Thomas Frey's Blog, page 50

July 20, 2012

Peter Thiel’s Quest for Creating a Viable Global Currency

In 2003 the DaVinci Institute produced a landmark event called “The Future of Money Summit” which took place at the Omni Hotel in Broomfield, CO. One of the featured speakers was Bernard Lietaer, chief architect of the Euro.

At the closing session for the event Lietaer introduced his plan for creating a global currency, a digital currency called the Terra.

The Terra, as Lietaer envisioned it, would start as a trade reference currency pegged to a mathematical equilibrium of existing major currencies, and be backed by a basket of commodities, as opposed to a single one like gold.

After the press frenzy and nationally coverage resulting from our event, the Terra has descended into near obscurity, with little more than a Wikipedia entry to show it ever existed.

One speaker we desperately tried to bring to the event was Peter Thiel, co-founder of PayPal, who was highly regarded as a disruptive visionary in monetary systems.

While Thiel, a darling of the media, seems to have stopped talking about creating a global currency, I recently came across one of his most recent investments in a company called Stripe, which is causing many to speculate. Here’s what I think is about to unfold.

First Some Background

In 1998, Peter Thiel gave a guest lecture at Stanford University and only six students showed up. However, one of those in the audience was Max Levchin, and together they went on to launch PayPal a year later based on a technology that allowed people to email payments.

By March of 2000, PayPal had already attracted 1 million users and Elon Musk took over as CEO.

In 2002, PayPay went public and a few months later the company was bought by eBay. The founding team members became very wealthy.

In 2007, Fortune Magazine began referring to this group as the PayPal Mafia because their people and investments have become some of the most influential in the tech world. Here are a few of the charter members of this so-called mafia:

PayPal CEO Elon Musk became the founder of Tesla Motors and SpaceX.

PayPay Executive VP Reid Hoffman became the founder and CEO of LinkedIn in 2002.

PayPal engineers Steve Chen and Jawed Karim, and web designer Chad Hurley were the founders of YouTube.

Russel Simmons, one of PayPal’s first engineers, and Jeremy Stoppelman, Vice President of Technology, founded Yelp in 2004.

Product manager Premal Shah became founding president of Kiva.org.

Keith Rabois, who was an early executive at PayPal is now the COO of Jack Dorsey’s payment company Square.

Many others have gone on to become super angels and super influencers in Silicone Valley.

Peter Thiel is often called the “don” of the PayPal Mafia. He only earned $68 million in the eBay buyout, but his $500,000 early investment in Facebook, along with countless other investments, has launched him into the stratosphere of wealthy individuals.

The reason Thiel is constantly in the news is because he’s an intensely bright disruptive thinker, and he has the money to take action. Recent estimates place his wealth well north of $3 billion.

Facebook Credits

In 2010, speculation was rampant that Facebook Credits would become the first global currency. While much of this was conjecture, based on Thiel’s influence in the background, the company did indeed try to build critical mass towards a borderless payment system, selling gift cards for Facebook Credits in the likes of Wal-Mart and Target.

However, in June of this year, Facebook decided to pull the plug on “the Facebook Credits brand” in recognition that app developers preferred to create their own virtual currencies, such as Farm Cash in Zynga’s “FarmVille” game. That reduced the need for a platform-wide virtual currency.”

Or so they say. More likely this move was caused by backroom pressure from counties like the U.S. and China who were getting nervous about the long-range implications of this so-called global currency.

Introducing Stripe

Since PayPal’s early days, when the mafia guys were at the helm, the company has grown increasingly complacent, creating an opening for a number of new startups like Square, Braintree Payments, and most notably, a little know startup named Stripe.

Stripe boasts a cadre of Silicon Valley’s pedigree investors including several members of the PayPal Mafia – Max Levchin, Peter Thiel, Sequoia Capital, Andreessen Horowitz, and Elon Musk.

Eliminating many of the headaches in setting up a merchant account, a process that today can take up to three-weeks, can now be done with Stripe in five minutes.

Where many payment systems like Google Checkout and PayPal try to insert themselves into the transaction by creating their own relationship with the customer, Stripe has done right. People selling products are able to retain control of the seller experience, product, and customer.

Naturally, with Thiel being a key investor in yet another breakthrough payment system, people are beginning to speculate on how Stripe could help launch his vision of a global currency.

Bernard Lietaer presenting at a recent conference

One Possible Scenario

Creating a global currency is a seemingly impossible task. Virtually every country on earth will feel threatened with the prospects of losing control of their own currency, something closely aligned with their own base of power. But that’s not stopping Peter Thiel

Most importantly, all currencies are based on trust. Who in their right mind would trust a digital currency people can’t touch or see?

However, assuming a payment system like Stripe can go viral and amass a significant global following, perhaps upwards of 1 billion people over the next few years, the company becomes a force to be reckoned with.

Naturally there are many holes in the ways currencies work, and one of the key deficiencies is the one Bernard Lietaer had identified with global trade. When a company signs a contract to purchase good from a vendor in a foreign country, sometime in the future, the payment price needs to be tied to a specific currency.

As an example, if a Mexico-based company is purchasing 2,000 computers from a company in Thailand six months from now, will the contract be written in Mexican Pesos or Thai Bahts?

Since both parties know their currencies will fluctuate considerably over the next six months, what’s the best way of structuring the deal without favoring one party over the other.

Lietaer’s idea was to create a form of digital money with a value that was mathematically pegged to a statistical center point of the world’s most dominant currencies. By doing this, the currency would be far less like to bounce around.

In the end, a currency that was not tied to a particular nation would be a fairer way of structuring a deal across national boundaries.

Bolstering stability even further, Lietaer’s idea of backing the currency with a basket of 9-12 securities, such as oil, precious metals, and farm commodities is a novel approach to providing a more durable and sustainable form of money.

Where Lietaer failed was his approach to funding the operation of the currency through something known as demurrage, a 4% annual holding fee on the money. As a digital currency, its value would evaporate over time. A total of 4% of all the currency in circulation would be siphoned off to cover the cost of managing the money. In his way of thinking, this type of attribute would prevent hording and promote circulation. In most other people’s minds, it was a little too quirky to embrace.

Assuming a company like Stripe established a company-run foundation to manage a global currency, and using both Lietaer’s ideas for tying it to a mathematical center point and a basket of securities for stability, the company could launch a trade-reference currency without the usual fanfare.

Over time, as more and more companies would begin to use the new currency, the startup community will invariably figure out a whole new spectrum of possibilities, and the currency itself will begin to grow virally.

That’s one possible scenario.

Political Forces at Play

China has long sought to undermine the U.S. dollar as the de facto standard for global currency. The creation of the Euro was in part an attempt by the European Union to create more clout in the global monetary system.

Depending on the political flavor of the week, individual countries may either try to promote or destroy a currency like this.

When Thiel talks about creating a currency that goes beyond the reach of taxation or central bank policy, virtually no country will get behind that. But if it does indeed promote safer, cross-border transactions and helps improve international trade, those are all qualities that few can find fault with.

Final Thoughts

Over time someone will eventually create a global currency. Will doing so create a better society? That will be the topic of debate for many decades after it launches.

Our ever-quickening pace of business has given strategists a whole new playbook, which has, in turn, forced companies to devise new systems and strategies to not only give them a competitive edge, but in the process, trump the competition.

Government, on the other hand, has virtually no competition, and consequentially, little motivation to innovate. Like a lumbering elephant alongside the sleek cat-like speed of business, government has done little to keep pace with change, and even less to experiment, innovate, and improve.

People in government are synchronized to a radically different clock. They are neither driven to compete nor incentivized to reinvent themselves. For this reason, any new global currency is not likely to be created by public entities, but rather by private enterprise.

Is Peter Thiel the person to make it all happen? Maybe.

He’s very bright, vocally opposed to our current systems, and wealthy enough to drive a permanent spike into the heart of something he considers broken.

Is he dangerous? Perhaps, but hopefully he will turn out to be a good form of dangerous.

Author of “Communicating with the Future” – the book that changes everything

.

.

July 13, 2012

Workerless Businesses: An Explosive New Trend

In 2004 when Chris Anderson released “The Long Tail,” the world was suddenly awakened to the potential for niche markets that appeal to an increasingly diverse consumer marketplace.

In business terms, it gave rise to the notion of online businesses selling relatively small quantities of unique products, yet generating enough income for a person to live without a job.

In 2007, Tim Ferriss pushed this idea several steps further in his book “The 4-Hour Workweek.” Not only can people create their own niche businesses, but they can build it up to something quite profitable and start regaining their freedom.

In 2008, I wrote an article on “The Empire of One” about one-person enterprises that were being enabled by the rapidly evolving communication structure inside the Internet.

In 2009, writer Tina Brown coined the term “The Gig Economy” as she noticed a growing number of young people (one third of her survey group) were working multiple jobs and as freelancers.

Combining the growing freelance mentality of young people with the relative ease of launching a niche online business and we have an explosive trend driving us towards a future of “workerless businesses.”

Forced Entrepreneurship

Whenever the economy takes a nosedive, it is typical for people to begin to dance with their “inner entrepreneur” and brainstorm ideas for launching their dream business. But today’s business climate no longer allows for people to wait for the ideal time or prefect conditions to make it happen.

When nothing else is working, they decide it’s time to blow the doors off their “comfort zone” and enter the “entrepreneur zone.”

To be sure, starting a business during a recession is not a bad thing. In fact more than half of today’s Fortune 500 companies were founded during a recession or bear market.

Forced entrepreneurship often starts with project work, temp jobs, consulting gigs, or other opportunities for making money. Sometimes the work is done as a trade-out to just get a foot in the door. Very often one opportunity will lead to another, and a patchwork business plan begins to form in the person’s mind. Formal business plans are rare, but the key metrics for managing the operation begins to crystallize in their head.

The Internet is now enabling people and ideas to connect in ways never before possible. The business models that eventually spring to life often have little, if any, resemblance to their original idea for a dream business. But the fluid nature of the startup world is more than enough to keep them engaged.

To succeed as a forced entrepreneur, bootstrapping is king. They quickly learn to never spend a dime unless it is absolutely necessary. Their skills, talent, and ideas become a form of currency that they can exchange for equally valued goods and services.

Building an “Empire of One” Business

An Empire of One business is a one-person (sometimes married couples) business with far reaching spheres of influence. Typically the business out-sources everything – information products marketed and sold online, or products manufactured in China or India, sent to a distribution center in the US, with customers in the UK and Brazil. Manufacturing, marketing, bookkeeping, accounting, legal, and operations are all handled as part of “the gig economy.”

Yes, much of this has been done before, but a person’s ability to leverage people and products across country lines in a below-the-radar fashion, and still maintain control of a vast and virtual empire is refreshingly new.

The Empire of One business model is one with great appeal to former corporate executives with global contacts and good ability to manage things remotely. With improving economies and Boomers searching for meaning and significance in their lives, we are about to see an exponential increase in these types of businesses in the years ahead.

A Few Statistics

According to Gallup, 32% of Americans aged 18-29 are underemployed or unemployed.

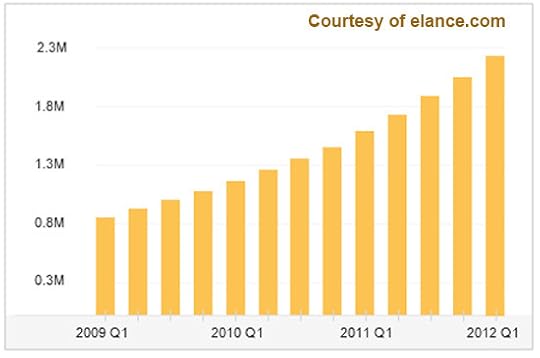

Job posting trends on Elance.com

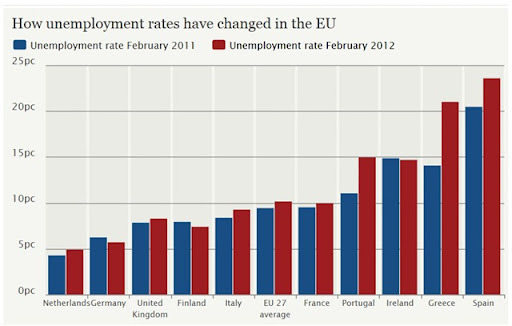

Elance, a site at the heart and soul of the gig economy, helping freelancers find their next gig, has seen dramatic increases in projects in turmoil-countries like Greece (up 122%), Spain (up 142%), and Egypt (up 147%) over last year.

A recent survey by The Guardian showed that out of 112,179 vacancies advertised in Britton in February 2012 only 52% were for long-term positions.

In Dec of 2011, the Guardian reported an additional 166,000 Brits became self-employed over a three-month period, an increase of 4% percent. This meant that a total of 4.14 million people in Britton were self employed, the highest since records began.

Going from Freelance to Empire of One

Transitioning people from doing piece-meal freelance work to running their own stable of freelance workers is still not well-defined. But the first step is finding a niche product or service to work with.

People typically do a lot of soul-searching to uncover something they’re passionate about, and somehow stumble upon their core concept.

Recently, a seasoned entrepreneur and good friend of mine in South Dakota told me about one of his recent ventures.

“I had a good opportunity to go into the specialty tire business and the numbers looked great. It had a tremendous upside.”

“But then it occurred to me that if I owned a tire business that I’d have to spend lots of time talking about tires. I don’t like talking about tires. It’s not a subject that interests me. I love talking about fruit and ice cream (other businesses he owns), but I really don’t like thinking about tires.”

Five Success Stories

Many of those who have carved out a successful “Empire of One” business of their own do not spend much time promoting their success. They quietly go about their business and dedicate most of their efforts on gaining publicity for their business, not for themselves.

That said, here are a few people who have launched successful one-person enterprises:

1.) Airline Advice Business – Gary Leff is a CFO for a university research center who used his Frequent Flyer Miles to travel all over the world in First Class, and his friends kept asking for advice. Almost on a whim, he decided to launch a basic website offering the service of booking travel awards for a fee. His service is something that people could do on their own for free—but plenty of people don’t know how it works or just don’t want the hassle of dealing with airline call centers. This “side business” now brings in more than $100,000 a year.

2.) Diet-Master Business - Jason Glaspey was a follower of Paleo, the controversial diet that is both loved and ridiculed. Jason noticed a common problem among fellow devotees: because of the requirement for regular shopping and planning, Paleo was hard to follow on a regular basis. So Jason created Paleo Plan, a membership site that offers shopping lists and ongoing guidance. The goal of Paleo Plan is to keep its customers on track, with detailed shopping lists and ongoing recommendations. The project now brings in more than $5,000 a month.

3.) Snowboard Guru Business - Nev Lapwood is a snowboarding instructor who created a set of instructional DVDs that are now sold around the world. Nev had a good business model almost from the beginning. The business now produces more than $240,000 a year in net income.

4.) Blogging Business – Steve Pavlina runs a blog named after himself, StevePavlina.com. The site was launched in 2006. By 2008 he was earning well over $100K annually from Google AdSense, but made the decision to drop all the ads after becoming uncomfortable with the companies he was, by default, endorsing. He now earns considerably more by promoting only the products and services he personally endorses.

5.) Documentary Business – Luisa Dantas raised $28,049 from 236 backers on KickStarter for her documentary film Land of Opportunity, which tells the stories of a diverse group of people as they struggle to rebuild post-Katrina New Orleans, highlighting issues that plague many American cities. The film uses personal stories to engage viewers with complex problems such as affordable housing, immigration, urban redevelopment, and economic displacement.

Eight Reasons to Work for Yourself

The appeal of creating a workerless business goes far beyond what anyone else can offer you. Here are a few of the more desirable traits compelling people to take the leap.

No-Alarm Clock Lifestyle – Your day starts and ends when you want it to.

Finding the Real You – You do what interests you, and what interests you defines who you really are.

Be Yourself, Genuine and Authentic – Most people spend their entire lives trying to be the person someone else wants them to be.

Living without Fear – You no longer have to do the work of others, or live in the fear of being fired.

Creating Your Own Value – Your personal worth is no longer defined by an employer. You get to keep as much as you earn.

Accountable for Your Own Risks - While it may be risky to set up a business venture and work for yourself, ultimately there is far greater security than working for a company or even government. You can’t be laid off, and while your income may vary, you can always make money.

Personal Freedom – You choose where you live rather than living where you happen to find the right job. You can sleep in, go to the beach during the day, work harder sometimes and slack off at others – all without having to ask for permission.

Control Your Own Destiny – In the end, wherever you end up, is entirely up to you.

Final Thoughts

Currently no one is offering training for this type of business enterprise. It is both a business for pioneers and daring risk-takers, and a logical extension of our current business culture.

Any startup business can be as simple or complicated as you wish to make it. But there are many advantages to keeping it simple.

In addition to the issue of flexibility and self-control, workerless businesses tend to fly below the radar. In our super-litigious society, a business’ ability to avoid legal challenges is directly related to its odds of succeeding. Beyond the monetary costs, litigation extracts an emotional toll that has ruined the lives of countless aspiring entrepreneurs. For some, a lawsuit resistant business may be its most appealing feature.

For others, the elimination of human resource responsibilities is the key. In the U.S. more and more laws are added every year governing the employer-employee relationship. A workerless business has no employees – potentially many contractors, but no employees. The business adds or subtracts contractors according to the needs of the business, and since it is not providing a place of employment, very few laws apply.

Since no colleges or universities are currently teaching one-person entrepreneurship, the DaVinci Institute is taking a serious look at developing it. If this is a topic you’re interested in, please let us know. We’d love to loop you in as we develop our plans for the future.

Author of “Communicating with the Future” – the book that changes everything

.

.

July 6, 2012

Controlling Your Own Legacy

Over the 4th of July, I attended a theatrical production of the history of my hometown of Mobridge, SD. The actors and actresses did a terrific job of illustrating the tough times of the early pioneers trying to forge a new life along the Missouri River in barren lands of northern South Dakota.

What I found most interesting was that this production took place in a cemetery.

They were giving us a glimpse of the legacy left behind by these brave and bold individuals against a backdrop of tombstones and gravesites.

While we know very little about those who lived 100-200 years ago, people today have the ability to leave a very detailed, well-documented legacy. In fact, they have the ability to control their reputation long after they die.

Emerging from the midst of our massive information revolution is a fascinating new industry – legacy management. And one of the critical decisions each of us will have to make is whether we want to manage our legacy virtually or have it tied to a specific location.

Preserving your precious life moments.

A Growing Number of Legacy Tools

Our ability to capture snippets of our lives and preserve them has been growing exponentially over the past few decades.

Posting documents, photos, videos, voice recordings, and other details of our lives onto the likes of Facebook, Youtube, LinkedIn, Twitter, and Google+ has never been easier. The number of “legacy-building tools” is growing quickly. But at the same time, we have no good understanding of whether these tools will still exist even 10 years in the future.

How much of what is being captured today will still be around 500 to 1,000 years from now?

In 1999 some of the top Internet properties were Lycos, Xoom, Excite, AltaVista, and GeoCities. Each of them were attracting millions of web visitors each month, competing head to head with companies like Microsoft, Yahoo, and Amazon. Today each exists in name only, resting quietly in a shadow of its former existence.

It’s difficult for us to think this far out when our technology is changing so quickly. Will companies like Facebook, Google, LinkedIn, and Twitter still be around 100 years from now? Probably not.

More importantly, if companies like this disappear, what happens to all the information they collected?

Organic growth often leads to organic abandonment. Is the speed with which they arrive a predictor of the speed with which they will leave?

In the midst of all these questions lie the makings of an entire new industry, one near and dear to our own hearts – building and preserving our own legacies.

As we look at the next generation of the Internet, watching carefully as it unfolds, we cannot help but be struck by how quickly it has infiltrated our lives and how much of our attention it currently commands.

Much like the physical structures in our cities that form along the horizons of our urban landscapes, the data structures inside today’s data giants represent some of mankind’s most remarkable feats. True, they exist only as a digital compliment to the bricks and steel of physical buildings, but they hold within them vital clues about who we are, what we find valuable, and our drives and passions for forging ahead.

Is this how all tombstones will look in the future?

How Much is Too Much?

Walking through cemeteries, I marvel at the huge investment people have made in the granite tombstones that mark each grave. People are desperate to leave some small record of their existence.

Over the coming years, funeral homes and estate planning professionals will offer a variety of services for “leaving a legacy.”

As we debate whether its better to leave a digital legacy or a physical one, many will still opt to buy cemetery plots as a permanent location to preserve our passing.

Using 3D printer technology, people in the future will be able to create a physical sculpture of themselves, life-size or larger, for not much money.

At the same time, we will be improving technology for producing digitally engraved portraits, documents, and other records in the likes of granite and marble.

Since we don’t have confidence in our ability to leave a long-term digital legacy, many will resort to leaving a physical one.

If, for example, over the next 100 years a total of 10 billion people decided to preserve their legacy, each leaving a total of 10 cubic yards of physical material, the resulting collections would take up a land area slightly smaller than the state of Ohio, and would be filled with countless immovable objects that communities would have to build around.

Is that a likely future?

Building a Digital Legacy Industry

Virtually everyone wants to leave something behind.

Regardless of whether it’s a simple photo, a message for our great, great grandchildren, or the lessons we learned along the way, our ability to make our mark on the future is limited by our tools of preservation.

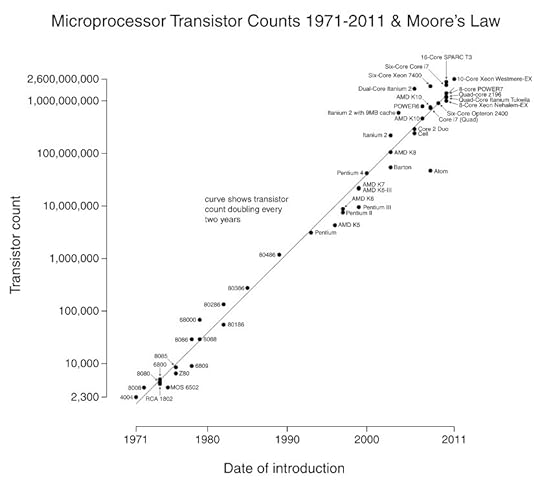

As we think through the future of information, there are three foundational pieces that will help us build this industry – finding the End of Moore’s Law, the Whole Earth Genealogy Project, and Creating a Digital Preservation Culture.

1.) The End of Moore’s Law – Before we can set standards for long-term data storage, we will need to find the ultimate small storage particle.

Based on this piece of Moore’s Law research conducted by University of Colorado’s Professor Mark Dubin, we still have 131 years before we are able to store information on an individual electron. However, that date will likely happen much quicker with some of the latest advancements in nanotechnology.

Assuming the electron is as small as we can go, something that we won’t know for certain for many years to come, we can begin to set standards around information storage. That would mean that a book digitally preserved in 2150 would still be readable with technology 500 years later, in 2650

If we were able to see a database of humanity’s DNA, what patterns would emerge?

2.) Whole Earth Genealogy Project - The genealogical industry currently exists as a million fragmented efforts happening simultaneously. While the dominant players, Ancestry.com and MyHeritage.com, have multiple websites with hundreds of millions of genealogies, there is still a much bigger opportunity waiting to happen.

So far there is no comprehensive effort to build a database of humanity’s heritage capable of scaling to the point of including everyone on earth, posted on an all-inclusive whole-earth family tree.

As we improve our ability to capture DNA and decipher it, it may even be possible to automate this process.

The information will prove to be tremendously valuable, providing data about hereditary diseases, demographic patterns, census bureau analytics, and much more.

More importantly, it will become a new organizing system for humanity – a new taxonomy. Every person on earth will have a placeholder showing exactly where they fit. In many respects, it will be similar to the way maps helped us frame our thinking about world geography. This would be a new form of “geography” for humanity.

3.) Creating a Digital Preservation Culture – While many people are rallying around efforts to “save the trees,” “save our oceans,” and “save our endangered species,” there is virtually no effort to “save our information.”

Most of the digital and analog information from only 20 years ago is unreadable with the tools and technologies we have today. Cassettes, 8-tracks, and even 3.5” disks are all becoming museum pieces as the tech world has left them as little more than a fading memory in its own digital exhaust.

One of the prized assets of today’s Internet companies is their ability to amass huge volumes of digital information. But we have no provisions for preserving the data if the company itself goes under.

While governments around the world have worked hard to create a monetary system with central banks to step in whenever a currency is failing, we have no “central information banks” that can step in when an information company is failing.

Final Thoughts

How will future generation remember you? How will they perceive your successes and failures, your accomplishments and misguided efforts, your generosity and perseverance?

While many still view inheritance as the primary way to leave a legacy, people now have the ability to manage, and even micro-manage, the information trail they leave behind. In fact, if they choose to, they can even communicate with their own descendants, future generations who have not even been born yet.

The body of work we leave behind has become increasingly easy to preserve. So if we chose to let future generations know who we are and why we set out to achieve the things we did, we can do that with photos, videos, and online documents.

Stepping one step further into the future, generations to come will have the ability to preserve the essence of their personality and work with interactive avatars capable of speaking directly to the issues future generations will want to ask.

The digital world, even as it exists today, contains the keys to humanity, the raw essence of personhood, and in the long run, the future of our children’s children.

As all of us age, the notion of leaving a legacy becomes critically important, and furthering our abilities in this area will become increasingly important.

In fact, it is on the verge becoming a fast-growing industry that many of us will want to work in.

Author of “Communicating with the Future” – the book that changes everything

.

.

June 29, 2012

Turmoil Ahead for the Automotive Industry

In 1954, Brook Stevens, a well-known industrial designer gave a keynote speech at an advertising conference titled “Planned Obsolescence.”

By his definition, planned obsolescence was “instilling in the buyer the desire to own something a little newer, a little better, a little sooner than necessary.”

Over time, planned obsolescence has become a commonly used term for products designed to break easily, and our cars have become the product that most consumers associate with this business practice.

Regardless of whether its true, the perception exists and the automobile industry has done little to change it. Naturally, shortening the replacement cycle has its supporters as well as its critics.

But the idea of replacement cycles will soon change as we enter the driverless car era, as automobile companies make the transition from selling cars to selling transportation.

Here’s how I see this transition unfolding.

Average Life Expectancy of Cars

The age of the average car on the road in the U.S. is now at an all-time high, nearly 11 years old, according to the latest statistics from R.L. Polk Co.

The auto industry wasn’t paying attention when this change started happening. Older generations have been conditioned to think that cars start to fall apart after four or five years, and consequently traded cars far more often than necessary. Twenty years ago, new cars were relatively cheap and credit was easy to get, so why should anything change.

This attitude helped feed a booming leasing era that started in the 1990s. With leasing, the customer only borrows the difference between the upfront cost and the residual value of what the car will be worth at the end of the lease.

Leasing became an easy way to take home more car for less money, but the downside was that the car never got paid off. Before the recession the auto industry was booming.

Then reality hit the fan. New-car sales fell dramatically between 2008 and 2009. New-car sales in the U.S. fell from 16.2 million in 2007 to 13.2 million in 2008, according to AutoData Corp. A year later, sales fell even further, to only 10.4 million in 2009. General Motors and Chrysler were forced to file for bankruptcy. Ford also restructured itself, although it avoided bankruptcy.

Now, with close to 6 million fewer new cars on the road, the average age of cars on the road has been climbing. New-car sales have started to recover, with sales back to about 11.6 million in 2010, and 12.8 million in 2011.

According to Polk there are now 240.5 million cars and trucks on the road in the United States, down from 242.1 million in 2008.

The Scenario – Ten Years into the Future

The year is 2022 and the automotive industry is on the verge of a major transformation. Even though the industry has been growing steadily over the past decade, and little has changed so far in the nature of personal vehicle transportation, the telltale signs of rapid transformation are showing up everywhere.

At issue is a plan published a year earlier by Toyota that proposed a foundational shift in the industry, a plan for making the transition from “selling cars to selling transportation. “

While this may have seemed like a subtle play on words to the casual outsider, it has the potential to dramatically alter the automobile industry in ways that most are still not able to grasp.

First, some background.

In 2005 the DARPA Grand Challenge created a competition for designing the world’s first driverless vehicle capable of driving 132 miles through the deserts of western U.S. with no human intervention. The winner was the team from Stanford University.

Encouraged by their first success, a second competition was staged in 2007, the DARPA Urban Challenge, to prove robotic vehicles could drive themselves through a city, which was won by Carnegie Mellon University.

As a result, the driverless-car era was born, first with experimental vehicles in R&D labs around the world, but later with well-designed production models.

In 2018 the first widely available models of driverless car hit the market. While it looked and functioned like a traditional vehicle, it gave drivers the ability to input a destination, sit back, and let the car calculate out the best route, based on traffic, and perform all of the normal driving functions to take passengers to their destination in a smooth, relaxing environment.

Driverless cars all use a common “Autodroid” operating system, developed by Google, so vehicles can do a better job of communicating with each other, while constantly mapping the ever-changing road conditions.

The past four years have seen a large number of these vehicles sold, but as a percentage of the overall car population it represented only a small sliver. But consumer demand was growing quickly, and more importantly, people have been shifting their thinking about the role of the automobile in their daily life.

The Toyota Plan issued projections that over the next 20 years, most consumers will adopt a “transportation-on-demand” lifestyle where, much like hailing a cab, people will use their mobile devices to summon a driverless vehicle whenever they needed to travel somewhere. Without the cost of drivers, this type of transportation is expected to become infinitely more affordable, for most people, that owning a vehicle themselves.

So rather than buying their own car, and taking on all the liabilities of maintenance, upkeep, and insurance, consumers will begin to adopt the lifestyle of simply purchasing transportation as needed.

As the transition is made to driverless vehicles, combined with the shift to the transportation-on-demand lifestyle, the number of vehicles sold will begin to decline. And a growing percentage of total sales will be to large fleet operators who are offering the “transportation on-demand” service.

In response to declining car sales, the automotive industry will adopt a “selling transportation” model where, rather than “selling” cars to large fleet operators, car companies will begin charging a nominal per-mile charge.

Fleet operators will love the arrangement because there will be no large up-front purchase price, but instead, only a small monthly fee based on the number of miles driven.

As the sale of cars begins to decline, the automobile industry will start to design and manufacture cars capable of driving over 1 million miles. By collecting a small per-mile fee over the life of a million-mile car, automobile manufacturers will have the potential of earning ten times as much, per vehicle, as they do today.

This will mean all car parts and components will need to be designed more durable, longer-lasting than ever before. Both quality and design standards will be pushed to new levels.

Reshaping the Industry

Many of the ancillary businesses in the auto industry will not find the above scenario very appealing. In an industry that has been driven by “unit sales” for over a century, a shift of this nature will leave many out in the cold.

Insurance companies will watch their auto businesses evaporate. Banks and credit unions that specialize in financing cars will see that business disappear. Parking lots will become largely unnecessary. Traffic cops and traffic courts will fade into the sunset. Ambulance services, EMTs, gas stations, auto supply stores, tire stores, oil change and brake repair shops will all begin to dwindle away.

At the same time, a transportation industry with vehicles on the road for longer periods of time will spawn entirely new industries.

Maintenance and repair will still need to occur, but these will no longer be customer-facing businesses. Driverless cars will cause a move towards a more automated system for routine upkeep.

In remote areas, where few people live and the efficiencies of on-demand no longer make sense, new kinds of transportation services will spring to life.

Niche businesses will spring to life that specialize in the “rider experience” now that passengers no longer have to focus on the task of driving.

Automobile transportation has become a very pervasive part of global culture, and the U.S. will strive to remain at the forefront of this next generation of the industry.

Final Thoughts

Ten years ago, Scott Thompson, a rising star at Visa who later became CEO of Yahoo, was pushing the idea of universal commerce. In his way of thinking, universal commerce was a technology capable of turning any device into a payment device.

So instead of Nikon or Cannon selling “cameras,” they could sell “photography” by charging a small fraction of a cent for every shutter click. Cameras could be given away for free and the companies would make more money by charging for photos taken than for the camera itself.

Similarly, printer companies like Hewlett Packard and Lexmark could start selling “printing” instead of “printers.” Rather than charging for the machines and the ink, they would charge for each page that is printed.

In this type of arrangement, companies would compete on the price of output instead of price per unit. As a result, design teams would be driven to create devices that lasted many years as opposed to some “planned obsolescence” schedule that encouraged throwing out old equipment in favor of buying something new.

Details of usage for both the cameras and the printers would be transmitted wirelessly to the companies so they could send their customers a monthly bill.

However, this whole idea begins to fall apart in a field where technology is changing quickly. In a consumer product marketplace, where innovation is happening swiftly, and pricing is very competitive, the rapid changes discourages long-term thinking. Even though the equipment would last far longer, it would be too easy to throw away “dated” equipment when something new comes along.

But the auto industry has different forces at play. The average life of cars on the road today is nearly 11 years and growing. People don’t “throw away” cars like they do cameras and printers.

Once we find ourselves as passengers instead of owners, our attitude will change. We will find ourselves far less concerned about the efficiency of the vehicle, and whether it has a great paint job, or whether it makes the right statement. Yes, there will still be niches of people who care about these things, but much like catching a taxi, the focus will be far more on getting from point A to point B, rather than how it will look in our garage.

I’m sure I’ve just scratched the surface with this line of thinking, so I’d like to hear your thoughts. What have I missed, and when and how will the industry “zig left” when I’ve projected they will “zig right?”

There are many variable at play, which makes forecasts of this nature rather precarious at best.

In any case, the next two decades will prove to be an exciting time to watch as industry players rethink strategies and rewrite playbooks for our unfolding future of transportation.

Author of “Communicating with the Future” – the book that changes everything

.

.

June 22, 2012

The Disruptive Underground Vs. the Banking Industry

In 1997 Reed Hasting returned his copy of “Apollo 13” to the video store and was hit with a late fee so big that he was embarrassed to tell his wife about it. Out of this moment of humiliation the idea for Netflix was born, a business that would eventually take down the entire video rental industry, and its excessive fee-charging practices in the process.

Today, many young entrepreneurs are looking at the excessive fee-charging practices of the banking industry with the same kind of righteous anger and opportunistic eyes that motivated Hastings. Banking fees in 2011 cost U.S. consumers $29.5 billion, so the stakes are considerably higher than those of the video industry.

However, banking is an industry that has fortified itself with armies of lawyers and centuries of laws to insulate itself from any one person crying foul, so the pilfering continues.

Yet it is in the rubble of these daily fee-hazings, where an estimated 60 million unbanked and under-banked people have been extricated from the system, that we are beginning to see a number of disruptive business models emerge that will soon make these banking practices a thing of the past.

Driven by Fees

A recent report released by Pew Research on the “Safety and Transparency of Checking Accounts” showed that the average length of bank disclosure statements for a simple checking account were 69 pages long, and the median overdraft penalty fee banks charged was $35.

Also of note, Pew found that all of the banks in their study made it a common practice to reorder withdrawals from highest to lowest dollar amount as a way to maximize overdraft fees.

So where is the line separating fair business practices from those that mislead or confuse consumers? Does it matter if that fee dwarfs the actual costs?

The average household in the U.S. pays 10 overdraft fees per year, but that’s a bit misleading. Fees aren’t distributed evenly and 9% of depositors generated 84% of the overdraft fees. And those fees amounted to roughly three-fourths of banks’ income for deposit-account services.

While banks have gone out of their way to paint the picture of careless consumers who need to be more responsible for their accounts, they have introduced a variety of new services such as electronic banking, ATMs, check-by-phone, and debit cards, to dramatically increase the number of tripping points along the way.

Understanding the 60 Million Left Behind

Roughly 8% percent of U.S. households are unbanked – 17 million people. Another 18% are under-banked, relying on money orders, pawnbrokers, payday loan services, and loan sharks – 43 million people.

According to a 2009 FDIC survey, 60 million Americans need to use some form of cash to pay their bills. This demographic is young, minority, poorly educated, and extremely low-income. 80% of these families make less than $25,000 a year, and 40% have annual incomes of less than $10,000.

In this world there are many hidden costs for being poor. The fees they pay for borrowing money, cashing a check, and paying bills are extremely high.

A check cashing service alone can demand 5% or more of these paltry paychecks. (5% of $25,000 is $1,250 per year).

A 2010 Pew study of 2,000 low-income households titled “Slipping Behind: Low-Income Los Angeles Households Drift Further from the Financial Mainstream,” showed how unexpected and unexplained fees such as overdraft charges push consumers out of the banking system.

Half of the study group were banked and they other half unbanked. The study, conducted during the economic downturn of 2009-2010, showed the detrimental effects of these and other hidden fees – 32% left the banking system because of unexpected or unexplained fees.

Hidden inside this group of 60 million people, who have been rejected by the banking industry, lays the disruptor’s keys to revolutionizing the global monetary systems.

Three Questions

For the enterprising entrepreneur, there are three key questions that will need to be thought through as they formulate an offer and entry point for their services:

What opportunities are currently being missed because the friction in today’s monetary transactions is far too high?

How many more people would be able to work their way out of poverty if all the current tripping points were removed?

Who is it that’s offering a better mousetrap elsewhere in the world? What can we learn from their successes and failures?

Mobile Money in Africa

With mobile phones becoming ubiquitous in Africa, significant inroads have been made mobile wallets. Mobile money transfer allows those without a bank account to transfer funds as quickly and easily as sending a text message.

M-Pesa: The most successful of these systems, and the first to operate on a large scale, is M-Pesa, a joint venture between mobile phone giant Vodafone and Kenya’s Safaricom. The M stands for mobile, and Pesa is Swahili for money.

Over 50% of the adult population in Kenya use this service to send money to far-away relatives, to pay for shopping, utility bills, or even a night on the tiles and taxi ride home.

To use the service, customers first register with Safaricom at an M-Pesa outlet, usually a shop, drug store or gas station. They can then load money onto their phone. The money is then sent to a third party by text message. The recipient takes the phone to a nearby store, where they can convert the message into cash.

Xapit: Similar to M-Pesa, Xapit offers users the freedom of doing their banking from any location. Services include the ability to check account balances, transfer funds, pay utility bills, top up their air time, or withdraw cash from ATMs around the world, all without having to go to a bank.

EMIDA: With operations now extending to six continents, EMIDA’s mobile wallet allows consumers to apply cash to their virtual mobile account without requiring an existing bank account or credit card. Account holders can load value to their account and transfer money for goods and services to anyone, anytime, from anywhere. Their vision is to create a borderless user community connected through their mobile wallet.

For businesses in Africa, mobile wallet technologies like these have revolutionized cash flow. They have become successful because they don’t focus on traditional bank services, but instead providing new kinds of financial service to the unbanked.

Mobile phones have become the wallet of choice for the unbanked. GSMA, an association of mobile operators and related companies, says that by 2012, nearly 300 million of the previously unbanked in Africa are now using some form of mobile banking.

Mobile Wallet’s War on Banking Fees

Once mobile banking catches on in the U.S., combined with the rapid proliferation of smartphones, the app builders will find new and ingenious ways to protect consumers from bank fees.

48% of U.S. consumers surveyed in April said they are interested in mobile wallets. Of these, 80% expressed a preference for a PayPal wallet, while Google Inc. and Apple Inc. each drew 60% positives. PayPal’s wallet is currently accepted at 16 physical-world chains. The Google Wallet, unveiled last year, can be used for payments at any store that accepts contactless cards. Apple’s wallet works with its proprietary online App Store and iTunes site, as well as its brick-and-mortar Apple stores.

So who will take the lead in emancipating 60 million hard working Americans by creating and promoting a light-weight cash-focused mobile wallet?

Here are five possibilities:

Stored Value Vendors – The post-recession, stored value card is one fastest growing products in the financial industry. Gift cards, prepaid telephone card, and open-loop goods or services with a prepaid debit card all use a stored value card network. Vanilla Visa is a perfect example of a successful open-loop stored value card.

Money Transfer Agents – Money transfer companies will naturally see a huge business opportunity for the unbanked market. Each year, millions of migrant workers transfer hundreds of billions of dollars globally, often paying more than $20 per cash wire transaction with recipients having to travel for hours to pick up remitted funds.

Wireless Carriers - Carriers that focus on already banked customers, know that 15% of their prepaid top-up accounts are eaten by in-market service providers. The carriers would like a banking wallet relationship with the unbanked to allow for direct top up solutions.

Commercial Banks - Joint ventures such as clearXchange, which is a Bank of America, JPMorgan Chase and Wells Fargo initiative launched earlier this year, allow people with bank accounts to move money through a mobile device. However this is predicated on an existing banking relationship. The service is simple for established bank customers, but not likely for an unbanked person.

Government – One of the most motivated parties will be the government. Getting a citizen into a light-banking mobile wallet will help them avoid the fees and build and protect their wealth. According to the Federal Reserve Bank study in December 2010, the “Unbanked consumers spend 2.5%-3% of their government benefits check and 4%-5% of their payroll checks just to cash them.”

While banks and other financial institutions need to be in this emerging food chain, it is far more likely that telecom carriers, payment vendors, money transfer vendors, and the government will push the needle of innovation and take the lead in this sector.

Final Thoughts

The $30 billion dollars a year currently being syphoned from the U.S. economy through banking fees is a target that is far too attractive for disruptive entrepreneurs to overlook.

With most future transactions being conducted through smart phones, any number of downloadable apps will make it nearly impossible for banks to levy a fee on a personal account.

Yes, banking fees will be with us for many years to come. But their role as a primary source of income for banks will diminish quickly as social networks feed the fires of discontent by showing people “how to fight back” against the evil bankers.

To be sure, there will be many attempts to impose new fees, and the victimization of the less fortunate will certainly not end. But perhaps a small ray of hope can be found along the way, as a few more people may be able to work their way out of poverty.

But in the end, the battle for the bottom will have huge implications for the people at the top.

Author of “Communicating with the Future” – the book that changes everything

.

.

June 15, 2012

The Curse of Infrastructure

Every time I drive to the office there are 11 separate stoplights along my route. Based on some cosmic luck-of-the-draw, two thirds of the stoplights will either be red or green, and the time it takes me will vary from 12 to 22 minutes.

Yes, it’s a relatively short commute. But the countless hours spent every year sitting mindlessly at ill-timed stoplights represents a tremendous expense of time, fuel, and resources that not only I, but also the majority of workers in America bear, all because of one tiny piece of ancient infrastructure – the dumb stoplight.

Indeed many communities are beginning to shift to intelligent traffic systems that constantly adjust patterns to better match the flow of cars. But this long overdue transition is happening at great expense to cities, an expense that cities themselves derive very little direct benefit from.

In this one teeny example, we can begin to see the challenges ahead for dealing with infrastructure. Not only is it expensive to maintain and upgrade what we have, but more importantly, it blinds us to what-comes-next.

For this reason, I’d like to take you along on a journey into the complex world of future infrastructure, and the curse of every legacy system that accompanies it.

Philosophy of Infrastructure

There is a long-held belief that infrastructure, in general, represents a long-term societal investment, that will move us along the path of building a more efficient, better functioning, society. And usually it does…for a while.

However, infrastructure comes in many forms and as we build our elaborate networks of pipes, wires, roads, bridges, tunnels, buildings, and waterways, we become very focused on the here and now, with little thought as to whether there might be a better way.

Once wired power lines are put into place, it becomes hard to imagine us using wireless power.

Once a human-based delivery system is put into place, like the post office, it becomes hard to imagine a human-less automated delivery system.

Once a tunnel is bored through a mountain, it becomes hard to imagine a better way to get to the other side.

Once a prison is built, it becomes hard for us to imagine a prison-less justice system.

Once an airport is constructed, it becomes hard to imagine air transportation in any other way.

Once a highway is built, it becomes hard to imagine an alternative transportation system that uses something else.

Infrastructure creates its own inertia. As soon as its in place we suddenly stop thinking about what comes next.

Our life is based on stories of the here-and-now. Once stories are told, it becomes hard to un-tell them.

Sacred Cow Syndrome

In many respects, infrastructure becomes a lasting testament to who we are as a society, and part of the cultural moorings we use to guide our existence.

People become emotionally invested in them because they create stability, usefulness, and purpose. But more importantly, people become financially invested in them and their livelihood depends on their ongoing existence.

Virtually every piece of infrastructure creates jobs, revenues streams, and investment opportunities, as well as new laws, regulations, and industry standards.

The longer a piece of infrastructure is in place, the greater the resistance there is to replacing it. Much like an aging tree, the root system that feeds it becomes enormous.

Every community has its own form of sacred cows, and infrastructure is often one of the most entrenched.

Life Cycles are Getting Shorter

Whenever a new piece of infrastructure is put into place, the clock starts ticking. The corrosiveness of nature, structural deterioration, and functional obsolescence all begin to rear their ugly head. It’s useful life may be measured in decades or in centuries, but all forms of infrastructure will eventually wear out.

For virtually all forms, the life cycles are getting shorter.

On the long end of the spectrum, many of the hydroelectric dams in the U.S. were built in the 50s and 60s. But with modifications and upkeep, these dams still have many useful decades ahead of them.

Lasting considerably less time, the usable life of shopping centers is around 10 years before major renovation, and often less than 20 years before they’re torn down completely. Similarly, experts are now viewing the usable life of large stadiums shortening from 50 years to somewhere around 20 years.

Eight Stages of the Curse

As with most of the cycles we deal with in life, there are well-defined stages that infrastructure goes through during its existence.

Celebration – Once a new project is complete, we begin by patting ourselves on the back in celebration of this latest accomplishment.

Acceptance – It usually doesn’t take long for people to accept it and make it part of their daily life.

Dependence – Over time we lose sight of what life was like without it and we learn to rely on it as a routine part of life.

Deterioration – All man-made structures eventually wear out, and once they do, we look for something new and better to replace them.

Disagreement – Repair is almost always cheaper than replacement, and the vocal few that have their eyes on something better, have to wait.

Denial – With ongoing repairs being made, it becomes easy to deny any problem exists.

Agonizing Sunset – Even when newer better systems are being used elsewhere, the replacement decision will drag on, and on, and on.

Painful Transition – Eventually the replacement decision will come, but it will come at a price. Change is never easy to accept, especially when countless numbers of individuals become heavily invested in the surrounding systems.

As you are starting to see, our aging and problem-riddled infrastructure, and the painfully slow processes we have for changing it, is taking its toll. Here’s one example.

Airports Get a “D”

According to Jonathan M. Tisch, CEO of Loews Hotels, “Even though five of the world’s 10 busiest airports are located in U.S., not one of them ranks in the world’s 10 best.”

He went on to say, “Travel frustrations caused people to avoid 41 million trips in 2008, according to a study conducted that year. Cost to the economy was estimated at $26.5 billion.”

A survey he sited showed that civil engineers gave the U.S. aviation infrastructure a “D” grade – only slightly higher than the D minus given to our country’s roadways.

“Our aging infrastructure simply cannot handle today’s demand for travel,” Tisch concluded.

Working within the Current System

Clearly I’m not the only one complaining about stoplights.

A group of researchers from MIT and Princeton University have developed an app that takes advantage of a growing trend: drivers who install brackets on their dashboards and mount their smartphones as GPS navigators.

The researchers used a network of these GPS-enabled cell phones to collect information about traffic lights. Based on images captured by the phones’ cameras, the app is able to predict exactly how slowly a person needs to drive in order to miss the next red light.

The app, called SignalGuru, was tested on 20 cars in both Cambridge, Mass. and Singapore. The system used in Cambridge, where lights change according to fixed schedules, predicted the change of red lights to within two-thirds of a second. In Singapore, where traffic lights change depending on traffic flow, the system was less precise.

This is an example of people going to extreme lengths to compensate for our ailing infrastructure.

Disruptive Infrastructure

As with other areas of society, disruptive technologies are beginning to attack the sacred cows of infrastructure.

Here are a few fascinating projects where the founders are working hard to disrupt the status quo.

ET3: Billed as “Space travel on earth,” ET3 is an Evacuated Tube Transport Technology that transports packages or people inside car-sized capsules on a frictionless maglev track that moves effortlessly inside airless tubes to the destination. It’s estimated that speed of up to 4,000 mph can be achieved with this system.

Eole Water: The Eole Water company has developed a special wind turbine capable of extracting upwards of 1,000 liters of water a day directly from the air.

Contour Crafting: Developed by USC Professor Dr. Behrokh Khoshnevis, contour crafting is a layered fabrication technology similar to 3D printing that can be used to construct buildings and other key pieces of infrastructure.

Google’s Driverless Cars: After conducting over 100 separate test and logging over 250,000 on their fleet of driverless cars, Google is setting their sights on a very disruptive system that will forever change transportation. Hidden behind the hype of this technology is Google’s plan to come up with an Android-like operating system for all future driverless cars. As cars become driverless, we will see dramatic shifts in how roads and highways are built.

Blueseed: Funded by PayPal founder Peter Thiel, Blueseed proposes to create visa-free floating work villages in international waters, with the first to be located within helicopter distance of Silicon Valley. This floating island is a new form of infrastructure destined to disrupt a variety of existing systems.

Airdrop Irrigation: Winning the James Dyson Award for Innovation, Edward Linnacre has developed an inexpensive self-contained solar-power irrigation unit capable of extracting water from the air to add moisture to surrounding plants.

Bitcoin: Even though it’s a virtual currency, many investors now think Bitcoin is safer than the euro, and it can be used for real-world purchases. The advantage of bitcoin as a currency is that it is decentralized, and the supply of bitcoins is controlled by an algorithm, rather than a bank or a government entity

Final Thoughts

Much of the world around us has been formed around key pieces of infrastructure.

In spite of its tremendous value, infrastructure is expensive to maintain, hard to change, and generally limits how we think about the future.

The world of infrastructure has far too many sacred cows with built-in inertias that are highly resistant to change.

Eventually change will happen, but people who are at the heart of these changes pay a price. Transitions like this can be very painful.

That said, the lifecycles for infrastructure are getting shorter, and the teams driving the disruptive technologies are getting far more sophisticated.

Infrastructure projects represent huge paydays for someone, and the disruptors are determined to make it their payday.

By 2030, we will see more changes to core infrastructure than in the combined total in all of human history. Our sacred cows are about to be set free, and the fundamental shifts we will see to the way society functions will be nothing short of breathtaking.

Author of “Communicating with the Future” – the book that changes everything

.

.

June 8, 2012

56 Future Accomplishments: Waiting for Someone to go First

On May 24th, Gary Connery, a 42 year old stuntman from Oxfordshire, England jumped from a helicopter hovering over one mile in the air over southern England, and glided to the earth using a specially designed wing suit. His runway was comprised of a cobbled-up crash-pad fabricated from 18,000 cardboard boxes to soften the impact.

With this record-setting jump, Gary became the first skydiver to land without using a parachute. While others have survived through some fluke of nature, he was the first one to plan it from the start.

We live in a world obsessed with accomplishments, and more specifically, obsessed with being FIRST.

Few of us remember the 2nd person to set foot on the moon, or the 2nd person to invent the airplane, or the 2nd one to run a mile in under 4 minutes.

So given this almost fanatical pursuit to become the “first” at something, what exactly are some of the big accomplishments still waiting to be claimed that will land someone in the history books? Here are a few that come to mind.

History of Firsts

People can become famous for a variety reasons stemming from heroic, unfortunate, ground breaking, or even uncontrollable circumstances. When a new trend appears in transportation, communication, or the technical world, an opportunistic innovator is always there to be the first to develop or test the new technology. History has many examples of influential firsts that have had a huge impact on society, culture, and the world as a whole.

Here are a few examples of people who have gone first:

1st People to Fly: On November 21, 1783, the first manned hot air balloon flight was made in Paris, France, by Jean-François Pilâtre de Rozier and François Laurent d’Arlandes.

1st Nude Actress in a Movie: In 1915, actress Audrey Munson became the first leading actress to appear nude in a movie. Her appearance in the film “Inspiration” led to her being the model or inspiration for more than 15 statues in New York City.

1st Woman to Cross the Atlantic: May 20, 1932, Amelia Earhart became the first female American aviator to conduct a solo flight across the Atlantic Ocean.

1st Woman Cabinet Member: In 1933, Frances Perkins was appointed Secretary of Labor by President Franklin D. Roosevelt, making her the first woman member of a presidential cabinet.

1st Symbol for the Civil-Rights Movement: On December 1, 1955, Rosa Parks, a longtime activist with the NAACP, refused to give up her seat on a bus in Montgomery, Alabama, so that a white man could have it. Her arrest became a major turning point for the civil-rights movement.

1st Person to Expose the Mafia: In October 1963, Joseph Valachi became the first informant for the FBI to testify that the Mafia did exist.

1st African-American Major League Baseball Player: On April 15, 1947 Jackie Robinson made his major league debut for the Brooklyn Dodgers, becoming the first African American Major League Baseball player in the modern era. Robinson broke the race barrier and changed the world of professional baseball.

1st Million-Dollar Actor: In 1957 William Holden became the first actor to be paid $1 million for a single film. That year he starred in the production of The Bridge on the River Kwai and established the first million dollar payday for Hollywood.

1st IVF Baby: On July 25, 1978, Louise Joy Brown became the first baby to be born through in vitro fertilization. Today, IVF has become a commonly practiced procedure all over the world.

Robert Tappan Morris

1st Computer Virus: In 1988, Cornell University student Robert Tappan Morris unwittingly became to first person to create a computer virus. While trying to gauge the size of the Internet, the “Morris Worm” exploited some known vulnerabilities in Unix sendmail, but became extremely damaging when the code infected computers multiple times with the virus.

1st Super-Marathoner: In November 2003, 59-year old Sir Ranulph Fiennes became the first person to run 7 marathons, in 7 days, on 7 different continents.

1st on Twitter to Reach 25 Million: In May 2012, Lady Gaga became the first person on Twitter to reach 25 million followers.

1st to Solve Isaac Newton’s Problem: In May 2012, Shouryya Ray, a 16-year-old German student became the first person to solve a mathematical problem posed by Sir Isaac Newton more than 300 years ago – how to calculate exactly the path of a projectile under gravity and subject to air resistance. This was a problem that had stumped mathematicians for centuries. Bravo Shouryya!

56 Future Firsts

If we look at where we’ve come from, the list of opportunities for new “firsts” are growing on a daily basis. Here is a list of 56 of them to help challenge your thinking.

Eight Space Firsts

While Star Trek famously proclaimed space to be the “final frontier,” there are, in fact, many unexplored frontiers. Here are a few space-related “firsts” that come to mind:

First person on Mars

First person to set foot on an asteroid

First person to travel at the speed of light

First space hotel

First person to set foot on the Sun (No, I’m not volunteering!)

First President of the Moon

First space-based power station

First to develop an inexpensive way to escape earth’s orbit

Eight Physics Firsts

Without trying to violate too many of the laws of physics, here are a few of today’s holy grails:

First mass energy storage system

Controlling gravity – first to discover the true nature of gravity

Discovery of the “God” particle

First person to create room temperature super conductors

First person to create low-energy hot water

Nuclear fusion

Movable holes – drill a hole in the wrong place, no problem, just move the hole

Flashdark – the opposite of a flashlight. This one shines “darkness” onto a surface

Eight Driverless Vehicle Firsts

Over the next 10 years we will see the first wave of autonomous vehicles hit the roads, with some of the initial inroads made by vehicles that deliver packages, groceries, and fast-mail envelopes.

First driverless valet service

First person to travel across the U.S. without a driver

First person to travel over 200 mph in a driverless car

First driverless taxi service

First driverless pizza delivery

First flying delivery drone to dock with a house

First accident-free driverless vehicle over 10-year period

First driverless vehicle allowed to enter the Indianapolis 500

Eight Firsts in Healthcare

Comedian Chris Rock likes to take medical researchers to task, noting, “There’s no money in the cure. They haven’t cured anything since polio.”

Whether or not there is any truth to his statement, there are a huge number of cures and other medical advances waiting to happen:

Cure for cancer

Cure for diabetes

Cure for obesity

Cure for Alzheimer

Cure for strokes

Cure for heart disease

Self-healing, self-repairing body

First person to live past 200

Eight 3D Printer Firsts

3D printing is an object creation technology where the shapes of the objects are formed through a process of building up layers of material until all of the details are in place.

First printed house

First printed commercial building

First shredded and reprinted house

First printed airplane

First printed rocket

First to scan and print “perfect fit” clothing in under 10 minutes

First to scan and print “perfect fit” shoes in under 10 minutes

First printed can filled with printed soup, or first printed bottle filled with printed wine

Other Notable Firsts

Achievements of this nature don’t always fit neatly into categories like those listed above. Here are a few more that needed a bit more explanation:

First Global Election: When will we see the first global election with over 500 million people voting from over 50 different countries? Will they be voting for a person, or voting on an issue? If it’s a person, what position will that person be running for? And, if it’s an issue, what issue will be so compelling that everyone wants to vote on it?

First Crowd-Funded University: With a huge number of experiments going on it today’s world of higher education, one logical approach will be to crowdfund an entire university from scratch.

First Billion-Cam Video Project: What would it take to get people to connect 1 billion video cameras to the Internet?

First Billion-Person Genealogy Project: The genealogical industry currently exists as a million fragmented efforts happening simultaneously. While the dominant players, Ancestry.com and MyHeritage.com, have multiple websites with hundreds of millions of genealogies, there is still a much bigger opportunity waiting to happen.

First Global DNA Animal Library: Similar, in some respects, to the Svalbard Global Seed Vault in Norway, this library would preserve the actual DNA of all animals.

First Instant Sleep: A workaholic’s dream. People who need to finish an important project, but are feeling exhausted, could simply walk into the instant-sleep chamber. Voila! In a few seconds they could walk back out, fully rejuvenated and raring to go. Is this possible?

First Dream Recorder: How often have you forgotten your dreams the next morning? Is it possible to create a “hit-play-to-record” device that would allow you to visually archive your dreams?

First Dream Clique: As someone falls asleep and starts dreaming, others can also enter and participate in the same dream with the aid of Dream Clique Technology.

First Centralized Law Project: Very few countries have their laws posted in a central repository. In the U.S. the laws, rules, and regulations are so numerous and obscure that few people know what laws are governing them at any given moment.

First Crowd-Sourced Court System: If a court system were developed using crowdsourcing to form its jury decisions, what things would have to change?

First Atom-Mapping of a Kernel of Wheat: Going beyond the genome sequencing of plants and animals, the next quest will be mapping the interplay between individual atoms.

Perpetual Self-Filling Canteen: In a world where people continually die from lack of hydration, one of the most-needed devices is a handheld canteen that is constantly extracting moisture from the air.

Reviving the First Extinct Species: Should extinct species be brought back to life? This question will come to the forefront once the first one is revived.

First Self-Cleaning House: The long-time dream of housewives everywhere remains today as little more than a far-off dream. However, this could soon change with the right visionary.

First Plant or Animal Communicator: With prototypes of natural language translators already in existence for humans, the next step will be technology that bridges the communication gap between humans, and plants and animals.

First Swarmbot Sweater: Flying SwarmBots will someday serve as our clothing, flying into “clothing formation” on command, reconfiguring themselves according to our fashion moods, changing color on a whim. Once we step out of the shower in the morning, the SwarmBots will dry our skin, fix our hair, and take their place as part of our ever-changing wardrobe.

Final Thoughts

It’s easy to look around us and see what exists today, but the true visionaries are looking for what’s missing.

The voids and empty spaces around us will have people stampeding to fill these vacuums once they can be defined and understood.

People who go first are the ones who create entire new industries, and the job-generating opportunities that go along with it.

With the automations of today’s technologies, jobs are disappearing faster than ever before in history. The only way to compensate for this is to build new industries from scratch.

For this reason, the people who are willing to take the risks and blaze new trails need to be encouraged, empowered, and revitalized.

I’m pretty sure Steve Jobs and the marketing geniuses behind Apple’s “Think Different” campaign said it best:

“Here’s to the crazy ones. The misfits. The rebels. The troublemakers. The round pegs in the square holes. The ones who see things differently. They’re not fond of rules. And they have no respect for the status quo. You can quote them, disagree with them, glorify or vilify them. About the only thing you can’t do is ignore them. Because they change things. They push the human race forward. While some may see them as the crazy ones, we see genius. Because the people who are crazy enough to think they can change the world, are the ones who do.”

On this note, I’d love to hear your thoughts and ideas. What other “firsts” do we need to be focusing on? What are the “crazy people” in your circles working on?

Author of “Communicating with the Future” – the book that changes everything

.

June 1, 2012

When Countries Go Bankrupt

In December 2006, Britain made its final payment of $84 million on a $4.34 billion loan from the U.S. that was made all the way back in 1945. Germany wasn’t the only country to go bankrupt after WWII. This money allowed Britain to stave off its total collapse after devoting almost all its resources to the war for over half a decade.

To put this in perspective, $4.34 billion in 1945 is roughly equivalent to $140 billion today, an amount that was double the size of Britain’s economy at the time.

Had the U.S. not made this loan, the British economy would have been thrown into a tailspin, causing huge implications, not only to the UK, but also to countries around the world.

Today we see a number of nations on the verge of bankruptcy. But what does this mean for our global economy with heightened awareness of every micro-decision, and fluid capital markets that can react to virtually every whim?

To be sure, many countries have gone bankrupt in the past, and many more will default in the future. So who’s next, and what kind of problems will a nation’s insolvency cause?

What happens when a nation goes bankrupt?