Jane Gallina's Blog, page 2

November 18, 2019

The Best Free Stock Screeners

If you follow me at all for sure you have heard me mention my goto stock scanner Trade Ideas. It is amazing software and when they have their test drives you can use the software for $8.99 for up to 10 trading days now.

In reality not everyone has the capital to spend $100+ for software when they are still learning. Of course having the right tools can help you to make those profits.

I usually think if I have recovered the cost of a tool I use, then it is a worth while tool in my toolbox. Just like a trade what is the return on the investment for that scanner or charting software.

Which brings me to my top 3 favorite free stock Scanners. They all have a basic free version and then a paid service should you choose to upgrade.

Finviz.comMarketChameleon.comStockFetcher.com

Finviz Stock Screener Review

Finviz is a great tool for the newbie trader there are alot of Free attributes that are very helpful. Below is a photo of the Home Page. You can see there are two different lists of stocks the left with stocks that have moved up and then the right are the stocks that moved down. There is also a heatmap for the movement of the market.

[image error]

Below the Indexes charts you also see the advancing versus declining stocks in the market , New Highs and New Lows, Bear versus bull.

You can also use their screener (below) to create your own list and you can see that they have a number of options in the free version

[image error]

You can see in the chart below that you can be a user of Finviz in two ways as free and then more attributes come available at a $26.95/mo charge.

[image error]

The best part about the paid service to me is if you want real time prices and custom charting. They unfortunately don’t have level 2, but you can see it all unfold in a real time fashion with ability to customize the layout and scanners more to your liking.

All in all, I like Finviz more for post market scanning of stocks as there is no issue with price delays, because the market it closed. A downside to the free version is that there is no premarket data. So that brings me to MarketChameleon.

Market Chameleon Screener Review

[image error]

To be honest when I am up and need to do my watchlist between the hours of 4-7am, this is my go to resource. I love the fact that the data is available earlier than Trade Ideas.

[image error]Premarket Free Screen

Also Market Chameleon was developed by professional floor traders to make their life easier in searching for unsual activity to profit. This is my second favorite Scanner.

You can see in the photo above that Market Chameleon offers screening on more than just stocks they have Stocks, Options by Expiration, Options by Blocks and ETFs.

That is just part of the software you can access for free. You can look at specifically premarket activity, post market activity, Market Movers, 52 week hi/lo, usual stock volume and more.

[image error]

What I like about the pricing for Market Chameleon is that it is somewhat ala carte. If you want just stocks ok , Or if you want just option details you got it. or the whole package.

[image error]

The final Stock Screener to add to my free list is Stock Fetcher.

[image error]

Stockfetcher Screener Review

Stockfetcher I find as the most techy stock scanner out there. Trade Ideas allows you to simple check boxes to create a scan while StockFetcher somewhat forces you to write the filters out for each step.

Once you have a scanner that you like you can save it and run it over and over each day. It is easy to create you scanner as they have 125 different indicators to customize your alert.

[image error]

Stockfetcher is also available as an Apple app.

The bare bones Stock Fetcher is also priced as a scanner with less bells and whistles. However for the price you definitely get a great value. $9 a month for being able to scan gap stocks on higher than normal value is a great tool.

[image error]

I’m not sure as to what time the data becomes available for the premarket scanning as I usually use Market Chameleon before 7 am and after 7 am Trade Ideas

Choose your Stock Screener based on Profits

Being a trader you need to find tools that you trust and will generate income for you. Make sure that if you test out a new tool there is a profitable return on your investment.

[image error]

As a trader you are a bit of an entrepreneur and you need to make sure all expenses are warranted and will provide you positive returns. So definitely compare what is out there and when someone has a free trial or something that is less than $10 ( the cost of 2 Starbucks )

I love hearing feedback, so please share. You can also contact me on my social media accounts Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use Tradingview which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

November 5, 2019

Prop Trading Firms | Is it the best way to start day trading?

We are in a very exciting time in the market when the cost to enter the market is dropping daily. In the past month we have seen all brokers drop their securities commissions fees down to zero except for Vanguard.

So no commissions means it is easy to practice trading with real money. You could buy 1 share or 10 shares depending on the value of the stock and really practice your entry and ext to determine your best strategy to keep risk to a minimum.

You could try trading the super low float, high volatility and high momentum stocks . You could try trading the blue chip stocks that have high daily range as well. It is the perfect time to practice with small money after you have learned basic knowledge of how to trade.

I am not recommending you to trade with zero knowledge about trading, as that is very important first.

You might say yes Jane I want to get into trading, but I have no money to trade with right now. This is something that I hear from people quite often.

In fact I know of a flight attendant and she wanted a better life for her family so turned to trading. However capital was a barrier.

If this is you then Prop Trading Firms might be your answer. However I only found one virtual prop firm for Stocks the rest are for Futures and Forex.

Prop Trading Firms

You might be wondering what on earth a prop trading firm or proprietary trading firm is and how can this help you.

Well a prop firm or proprietary trading firm is a firm that allows individuals to trade the firm money for profits for the firm and the individual trading the money.

There are always certain rules imposed such as the breakdown of the profits firm to trader, the maximum amount of drawdown or losses before the firm will cut you off, and certain education requirements

Top Prop Trading Firms 2019

Tradenet – StocksOne Up Trader – FuturesTop Step Trader -Forex, FuturesEarn2Trade – Forex, Futures

Tradenet | Prop Trading Firm

To be honest this is the only virutal prop stock firm that I could find. There are many 4 wall office prop firms, but you have to go in person. Tradenet hosts everything virutally allowing you the flexibility to prosper.

Tradenet can give you the opportunity to learn how to day trade, and potentially enjoy extra income. Learning how to day trade the markets, taught by our top moderators, Meir Barak and Scott Malatesta.

Since 2004, Tradenet live day trading academy has educated more than 30,000 professional traders worldwide.

They also offer a free 5 day demo account with 14K to trade to test out their methods.

[image error]

If you find that you are interested in working with them they have 4 different programs that you can choose from in your desire of education in order to receive funding to trade

[image error]

Intro Program after training has been passed then you are eligible to apply to trade a $14,000 funded trading account. You will receive 70% of the net profits you generate and will have a maximum drawdown of $700. Student Program after training has been passed then you are eligible to apply to trade a $80,000 account. You get the account with a maximum drawdown of $4,000 and will receive 75% of the net profits.Expert Program after training has been passed then you are eligible to apply for a $160,000 funded trading account. You receive 80% of the net profits with a maximum drawdown of $8,000. Pro Program after training has been passed then you are eligible to apply for a $240,000 funded trading account. You will receive 85% of the net profits that you generate with a drawdown of $12,000.

[image error][image error][image error][image error]

Tradenet also has a virtual trading room live on Youtube during NYSE trading hours. As well as a free book by Meir Barak all about trading after 20 years of experience.

Meir’s Book is The Market Whisperer. You have two choices you can sign up to get a digital copy free or purchase from Amazon.

[image error]

For now Tradenet is the only Stock Prop Trading Firm that I have seen virtually. All the others for stocks are a physical locations where you have to go into an office to work.

If you trade Futures or Forex them these firms below might interest you as well with their fees being low to enter to receive access to funds from $95/mo for $25,000 access up to $500/mo for $250,000 of funding.

One Up Trader | Prop Trading Firm

[image error]

One Up Trader is a funded trading account for traders that are interested in trading Futures securities instruments.

The way to open up an account is to go through One Up Trader’s 1 step assessment and then you will be able to sign up for a free trial of a $100,000 funded account for 14 days. Then you have the choice of the level of funding you want based on a monthly cost.

[image error]

There are 4 options of Novice, Beginner, Advanced, Professional and Expert.

You have the choice of profit split between you and One Up Trader receiving 50%/50% or 80%/20%. I searched to see if they clarify who gets the 80% and I believe that it is 80% to the company and 20% to you, but I could be wrong.

The amount of funding for each of the different accounts is Novice $25,000, Beginner $50,000, Advanced $100,000, Professional $150,000, and Expert is $250,000.

One Up Trader’s fees are monthly based on your choice of profit split Novice ($95/$125), Beginner ($120/$150), Advanced ($240/$300), Professional ($300/$350) or Expert ($500/$650).

[image error]

One Up Trader’s Trading guidelines are fairly simple, 15 trading days a month not including weekends, only the permitted products, you must be closed out by 3:15 CST, Maximum Position Sizing based on the account you choose, to reach your profit target, daily loss limit (if met shuts down trading for that day), not to hit your trailing drawdown, showing consistency in your trading.

I did look into if this is only available to certain countries and their website says if your country or city is not accessible on their sign up page then it is not available to you. It seemed to me that most countries are available.

Top Step Trader | Prop Trading Firm

The Top Step Trader Program Is for Futures only. Like One Up Trader you have to go through an evaluation to receive the ability to be funded.

[image error]

Top Step Trader allows you to prove yourself in a simulated trading account with profits and risk management and then you have the ability to choose your funded account.

[image error]

Now just like One Up Trader, Top Step Trader has their own parameters or rules that you must follow to remain being funded.

[image error]

The Rules are fairly straight forward. You can only trade during permitted times, you can’t exceed the daily or weekly loss limit, you are not allowed to exceed the trailing maximum Drawdown, you can’t hold positions into major economic releases and you have to follow the scaling plan.

Earn2Trade | Prop Trading Firm

[image error]

The final prop firm that I found that is good for Futures and or Forex Traders is Earn2Trade. Much like the other prop firms mentioned above you do have to go through a qualification process to be able to trade with their capital.

Earn2Trade is similar to Tradenet, in that they offer you 3 different training programs to reach your funding account.

[image error]

The Crash Course consists of 60- 10 minute videos to help educate you on the market, risk management and technical trading. The cost for the Crash Course is $249 for lifetime access.

[image error]

The curiculum is set up to run you over the course of 6 weeks. I’m not sure if you have the ability to do them more quickly

[image error]

The Bootcamp is a 4-6 month long course with a price tag of $2499. What the biggest difference is with the Bootcamp is a personal mentor that is a licensed professional.

The Bootcamp is a 360 view of trading including Earn2Trade , Crash Course and then 4 more months of mentorship and the Gauntlet. Once you have completed the Gauntlet successfully you will receive a funded account offer.

The training program is actually a 2 part. They have the mini-Gauntlet and The Gauntlet. The Gauntlet is a 60 day program and the Mini Gauntlet can be done in as litte as 15 days.

The Gauntlet is a one time fee of $249.00 for $25,000 and The mini Gauntlet fees are monthly similar to One Up and Top Step Trader.

[image error]

So you can see that the Mini Gauntlet is the newest addition but the monthly fees could really add up if you are trading more than the $25,000 capital amount.

Potentially with patience you could spend the $249 and then grow it up and it is a one time fee instead of monthly cost. I’m not sure if they would let you transfer from the mini-Gauntlet to the Gauntlet after a 60 day time frame.

I love hearing feedback, so please share. You can also contact me on my social media accounts Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use Tradingview which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

October 12, 2019

Tradingview Review | Top Charting Software

When you are getting set up with trading being able to set your charts up how you want is very important. As a pilot, I know how important it is to be able to trust your tools.

For trading your most crucial tools are your stock scanner, charting software and broker.

[image error]

Why use Tradingview?

For me as a mom of 2, I tend to be at my desk in the morning for my premarket prep, market open and until around 11am. Then it is time for adding balance into life with the gym, and mom duties.

So for me the top reasons I use Tradingview are

Cost of the SoftwareCustom choice of Data Feeds for Global MarketsMobile Ios App and Android AppThe Charts and AttributesList building Capacity Scanning of StocksSharing of ideas

[image error]

Tradingview Cost

You can see that Tradingview does have very affordable rates for charting. There are other free charting softwares out there, but the additional attributes offered with Tradingview make it my #1 charting option.

[image error]

Stock Market Data Feeds

Tradingview is a great charting software for traders of crypto, forex and stock markets around the world. The data feed is monthly add on ala carte.

Meaning you can add only what you need and you don’t pay for what you don’t use. I really like that feature.

For the North American Markets you have your choice of ARCA, NYSE, Nasdaq, CBOE, OTC, Futures (CME Globex, CBOT, NYMEX, CBOE, ICEUSA) , Canadian (CSE, TSX).

For European Markets you have the choice of BELEX, BIST, BME, EUREX, Euronext, FWB, GPW, ICEEUR, LSE, LSIN, MIL, MOEX, OMX, OSE, SIX, SWB.

For Middle East and African Markets you have the choice of BSE, DFM, EGX, JSE, NSE, QSE, TASE, Tadawul.

For the Mexican and South American Exchanges you have a choice of B3, BMV, BVC, BVL, BYMA and SSE.

That brings us to the Asian and Pacific Markets offered of ASX, BSE, FTST, HKFE, HOSE, HSI, IDX, KRX, MYX, NSE, NZX, OSE, SEHK, SET, SGX, SZSE, TFEX, TOCOM, TSW and TWSE.

So you can see that you definitely have you choice of markets around the world you can trade with this software. The next feature is my absolute favorite.

[image error]

Tradingview App

As I mentioned above, I am usually away from desk as of noon as the markets tend to be more run by algos and less retail traders and more high frequency manipulation.

That is why I love having the Tradingview App at my fingertips to keep a pulse on the markets. I can set everything up at my desk in the morning and it transfers right to the charts on my phone.

I have not found another charting software that presents the same view of charts on desktop as with mobile. This app is also available as a free customer.

Basically I set up my watchlist, alerts and charts with targets before I leave my desk so that I will receive notifications. I have also tried other broker software for alerts, but non have sent notifications to my phone.

I can be working out on the treadmill and receive the alert on my headphones and its time to take partial profit as the target has been hit. Love the apps.

[image error]

Chart Indicators

I also have yet to find another charting software that offers over 100 of the most popular indicators and allows you to also write your own script for custom signals. There are over 8000 of the community powered indicators.

The Free version will unfortunately only allow 3 indicators at a time, while any of the paid versions will allow you to have 5,10,25 indicators based on your subscription level.

[image error]

Chart Alerts

This as I mentioned is amazing with Tradingview. You can set alerts based on price when a certain condition is met and then once your criteria is fulfilled you can receive an sound alert on your computer, email and even a notification on your phone.

The alerts are great as well because you have the software watching your stocks while you are on one chart and then a pop up will alert you when conditions are met.

[image error]

Watchlists

The free version will allow you to have 1 enhanced watchlist and with the paid versions unlimited numbers of lists. This is great if you like to watch stocks in indexes, a sector, swing trades or day trades.

Not only setting up your own watchlist but Tradingview offers you hotlists of top movers and more. It doesn’t stop here.

[image error]

Stock Screener

Tradingview will also offer you a complimentary screener. Not only can you use this screener for stocks but also for crypto and forex. For the free version you are limited to Daily, Weekly and Monthly timeframes. All of the paid versions have the ability to scan on all timeframes.

What is better than being able to share all these ideas.

Social Network Sharing

You have the ability to publich private or public ideas. You can share viewo ideas, two of the plans offer custom chats.

Negatives to Tradingview

To me it came down to only 2 negatives with the software.

The paper trading could be improved. Right now the software only offers the capacity to paper trade stocks and with simple buy and sell limit or market orders.

It would be great if you could put in trailing stops and stop limits as well on the paper aspect. I would also love to see if they add options paper trading as well.

The second negative is that the brokers that they link with are not your usual trading brokers. I know that they are looking to set up many of the popular brokers such as Interactive Brokers coming in 2020.

Overall you can see that TradingView has some amazing features at a very affordable cost. Bottom line with any tool that you use in trading is if you are able to cover you costs by profitable trades using the software it warrants the use of that software,

If you want to learn more check it out and sign up for your free account.

I love hearing feedback, so please share. You can also contact me on my social media accounts Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use Tradingview which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

October 2, 2019

What are your trading Commissions?

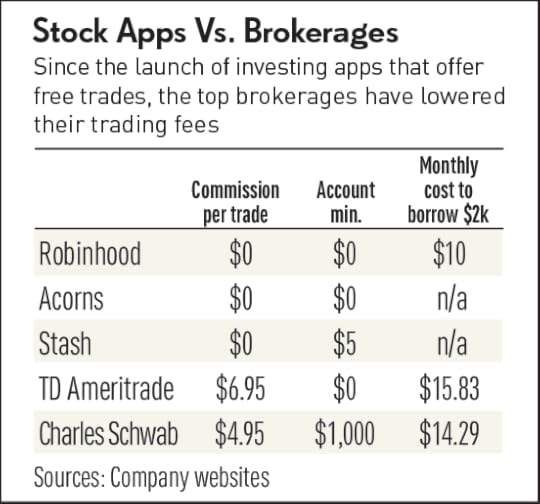

Today we are in a changing world where the trading commission structure is changing. It was just yesterday October 1, 2019 that Charles Schwab announced that it was cutting its fees down to zero on stock trades but .65 for options.

This is huge for the stock trading community, but what does it mean to you as a retail trader?

Trading Commissions

Robinhood was the first broker to offer zero commission fees to their users. However from many people I have heard that these fees come with a price.

The price is not direct in a commission charge, but for them it was a price of not being able to get the best fills for orders.

So even though the initial thought is this is great that there are no fees especially for over traders, it does come at a price that is hidden.

Now we see that many of the bigger brokerage houses are also reducing their fees to compete with each other.

Initially this seems like a great opportunity to get into day trading as one of the major costs of trading. Here are sold old fees

Cost of Trading Stocks

When you are a trader it is not just the profits and losses that you have to think about you are your own business owner and you do have costs

Broker FeesData FeesStock Scanner SoftwareCharting Platform

So eliminating the brokerage commission fees is going to help to grow your profits over night as it is truly a cost for you in placing every single trade.

So now we see that they are removing these fees but only for stock trades.

What does that mean for the options traders and futures contract traders?

Lowest option trading commissions

In order to open an options account the minimums to trade are lower than trading stocks. So some traders start with trading options before trading stocks.

The lowest options trading companies now are:

Tasty Trade $1.00 to enter nothing to exit Trade Station for 0.50 cents a contractTD now for .65 cents per contractCharles Schwab 0.65 cents per contractLightspeed 0-.50 per contract Interactive brokers 0.70 cents per contract

So now the only people to be paying fees are the options traders, which tend to be more day traders as opposed to longer term investors.

Why are they cutting trading fees?

Again it looks like a benefit to traders, especially ones that were worried about the fees in getting into trading.

But sometimes when something is too good to be true it is. That’s right why are they cutting the trading fees.

There is a major talk of recession coming and dropping these fees is going to retain customers and try to gain new customers. These new customers are going to come with money.

Why are these brokerage houses trying to gain more reserves. What is the back story besides just competing for day traders.

Originally brokerages loved day traders because the commissions allowed them to generate daily income for these brokers. But now that is disappearing.

It is no wonder that Etrade, TD Ameritrade, and Schwab have all had their stock value drop because their revenue is being cut.

I’m curious why do you think that they are cutting their fees. What is it that they are hiding to try to gain the additional money into their brokerages? Is this truly for the benefit of the customer?

Tell me your thoughts below

I hope to see you there, but if you are not able to join us and you might still have questions you can reach out to me at carpeprofit@gmail.com or in the comments below. I love hearing feedback, so please share. You can also contact me on my social media accounts Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use tradingview.com which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

September 25, 2019

Trading from home

Trading from home for many is a blessing, but sometimes it can be a curse. For someone that is a big socializer, they might miss the attributes of having coworkers in an office setting.

Working from home

This was my goal once I had my first daughter. How can I set up my home office to be readily available for my now 2 daughters.

I am an expat living in Quebec, Canada and I tried to go to my former career from the states of being a real estate agent. All was going well until I was told I had to pass a french exam before receiving my license as an agent.

Wouldn’t you know I passed the real estate portion of my exam, but due to health issues of my daughter I did not pass my french exam.

Sometimes the biggest negatives can be life lessons to make lemonade out of lemons. This was one example.

I did some soul searching and rediscovered my passion for stocks and studied to work from home or anywhere with internet access and my laptop.

That is when I found myself becoming a daytrader an searching for like minded people.

Day Trading Community

First step for me was looking for a mentor to learn from and a group to join as a trader. When you work from home especially as a trader it is definitely a solitary job in your home office unless you reach out to others.

I know for myself I need to have that community to hold me accountable and need fellow traders to communicate with and as a result I tested out different chat and trading rooms.

First off I found Timothy Sykes with his penny stocks program and how to be a millionaire. I hung around there for a year as part of the program and it was great for me to learn some basics. However I felt his chat room had a bunch of ego traders in there all about their profits

His strategy of penny stocks works well for him but not for me. I realized that I had to find my strategy. It was too high risk for me.

Then I tested out Ross Camerons Warrior Trading room, and I learned from some of his colleagues and learned all about the Trade Ideas Scanning Software.

After learning about the software I discovered the Trade Ideas Free Trading Room. It is a great room where Barrie the moderator helps to educate you about the software, AI and potential trades.

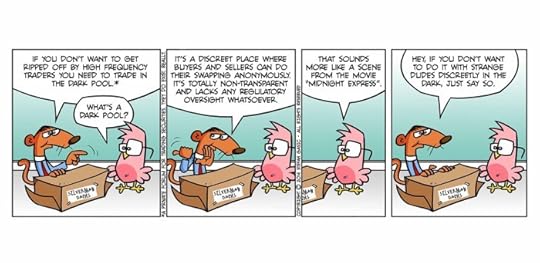

There are also many other great traders there and for me I found it to be a perfect fit that is until I discovered the darkpool. I’m sure I know what your next question is …..

What is the dark pool ?

Well the definition of the dark pool according to Investopedia is as follows.

[image error]

You can see that the dark pool is where the big institutions and large money traders go to get the best fees and best fills for their trades.

Now how did I learn about the darkpools? Well it happened when I was writing my book, #FMJ Trust Transition Trade. It is a book about female traders with different experience from 5 months to 25+years.

One of the top seasoned traders interviewed was Stefanie Kammerman and she enlightened me on the darkpools. I became more and more curious and then asked her to speak at my trading Summit, The Modern Traders Summit.

It was there during her presentation that my interest was really peaked. Why not follow the guys placing these trades?

So I joined her in the Java Pit in 2017 and have never looked back. When you have the ability to ride the coat tails of these guys you can profit. And you can profit big time.

I would mention all the times that we have seen the prints come out before the news, but there would simply be 100s of examples. One of the most recent ones was before the potential threat of impeachment.

We say the prints happening on the indexes 3 days before the news came out. And we see it happen before major oil moves, earnings and more.

So I have found my happy trading place in the Java Pit. It is a great trading room where everyone works together to help spot these amazing trades.

Now the Java Pit is not a beginners room. If you are more of a beginner or want to learn more about trading around the dark pool and that edge then you might like the Training Pit.

[image error]

Trading with an edge

Trading right off the bat is 50/50 success rate. If you can skew that in your favor then you want to stick with that edge.

The Training Pit can help to teach you the basics of trading and how to use the darkpool as your trading edge. To be honest the market is moved by the guys who have placed these trades in the darkpool.

In the beginning it can be very confusing. What is a darkpool print? What am I supposed to do with it? Once you start to see how it works for a couple of months the lightbulb turns on.

Ah hah, this is how the big guys get in before the news is announced and how they make money. I don’t need to know any insider information.

When you have the prints of the guys that are in the know you just follow them.

If you have been following me you know I am passionate about helping others learn to trade and keep their profits. Well I took the step to teach August 2019 in the Training Pit.

We help you learn more than just the mechanics of trading, but also how to set up your charts, software, terminology and much more. There are over typically 9 live webinars a week which are all downloadable if you are not able to watch them live.

This is the place I wish I discoverd back in 2019. Just like my book is one I wish I had to read breaking into the trading world, this room is one I wish I had in the beginning.

Trader Meetups

Meeting in person to relate is also huge and Traders Meet ups are amazing. This Fall I have two on my agenda and they are both free if you are interested in joining .

Oct 24th in Los Angeles

Nov 23rd in Dallas

I hope to see you there, but if you are not able to join us and you might still have questions you can reach out to me at carpeprofit@gmail.com or in the comments below. I love hearing feedback, so please share. You can also contact me on my social media accounts Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use tradingview.com which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

September 19, 2019

Top 5 day trading tools

Just like a Pilot has to trust their instruments when flying in bad weather, a Day Trader must be able to trust their tools. If you talk to any traders you will find out they all agree that there is not one platform or service that provides everything they want in one location

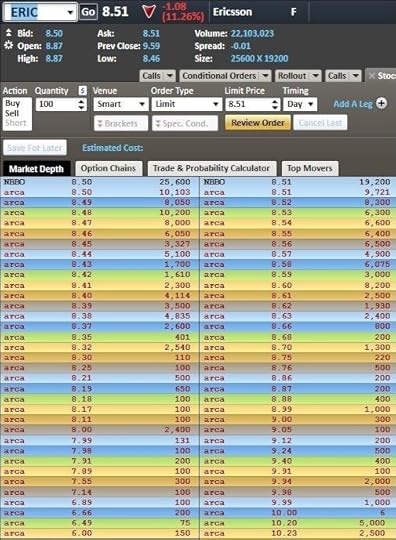

The Top 5 tools for me include a reliable Level 2, a reliable stock scanner, a reliable charting software, reliable community of traders and a reliable trading site.

Reading Level 2 for profits

Having an in depth level 2 market data is in my opinion very important. Without being able to see where the big orders are on the book you are trading blind. Being able to see a buyer or seller refresh their bid to get their bigger order is very important. Understanding where the strength lies on the volume is very important.

There isn’t always one provider that will give you everything you want. For my level 2 market data I use two different sources. Think or Swim and Schwab Street Smart Edge.

[image error]

Why do I like Think or Swim? I love that I can see GSCO or Goldman Sachs to see where they lie on the books. Many times I use their bids or offers as targets as they have a great deal of capital and can help to move the market. I will track their initial bid and offer 15 min after open. If they move their offer up there is a chance that the price will continue past their first offer, but it still remains a target.

The second one I use is Schwab Street Smart Edge that shows bigger orders and the refreshing of orders on bids and offers more easily as well as a time and sale box that shows when a sale goes through the ADF or Alternative Display Facility.

I love being able to offer people free alternatives but I haven’ been able to find a free real time level 2 quotes online.

Best Stock Scanners

I know you are thinking more than one scanner what Jane you must be crazy. No I don’t know of any more than one because I do have a free stock scanner to offer to you on this one. First we will start off with the best stock scanner.

Trade Ideas is an amazing software that has been evolving since 2002 and with 17 years of tweaking and feedback from their customers and outside users it is an amazing software. You have the ability choose to use the scanning and alerting by itself. You have the ability take the premium version to back test you strategies and use their Artificial Intelligence Holly to generate ideas for you. You have the ability take it one step further and automate your trading directly with certain brokers. A software built by traders for traders. They also offer a free trading room and a free web version of the product with delayed data.

[image error]

The Second top scanner that I am happy to enlighten new traders about is Finviz.com They have a free version and a paid version. The paid version obviously gives you more abilities, but the free version is amazing and great for end of day scanning. They also offer an amazing map of the market sentiment by sector.

[image error]

Stock Charting Software

For Charting there are a couple options that I really love. The best charting software to me is Tradingview.com. One of the main reasons why I love this software is because it is so easy to use on a mobile device. I set everything up on my laptop. I set levels to watch alerts and then when I’m at the gym getting in a workout I receive my alerts and can see the same charts. Some platforms especially brokers offer different views on the desktop versus the mobile device.

[image error]

My second favorite charting software is Trendspider that has the first ever that I know of rain drop candles. Truly only second because they are a new company and don’t have their app up yet. Since I’m a big follower of volume they use the data feed to create these candles which help to show where the volume flow was during that candle. Best way to describe it is to show you an image Worth 1000 words right!

Also the ability to have multiple time frame analysis on one chart. Where you can use a 5 min chart to trade but see the daily averages as a dashed line to know where the price action might stop.

The final feature of Trendspider that is great for newbies is the algo that will draw trend lines for you, to help you shorten the trendline learning curve.

There are actually a couple of free charting platforms. Tradingview.com also has a free version which like finviz.com is great when the market is closed. There is also Bigcharts.com which has a premium upgrade to it and StockCharts.com

Day Trading Community

There have been two very positive and supportive trading rooms that I don’t know of any really found to be my home. One of which is you bet free. It is so important as a day trader to be in a community of supportive people as you will make mistakes and when others support you and allow you to get better we all win. That mentality really hit home in the Java Pit Trading Room.

I clicked with Stefanie Kammerman and now we are working together in the Training Pit to which would be similar to trading 101 in trading university. A place for beginner traders to come and learn the proper foundations of trading. Software execution, Charting, and more tips.

[image error]

The other trading room that is great for people just wanting to get a taste of the stock trading world is hosted by Trade Ideas. Where you can see their software for free ad Barrie the moderator will keep people in check.

Many times I hear people talk about stock chat rooms, but the day trading chat rooms that I don’t know of any been have been more about chatting than trading and unfortuntately not a supportive atmosphere. Bottom line is you will find the room and style that meshes with you. I prefer up beat positive people that yes are human and make errors and take small losses in trading.

Your Trading Platform

It is very important to have a platform that you like. There are many out there depending on where you live. For me as an expat in Canada I only have a handful. I use Interactive brokers remotely on my phone, but find their platform not the easiest. I love the mobile version of Think or Swim.

A great resource for finding Top Online Stock Brokers is the Benzinga updated list. Where they review the brokers annually and change them as the latest and best become available.

I don’t know of any heard horror stories from some Americans that are day trading with Robinhood. It is somewhat true to say that you get what you pay for. So make sure that you go with a reputable broker that will not kill your capital with fees.

Arsenal of Tools in Trading

When someone asks me what I use, I always think of my instrument flying experience and trusting my instruments. I need to know that I can rely on all the items I mentioned above. To be honest if one faulters it can distract me from the job of trading. When that happens. I wait until everything is fixed and watch for the next setup. This I just realized does not include my desk setup of hardware it is all software for trading.

Trade On The News

Everyone wants to have their hand on the fastest news service out there to be able to jump on the trade before the masses get their hand on the move.

What if I could tell you that there is another way to trade before they news even comes out to the public? Would you be interested?

Click here to learn more

Top Breaking News Today

The top five news sources for traders to receive the latest infomation

The chart below compares their costs and services offered:

[image error] AMP Global

[image error] BenzingaPro

[image error] Redbox Global

[image error] Ran Squawk

[image error] Trade Xchange

[image error]

Having the latest and greatest news you can see is quite a lucrative business for the services above, but wouldn’t you like to be able to trade with an advantage before the news came out.

Another way to catch a glimpse of what might happen is to track what the insiders are doing.

Trade like the big guys and profit

Insider Trading

Most of us do not have the ability to get the insider information, but the insiders of the company do have it and when they place a trade they have to report their trade to the SEC.

The insiders must fill out a Form 4 for when buying or selling stock or options. You can easily check if there is a form filed on a stock here

Many times the form 4 buying will signify a big move to the upside coming potentially, but an insider could sell for any reason.

They could sell because they want a new house, they need to pay for their child’s education, they want to transfer money to another investment, or potentially a divorce settlement.

So you never really know why behind a sell, but a buy tends to be stronger than a form 4 sell.

Wouldn’t you want to know before these forms pop up 3 days after the transaction. You can see these transacions in the darkpool.

Trade around the darkpool trades

What is Dark Pool

The Dark pool was established back in the 1980’s. It was established for people that have those massive orders to get better fills and better commissions.

When you are trading 1 mill shares you can get a discount on the fees and the best fills. Another reason to use the darkpool is to keep that order out of the public eye.

They do have to report those trades, but they have up to three hours after the trade is complete to report these trades. This where you can learn about the prints before the news and before the form 4s are reported.

This is where you truly get an edge before the news and the insider reportings.

Are you ready to come to the Dark Side?

Join the Dark Side

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you would like to be in Training Pit with me sign up here or if you want one on one training you can email me jane@thedarkpools.com You can contact me here or Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use tradingview.com which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

September 14, 2019

StocksToTrade

What is StocksToTrade.com ?

I will explain fully what Stocks to Trade in this post. I first learned of Stocks To Trade as a Millionaire Challenge student of Timothy Sykes.

I was using Equityfeed at the time and Tim wanted to create something that was better than Equityfeed for trading.

As with all trading softwares the initial software is developed initially for the funding partners and then it will evolve over time. The initial version of StocksToTrade was released back in 2009.

At that time it was fairly basic with the charting , alerts of highs and lows of the day and the use of level 2 and indicators.

Try it for 14 days for only $7

StocksToTrade Software

[image error]

In the past 9 years the software has truly evolved.

Stock Scanning ( With Penny Stocks in mind)Alerting SystemOracle -Custom AlgoNews Fees, Sec ReportsTwitter filterBroker Linking for Trading ( Special Deal with Tradier Brokerage)Paper TradingModern Charting with drawing and indicators.Free Level 1 Stocks to Trade University Add Ons (Level 2, Chat Channel, Trade Sentiment, Pro)

Free Tools they offer outside of the Platform

StocksToTrade Youtube ChannelStocksToTrade Blog StocksToTrade Twitter

Before I expand on the above features lets talk about more about the expense of StocksToTrade

Try it for 14 days for only $7

StocksToTrade Cost

For the basic version of StocksToTrade monthly costs you are looking at a 14 day trial for $7 and then a cost of $179.95 per month or an annual version for $1899.50 a $250 a year savings.

What you could do is if you like it on the 13th day upgrade to annual and you have saved more than $250 getting those additional days for $7.

You have the ability to add the Level 2 Market depth for $29.00 each month.

The Add on of Tip Ranks Trade Sentiment would be an additional $8.95 each month.

The cost of adding the Chat Channel is $6.95 per month.

So if you go for all the bells and whistles then you could be spending $179.95+$29.00+$8.95+$6.95 = $224.85 a month ( x12 for a year $2698.20)

I’m not sure if they would give you a deal if you buy the annual and you would like to get level 2 or the chat for the whole year as well. You would likely have to email them to find out.

The customer service is quick to rely and resolve issues if they do occur.

Try it for 14 days for only $7

StocksToTrade Features

[image error]

All of the Features in StocksToTrade have been developed by traders for traders. I remember when I first started using the platform back in 2016 and they were taking feedback from all the users.

Emailing them to find out what the liked and what they didn’t like. The honest true of trading platform is that you are never going to be able to find one platform that is going to fit all traders.

Here are some of the top features that are amazing with StocksToTrade.

First off it is a great scanning tool and the ability to see on the chart as well as set the alerts for stocks breaking new highs or new lows on the day.

There is the feature of being able to see the premarket and postmarket price action.

The Oracle with the 15 proprietry algo scans to find setups is pretty awesome as well.

The ability to have the all in one screen is great for single screen laptop traders to have the news, SEC filings, Price action, Charting and the linking to your broker all in one spot.

[image error]

The Stocks to Trade University is amazing as well for new traders to be able to watch videos to educate themselves more, which goes with the hand in hand feature of papertrading capacity.

Any Time that a platform will allow you to train on their software it makes it easier to place real money trades later as understanding the software, especially with penny stock trades is crucial.

Try it for 14 days for only $7

StocksToTrade Cons

For me the cons are that they Level 2 is an add on feature. I am someone that absolutely loves to see the orders lined up on the books.

The Time and sales will help you see the past, but the orders lined up can help you to view where the stock might stall or reverse for that day trade.

Another con for me could be a plus for someone else. I like to have multiple screens going and the ability to take my charts off the main page and enlarge them.

StocksToTrade all in one screen has tabs where you can see the price action at the top of each tab, but you can’t open that chart on another window as far as I have figured out.

One minor detail but a big one for me is I like to have the ability to set up a custom timeframe on the chart. I like to watch the 45 minute chart.

To let you know my evolution I used to love the 1 minute, then the 2 minute, then the 5 minute and now the 45 minute chart. I have also gone more from a scalper to a intrady trade or swing trader after seeing the bigger moves tend to come overnight.

Try it for 14 days for only $7

StocksToTrade vs The Competition

Overall the platform has alot of amazing attributes. Not every platform out there will give you a free trial, but half a month is pretty good.

The development of the alerts on the chart is pretty cool as well as the all in one to find out stock information such as the filings, news and social sentiment.

The trading world is evolving at a fast pace and I believe the two biggest competitors for scanning and alerting stocks are StocksToTrade and TradeIdeas

I hope my personal review and perspective on StocksToTrade helps you in your decision making. I truly believe the software that you use is a personal preference.

There are some amazing features and attributes with the software, but Trade Ideas is my number one for stock alerting software and using AI in trading.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you would like to be in Training Pit with me sign up here or if you want one on one training you can email me jane@thedarkpools.com You can contact me here or Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use tradingview.com which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

September 6, 2019

Hot Stock List 9.6.19

PREMARKET ACTION FOR THE INDEX ETFS

SPY – UPQQQ – UPIWM -UPDIA –UP

The announcements from forexfactory.com for today.

[image error]

The Stocks and Charts can be accessed here.

The stocks have been found by using Trade Ideas stock scanning and alerting software you can see in live action in the always free trading room This is for educational purposes. There is a high degree of risk involved in trading equities, ETFs and options. Past results are not necessarily indicative of future returns. Airplane Jane and Jane Gallina assume no responsibility for your trading and investment results. The indicators, strategies , columns and articles and all other features are for educational purposes only and should not be construed as investment advice. Information for future trades and observations are obtained from sources believed to be reliable, but we do not warrant is completeness or accuracy, or warrant any results from the use of such information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein.

September 5, 2019

Hot Stock List 9.5.19

PREMARKET ACTION FOR THE INDEX ETFS

SPY – UPQQQ – UPIWM -UPDIA –UP

The announcements from forexfactory.com for today.

[image error]

The Stocks and Charts can be accessed here.

The stocks have been found by using Trade Ideas stock scanning and alerting software you can see in live action in the always free trading room This is for educational purposes. There is a high degree of risk involved in trading equities, ETFs and options. Past results are not necessarily indicative of future returns. Airplane Jane and Jane Gallina assume no responsibility for your trading and investment results. The indicators, strategies , columns and articles and all other features are for educational purposes only and should not be construed as investment advice. Information for future trades and observations are obtained from sources believed to be reliable, but we do not warrant is completeness or accuracy, or warrant any results from the use of such information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein.