Andrew Rogerson's Blog, page 42

December 16, 2015

New business owners first decision

What’s the first decision for a new business owner?

The answer should be simple and complete. Do absolutely nothing.

Buying a business is a demanding process. It’s demanding intellectually and financially but it’s more demanding emotionally.

If you’ve bought a business you’ll know the above makes perfect sense as you can remember lying awake late at night wondering what you were doing. You probably even had your closest family and friends questioning your sanity but for you, it all made sense or you wouldn’t now be the new owner of a business.

Why a new business owners first decision is to do nothing?

There are many reasons why the first decision of a new business owner is to do nothing. However, the primary reason is that there are too many things to do and as the new owner of the business with limited information you won’t know where to start. That is, it makes no sense to start making decisions about things you either don’t know about or will need more information.

It’s much better to delay making a decision with the expectation you will get it right than make a decision so you can feel good about yourself and you can go and work on something else.

Let the seller run the business in the short-term

If you’ve bought an existing business, hopefully your negotiations included the seller staying for a minimum number of days or weeks and provide free or discounted training to transition their knowledge to you.

If that’s the case, let the seller continue to run the business on a day to day basis while you clean up all the outstanding pieces you had to deal with when buying the business. This will include legal, tax, accounting and other issues. For example, it could include paperwork for your new legal entity, an outstanding item for a lender, landlord, legal or accounting document(s), something the escrow company needs, a business or other type of license and more. Get these outstanding items addressed now while they are fresh because if you don’t get to them now, once you get into the swing of the business and its day to day requirements you won’t get back to them. They are issues you will want to resolve.

What does the seller want to do?

The business under a new owner is the most vulnerable when there is a change of ownership. Before you close the sale with the seller, have a conversation about what they want to do so it’s crystal clear what’s happening in the first month of the change of ownership.

Just as I suggested above that you, as the buyer of the business should do nothing when you first take over, be aware the seller will be tired and unsettled from selling the business to you. Perhaps the seller wants time off to re-energize and decide what they are doing over the next weeks and months. If necessary, give them a day or two off while you “make no decisions” but keep this as short as possible.

The owner of a business wears many hats

Another reason I’m suggesting that you, as a new business owner make no decisions when you first buy your business is that a business owner typically wears many hats. They wear many hats as there are many things to get right; customer satisfaction, accounting, tax compliance, legal and business regulation compliance, sales, marketing and so the list goes on. For most business owners it also includes filling a gap such as an employee that’s on vacation, answering a ringing phone because no one is around and more. As they say, someone has to run the business.

Because of the vibrancy of a business and with so many things happening, it is impossible for a new business owner to understand the flow of many aspects of the business and to therefore make the right decision. Undoing a decision is so much harder as it may frustrate a customer or employee.

You are the new business owner, not “the boss.”

One of the temptations of a new business owner is the need to very early in the change of ownership prove they are “the boss.” That short term need can come back to bite the new owner because if they get it wrong, it can take a long time to recover from it.

Making no decision to arrive at the right decision is so much better as it’s easy to apologize for the delay by explaining you are the new owner of the business and your preference is to get it right.

If you would like more information about buying a business please visit my webpage Buy a business or buy a copy of my book Successfully buy your business.

For more immediate help with buying a business you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post New business owners first decision appeared first on Rogerson Business Services by Andrew Rogerson.

Business Finance Basics with a DIY Education

Finance is the lifeblood of business, but for many small business owners, it is also their least favorite part of being an entrepreneur.

When TD Bank asked 500 small business owners to name their least favorite task, 46 percent said bookkeeping. Many entrepreneurs avoid this anxiety by putting off their finances, but this can return to haunt you.

In a CCH survey of 1,000 small- to medium-sized enterprise owners, 35 percent of those surveyed named insufficient time managing the books as a major contributor to business failure, and 49 percent identified insufficient capital as another key culprit.

Hiring a good accountant is part of the solution to this problem, but as a business owner, you’re ultimately responsible for your company’s finances. If you’re considering becoming a franchise owner, it’s in your best interests to educate yourself as much as possible about business finance. Here’s how:

Educational Resources

Fortunately, resources abound if you’re an entrepreneur seeking a business finance education. Forbes and The Princeton Review provide rankings of the top business schools, and most local community colleges offer basic business courses.

For an advanced understanding of specific subject areas, such as corporate credit rating analysis, Moody’s Analytics offers intensive short seminars. If you want some one-on-one guidance, SCORE connects entrepreneurs with mentors and provides online and local training resources. Online College provides a list of other open courses you can find online. The SBA and Investopedia feature extensive online training for small business owners.

If you’re looking for textbooks, Amazon’s best seller section includes a category for textbooks in different areas of business and finance.

Tax Planning

Tax planning is one of the most fundamental areas of finance you need to learn for the simple reason that it affects your choice of a business structure. This in turn affects your ability to open a business bank account and perform other essential setup tasks.

The IRS’ website provides an overview of what small business owners need to know about federal tax planning. Essentials covered include selecting a business structure, applying for an Employer Identification Number, determining which type of business tax you need to pay, choosing when to start your tax year, integrating your retirement planning into your business tax planning and keeping tax records.

Financial Planning

Financial planning has a bigger impact on your company’s success than any other area of business finance. Developing a successful financial plan involves creating and maintaining your key financials, which include your balance sheet, profit and loss statement, sales forecast, inventory schedule and cash flow statement. These should all be projected for at least your first three years of operation. Score’s website provides templates for these key financial statements along with the opportunity to share your statements with an experienced mentor.

Financing

Putting your financial plan into effect requires startup capital, making learning about financing another essential element of your success. Sources of financing include personal finances, family and friends, grants, loans, venture capitalists, angel investors and crowdfunding. Your ability to tap into these resources can be affected by your credit rating and by how persuasively you prepare your funding request. The SBA’s website provides a useful introduction to the major sources of business finance along with links to resources that can help you secure financing.

Bookkeeping and Accounting

Even if you plan to hire a professional accountant, which is recommended, learning the basics of bookkeeping and accounting is essential to understanding what’s going on with your business. Bookkeeping primarily involves recording your business’ transactions and financial activity. Accounting includes bookkeeping and also involves managing your bookkeeping policies and execution as well as analyzing your financial records and preparing financial statements and tax returns. The For Dummies website provides a 12-step introduction to the basics of bookkeeping and accounting.

Good financials increase the chances of selling your business

A strong and clean set of financial statements are probably the number one thing that will increase the chances of selling a business when that time comes.

What’s important to remember is that a strong and clean set of financial statements are not just put together overnight; it includes tax returns that are filed with the IRS and signed by the owner of the business each year.

If you follow the suggestions above it will make your business stronger and easier to manage as it will provide information to use on a regular basis so small changes can be made; rather than big reactive changes.

Are you thinking about selling your business and move to your next challenge? Would you like to know the value of your business? If you would like more information please visit my website Business valuation.

For more immediate help you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Business Finance Basics with a DIY Education appeared first on Rogerson Business Services by Andrew Rogerson.

December 15, 2015

Hire a CFO if financial statements are confusing

Over the last two years I’ve become completely convinced of the importance of financial statements.

Four of my clients had listed their business to sell with me. In all four cases, the business had to come off the market as the financial statements they had given me to share with buyers and represent the performance of their business were wrong.

The financial statements were not a “little wrong”; they were wrong by a lot. One client had a problem transitioning from one accounting program to a more complex accounting program.

One client was experiencing rapid growth and simply didn’t have the skills or processes and procedures in place.

One client had too many things happening in the business and didn’t have the time to check what was happening and talk to their CFO that put the financial statements together.

One client had a family member help with the accounting but instead of having one Profit and Loss statement with one bank account, had two profit and loss statements and two bank accounts; which made it more complex to manage.

Hire a CFO if your financial statements confuse you

What’s the lesson from all of this? If you do not understand your financial statements and how they are put together, hire an experienced CFO to help you.

Mark Denning was the guest on my radio show, 105.5FM and Money 2.0. Mark is a CFO and the author of a book “Drive your business to financial success.” It comes with a sub-title “The Real-time Cashflow Management System for Small Business.”

My conversation with Mark was thoroughly enjoyable as it was my chance to learn.

Mark is a CPA and specializes in advising small business owners, CEO’s, bankers, attorneys, tax CPAs and financial planners about the financial health and financial strategies to run a successful small business.

You are welcome to listen to my conversation with Mark. If you do, here’s some of the topics we spoke about.

Is there such a thing as a ‘typical’ client that should read your book and if so, who would it be?

The book at its core uses the analogy of driving a car and using your financial system to manage the company’s profit and just as importantly, its cash flow or its cash flow potential. Explain a little more about what that means and how your system helps do this?

How do you help a business owner put a system together?

How long does it take to learn the system?

One of the chapters of the book talks about a road course or race course? What does that mean?

A tool you talk about is a Real Time Financial Dashboard. How does a Real Time Financial Dashboard work?

Can you give me an example of how you’ve applied what you wrote the book about to a company you’ve helped?

Where can you buy the book and how much is it?

Although Mark’s location is in the Sacramento, CA, area, he’s available to talk and understand your goals and if he’s the right person to help.

One of the best things about using Mark and the service he’s put together is that it the benefits will always be with you as your business will be stronger because of it. However, the good news is that doing things properly will allow you to focus on other areas of your business but the best news is what happens when you decide to sell your business.

If you’re financial statements are accurate and present strongly, a potential buyer of a business will have additional confidence in what they are buying as opposed to walking away because they are not quite sure.

This benefit also shows up if the buyer has to get a loan from a third party such as a bank or other financial lender.

There were other topics covered during my conversation with Mark. If you would like to listen, simply click the following link: Hire a CFO if your financial statements confuse you.

The post Hire a CFO if financial statements are confusing appeared first on Rogerson Business Services by Andrew Rogerson.

Hire a CFO if your financial statements confuse you

Over the last two years I’ve become completely convinced of the importance of financial statements.

Four of my clients had listed their business to sell with me. In all four cases, the business had to come off the market as the financial statements they had given me to share with buyers and represent the performance of their business were wrong.

The financial statements were not a “little wrong”; they were wrong by a lot. One client had a problem transitioning from one accounting program to a more complex accounting program.

One client was experiencing rapid growth and simply didn’t have the skills or processes and procedures in place.

One client had too many things happening in the business and didn’t have the time to check what was happening and talk to their CFO that put the financial statements together.

One client had a family member help with the accounting but instead of having one Profit and Loss statement with one bank account, had two profit and loss statements and two bank accounts; which made it more complex to manage.

Hire a CFO if your financial statements confuse you

What’s the lesson from all of this? If you do not understand your financial statements and how they are put together, hire an experienced CFO to help you.

Mark Denning was the guest on my radio show, 105.5FM and Money 2.0. Mark is a CFO and the author of a book “Drive your business to financial success.” It comes with a sub-title “The Real-time Cashflow Management System for Small Business.”

My conversation with Mark was thoroughly enjoyable as it was my chance to learn.

Mark is a CPA and specializes in advising small business owners, CEO’s, bankers, attorneys, tax CPAs and financial planners about the financial health and financial strategies to run a successful small business.

You are welcome to listen to my conversation with Mark. If you do, here’s some of the topics we spoke about.

Is there such a thing as a ‘typical’ client that should read your book and if so, who would it be?

The book at its core uses the analogy of driving a car and using your financial system to manage the company’s profit and just as importantly, its cash flow or its cash flow potential. Explain a little more about what that means and how your system helps do this?

How do you help a business owner put a system together?

How long does it take to learn the system?

One of the chapters of the book talks about a road course or race course? What does that mean?

A tool you talk about is a Real Time Financial Dashboard. How does a Real Time Financial Dashboard work?

Can you give me an example of how you’ve applied what you wrote the book about to a company you’ve helped?

Where can you buy the book and how much is it?

Although Mark’s location is in the Sacramento, CA, area, he’s available to talk and understand your goals and if he’s the right person to help.

One of the best things about using Mark and the service he’s put together is that it the benefits will always be with you as your business will be stronger because of it. However, the good news is that doing things properly will allow you to focus on other areas of your business but the best news is what happens when you decide to sell your business.

If you’re financial statements are accurate and present strongly, a potential buyer of a business will have additional confidence in what they are buying as opposed to walking away because they are not quite sure.

This benefit also shows up if the buyer has to get a loan from a third party such as a bank or other financial lender.

There were other topics covered during my conversation with Mark. If you would like to listen, simply click the following link: Hire a CFO if your financial statements confuse you.

The post Hire a CFO if your financial statements confuse you appeared first on Rogerson Business Services by Andrew Rogerson.

December 2, 2015

Automate Your Business To Save Time

Email is the top time waster for small business owners, entrepreneurs, freelancers and professionals, according to an OfficeTime survey released earlier this year for National Time Management Month. Out of 1,200 respondents, 44 percent said they spend an hour or more a day answering emails. Meetings, Internet surfing, traveling and dealing with technology problems round out the top five time wasters. Although technology can create time management problems, it can also help solve them. Here are five ways you can automate your business, so you have more time to focus on priority tasks.

Most email programs include a number of automated time-saving features. Preventing junk from reaching your folder is the first step. Email programs usually have built-in filters that you can customize to catch junk. For instance, Outlook 2013 has an automatic junk filter that you can supplement by adding lists of safe senders, safe recipients and blocked senders, as Microsoft’s website details. You can also use your email program’s general filter tools to flag junk by keyword or other criteria. Entrepreneur contributor Jacqueline Whitmore suggests that you can further reduce the amount of junk in your inbox by searching on the term “unsubscribe” and reviewing which mailing lists you want to remove yourself from.

Filters also make email management easier by letting you sort email so it automatically goes into specific folders instead of your inbox. Additionally, you can use features, such as categories, labels, tags and marks (depending on what your program calls them), to automatically identify which emails need priority attention.

In addition to these built-in tools, you can enhance the power of email programs by integrating them with other software. For instance, Zapier lets you supplement most common email programs by adding text notifications, to-do lists and other features.

Calendar Management

To save time, manage meetings and coordinate projects, make the most of your calendar management software. For instance, Outlook 2013 lets you drag meeting invitations from your email into your calendar to automatically schedule an appointment with the details from your email. Hubspot editor Ginny Soskey shares some Google Calendar features that let you automate tasks, such as finding available meeting times, sharing your calendar with others and emailing event attendees.

Scheduling Repetitive Tasks

If you or your staff find yourself performing the same computer tasks frequently, using automation tools can save you considerable time. For instance, devices running on Apple’s OS X come with a built-in tool called Automator, which uses a point-and-click interface to automatically create custom workflows, reducing multiple steps to a single macro. Office 2013 comes with similar tools that create macros for Word and other programs. To automatically back up your files, some storage services, such as Mozy’s automatic cloud backup, let you automate this task.

Document Management

Document creation and management often involves repetitive steps and tedious editing. Document Management System (DMS) software helps automate tasks such as standardizing workflow, digitizing documents and tracking version updates. Top Ten Reviews provides a comparison of some leading DMS solutions.

Marketing

Some tasks that do not lend themselves to full automation nonetheless lend themselves to semi-automation. For instance, email marketing autoresponder services automate tasks such as adding mailing list subscribers, sending out newsletters, sending invoices and receipts, and responding to customer service inquiries.

Social media tasks such as content curation and distribution, tweet scheduling and post publishing can also be semi-automated. WordPress marketing automation platform Socal provides a step-by-step guide to designing a social media automation strategy.

If you would like more information about selling a business, selling a medical practice or valuing a business, please visit my website Rogerson Business Services.

The post Automate Your Business To Save Time appeared first on Rogerson Business Services by Andrew Rogerson.

November 24, 2015

More Questions to Ask when Buying a Business

If you plan to buy a business you can never ask too many questions. If the answer doesn’t make sense, ask a clarifying question. If it is still not making sense its either time to move on and look for another opportunity or sit down with seller and make sure they are clear on what you are asking and why.

Questions to ask when buying a business

So far there are two articles in this series and this is the third. In the first article called “Questions to ask when buying a business,” I looked at the most important question of all to you as a buyer of a business; “Do you really want to buy a business?” In that same article I then offered ten questions that you as the buyer of a business could ask the seller.

More questions to ask when buying a business

In the second article called “Questions to ask a business seller,” I looked at 12 questions that you could ask the seller of a business.

In this third article, here are a series of 10 questions to add to your list of questions as the buyer of a business you should consider asking the seller of a business.

Tell me about the revenue your business generates? Is it just for products or just for services or a combination of both? Is your revenue consistent on a month to month basis or do you have ups and downs due to different seasons for your products and services? Does one product or service make up more than 10% of your gross revenue?

What are your top five expenses? Are they typical for a business with your size of revenue and expenses? What strategies do you have in place to manage your expenses including your top five?

Do you manage the accounting you use for your business by in-house employees or do you outsource this to a third party? If your business receives cash, do you have policy in place with how the employees receive and handle cash?

How handles the daily responsibility of banking and reconciling bank statements? Is it the same person in the office or do you use different people?

Do you use any outsourced service providers? If so, why and why did you choose the companies that you use?

Does your business have inventory? Is this included in the purchase price? How often do you turn your inventory? When was the last time you did an inventory count? Do you count the inventory yourself or hire a third party to do this for you?

How do you promote and market the business? Do you have a website? Do you have any sales and marketing material I can see? Do you have employees that specialize in sales and marketing or do you outsource this to a third party? How much per month or per annum do you spend? How do you measure its effectiveness?

What legal contracts do you have in place? Can they be cancelled or will I need to take over those contracts?

Do you have a HR or Human Resources department? Do you have an employee handbook? Did you put this together yourself or have an attorney provide this for you? When was the last time you had the employee handbook reviewed? Do you require the employees to sign a written document they have received a copy of the employee manual?

When you need to hire new employees, how do you find them? Have you had any lawsuits from previous employees? Do you have any lawsuits you are managing at the moment?

There is no question that buying a business is tough. I read recently that according to … 400,000 entrepreneurs are starting a new business in 2015.

Think about that for a minute. Over 400,000 new businesses are starting in 2015. This is only new businesses getting up and running. This doesn’t include business buyers that are buying an existing business.

Not everyone is cut out to be a business owner. It’s hard work and demanding but so is anything you wish to achieve in life.

If you would like more information about buying a business please visit my webpage Buy a business or buy a copy of my book Successfully buy your business.

For more immediate help with buying a business you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post More Questions to Ask when Buying a Business appeared first on Rogerson Business Services.

November 23, 2015

Selling a Business in 2015 Still Strong

Market condition for the sale of businesses in 2015

The sales of businesses continues to strengthen across all market sectors in the third quarter of 2015 based on the results of the Market Pulse Survey just published by the International Business Brokers Association (IBBA), M&A Source and the Pepperdine Private Capital Market Project.

Despite the September and October 2015 share market volatility, it did not prevent buyers from pursuing a business purchase with 75% of surveyed advisors indicating there was no impact from the instability in the stock market. The findings also indicated that sellers did not feel a sense of urgency with the elections and political debates dominating the news and pre-occupying the media.

Market Pulse report participants

The International Business Brokers Association (IBBA), M&A Source and the Pepperdine Private Capital Market Project provide a quarterly report and evaluation of the market for businesses being sold in Main Street markets (values under $2 million) and lower middle markets (values $2 million to $50 million).

This is the only report for the sale of these types of businesses. The 3rd Quarter 2015 survey was completed by 192 business brokers and M&A advisors, representing 20 regional and international business brokers and M&A Associations. Half of the respondents (50 percent) had at least 10 years of experience in the M&A industry. Those that participated in the survey reported closing 214 transactions in the 3rd Quarter of 2015.

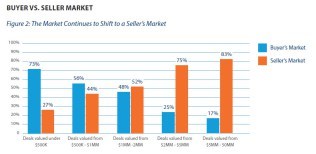

Buyer Vs Seller Market

This quarters report continues to see the pendulum shift to a seller’s market across all deal sizes.

While buyers still hold the upper percentage for transactions valued at $1 million or less, the percentage is shrinking.

Retirement continues to dominate Seller motivations

Retirement remains the leading reason that business owners went to market, which is understandable since baby boomers continue to retire in increasing numbers.

It may appear there is a stronger shift to a buyer’s market as the quantity shifts; however the findings indicate that the market is slowly becoming a seller’s market especially as transactions appear in size.

Also, as I mention below, this is a national report and so different regions and indeed different industries have different results.

How long does it take to complete a deal?

Larger transactions take longer to close and this period of time continues to increase as buyers become more sophisticated.

As the graphic shows below, transactions over $1 million in value take an average of more than 8 months to close. Additionally, 32% of those transactions that closed worth over $1 million had taken 12 months or longer to close.

Valuation multiples

By comparing data from the last five quarters, we can see that valuations are similar across all sectors. However, there is a slight decrease in the $1 to $2 million valuation range.

This tends to be the price range individual buyers are priced out and existing business owners are inclined to buy, but only when it can add to their current operations.

Market Pulse is a national report

A reminder that this report is a national report and so does not include what’s happening in each individual state of the USA.

As I am focused purely on the sale of businesses in California it would be my suggestion that the results are a patchwork with Southern California and the Bay Area of San Francisco doing reasonably well but the Central Valley and more remote areas of California still feel the effects of the Great Financial Crisis.

Are you thinking about selling your business and move to your next challenge? Would you like to know the value of your business? If you would like more information please visit my website Business valuation.

For more immediate help you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Selling a Business in 2015 Still Strong appeared first on Rogerson Business Services.

November 18, 2015

Sell a medical practice to a hospital or similar entity

Is the time right to sell your medical practice to a hospital or similar entity?

With the rolling out of Obamacare there are many physicians who have been in private practice for a number of years trying to decide not only the future of their practice but also their own personal future; close it down and retire, sell it to a doctor in the practice if it’s not a solo practice, find a doctor that wants to keep the practice going and buy you out or perhaps sell it to a hospital or similar entity.

Shutting down the practice doesn’t appeal for many reasons. The primary reasons against shutting it down are what would the patients and staff do that have worked and been loyal to the practice and probably more importantly, what happens to the patient records and files and what should be done with those.

Selling the practice to another similarly qualified physician is an option but getting answers to the “thousand questions” comes into play. How much is the practice worth, how long will it take to sell, how quickly can the buyer obtain all the licenses and affiliations the practice currently holds, will the health insurance companies accept the new doctor plus many more important questions?

Selling a medical practice to a hospital is very complicated

I’m currently trying to help two doctors sell their practice to a local hospital. There are good reasons for the hospital to buy this practice but the rules and selling process are much different than selling the practice to another independent physician.

Let’s have a look at some of the reasons why it is very complicated.

The doctors that are selling their practice have been working together for over 40 years and it’s time for them to retire. There were other buyers with an interest to buy the practice but the hospital with an interest to buy the practice would not make an offer or enter into any negotiations unless they were given an exclusive period of time to conduct their due diligence, negotiate an offer, put all the legal contracts together and move through their complicated approvals process. The time period they wanted was 6 months; which is a long time especially if they decide not to buy.

Once the hospital decided to make an offer here was there many next steps.

The initial negotiations came with a simple Term sheet that outlined in very broad terms the main points of their offer.

Once this was accepted and more information was provided, a Letter of Intent was presented. The Letter of Intent was more detailed than the Term sheet but there was nothing binding to either buyer or seller. This made it hard to know if they were serious and motivated or just wasting everyone’s time.

Once the Letter of Intent was agreed upon and accepted by both buyer and seller in writing, the attorneys for the buyer presented an 88 page Purchase Agreement.

The 88 page Purchase Agreement, in this case, included many separate schedules including an employment agreement for the doctors in the practice being sold, a third party appraisal for the price of the practice, approval by the hospital board plus their related parties which included a foundation that were buying the practice plus many more documents. Once again, the Purchase Agreement was extensive but there was absolutely nothing binding the buyers to pay any penalty if they didn’t complete the deal and no downpayment would be paid.

The buyer’s professional advisors included a company to perform the valuation, collect and analyze approximately 79 items as part of their due diligence including and 3 different legal practices advising a legal opinion on different parts of the transaction.

For the sellers, as I mentioned above, there were 79 items the buyer required to review as part of their due diligence which required upwards of 50 hours of work of the sellers time to put it all together, not knowing if the buyer would close the sale.

Wth all the due diligence documents now available, the next step was to notify the 5 doctors employed in the practice that the process was about to start to onboard them to the hospital system. This then created one of the main concerns about whether some of the doctors may not wish to work in a hospital system and so if they said no, what this would mean to the sale of the practice.

Another condition to the purchase of the practice was getting a business or practice valuation acceptable to the buyer. This is not unreasonable however the challenge was that the valuation would not be done until most due diligence steps were complete which took such a long period of time and incurred so many costs. It would make better sense to do the valuation at the start of the buying process rather than leave it towards the end.

The above covers some of the main problems to navigate but they did not stop there. Other items that were necessary to come to an agreement were Purchase Price Allocation and Covenant Not to Compete.

Did I say selling a medical practice is complicated?

Selling a medical practice is never an easy process. Selling the medical practice to a large employer or hospital system brings many challenges. It takes much longer, the due diligence is much more detailed and complicated, the buyers or the hospital system making the acquisition are risk adverse, that is, they are not willing to make mistakes.

To minimize their mistakes they employ professional help which is very positive but it does add to the costs and complexities for all parties involved.

Are you thinking about selling your medical practice and move to the next phase in your life? Would you like to know the value of your practice? If you would like more information please visit my website Sell a Medical Practice.

For more immediate help, send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Sell a medical practice to a hospital or similar entity appeared first on Rogerson Business Services.

November 11, 2015

Capital costs and selling a business

What does capital costs and selling a business mean?

Almost without exception, a business sells for a Fair Market Value or FMV. FMV is recognized in law as mainly meaning that a business will only sell once the buyer and seller understand exchange full information not only about the business and how it works etc. but also about key information that’s important to each party so they can make their final decision. FMV also means that neither party has to or must do the deal, that is, neither party is subject to an outside pressure that’s forcing them to make a decision.

For example, if the seller owns a business and owes a third party such as a lender or the IRS money, this may be seen as an outside pressure that’s forcing the seller to sell the business and so it affects their decision to the point the business is not being sold for FMV.

Just recently I’ve seen three sellers trying to sell their business but unable to get close to their expected price because of decisions they made with their business.

The first examples concerned a grocery store that the owners owned for just on 14 years. As part of owning the business it also included the real estate. One of the challenges trying to sell their business was that during their 14 years of ownership that had done very little capital improvements. This meant they had not upgraded lighting, flooring, heating and air-conditioning or made other capital investments to present the business as an attractive place to come and do business.

The financial performance of the business was strong making well over $250,000 per year. The business had no competition or its nearest competition was well over a 2 hour drive away. The business had well trained and qualified employees; which was another asset in the business. The only negative that prevented the business from selling was that it required a series of capital investment to upgrade the look and feel of the business as this had been delayed too long. What was frustrating to the sellers was that there was good buyer interest but no buyer was willing to offer close to what the seller wanted as it meant they would have had to make the capital investment improvements which they felt the seller should be willing to cover part of that cost as it had been delayed too long and so much was required.

This same situation occurred with a pizza restaurant I was asked the sell. The business had been under the same ownership for 38 plus years. The business was closed on Mondays but had a very loyal clientele that came back year in year out.

When the business valuation was put together it came in at over $725,000. However the market was not willing to pay that price as little to no capital improvements had been made and they were well over due.

In this case the seller was highly motivated to sell as they were in their early 70’s and so they accepted an offer that was about $225,000 lower than the valuation so they could retire. Part of the complication in this transaction was that the owner of the business and the landlord were unable to agree on who should pay for all the capital improvements. The seller wanted the landlord to cover some of the costs but because a new lease was in place with a number of years to go before it was renewed, the seller had no bargaining power.

Importance of making capital improvements

The cost of capital improvements is like any other cost when owning and operating a business. It’s tempting for the business owner to delay the work as it takes a lot of time and effort, generally costs more than expected and is a distraction from the day to day operation of the business. A good lesson can be learned from the larger companies as it simply forms part of their doing business. Where I live in Sacramento, CA it’s easy to see Starbucks in full swing, making capital improvements and investments even though it often doesn’t seem this work is necessary.

Planning for capital improvements

If you adopt the right approach, making capital improvements can be a win/win/win. If you lease the property you will know when your lease is up for renewal. Plan to have a discussion with the landlord about capital improvements and see if they are willing to contribute to part of the cost. Most landlords are as it’s in their interest to keep the building as presentable as possible because if they ignore it, it will lower the amount of rent they can charge and the price they can get if they try to sell it.

Some capital improvements such as a solar or renewable energy upgrade can attract subsidies or rewards from utilities or government programs.

Benefits of capital improvements

Making capital improvements also provides an opportunity to have conversations with your customers and get their feedback. Bella Bru is a coffee shop I frequent new where I live in Carmichael, CA. The business is open 7 days per week and I rarely see the owners but I talk to their employees each and every time. At the moment the business is going through a major upgrade that’s taking months to complete. Rather than be too negative, the employees explain what’s happening and why and present it as positively as possible. That is, they are handling the disruption very well.

Strategies if unable to do capital improvements

Capital improvements generally move in the cycle of the business. If you are unable to perform capital improvements, here are some strategies.

The first strategy is to acknowledge they are necessary and not simply ignore there is a need. If you plan to sell your business and they are not done, say this to the buyer. If you pretend it doesn’t exist, what else will you pretend doesn’t exist?

Capital improvements cost money. Be prepared to provide the buyer a discount on your asking price if they spend their time managing and organizing the capital improvements. Encourage the buyer that this is a good idea by suggesting they can do the capital improvements on their timetable plus the buyer can get to choose the design, colors and materials.

Some capital improvements will need to be depreciated and some can be lowered in the year of purchase to reduce the amount of tax the business pays. Highlight these benefits to the buyer.

Mention to the buyer that doing the capital improvements will attract new customers and have existing customers spend more. Customers love a new environment for doing business.

If you wish to be brave and have the interest, suggest to the buyer that they buy the business and you’ll organize and manage the capital improvements as a separate project after the sale of the business closes.

Capital improvements are necessary part of being in business. They are too frequently avoided or delayed too long as I’ve mentioned above, to the point where it has a negative impact on the business.

This negative impact shows up in the amount a buyer is willing to pay; if indeed they are willing to negotiate to buy the business in the first place and influences the amount they are willing to pay as Fair Market Value.

Are you thinking about selling your business and move to your next challenge? Would you like to know the value of your business? If you would like more information please visit my website Business valuation.

For more immediate help you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Capital costs and selling a business appeared first on Rogerson Business Services.

What is the cost to buy a franchise

One of the first questions I usually receive when I speak with a new entrepreneur in the market looking to get into business is simply, “How much does it cost to buy my own franchise business?”

It seems a simple question and often comes up early in the new entrepreneurs search process as they are either comparing the cost of buying an existing business they have seen for sale or want to compare the costs of different franchise concepts.

Costs to buy an existing business

If you are looking to buy an existing business and see the price the owner wants to sell it, remember there are more than just the costs to buy the business.

In addition to the purchase price you need to allow for the costs of professional help such as accounting, tax and legal advice.

You need to allow for working capital, that is, costs to get established and keep the business operating until it generates a positive cash flow. Working capital may include employee payroll, rent, debt servicing costs and more.

Apart from working capital you will need “personal capital”. That is, money you need to feed your family and pay your personal bills with all the day to day responsibilities you currently incur until the cash flow in the business is positive.

Escrow fees or costs to pay to cover the purchase of the business.

Government or supplier fees such as rent, getting a business license and/or a special permit, insurance premiums for workers comp and other business products plus a buffer in case there are unexpected costs such as repairs etc.

Costs to buy a franchise

The costs to by a franchise and build it from scratch are much different than buying an existing business. The costs will vary with the franchise you wish to buy. Below are the more common costs but there are others and the often come with a different name. The costs are disclosed by the franchisor in a document they are required by law to provide called the Franchise Disclosure Document.

Here is a brief summary of typical franchise costs.

The first cost to incur if you buy a franchise is the initial franchise fee. The initial franchise fee varies depending on whether you are buying a single unit or there may be a discount for buying three or five or more. This fee is to offset the franchisors marketing costs to promote and sell their units or territories.

The next cost may be a territory fee or cost to have the franchisor map out the market or territory that will be yours exclusively as the owner of the franchise. Often this is outsourced to a third party so it’s done accurately and professionally.

Advertising/Marketing – this fee is self-explanatory. Sometimes there is a national fee to promote and build awareness of the brand and/or there may be a local advertising fee where a group of local franchisees wish to do some radio or TV marketing that targets where their franchise is located.

Royalties are a monthly fee paid to a franchisor as part of their compensation for using their brand and their backend expertise to run and operate the franchise.

Training is once again self-explanatory; that is, the cost to get the franchisee educated and confident how to run and successfully build their franchise using the proprietary knowledge and information developed by the franchisor.

The technology fee applies if the franchise uses or provides online access to different computer hardware or software. Technology is constantly changing and evolving and so this cost is to keep the franchise and its franchisors current and up to date.

If the franchise requires a physical presence in its territory there will be cost to build out and customize that location. These costs will vary, depending on the size, location and materials used in the build out.

Every business has day to day operational costs to own and operate a business whether it’s a franchise or privately held business. These costs include but are not limited to insurance, travel, office expenses, payroll, travel, finance such as third party borrowing cost and professional fees such as accounting, tax preparation and legal fees.

Buying a franchise is not just about the cost

There is no doubt that the cost to buy a business is a critical part of the decision making process. It’s also just as critical to have a clear picture of all the costs so when you are comparing which option makes the most sense to you, you can do a side by side analysis.

However, buying a franchise is much more than a side by side comparison of costs.

Does it cost to buy a franchise or is it an investment?

No matter what you do in life there is a cost. If you go to college, there is a cost. If you get married, there is a cost. If you buy a house or have children or buy a car there are costs.

At the end of the day, though and the final decision you make is about what that cost provides or more importantly, what return on investment it generates for you.

As you do your research, understand what you are really getting for your investment. Does it match your goals, the life style, business skills and expertise you bring to this new business opportunity?

Just as you make other decisions with your time and money, if you find the right franchise to help you achieve your personal dreams and goals then you are heading in the right direction.

If you would like more information about buying a franchise please visit my webpage Buy a franchise or buy a copy of my book – Successfully buy your franchise.

For more immediate help with buying a franchise, send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post What is the cost to buy a franchise appeared first on Rogerson Business Services.