Andrew Rogerson's Blog, page 43

November 9, 2015

Work-Life Balance Is not a Myth

The concept of a work-life balance is hardly a new one. Most parents are familiar with the idea of devoting attention to their families while also masterfully handling their career and personal goals. The problem is that most of these folks also think it is impossible to truly achieve. While it’s not an easy balance to attain, the truth is that this sort of equilibrium is indeed possible. Here are some tips for doing so, all while maintaining your sanity:

Set Clear Boundaries

Whether you have an office job or hold the job of staying home with your kids, your days are undoubtedly chaotic. Because of this, it’s important to set clear boundaries around each compartment of your life. For moms and dads with careers, these limits need to be communicated both at work and at home. Have a conversation with your boss (and co-workers if need be), and explain that you aren’t willing to work in the evenings past a certain point. On the home front, be clear with your spouse and children that work is your focus during certain hours and they are your focus during other hours. Then, stick to these commitments.

If you’re a stay-at-home parent, the need for boundaries is no less necessary. Be sure you and your family decide upon periods of time that you can use to take care of yourself, such as declaring Saturday mornings as your time for yoga and coffee with a friend. This way your needs don’t get neglected in the day-to-day grind. Furthermore, be intentional about giving your family your undivided attention while in their presence. Commit to keeping your hands free (especially from the distraction of a cellphone) while playing with your kids or during one-on-one time with your spouse.

Share and Delegate

Even with clear boundaries, happy homes can still reach a point of crisis. There’s no way around the fact that there is always a lot to be done and limited time in which to do it. This is why recruiting others to help you is essential to establishing harmony between work and life. If you work outside the home, find a willing co-worker who can be your partner in sharing responsibilities. The understanding should be that if one of you experiences an emergency at home, illness or has an event you must attend during work hours, the other person will pick up the slack and help out.

If your job is to keep your household running smoothly, you still can delegate chores to others. Perhaps your spouse can have a specific task each week (like doing the grocery shopping), and your eldest child can be on laundry duty with you every other night. If no one at home is able to pitch in, see if your finances will allow you to bring in some reinforcements (like professional cleaners). You shouldn’t have the weight of all responsibilities on your shoulders.

Take Advantage of Tools

Finally, turn to technology as a way to help you become more efficient. The more productive you are, the more time you have to devote to your family, your obligations and yourself. Get in the habit of using a tool like the S Pen on the Samsung Galaxy Note 4, which gives you a digital notebook of sorts. With this tool you can readily jot down reminders in one place and avoid hassle and wasted time. Another idea is to sign up for a service like Cozi, which is a digital, shared family calendar that helps you keep activities, time commitments and tasks in line.

The secret to reaching a perfect work-life balance is that there really isn’t one. Start slowly, and you’ll find yourself in a place of peace in just a matter of time.

The post Work-Life Balance Is not a Myth appeared first on Rogerson Business Services.

November 4, 2015

Where to Start when Selling your Business

Do you own a business in Sacramento, CA and thinking it is time to sell but not sure where to start?

As the host of my own radio show, there is nothing better than meeting clever and interesting people and being able to spend about half an hour with them to talk about their area of expertise.

Dell Richards who is the owner of Dell Richards Publicity offered to interview me as the first guest on my show and the topic was “Where to start when selling your business.”

Each Tuesday at 10.00am PST on radio station 105.5FM I conduct a radio show called Money 2.0.

The purpose of the show includes interviewing business experts in a range of topics including selling a business, selling a medical practice, valuing a business, buying a business and buying a franchise plus all the responsibilities and challenges that come with owning and operating a business or as I like to say, where Wall Street meets Main Street.

You are welcome to listen to me being interviewed by Dell about the process and where to start if you are trying to sell your business.

Some of the questions from Dell when we talked not only where to start when selling a business but some of the complications includes the following:

Where is the first place to start if someone is thinking of selling their business?

What’s the best way to present the business for sale to a buyer?

How do I know what my business is worth?

If I sell the business will I get all cash?

How long does it take to sell a business?

How much do I have to tell the buyer?

Do I need an attorney to prepare the legal documents?

What are some of the mistakes sellers make when selling their business?

How do I know the tax consequences if I sell my business?

What’s an important item you would encourage all sellers to do?

Does this approach just apply to selling a business in Sacramento, CA?

What’s Andrew’s Golden Rule for selling or buying a business?

Although my location is in Sacramento, CA, to be to provide the business brokerage service I provide, I am required to hold a Real Estate license with the California Bureau of Real Estate.

Holding this license provides the necessary qualification to sell a business anywhere in California. Additionally, because this is my area of expertise I also get inquiries from out of California including inquiries from around the world.

There were other topics covered during my conversation with Dell. If you would like to listen to me being interviewed by Dell, simply click the following link: Selling your business with Andrew Rogerson.

The post Where to Start when Selling your Business appeared first on Rogerson Business Services.

November 3, 2015

Mobile Technology and Your Business

Mobile technology is in a constant state of flux. Hardly a week goes by where apps don’t update, and smartphones often change in size or in software versions. In an ever-changing digital landscape, how do you optimize your business’s website for maximum sales and outreach? If your business has run aground in keeping up with mobile technology, here are some tips to consider before you throw in the towel.

Mobile Technology Payment Platforms

If your business provides a product for customers, one of the most baffling statistics is that of smartphone conversion rates compared to that of tablets or laptops. On smartphones, completed transactions are 1 percent. This means that if 100 people visit your marketplace on a smartphone, only one will actually complete a purchase. On tablets and computers, however, the conversion rate is closer to 2 or 3 percent. This increase represents more than 100 percent in sales, simply because tablets and computers have larger screens.

However, there are ways a company can make smartphone transactions easy and improve their conversion rate. For instance, enable mobile users to complete transactions with their existing PayPal account, and more customers are likely to carry through with the transaction. Eliminating the steps taken and the time of transactions greatly increases your company’s sales.

Security

As with any marketplace, security is an issue. When your business asks customers for personal information, you immediately become a target for hackers. Some hackers can even hack smartphones and mobile devices using voice commands such as Apple’s Siri, or Android’s Google Now. Hands-free headsets can be used as an antenna by hackers to control phones, send sensitive information through texts and email, or obtain passwords and user names.

If your business decides against a third-party marketplace checkout such as PayPal or WePay — both which offer thorough security — remind customers that smartphone antivirus and security measures such as two-factor authentication will help to keep their information safe. Use an encryption service on your marketplace as well, such as KeyNexus or Vormetric.

Social Media

Most social media is conducted on smartphones and other mobile devices. People traveling from work or school spend time on social media, so don’t let this market base slip through your grasp. Companies, large and small, cash in on social media activity. But it’s not enough to simply promote your products or services.

Instead, when you post on Facebook or Tweet on Twitter, draw connections between your products and the needs of your customers. For instance, LifeLock is an identity theft prevention service, and they focus on a wide range of issues on Twitter. From medicare scams to Domestic Violence Awareness Month, they relate and take interest in a host of topics as part of the Twitter community.

Mobile Technology for your business starts with RWD

Responsive Web Design is a term used for a website that is optimized for mobile devices as well as traditional computers. While there are many schools of thought about how best to deal with the mobile market, RWD doesn’t require multiple websites for mobile devices. RWD code recognizes the kind of device a customer is using and then loads the appropriate interface of your business’s website for that device, whether it’s a smartphone, tablet or computer.

Mobile technology is here to stay. It’s fast, innovative and highly disruptive to a business. The winner may be those that are at the bleeding edge but more likely those at the cutting edge. Too many mistakes are made at the bleeding edge plus ideas come and go at an incredibly high speed.

The post Mobile Technology and Your Business appeared first on Rogerson Business Services.

November 2, 2015

Small Business Sentiment holds Steady in California

Small business is the engine room of the larger economy. It’s where ideas start and fail, develop and die and where those that survive, get stronger and thrive.

Thumbtack.com is a web portal where a consumer can find a professional resource to complete any project, anywhere, anytime. From painting a home to training a dog to finding a wedding planner to finding a voice coach. It has annual revenue of over one billion dollars and completes over five million projects each year.

Thumbtack.com has just completed a national survey of business owner sentiment, that is, they wanted to know from small business owners what they think and feel about the economy.

What’s happening in California?

The national small business economic optimism in October came in with a score of 63.75 on a 100-point scale. California came in just under at 63 and was ranked 11th nationwide.

For California, in January to March the score was 65 while April to August the score was 64.

Midwestern and northeastern states were the least optimistic in October, while only southern states as a region had a better outlook than the national average. Sentiment in the west has for the past three months closely mirrored the national average.

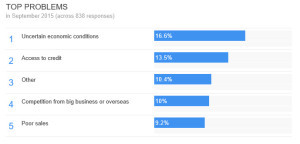

What’s California’s top problems?

The survey asked the question of small business owners, what are your top problems and received 838 responses.

As the graphic shows below, 16.6% of respondents identified uncertain economic conditions, 13.5% said access to credit, 10.4% highlighted other issues, 10% mentioned competition from big business or overseas and 9.2% said poor sales.

How does the future look?

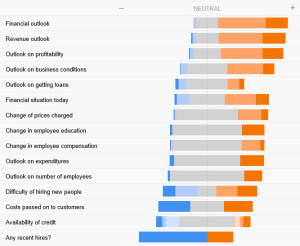

Below is a graphic that shows how small business owners feel about the future or their sentiment. (To make the graphic larger, simply click on it.)

The survey asked a range of questions including financial and revenue outlook, as well as profitability, business conditions, getting loans, hiring employees, passing on costs and more.

A very negative response was in dark blue, a negative response was in light blue, a neutral response was gray, a positive response was light orange and a very positive response was bright orange.

Some of the questions asked and the response is as follows.

How do you feel your company’s financial situation will be in three months from now? 73.6% said it will be a little better or substantially better.

How do you expect your company’s revenue to change over the next three months? 70.2% said it would increase by at least 1% and more than 10%.

How do you expect your company’s profitability to change over the next three months? 66.1% said it would increase by at least 1% and more than 10%.

How do you expect business conditions in the general economy will be in the next 3 months compared to now? 49.9% said it would be a little to much better than it is now.

Have you filled or attempted to fill any full-time or part-time job openings over the past three months? 72% said no.

If you would like more information about the survey, please click this link.

The economy constantly and often dynamically changes momentum. Do you remember a few weeks ago we were worrying about the slow down in China, what has happening in Greece and Spain?

These worries are part of the global capitalist system but in the US, the economy appears to be gaining strength with California enjoying its share.

Hopefully with some rain over the next few months, the concerns from the drought will fade and we have made an adjustment of how to use much less water.

If you would like more information about selling a business, buying a business, buying a franchise or a related service such as valuing a business, please visit my webpage Services and choose from the drop down menu the information you would like.

For more immediate help, you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Small Business Sentiment holds Steady in California appeared first on Rogerson Business Services by Andrew Rogerson.

Small business sentiment holds steady in California

Small business is the engine room of the larger economy. It’s where ideas start and fail, develop and die and where those that survive, get stronger and thrive.

Thumbtack.com is a web portal where a consumer can find a professional resource to complete any project, anywhere, anytime. From painting a home to training a dog to finding a wedding planner to finding a voice coach. It has annual revenue of over one billion dollars and completes over five million projects each year.

Thumbtack.com has just completed a national survey of business owner sentiment, that is, they wanted to know from small business owners what they think and feel about the economy.

What’s happening in California?

The national small business economic optimism in October came in with a score of 63.75 on a 100-point scale. California came in just under at 63 and was ranked 11th nationwide.

For California, in January to March the score was 65 while April to August the score was 64.

Midwestern and northeastern states were the least optimistic in October, while only southern states as a region had a better outlook than the national average. Sentiment in the west has for the past three months closely mirrored the national average.

What’s California’s top problems?

The survey asked the question of small business owners, what are your top problems and received 838 responses.

As the graphic shows below, 16.6% of respondents identified uncertain economic conditions, 13.5% said access to credit, 10.4% highlighted other issues, 10% mentioned competition from big business or overseas and 9.2% said poor sales.

How does the future look?

Below is a graphic that shows how small business owners feel about the future or their sentiment. (To make the graphic larger, simply click on it.)

The survey asked a range of questions including financial and revenue outlook, as well as profitability, business conditions, getting loans, hiring employees, passing on costs and more.

A very negative response was in dark blue, a negative response was in light blue, a neutral response was gray, a positive response was light orange and a very positive response was bright orange.

Some of the questions asked and the response is as follows.

How do you feel your company’s financial situation will be in three months from now? 73.6% said it will be a little better or substantially better.

How do you expect your company’s revenue to change over the next three months? 70.2% said it would increase by at least 1% and more than 10%.

How do you expect your company’s profitability to change over the next three months? 66.1% said it would increase by at least 1% and more than 10%.

How do you expect business conditions in the general economy will be in the next 3 months compared to now? 49.9% said it would be a little to much better than it is now.

Have you filled or attempted to fill any full-time or part-time job openings over the past three months? 72% said no.

If you would like more information about the survey, please click this link.

The economy constantly and often dynamically changes momentum. Do you remember a few weeks ago we were worrying about the slow down in China, what has happening in Greece and Spain?

These worries are part of the global capitalist system but in the US, the economy appears to be gaining strength with California enjoying its share.

Hopefully with some rain over the next few months, the concerns from the drought will fade and we have made an adjustment of how to use much less water.

If you would like more information about selling a business, buying a business, buying a franchise or a related service such as valuing a business, please visit my webpage Services and choose from the drop down menu the information you would like.

For more immediate help, you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Small business sentiment holds steady in California appeared first on Rogerson Business Services.

October 29, 2015

Statistics help when selling your business

There are many ways to measure the operating success of a business. The most obvious way is via the Profit and Loss and Tax returns. Another tool can be testimonials or customer feedback. A different and now more common tool for some businesses are results from Social Media with, for example, the number of Facebook likes, the number of Twitter or Google + followers.

In a previous article called “Why a business does not sell,” I looked at three reasons why a business does not sell and more importantly, what the owner can do about it so when they are ready to sell their business it increases their chances of the business selling.

Here is reason to start collecting data about the performance of your business and why it will come in handy when you are ready to sell your business.

Seller does not measure the success of the business

For the past 15 plus years my wife and I regularly go to a local bakery for a Sunday breakfast. We enjoy the food, the design and atmosphere of the bakery. In fact we enjoy it so much the drive takes us about 12 minutes and we pass two other bakeries to get to this one.

When we arrive there are two different queues to place our order. One queue is for bakery items and a different queue is for a cooked breakfast. Sunday morning is busy and so often one queue has no one waiting while the other has many customers waiting. The bottom line is that it appears poorly organized.

Despite my wife and I going for 15 plus years and seeing this same problem week after week there is no place to provide any feedback. I’ve seen many customers walk out and I’ve heard customers complain to other customers but it’s the one negative in what otherwise is a very positive experience.

How the seller can fix not measuring the success of the business

There are many ways to measure customer satisfaction or solicit feedback. A simple feedback card and pencil with a place to put completed feedback cards would be incredibly cheap.

The owner already collects business cards to send out monthly specials. It would be so easy to use that list and request customer feedback via an electronic survey with an online marketing tool such as Survey Monkey or Constant Contact.

In addition, many customers express their opinion on Facebook, Twitter, Yelp or other electronic social media forum. It’s not complicated, just takes a bit of effort and good business to measure and manage it.

Statistics help when selling your business

As Peter Drucker, the author of Innovation and Entrepreneurship said “If you can’t measure it you can’t manage it.”

The above are also examples where the Profit and Loss or Balance Sheet are unable to help. That is, there’s no way for the owner to know how much business he’s losing as he doesn’t know and doesn’t measure it.

The main way to hear of lost revenue opportunities is to get it from the source; which is the customer.

Are you thinking about selling your business and move to your next challenge? Would you like to know the value of your business? If you would like more information please visit my website Business valuation.

For more immediate, give us a try with an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Statistics help when selling your business appeared first on Rogerson Business Services.

October 28, 2015

How businesses are selling in 2015

BizBuySell.com is one of the many websites that charges business brokers and other professionals to list and market a business for sale. Business owners can also list and try and sell their business on their own.

On a quarterly basis they prepare and release different reports that analyze what’s happening with the sale of privately held businesses. That is, the report comes from the businesses that are listed for sale on their website.

The website only lists businesses for sale in the United States. However, one of their reports looks at specific geographies, for example, Sacramento, CA which they define as Sacramento-Arden-Arcade-Roseville, CA. This seems an unusual way to define the Sacramento, CA market plus it shows the number of businesses for sale as being 212 which is much greater than shown on the California Association of Business Brokers website which they operate for this association.

The report for the third quarter is now complete. Here are some of the conclusions.

Closed Small Business Transactions

One of the data points from the report is the Closed Small Business Transactions. That is, it looks at the number of businesses for sale during the quarter and the number of businesses that sold. In the third quarter it shows a near 9% drop in small business transactions from the same time last year. This year-over-year drop indicates a stabilized activity level after the market reached a record high in 2014.

One of the data points from the report is the Closed Small Business Transactions. That is, it looks at the number of businesses for sale during the quarter and the number of businesses that sold. In the third quarter it shows a near 9% drop in small business transactions from the same time last year. This year-over-year drop indicates a stabilized activity level after the market reached a record high in 2014.

For those of us on the West Coast, across industries, the retail sector experienced the largest decline (17%) in transactions compared to last year, and geographically, the Pacific region saw a 22% drop in transactions.

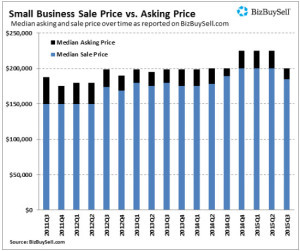

Small Business Sale Price Versus Asking Price

One of the good tests for the businesses for sale market is how close the Asking Price is to the Sale Price.

One of the good tests for the businesses for sale market is how close the Asking Price is to the Sale Price.

If the Asking Price is close to the Sale Price then it means there is a strong economy with plenty of buyer interest. If the Asking Price is a long way away from the Sale Price then it means the economy is weak and sellers are desperate to sell their business.

The report shows that businesses that sold during the third quarter were able to yield returns similar to last year. That is, the median sale price of a business sold in the third quarter slipped slightly from $189,000 last year to $185,000 this year and the median asking price remained stable at an even $200,000. This equaled a strong 94.5% asking price/sale price ratio.

On another positive note, the median revenue of sold businesses grew from $423,828 in the third quarter of 2014 to $438,000 in the third quarter of 2015.

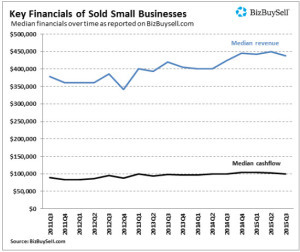

Key Financials of Sold Small Businesses

While slightly fewer transactions occurred in the third quarter of 2015, businesses listed for sale during the quarter grew stronger financially, pointing to an increasingly valuable supply for potential buyers.

The median revenue of listed businesses for sale grew to $450,000, up from $432,556 in 2014 while the median cash flow rose from $100,000 in the third quarter of 2014 increased to $104,000 this year. The improved financials also led to a slightly higher median asking price, increasing to $250,000 compared to $248,189 in 2014.

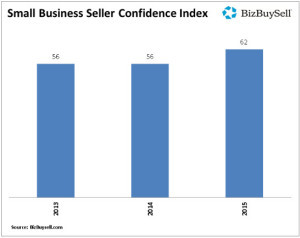

Small Business Confidence Index

The capitalist system is built on trust and confidence. If either is missing the economy goes down.

The good news is that rising financial indicators show that there is a large amount of high-performing small businesses still on the market. The median revenue of small businesses has been rising steadily since mid-2012, leading to higher sale prices upon exit. As more owners grow confident that they can achieve a profitable sale, expectations are that there will be even more businesses coming up for sale. This can be seen in the BizBuySell Buyer-Seller Confidence Index which reports a Seller Confidence Score of 62, up after two consecutive years at 56.

How businesses are selling in 2015

The sale of businesses in the third quarter of 2015 was not as strong as 2014. The reasons include that 2014 was a very strong quarter and so it would be difficult to repeat that performance. In addition, the third quarter of 2015 saw the affects from the fall out in the global economy with the slowdown in China and the instability of the Greek economy and its very public fight with Germany and the other members of the European Community as well as the International Monetary Fund or IMF.

Additional highlights from the third quarter of 2015:

One of the very good pieces of good news from the report is the improving small business financials. For example, the median revenue of listed businesses in the third quarter grew to $450,000 which is up from $432,556 in 2014. Perhaps this helps explain the likely reason behind the increase in seller confidence; that is, stronger financials mean more business owners are confident they can achieve a profitable sale.

Sale prices dip. The median sale price of a business sold in the third quarter slipped slightly from $189,000 last year to $185,000 this year, while the median asking price remained stable at an even $200,000.

Retail industry experiences roadblocks. Across industries, retail saw the biggest decline in transactions, with 17% fewer businesses changing hands this quarter as compared to last year.

Pacific region experience largest transaction drop. Geographically, the Pacific region drove down transactions with a 22% drop from the same time last year.

What’s the perfect time to sell a business? There really is no perfect time other than when you, as the owner of the business, are ready. Ready means you have something to move onto that’s just or more important than owning and operating your business.

If you would like more information about selling a business, buying a business, buying a franchise or a related service such as valuing a business, please visit my webpage Services and choose from the drop down menu the information you would like.

For more immediate help, you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post How businesses are selling in 2015 appeared first on Rogerson Business Services.

October 27, 2015

Sell a medical practice with 5 metrics

Selling a medical practice is not much different to selling any sort of business; it requires a willing seller and a willing buyer.

One of the best ways to motivate a willing buyer when you are selling a medical practice is to present the practice strongly with its current performance so the buyer thinks that if they continue what the current owner has been doing, they too can be successful.

There are many metrics a buyer will review as they move through their decision making process.

Here are 5 different metrics that are worth measuring and managing while you own and operate your practice so it makes it stronger.

Sell a medical practice with 5 metrics

If these numbers present well, highlight them to a potential buyer as a way to motivate them to buy your practice instead of buying another practice or going to work in a hospital and skip the whole idea of owning and operating their own practice.

1. First Pass Resolution Rate

The First Pass Resolution Rate is a metric that measures the rate by percentage that the medical practice claims of the practice are paid on first submission. Health Insurance companies love to reject a claim so they can hold onto their money longer.

To make this calculation it is fairly simple. Take the Total Number of Claims Paid and divide by Total Number of Claims Submitted for a period of time, for example, one month. To drill down further, consider doing this same calculation for the top five Health Insurance companies that you submit claims to see if one or more of the Health Insurance companies are too hard to work with.

A best practice for First Pass Resolution Rate is 90% or higher.

2. Days in Accounts Receivable

Days in Accounts Receivable shows the average number of days it takes for the practice to be paid. The lower the number the better.

There are different ways to make this calculation. A simple one is the Total Current Receivables less Credits divided by the Average Daily Gross Charge Amount.

A best practice would be for the Accounts Receivable to stay below 50 days while it would be preferable to have it in the 30 to 40 days range. After all you are running a medical practice and not a bank.

3. Percentage of Accounts Receivable > than 120 days

Accounts Receivables are generally grouped into 30 days, 60 days, 90 days and 120 days. Once they hit 120 days it simply stays in that bucket until its paid or written off. The more money in the 120 days bucket the worse it is for the practice.

This calculation is very simple. Take the Total Dollar Value of Accounts Receivables that are in the bucket for Greater than 120 days and divide by the dollar amount of the Total Value of Accounts Receivables.

A best practice would be for the Percentage of Accounts Receivable > than 120 days to be less than 25%. The lower the number the better.

4. Net Collection Rate

The Net Collection Rate may also be called the “Adjusted Collection Rate” and its purpose is to measure the amount of revenue the practice expects versus what it actually receives. The higher the number the better.

The calculation is a little messy. It’s (Payments-Credits) divided by (Charges-Contractual Adjustments.)

There are many reasons why a patient or claim may not be paid. There are things you can control and things outside your control. This is the purpose of the Net Collection Rate as it helps identify that number and encourage more research about how to raise or improve it.

A best practice for the Net Collection Rate would be 95% or greater.

5. Average Reimbursement Per Encounter

The Average Reimbursement Per Encounter shows the average amount the practice collects per patient encounter. It’s pretty simple.

The calculation is also fairly simple. It’s the Total Reimbursement divided by the Number of Encounters in a Given Time period.

There is no best practice number as it varies with the medical specialty. The goal is to make the number as high as possible.

Are you thinking about selling your medical practice and move to the next phase in your life? Would you like to know the value of your practice? If you would like more information please visit my website Sell a Medical Practice.

For more immediate, give us a try with an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Sell a medical practice with 5 metrics appeared first on Rogerson Business Services.

October 22, 2015

Buy an existing franchise confidently

If you are in the market to buy a business, one of the first steps is to narrow down your criteria so you don’t waste time and money look at options that simply won’t work. The normal criteria to help narrow down the search for a business includes price, geographic location, the owner benefit or profit from operating the business and industry type, for example, retail, manufacturing or service etc.

Another option which business buyers have a fairly strong opinion about are whether or not the business is or is not a franchise.

In a previous article called “How to buy an existing franchise,” I looked at why buying a franchise is different to a privately held business including some of the disadvantages of buying an existing franchise.

If you are in the market to buy a business and your criteria includes being willing to buy an existing business that is a franchise, here are some suggestions to give you more confidence and to have a successful outcome.

These steps apply once you are ready to make an offer.

Some of the steps are different to buying an existing business; hence the reason for this list.

Prepare either your Letter of Intent or Purchase Agreement to present to the seller.

Negotiate and finalize your offer as far as you can. That is, it will have contingencies and that’s perfectly fine.

Start your due diligence process. There will be a number of items to check as noted below but the immediate focus is the financial statements of the seller and what they are representing. If you or your professional advisor are not comfortable with the financial statements, there is no need to go any further.

Obtain a copy of the Franchise Disclosure Document (FDD) either from the seller or the Franchisor. This includes understanding if you will operate under the sellers FDD or will work under a new FDD that the Franchisor provides. Additionally, get a clear understanding of the Franchisor’s qualification process to make sure this is what you are willing to do.

If your offer requires any third party finance, start and move through that process.

Negotiate with the landlord; if this is applicable.

Complete your franchise due diligence of the Franchisor, conversations with Franchisees and whatever else you need to get in place. Some Franchisors require the buyer of the franchise to attend training by the Franchisor prior to the close of the sale, some prefer it to happen at a later date and some are comfortable with training just from the seller.

If all contingencies are ready or are able to be removed, open escrow and work through that process including any additional requirements specific to the type of business you are buying. Some transactions may require escrow to open at the start of due diligence; it varies for different reasons.

If everything is now a “go”, with the help of the escrow company, bring everything together and close escrow.

Start training be it just from the seller, just from the Franchisor or a combination of both. By the way; congratulations. You are now the owner of the franchise with all its responsibilities and rewards.

Buying a franchise, be it an existing franchise or a new franchise is not about “being right”, it’s about getting all the information, understanding what’s important to you and how, where, when and why you fit in and then making the best decision you can be as confidently as possible.

If you’d like more information on the steps to buy an existing business or franchise, feel free to get in touch today for a consult, and together we’ll talk about your goals. We’ll discuss what’s important to you and why and the options available to you.

If you would like more information about buying a franchise please visit my webpage Buy a Franchise or buy a copy of my book – Successfully buy your franchise.

The post Buy an existing franchise confidently appeared first on Rogerson Business Services.

October 20, 2015

Questions to ask a business seller

In a previous article called Questions to ask when buying a business I looked at one question to answer before you start buying a business and then ten questions to ask the seller.

Buying a business is tough. To show how tough it is, what do you think is the answer to the following question?

What percent of people in the United States own a privately-held business?

The answer will surprise you? The exact number is not known as it’s not an easy statistic to collect. However, according to the US Bureau of Statistics approximately 1% to 2% of the United States population owns a privately held business.

There is no question that owning and operating a privately held business is tough; as I said earlier. It’s even tougher trying to find the right business to buy and moving through the buying process as there as so many pieces to navigate.

To help you do this successfully, here are another 12 questions to ask a business seller.

What are the licenses, permits or any unusual conditions or restrictions the business requires to run successfully? This includes both government agencies including police, fire department, health and non-government agencies and are any of these a personal requirement of the owner of the business?

Are there any special requirements or covenants in the lease?

What has been the sellers experience with both neighboring businesses and the residential neighborhood where the business resides?

Does the business comply with the handicapped laws (that is, ADA or American Disabilities Act), and if not what are the requirements to comply? When was the last time you had a third-party audit?

Why does the seller want to sell?

Are all sales shown on the tax returns of the business?

Are the employees part of a union, and if so, which union? If they are not part of a union, what are the chances of the workers organizing to have a union?

Who and how many vendors service your business, how often do they make deliveries, and how do you make sure they are competitive?

What are the hours of the operation of the business and how do you know if they are meeting the needs of the customers?

Who is responsible for paying for the utilities and are there separate meters for electric, gas, and water?

Who are your nearest competitors and has this changed over the last 3 years?

Describe your customers, what percent of your customers are regular customers and do you have any customers that make up more than 10% of the annual sales of the business?

If you are looking to buy a business, at its most simple level, buying a business is all about managing your risk.

Managing your risk and getting it right is about asking good questions, making sure you get an answer that makes sense and backing your instincts to feel comfortable with the seller. It’s also about asking people you know and trust to get their perspective and feedback so it adds another layer of protection to your decision making process.

If you have questions on the steps to buy an existing business or franchise, feel free to get in touch today for a consult, and together we’ll talk about your goals. We’ll discuss what’s important to you and why and the options available to you.

If you would like more information about buying a business please visit my webpage Buy a business or buy a copy of my book Successfully buy your business.

The post Questions to ask a business seller appeared first on Rogerson Business Services.

Click to enlarge image

Click to enlarge image Click to enlarge image

Click to enlarge image