Andrew Rogerson's Blog, page 38

April 28, 2016

Buying a Business at the Right Time

Whether you already own a business and want to expand, or you want to break into the business world with the acquisition of an established company, there are many things to consider before you begin the process.

Purchasing an established company means you won’t have the struggle of building a business from the ground up and can work on a previously established foundation. For example, I was talking to a business owner the other day and he wanted to sell. He explained the business had been going 3 years and while it was yet to make a profit (and his reason for selling), he explained his business was worth a lot of money as it took 5 years for a new business to become established. When I went on to explain to him that 5 years is too long and very few buyers of a business are willing to buy a business not making money, we finished the conversation with different points of view. However, my position remains the same. I’m yet to find any business buyer that’s willing to pay too much money for a business that is not profitable as their preference is to start the business themselves and do things their way.

To be even-handed, keep in mind that when you buy an existing business, you could inherit some of its downside, for example, a questionable reputation or deeply entrenched operations that will be more difficult to optimize.

Factors to consider when buying a business.

When planning to acquire a business, consider whether the timing and fit are right for your company and if it will help it grow beyond what it could on its own.

Timing Is Everything

There are many points to consider when deciding if the time is right to acquire a business. You will need to evaluate your readiness on a financial and personal level and conduct market research on the industry.

Do your research to find out if your fundamental reason for buying an existing business is because you see the opportunity for growth; or as the seller likes to say, “this business has so much potential.”

How well do you know the industry?

Each industry has its own way of doing business including government regulations, training and hiring of employees, ups and downs in the economic cycle, barriers to entry by competitors, willingness of third parties to provide finance and more. Make sure these are understood if you choose to buy a business in a new or different industry.

How will it impact your current business and/or personal life?

If this is the first time or twentieth time of owning a business, your process to buy a business should be the same.

Here are exceptionally important items to consider.

Do you have the time to own and operate your business as the buck stops with you?

What role do you plan to play?

Does this fit with your current skill set or are their major new skills you need to learn and how much time will these take to learn?

Technology can quickly change an industry. Do you see major changes coming in the short-term that could disrupt your ability to be successful?

Are you willing to make the necessary sacrifices for the business to be successful? If you are unsure, step back and only approach business ownership when you are sure.

Have you researched the market to understand where it is in the economic cycle?

Have you researched the competition?

Have you researched third-party finance if you need it to make the acquisition?

Have you checked to make sure any advisors or critical decision-makers such as board members, executive management team or investors agree or can improve your decision-making?

Do you have time to invest in the acquisition process?

Are you financially ready to make the investment?

Does the reputation of the business you plan to buy match your reputation or can you adapt it to fit yours?

Does the reward match your Return On Investment criteria?

Just as all good things in life they come with risk. At the end of the day, a successful business owner is one that has successfully managed their risk as this is the essence of the capitalist system.

If you would like more information about buying a business please visit my webpage Buy a business or buy a copy of my book Successfully Buy your Business.

For more immediate help with buying a business you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Buying a Business at the Right Time appeared first on Rogerson Business Services by Andrew Rogerson.

April 27, 2016

Succession Plans Lead to Success when Selling a Business

A recent U.S. Trust Insights on Wealth and Worth survey found that roughly two-thirds of business owners who responded to their questions didn’t have a formal succession plan. Like many other long-term planning issues, some business owners ignore this strategy and don’t recognize how complicated and time-consuming the sale or transfer of a business can be. While many entrepreneurs excel at thinking about the big picture and the future growth of their companies—many don’t look long-term past their own leadership term.

Even if you’re many years removed from making the transition for your company to your heirs or outside managers, you still should find out the value of your business. This is especially true if you are looking to get out of running the business sooner rather than later. That looks to be the case for many folks, as the survey said that seven in 10 business owners were over age 50.

A wise move for every business owner is to engage an outside, third-party evaluator to look at your business and value inventory and accounts receivables. This can help uncover any issues with what you believe the value of the business to be and what buyers will be offering. An experienced valuation expert will also have knowledge of other businesses in your industry, the business climate in Sac, and ideas to boost your business’ worth and overall health.

Admittedly, all of this thinking can give you a headache, especially when you’re trying to run your company simultaneously. That’s why you need to stay on top of important issues like valuing your company. You want to be ready for when the time is right. Perhaps you’re not planning to sell, but you get an offer for the purchase your company. How will you know if it’s a great offer? You’ll know if you have a good understanding of your company’s worth. Even if you’re not planning to sell for another five to 10 years, you need to be ready for that call from out-of-the-blue that may be worth your while.

In addition to partnering with a business valuation expert, business owners should be assembling a solid team to assist with this process. This can help avoid some those headaches from trying to do everything yourself. It also gives your successors (if you are transferring the company to children or your managers) the opportunity to be immersed in more of the day-to-day operations. This is the best time to think about who you’d like to oversee the day-to-day operations and also shepherd you through your succession preparation and the sales process.

In many instances, the length and complexity of the succession process is severely underestimated by business owners looking to sell. Those that are starting to prepare have the luxury to make their decision and then have time until the actual transfer, whether it be to their children, long-time managers, or other investors or buyers. These folks will have the opportunity to leave their business on their own terms.

To discuss business succession planning and opportunities to sell your business in the Sacramento area, please visit our websiteServices and choose from the drop down menu the information you’d like.

For more immediate help, please send an email to Andrew Rogerson or call our office at (916) 570-2674.

The post Succession Plans Lead to Success when Selling a Business appeared first on Rogerson Business Services by Andrew Rogerson.

April 26, 2016

Small Business Sales are Not too Hot and Not too Cold

British Prime Minister Benjamin Disraeli is credited with the saying “There are three kinds of lies: lies, damned lies and statistics.” BizBuySell have announced the results of their analysis of the first quarter of 2016 and how the national market is performing with the sale of small businesses. If you’ve been looking to buy a business you may think the market is too hot. If you’ve been looking to sell a business you may think the market is too cold. If you look at the statistics you find it’s not too hot and not too cold.

Here are some of the highlights from the information put together by BizBuySell and their analysis of the first quarter of 2016.

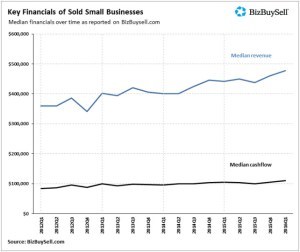

The good news, if you are a seller, is that in the first quarter of 2016, businesses had the highest median revenues and cash flows on record. This means financials are getting stronger and the selling price of a business appears to be encouraging more owners to put their business on the market as the number of businesses listed for-sale grew more than 6.4 per cent.

More good news for sellers when looking at the first quarter of 2016 and comparing it to 2015 includes the following:

The median revenue of sold businesses was $478,000 compared to $442,000.

The median cash flow $110,000 compared to $104,000.

The median small business asking price grew 11 percent in the past year to $249,500, while the median sale price increased 10 percent year-over-year from $200,000 to $220,000.

To look at the information in closer detail and see how it compares to previous years, the following is interesting.

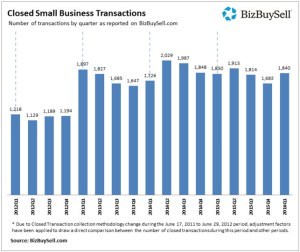

Closed Small Business Transactions

As the chart below shows, a total of 1,840 closed transactions were reported in the first quarter of 2016, a slight increase from the 1,830 transactions in the first quarter of 2015, however the businesses that sold this quarter appear to be much healthier. Businesses sold in the first quarter of 2016 grossed a median revenue of $478,000 compared to $442,000 last year, and a median cash flow of $110,000 compared to $104,000. These figures represent the highest median revenue and median cash flow of sold businesses on record at BizBuySell.

Key Financials of Sold Small Businesses

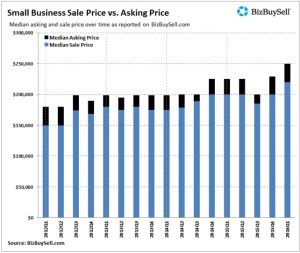

The improving financials are allowing sellers to ask for and receive more during the sales process.

The median small business asking price grew 11 percent in the past year to $249,500, while the median sale price increased 10 percent year-over-year from $200,000 to $220,000. That marks a healthy average sale to asking price ratio of 90 percent.

The increase in sale price is a great sign for sellers as it suggests the market may be shifting in their favor. However, it’s important to remember that these are national figures and the buying and selling of a business happens at a local level. In addition, according to the California Association of Business Brokers only about one in five or 20% of businesses actually sell. Also, it takes approximately 8.5 months to sell a business; if it sells.

Small Business Sale Price vs Asking Price

As is shown in the chart below, the better financial performance by business owners is allowing them to both ask for and receive more for their businesses. The median asking price grew 19 percent to $250,000, while the median sale price jumped from $190,800 in the first quarter of 2015 to $226,000 in the same period of 2016.

At a macro level, the first quarter of 2016 shows that small business listings, transactions and financials are all continuing on a positive trend. Confidence in the economy remains good with the Federal Reserve reluctant to increase interest rates and hopefully continue to translate into a strong spring and summer in the business-for-sale market.

Are you thinking about selling your business and move to your next challenge? Would you like to know the value of your business? If you would like more information please visit my website Business valuation.

For more immediate help you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

The post Small Business Sales are Not too Hot and Not too Cold appeared first on Rogerson Business Services by Andrew Rogerson.

April 21, 2016

Getting More from Your Employees

There are thousands of business books that will tell you how to manage your employees. Many of these resources can be useful. However, if you haven’t the time to delve into a book right now, here are some short and simple tips for improving the performance of your team.

1. Be clear with what you want.

Don’t be too general with your coaching. “Do better work” really doesn’t give an employee much to go on. Be clear and specific as to what you expect from him or her. That’s the way that they’ll know how to perform. Have clear goals and measurements so that both you and the employee understand what’s expected.

2. “Action” should be your mantra, not “attitude.”

Attitude is important, but there’s not a lot you can do to change how someone feels or what they think. Focus on their assignments and tasks and help them achieve what you need them to do.

3. Communicate your expectations.

This is not reciting what you want them to do—it means giving them some context around the assignment, like the type of results you want and the reasons they’re needed. Ask for and get the employee’s buy-in to produce these results.

4. Critique what you expect.

Give your employee the opportunity to perform and examine the results. Managers have a tendency to hone in to the areas of improvement, but don’t forget to be positive about other aspects of the employee’s work.

5. Compliment progress and hard work.

It doesn’t matter whether they say they like it or not, everyone wants to know that there’re doing a good job—and they also like to know that they’re doing a great job. This doesn’t have to be a cake in the break room for finishing a project on time. It may be a nice email, or better yet stop by their workstation and say “Nice job.” Positive reinforcement pays dividends.

6. Don’t accept poor performance.

If you are looking for performance improvement, and you’re not seeing it, you need to let the employee know about it. Just like praising an employee’s good performance (#5), you need to have a conversation about what’s not working well. Let them know that you’re disappointed and plan the steps they need to take to succeed.

These six reminders can help you manage your team to success. Don’t forget to be specific and make sure that you’re listening.

For more on managing a business and employees, as well as information on buying and selling a in the Sacramento area, please visit our websiteServices and choose from the drop down menu the information you’d like.

For more immediate help, please send an email to Andrew Rogerson or call our office at (916) 570-2674.

The post Getting More from Your Employees appeared first on Rogerson Business Services by Andrew Rogerson.

April 19, 2016

Strategies for Selling Your Medical Practice

There’s been a lot more interest from hospitals and large groups in buying medical practices in and around California. More and more physicians who are planning ahead and considering the sale of their practices are conducting valuations, as they want to have an idea of the value of their practice as a way to have a benchmark for negotiating. This process helps physicians improve their bargaining power and, as a result, realize a better price on the sale.

Keep these thoughts in mind as you consider a sale of your practice:

1. Develop a list of several potential suitors.

If you’re thinking about selling your practice, consider asking your business valuation consultant to get in touch with the most likely prospects to let them know that you may be selling your practice and that you wanted them to know about it. This can include touching base with local hospital administrators. You never know, they may have plans to start a practice group or may want to provide your specific practice to someone interested in practicing in the community. In addition, your business valuation consultant should talk with each local group or specialist and let them know of your plans. One of these practices may be planning to expand and the might want to hire a new physician to take over your practice.

2. If you’re the own the practice facility, start your preparation for two sales.

If you’re the owner of your practice building or own your office space, you have some additional options here, as there are really two sales. Consider the following:

Sell the practice and lease the space. This gives you the opportunity to become a landlord and collect rental income;

Sell the practice and lease the space, with an option to buy. This gives you the chance to continue as a landlord or find a buyer to invest in rentable space; or

Sell both the practice and the space. If a purchaser of the practice isn’t interested in owning the facility, you can look for a buyer.

3. Stay on as an employee physician.

You may want to negotiate a position for yourself into the practice purchase agreement. In fact, the buyer, especially a hospital, may want to have you stay on at the practice as an experienced employed physician. You now will have two negotiations to think about:

(i) the sale of the practice; and

(ii) the employment agreement.

When the hospital becomes the owner of your practice, you should try to separate the future performance of the practice from your own as an employee. Try to negotiate a compensation plan that’s based on your performance rather than that of the new owners.

These three ideas should help you and your business valuation consultant preparation for an effective sale of your practice.

To discuss selling your medical practice in the Sacramento area, please visit our websiteServices and choose from the drop down menu the information you’d like.

For more immediate help, please send an email to Andrew Rogerson or call our office at (916) 570-2674.

The post Strategies for Selling Your Medical Practice appeared first on Rogerson Business Services by Andrew Rogerson.

April 13, 2016

Buying a Franchise from another Point of View

You know, it never hurts to analyze a situation from a different point of view.

In many cases, you’ll hear about all kinds of advice telling you what to do, how to do it, and things to remember. But this article contains a few “Don’ts.” Here are some reminders of what you shouldn’t do when buying a franchise.

Don’t underestimate the impact of your potential decision on your family. While you’re probably calculating profit and loss, inventory, and prospects seven ways to Sunday, you shouldn’t underestimate or miscalculate the effect that this business will have on your immediate family if you decide to move forward. This franchise is going to need a big chunk of your time for the seeable future to get it running and keep it going.

Because of this time commitment, you should talk with your spouse and children about what this means. It will help everyone to understand your thinking if you take the time to tell them about your rationale for taking on this opportunity. Also, explain franchising to them and risks that come into play when you go into business. Be ready to listen to their feelings and worries. You’re going to need their support, so make the investment of time to be sure that they can see your vision the way you do.

Don’t be cheap. In for penny, in for a pound, the old adage says. A franchise can cost tens of thousands of dollars, which can be a lot of money. Thinking of that saying another way, something worth doing is worth doing right. That means don’t scrimp on some of the details that can really result in serious consequences.

Work a consultant to create a Franchise Business Plan. This can really help you if you’re planning on applying for a small business loan. Approval is much more certain if you submit a detailed business plan with your loan application. It shows that you’ve done some preparation and are taking this endeavor seriously. A Business Valuation Consultant can help you to make sure that you are addressing all of the necessary and critical issues. This expert can also help you select the proper business entity type for your franchise, and alert you to the California franchise laws. He can also review the franchise materials, such as the franchise contract.

In addition, you should be familiar with numbers or spend the money to hire an Accountant or CPA with a background in setting up small business payrolls and filing small business taxes.

Don’t miss the opportunity to visit company headquarters. If you receive an invitation from the franchisor to tour the company’s headquarters, don’t say no, but do so only when you’re near your decision, so that you don’t waste everybody’s time. If go, you’ll get the chance to personally meet with the people with whom you’re be interacting every month. Ask questions and make contacts in each department. This experience can be invaluable, as you’ll get an understanding of how the franchisor operates and what they will do to support your franchise.

So don’t be afraid to ask for help, to ask questions, and be prepared. Your franchise will be that much farther ahead if you do these don’ts.

To discuss franchise opportunities in the Sacramento area, please visit our websiteServices and choose from the drop down menu the information you’d like.

For more immediate help, please send an email to Andrew Rogerson or call our office at (916) 570-2674.

The post Buying a Franchise from another Point of View appeared first on Rogerson Business Services by Andrew Rogerson.

April 6, 2016

Basics of Buying a Business

Some people say that buying an existing business can be a shortcut to success. While that may be true, you should work with an experienced Sacramento business valuation consultant to help you make a wise decision, so that you can bypass some of the stressful and backbreaking efforts involved with the building of a business from scratch and go straight into the ownership and operation of a thriving company.

If you are working with an experienced business valuation consultant, the two of you can get a feel for the business by reviewing the research that your consultant has conducted: he’ll discover the reasons why the current owner is selling, the outlook for your industry and specifically this business, and the business’ stature within the community and within the industry. In addition, you should review each of these areas:

Financial statements.

Take a closer look at the company’s audited financial statements for the past three years and the same period of tax returns. Have your business valuation consultant review them with you. Your business valuation consultant will help you see beyond the numbers to try to determine the reasons for trends.

Accounts receivable.

Review the company’s accounts receivable and see what’s sitting out there as past due and by how much. Get a list of the company’s current debts and see if there are any liens against them.

Any legal issues.

Along with looking for liens, ask if there are any current or past litigation. Have your attorney review the company’s current contracts. See if they have all of the proper licenses, permits, and certifications, and whether they can be transferred.

Review the value of the company’s assets, both tangible and intangible.

Along with your business valuation consultant, see what tangible assets there are, like equipment, property, and company vehicles. Intangible assets can be patents, copyrights, and trademarks, as well as the goodwill of the business and its reputation in the market.

Vendor and employee relationships.

Although relationships vital assets of a business, they can be extremely hard to transfer to a new owner. Do some digging and see with which suppliers and vendors the company works and their current arrangements. See if they’ll work with you on the same terms if you’ll have to negotiate altogether new contracts. Within the company, ask about relationships with employees, and ask whether they’re likely to stay when the company is sold. Run down all of the salaries, benefits, and other HR costs with your business valuation consultant to see how these numbers look when compared to industry and local averages.

There’s a lot to ask when you’re buying a business. Working with a qualified business broker will pay dividends. Your business valuation consultant will help you to review the documents and make a wise decision that will build your business for the future.

To discuss business buying opportunities in the Sacramento area, please visit our websiteServices and choose from the drop down menu the information you’d like.

For more immediate help, please send an email to Andrew Rogerson or call our office at (916) 570-2674.

The post Basics of Buying a Business appeared first on Rogerson Business Services by Andrew Rogerson.

March 29, 2016

Buying a Franchise business?

One way to start your own business is to by a franchise, like Subway, Jiffy Lube, or Gymboree.

A person can buy into the franchise and run it as their own business, but then must pay an ongoing franchise royalty fee out of its sales to the corporation. The remaining revenue is the franchisee’s to keep. A solid franchise can be a terrific opportunity to make money and be your own boss.

There are plenty of good reasons to buy a franchise. Here are some of the reasons that you may want to consider it.

You get to work for yourself. This is a big reason that many folks around Sacramento consider purchasing a franchise. There’s no boss, except for the franchisor’s corporate headquarters. A person has to have some ability to adhere to the corporate guidelines, but that’s one of the positives of franchising: you don’t buy into a franchise to change it. You buy it because it’s a tried-and-tested business model. You’re buying the name, the logo, and the products that draws people to McDonald’s, for instance, instead of driving right past Bill’s Burger Barn.

You like to work hard. Although many of the processes and plans for a franchise are ready-made, it won’t run itself. Just like any business, there’s no 100% guarantee of success. Still, many entrepreneurs like the adrenaline rush they get from running a business, and if that’s you a franchise might be the answer.

You’re somewhat risk-adverse. The advantages of going into franchising are that you have the experience of the franchisor and its established system of franchisees who can give you guidance. A good franchisor will provide training and support, so that you become familiar with the way that they do business. Also, a franchisor will have the buying power and efficiencies of scale in the franchise system. They can negotiate lower prices for the products and services you need for your franchise.

Buying a franchise has some drawbacks. It can be expensive and risky. There are a lot of issues, and that’s why working with an experienced business broker like Andrew Rogerson can be critical.

There’s leasing commercial property, buying inventory and equipment, and paying franchise fees. Andrew can help you with deciding on an appropriate franchise, location, financing, as well as answering all of your questions. Take the time to speak with Andrew about buying a franchise or visit our websiteServices.

Contact Andrew viaemail or call him at (916) 570-2674.

The post Buying a Franchise business? appeared first on Rogerson Business Services by Andrew Rogerson.

March 23, 2016

Businesses sold continue to increase in 2016

Although reports from the post-recession business-for-sale market have for the most part been most promising for buyers, there are several indications that a shift is underway towards a more balanced market and more opportunities for business sellers.

The latest data shows that the overall financial health of small businesses has improved, and there has been an increase in the rate of small business transactions. Data from BizBuySell.com’s most recent survey showed a 6% year-over-year increase in business transactions. This is the second straight year of financial improvement in the business-for-sale market. Experts say that there are several factors that contribute to favorable market conditions for buyers and sellers:

Better financial health. The financial performance of small businesses has recently been very strong. This lets sellers to ask for and receive higher prices for their businesses. The median asking price of a small business in Q1 2015 was $225,000, up significantly from the $199,000 median asking price at the same time last year. The median sale price in Q1 of 2015 also was up—at $200,000—compared to $175,000 a year earlier.

Experts say that the environment is quite favorable for those seeking to enter or exit the small business retail or service sector. The latest numbers show that transactions within the service industry increased by 18%. These positive financial indicators allow sellers to increase their asking prices and sell their businesses at a higher profit.

Increased supply and demand. The recent BizBuySell survey notes that this jump in small business transactions has much to do with a growing supply and demand in the business-for-sale-market. Many of the sellers are retiring baby boomers, with over 78% of business brokers surveyed attributing at least a quarter of their closed transactions to baby boomer sellers.

Along with baby boomers looking to sell, the economy’s growth and potential business buyers’ personal wealth and ability to take on new ventures have also grown. Many of these new buyers are younger but are now ready to get into owning a business. Roughly 75% of business brokers surveyed said that the average buyer was between 30 and 49, with sellers between 50 and 64 years old.

A more balanced market. This steady supply and demand of businesses is forging a much more balanced market—with both buyers and sellers realizing value from transactions. Generally, a more balanced business-for-sale market offers benefits for both buyers and for sellers. Transaction activity has been consistently strong for the past three years. As a result, it’s a great time to capitalize on the market.

That’s great news for anyone thinking of buying or selling a business.

To discuss business buying opportunities in the Sacramento area, please visit our websiteServices and choose from the drop down menu the information you’d like.

For more immediate help, please send an email to Andrew Rogerson or call our office at (916) 570-2674.

The post Businesses sold continue to increase in 2016 appeared first on Rogerson Business Services by Andrew Rogerson.

March 17, 2016

New Trend: Private Equity Buying Medical Practices

Private Equity firms eyeing primary-care practices proven to be ahead of the curve in value-based care.

One of the recent trends in business sales is the growing number of investments that private-equity firms are making in primary-care physician practices. Specifically these investors are targeting medical practices that are at the forefront of offering new care delivery and payment models.

These investors are finding an opportunity in being early participants in value-based care, while the business case continues to evolve. Then again, experts contend that the niche is tailored for private-equity firms, which thrive on a degree of uncertainty. Investors continue to put stock in the concept of shared-savings payment models and want to get in on the ground floor.

Long-term, these private-equity firms see the opportunity to turn around and sell these managed-care-savvy medical groups to insurers or health systems. They will pay a premium for the care-coordination expertise and data analytics of these practices. Experts believe that primary-care groups with the ability to show better quality and lower costs in managing medically complex patients will be valuable in a healthcare system that will increasingly reward cost-effective care.

A Break with Tradition

Private-equity firms traditionally look to invest in medical groups that have the ability to offer high-reimbursement potential, for example, dermatology, pain management, and dentistry. While this is still the norm, private-equity investors are looking at primary-care groups, and the managed-care space in particular, due to the relative expense of specialty practices.

Experts say that provider groups that ask for high prices are often times getting them from companies making a strategic play. However, private-equity firms are looking at other opportunities.

Modern Healthcare monitored 294 deals in 2015 and saw an increase of 25% over the same period in 2014. Remarkably, deal value skyrocketed to $97.9 billion—over twice as high as the comparable period’s $48.9 billion. Private-equity firms upped their activity in the first quarter of last year with 41 healthcare deals, compared to 28 total deals in the prior-year period.

Hospitals Buying

Hospital systems have been buying physician groups at a steady rate to bolster their provider networks and prepare for the time when they will be paid based on their effectiveness in keeping their enrolled populations healthy. Solid primary care will be critical to this eventuality, and a practice’s experience in managed-care contracting with public and private insurers provides significant value.

Experts agree that providing care for Medicaid patients often requires a varied outlook than might be implemented with commercially insured patients, and the best providers are those who have the wherewithal to manage complex medical needs.

Insurance Companies Also Buying Medical Practices

Insurers also have been acquiring medical groups that specialize in chronic disease management. For example, in late 2013, Cigna purchased Chicago-based Alegis Care, which coordinates care for homebound Medicare and Medicaid beneficiaries. About the same time, Centene purchased a $200 million majority stake in U.S. Medical Management, which also provides home health services for high-risk patients.

Contact Rogerson Business Services

If you’d like to talk about strategies for selling your medical practice, please visit our websiteServices and choose from the drop down menu the information you would like.

There are many steps to successfully sell a medical practice. Click this link if you would like a one page summary of the Many Steps to Sell a Medical Practice.

For more immediate help, please send us an email to Andrew Rogerson or call our office at (916) 570-2674.

The post New Trend: Private Equity Buying Medical Practices appeared first on Rogerson Business Services by Andrew Rogerson.