cloud, with numbers that had multiple votes appearing larger.

A summarized report would have shown that the average was 10 percent, with a standard deviation of four percent. But we were more interested in the outliers, which ranged from two to 20.

Read the full article ON Harvard Business Review

The post A Simple Way to Get Your Leadership Team Aligned on Strategy appeared first on Innosight.

December 17, 2018

Digital Growth Depends More on Business Models than Technology

For startups, 2009 was a good year. More than 20 companies launched at that time, including Uber, Slack, Pinterest, and Blue Apron, eventually achieved $1 billion-plus valuations. Given that those companies were all venture-financed and emerged from Silicon Valley, you might assume that the key ingredients that have ensured their success were cutting-edge technologies, digital platforms, and customer bases that were chiefly made up of digital natives. You would be wrong.

Yes, those companies had great technologies, platforms, and demographics, but the secret of their success turns out to be much more prosaic. Each was able to satisfy real customers who needed real jobs done — and by jobs, I mean a fundamental problem in a given situation that needed a solution. In other words, they had great business models.

Every successful company, whether it knows it or not, owes its success to its business model. I explained this in an article that was published in Harvard Business Review in 2008, before any of those companies began, and, now, 10 years later, that still holds true, as more and more of the business discourse is focused on digital transformation. A digital platform, or a digital solution, may enable a new epoch of transformative growth, but when you get under a company’s hood and look to see what’s really driving it, the engine of transformation turns out to be its business model.

In my article, I identified the four interlocking elements that, taken together, create and deliver value to both companies and its customers:

Customer Value Proposition (CVP), which is a way to help customers get a job done. The more important the job, the lower the level of satisfaction with other companies’ attempts to solve it, and the better and cheaper your solution is than theirs, the more potent your CVP.

The second is a Profit Formula, or how you create value for yourself while providing value to a customer. There are four essential elements to the formula: revenues, cost structure, margins, and resource velocity. The best way to create a profit formula is to work backwards, either starting with the price for lower cost businesses that is required to deliver the CVP, and then determining what the cost structure and other factors need to be or in highly differentiated businesses, start with the needed cost structure and margins that leads to the required price.

Key Resources are the assets that are required to deliver the CVP to the customer at a profit, meaning the people, technology, products, facilities, equipment, channels, and brand.

Key Processes are the operational and managerial capabilities that allow a company to deliver value in a way that can be repeated and scaled. These include manufacturing, budgeting, planning, sales and marketing, and customer service.

Successful business models have an exceptionally strong CVP, and a stable, scalable system in which all the elements mesh together seamlessly while complementing each other. As simple as this framework may seem, its power lies in the complex interdependencies of its parts. Major changes to any one of these elements affect the others and the whole.

Read the full article ON Harvard Business Review

The post Digital Growth Depends More on Business Models than Technology appeared first on Innosight.

December 14, 2018

Building a Direct-to-Consumer Strategy Without Alienating Your Distributors

Companies increasingly use digital technologies to circumvent distributors and enter into direct relationships with their end-users. These relationships can create efficient new sales channels and powerful feedback mechanisms or unlock entirely new business models. But they also risk alienating the longstanding partners that companies count on for their core business.

The auto industry is a case in point. Porsche’s Passport program allows consumers to subscribe via a phone app to a range of vehicles for a fixed monthly fee. Your chosen Porsche is delivered to your house with insurance and maintenance as well as unlimited miles and flips to other models included. But if you’re a Porsche dealer, how do you like this idea? Now consider that similar subscription services are being offered by Volvo, Lincoln, BMW, and Mercedes, with more to follow.

These direct-to-consumer offers threaten the very livelihood of dealerships, who historically have owned the customer relationship. And many dealers are pushing back. The California New Car Dealers Association lobbied for a law that required subscriptions to go through dealers. Volvo’s program has elicited so much criticism that dealers have mobilized the Indiana state legislature to outlaw the business model.

This is but one example of the digital Catch-22, the dilemma that most manufacturers and service companies face when creating new distribution channels. As a result, many B2B companies remain stuck in a stalemate. Writing in the Sloan Management Review, Boston College professor Gerald Kane noted that 87% of executives surveyed indicated that digital technologies will disrupt their industries to a great or moderate extent. Yet fewer than half felt that their companies were doing enough to address this disruption.

We frequently find that executive teams understand the potential of a reinvented distribution strategy; however, they are unclear on how to proceed. While the opportunity is compelling, so is the potential to upset existing distribution partners and thereby damage the core business. Disgruntled distribution partners may retaliate in ways such as switching to rivals, favoring competing products, or even lobbying for legislative remedies.

How can companies position for the future without putting their current business in jeopardy? Here are three strategies for developing digital distribution approaches that minimize risk:

Read the full article ON Harvard Business Review

The post Building a Direct-to-Consumer Strategy Without Alienating Your Distributors appeared first on Innosight.

December 12, 2018

LEADING TRANSFORMATION – CEO SUMMIT REPORT 2018

The post LEADING TRANSFORMATION – CEO SUMMIT REPORT 2018 appeared first on Innosight.

December 7, 2018

Unite Your Senior Team Webinar

Innosight Unite Your Senior Team Webinar 2018 from Innosight on Vimeo.

The post Unite Your Senior Team Webinar appeared first on Innosight.

Clayton M. Christensen's Blog

- Clayton M. Christensen's profile

- 2168 followers